Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

4th August 2025: Investor Presentation - KCGM Site Visit [39 pages]

Today's presso is 39 pages long, so below I'm just going to share the 10 most important slides, in my opinion (as an NST shareholder):

Firstly it's important to understand just how big KCGM (Kalgoorlie Consolidated Gold Mines, being the Kalgoorlie Super Pit and the Fimiston Mill and surrounding tenements) is, and why it is NST's key global asset:

Next, here's a breakdown of exactly where NST are in the multi-year upgrade of Fimiston (the KCGM gold mill) which they are expanding from 13 Mtpa to 27 Mtpa, so more than doubling its annual ore processing capacity:

The following slide has to be understood in the following context: Back when Bill Beament was running NST, he developed a really good internal mining services arm that allowed NST to be owner-operators without needing to employ contract miners. Bill came from a mining services background before he took over NST and built it up to be Australia's second largest gold mining company, behind Newcrest which was then acquired by US-based Newmont, so NST is now Australia's largest gold miner.

Not only were NSMS - Northern Star Mining Services - competent, they were actually better, cheaper, and faster than many of their competitors in the Australian gold sector. This slide shows just how much better KCGM underground has been performing since NSMS took over the actual underground mining - it's impressive:

The summary (page 35):

And their FY26 guidance:

Disclosure: Holding.

The market likes it - NST is up +5.88% today to $16.20 (up 90 cents today) - so far - with over 2 hours left in the trading day.

It's is a good day on the Aussie market for the Aussie Gold Sector, with most goldies in the green. In fact there are around 8 companies that are up even more than NST are:

Good to see more green on the screen after a string of red days across the sector recently. Plenty of market/price-sensitive news in the Aussie Gold Sector today, and it's mostly good news.

That's just the top 11 performing Aussie gold companies today, there are around another 50 Aussie gold companies not shown there.

Note: For proper context of the slides in this post, please see the entire presentation:

4th August 2025: Investor Presentation - KCGM Site Visit [39 pages]

Saturday 7th June 2025. A wet and windy day in Adelaide and I'm getting over the flu, so have been sitting in my office with the heater on eating reheated Mexican food, soup and porridge (not in that order) and enjoying MoM's deep dive into the history of Australia's largest gold miner, Northern Star Resources (NST) that MoM released 1 hour ago (earlier this arvo).

How Northern Star Became Australia’s Biggest Gold Miner, Money of Mine, Jun 7, 2025

Show notes:

How does a shell company turn into Australia’s biggest gold miner, capped at nearly $30 billion?

In this episode, we unpack the fascinating story of Northern Star — from 2c a share to over $20, securing world-class assets across multiple continents, including the Australia’s greatest gold mine, the Super Pit.

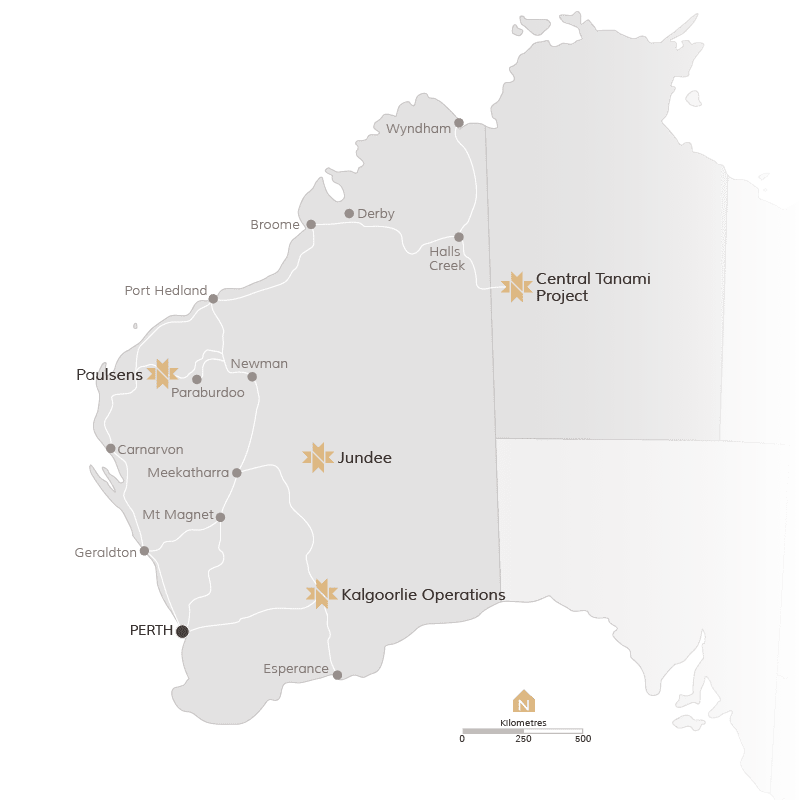

We trace the company’s journey, get in the weeds on their M&A approach, and highlight the characters who shaped it — with a focus on the early days at Paulsens, the deal that set Northern Star on its path, and culminating with the coronation of the “King of Kalgoorlie.”

THE DIRECTOR'S SPECIAL

Join 12k+ subscribers to the Director’s Special: one daily email with all the news that matters in mining

https://www.moneyofmine.com/subscribe

-------------------------------------------------------

▶️ CHAPTER TIMESTAMPS

00:00 Introduction

04:05 Paulsens

30:10 Plutonic

34:11 East Kundana & Kanowna Belle

42:57 Jundee

57:18 South Kalgoorlie

58:50 Pogo

1:10:48 Echo

1:13:15 Super-Pit

1:19:18 Saracen

1:25:27 Learnings

1:36:59 Shout out

-------------------------------------------------------

--- end of show notes ---

Here's a small transcript from near the beginning:

"In May 2010, they come out with an announcement that they're going to acquire the Paulsens Gold Mine; The company has a mighty market cap of under $8 million, and the share price is four and a half cents, so... how's that for a starting point?"

--- end of transcript ---

For those who may not be aware, Bill Beament, prior to becoming the MD of NST, which was just a shell at that point (and later becoming it's Executive Chairman when Bill brought Stuey Tonkin across to NST and made him CEO in Nov 2016), held several senior management positions, including General Manager of Operations for Barminco Limited with overall responsibility for 12 mine sites across Western Australia; Bill had also been the General Manager of the Eloise Copper Mine in Queensland.

At Barminco, Bill was responsible for Barminco's mining services (contract mining) contracts at 12 mines, and one of those 12 was Intrepid Mining's Paulsens gold mine, and Bill clearly thought he could run that mine a lot better than Intrepid (the mine owners) were at that time. Intrepid Mines had deprioritised Paulsens in favor of Indonesian projects where they thought they'd get more bang for their bucks. Intrepid were therefore not spending the money at Paulsens to define how far the gold extended or even to run the mine efficiently as it was.

This proved to be a disastrous decision for Intrepid, whose experience with Indonesian mines, specifically the Tujuh Bukit project, was marked by significant disputes and ultimately, a loss of control over the project. While the company initially made promising discoveries and saw potential in the region, it faced challenges with its local partner and legal issues in Indonesia, leading to a major loss of investment, and a protracted legal battle, and accusations of fraud, severely negatively impacting shareholder value and leading to a CEO resignation.

Intrepid Mines Limited ultimately merged with AIC Resources in 2019, becoming AIC Mines. This followed a failed takeover offer by Intrepid for AIC.

Meanwhile, the gold mine that Intrepid Mining were happy to divest back in 2010, Paulsens, did VERY well under NST ownership, and is still being mined today, this time by Black Cat Syndicate (BC8) who bought the mine from NST in 2022 and have extended its mine life through successful regional exploration in the surrounding area within tenements that they (BC8) own.

However, back in the day, from 2010, Paulsens became the foundation of NST's extraordinary success that today sees Northern Star with a share price of circa $21/share, a market capitalisation of $30 Billion, being an ASX50 company, Australia's largest gold miner, and one of the 10 largest gold mining companies in the world, and the only Australian-domiciled gold miner in that list.

And they are certainly still growing - they're in the middle of doubling the mill capacity at Fimiston (the Super Pit, a.k.a. KCGM), and have bought De Grey Mining for $5 Billion recently, so NST now own Hemi, the largest known undeveloped gold deposit in Australia.

It's quite a story and well worth a listen/watch: How Northern Star Became Australia’s Biggest Gold Miner [MoM podcast, Saturday afternoon, 7th June, 2025]

Disc: Yes, of course I hold NST shares! [both here and in my SMSF]

02-Dec-2024: NST’s $5B Deal: Most Expensive Undeveloped Gold Mine Ever (Money of Mine podcast)

"There’s only one thing to talk about today… Northern Star’s big swing for De Grey. This friendly, all-scrip deal which implies a A$5b value for the developer of Hemi is the biggest deal of its kind, so we’ve got plenty to chat about."

CHAPTERS

0:00:00 Introduction

0:01:40 NST make $5b move for DEG

0:08:21 Will Gold Road get in the way

0:13:23 How does Hemi fit into NST

0:22:03 Hemi's met

0:35:12 Thoughts on the deal

DISCLAIMER

All information in this podcast is for education and entertainment purposes only and is of general nature only.

The hosts of Money of Mine (MoM) are not financial professionals. MoM and our Contributors are not aware of your personal financial circumstances. Before making any investment decision, you should consult a licensed financial, legal or tax professional.

MoM doesn’t operate under an Australian financial services licence and relies on the exemption available under the Corporations Act 2001 (Cth) in respect of any information or advice given. MoM strive to ensure the accuracy of the information contained in this podcast but we don’t make any representation or warranty that it’s accurate or up to date. Any views expressed by the hosts of MoM are their opinion only and may contain forward looking statements that may not eventuate.

MoM will not accept any liability whatsoever for any direct or indirect loss arising from any use of information in this podcast.

--- ends ---

[I do currently hold DEG and NST, but not GOR]

02-Dec-2024: Northern Star agrees to acquire De Grey.pdf

And: Presentation - Northern Star agrees to acquire De Grey.pdf

Details of this deal:

- Northern Star agrees to acquire De Grey by way of a recommended scheme of arrangement, with De Grey shareholders to receive 0.119 new Northern Star shares for each De Grey share held; and

- De Grey’s flagship project, Hemi, provides Northern Star with an additional Tier-1 future low-cost production centre, aligning to its strategy to deliver superior shareholder returns.

A Tier-1 gold asset is defined as an operation producing in excess of 500kozpa of gold per annum with a 10+ year mine life.

At 1:42pm Sydney time, DEG is trading up +26.45% (or +40.2 cps) @ $1.922 and NST is trading -7.37% (down -$1.29) @ $16.22.

I have to do some work on whether the price paid is reasonable here, but as an NST shareholder I am encouraged that NST have used their scrip for this deal rather than cash, so this doesn't result in any change to their cash or debt positions.

This deal (0.119 new NST shares for each DEG share) represents an implied offer price of A$2.08 per De Grey share and a total equity value for De Grey of approximately A$5 billion on a fully diluted basis, based on the closing price of Northern Star shares of A$17.51 on Friday (29 November 2024) - obviously a bit less now since NST's share price has dropped today.

The Scheme is unanimously recommended by the Board of Directors of De Grey, and each De Grey Director intends to vote all De Grey shares that they hold or control in favour of the Scheme, in each case, subject to no Superior Proposal (as defined in the SID - Scheme Implementation Deed) emerging and the Independent Expert concluding (and continuing to conclude) in the Independent Expert’s Report that the Scheme is in the best interest of De Grey shareholders.

The Scheme Consideration represents a significant and attractive premium of:

- +37.1% to De Grey’s last closing share price of A$1.52 per share on 29 November 2024; and

- +43.9% to De Grey’s 30-day volume-weighted average price of A$1.45 per share up to and including 29 November 2024.

Upon implementation of the Scheme, Northern Star shareholders will own approximately 80.1% of the combined Group and De Grey shareholders will own approximately 19.9%.

Here's the 5 year SP graphs of both companies up until today:

Here's the important stuff (IMO):

So NST's Ore Reserves increase by +29% to 26.9 million ounces, and their Mineral Resources increase by +22% to 74.9 million ounces.

Low cost - Hemi should be in the lowest quartile of the AISC (cost) curve.

Consistent with NST's purpose of generating superior returns for shareholders.

So, I'll have a think about the price, but at this stage, I'm happy enough with this as an NST shareholder.

Thursday 22-August-2024: FY24 Financial Results

Results Presentation for Year Ended 30 June 2024

Also: Northern Star - delivering on our commitments - Diggers & Dealers Presentation, August 2024

https://www.nsrltd.com/investors/presentations/#type=Presentation

https://www.nsrltd.com/investors/asx-announcements/

https://www.nsrltd.com/investors/

Disclosure: Yes, I hold NST shares.

And so does Marcus Padley's "Growth Portfolio" (managed fund) as from today (Monday 26th August). Here's his commentary on Friday:

- Northern Star Resources (NST) – One of our favourite gold plays along with EVN (NST is less volatile than EVN, daily ATR of 2.3% vs 3%). NST reported yesterday, rising 3.2% before losing morning gains to finish up 1.7%. The results either meeting or beating broker expectations. Record cash earnings of A$1.8bn, 1,621koz of gold was sold at AISC of A$1,853/oz, meeting its FY24 guidance. The outlook included gold sales of 1,650-1,800koz at an AISC of A$1,850-2,100/oz. Solid numbers but results for commodity stocks are less important compared to companies like WTC or BXB (covered yesterday). The biggest share price driver by far is the gold price which has been hitting one record high after another this year. Our gold price outlook is that despite being at record highs if bond yields continue to fall the gold price will continue to rise, supported by ongoing central bank buying around the world. Commodity stocks can be risky, there is every possibility of a 10-15% dip along the way but for a long-term holding it’s a buy. Will add to the Growth Portfolio with a 5% weighting on Monday provided Powell doesn’t do anything to scare the market tonight.

Source: https://marcustoday.com.au/

So he's adding it based on technicals and momentum. I hold it because it's Australia's largest gold producer and a very well run company. Here's some excerpts from their FY24 results summary announcement.

Under Bill Beament as Executive Chairman back when he was still at NST, he always said they ran the company as a business first and a miner second, so profitability and shareholder returns were what their decisions were based on.

Stuey Tonkin was their CEO under Bill and he's now their MD as well, and he's carrying on that same tradition.

In Summary: Why I hold NST:

- Australia's largest and best gold exposure (Aussie HQ'd and their primary listing on the ASX);

- Profitable, with plenty of growth, particularly the KCGM (a.k.a. the Super Pit/Fimiston Mill) mill expansion, underway right now;

- A$2.7 Billion of liquidity including 30 June cash and bullion of A$1,248 million with net cash of A$358 million, plus during the year, they refinanced their corporate bank facilities with maturity dates of December 2027 and December 2028 across two equal tranches totaling A$1.5 billion, which remains undrawn at year end, and which along with their cash and bullion, provides liquidity of A$2.7 billion leaving the Company very well-funded;

- Zero net debt;

- On top of what they already own and operate, which is very substantial, NST have guided for $180 million just for Exploration expenditure in FY25, so there's certainly plenty of further potential upside from that as well;

- Despite higher costs at Yandal (which is still profitable), NST's group AISC remains competitive, particularly considering their size and the fact that they aren't relying on hundreds of millions of dollars worth of copper by-product credits to reduce their AISC (yes, I'm looking at you EVN !) - so NST will remain profitable at substantially lower gold prices, and they are controlling their costs reasonably well (considering the inflationary environment they've been exposed to in terms of mining and engineering sector costs); and

- I like Stuey's management style - low profile, but gets the job done.

02-May-2024: Annual Resources, Reserves and Exploration Update [489 pages]

Market Like.

NST closed at $15.10 on Friday and have been down every day this week (Mon, Tues & Wed) prior to today (Thurs 2nd May), with the worst day being yesterday when NST's SP dropped -51 cents (-3.41%), so good to see some claw-back today on the back of this annual Reserves, Resources and Exploration update.

Since that low point in early October (@ around $10/share), NST have been in a decent uptrend, which is not surprising given what the gold price has done and that NST is Australia's largest gold mining company.

Some people may think gold has peaked for now based on yesterday's sector sell down...

Source: MarcusToday daily EOD newsletter yesterday, Wednesday 1st May 2024.

But today Gold and Financials are the best sectors - leading the market back up.

Source: MarcusToday, mid-day email, Thursday 2nd May 2024 [so middle of the trading day snapshot]

Consumer Staples are the worst sector today mostly due to the market selling Woolies (WOW) down by around -4% on the back of their Third-Quarter-Sales-Results.PDF.

The gold price has certainly dropped back from its recent all-time highs, but I doubt that the rally is done yet, I would expect this is more a pause in a continuing uptrend. But you never know.

11-Apr-2024: NST-Operational-Update.PDF

Source: Commsec.

Nice Update (below, link above), nice chart, onward and upward.

Cost guidance (AISC) up, but gold production guidance of 1.60-1.75Moz maintained, despite the bad weather around Kal in April and March affecting production. They produced 1.18Moz in the first 9 months of this FY (to March 31st), so they only need to produce 402koz in the final quarter to hit the bottom end of that full year production guidance. And they produced 401koz in the March quarter despite the weather. Additionally they expect a strong June quarter, with increased grade and improved mill utilisation rates.

Northern Star Resources (NST) is Australia's largest listed gold miner headquartered in Australia, and Australia's best gold miner by a country mile. The market weren't too interested in them after Bill Beament left to head up Venturex (now Develop - DVP), but the market is coming around now - because with the gold price hitting new all time highs now on a regular basis, and NST being so big and dominant in the sector, and performing well too - producing so much gold at reasonable costs (remembering that costs have increased for every gold miner), NST is hard to ignore. They will also be an obvious play for international money looking to find some exposure to the sector, because NST is now one of the top 10 gold mining companies in the world (see here: Largest gold mining companies by Market Cap (companiesmarketcap.com)) and the 34th largest mining company (across ALL commodities) in the world (see here: The top 50 biggest mining companies in the world - MINING.COM 05-April-2024).

NST also operate one of the 10 largest gold mines in the world (the Super Pit, next to Kalgoorlie) - see here: Here are the top 10 largest gold mines in the world (miningreview.com) - and one of the two largest gold mines in Australia - the Boddington Gold Mine (owned by Newmont GoldCorp) is the other one.

The "Super Pit".

NST have stated (see here: Northern Star Resources approves $1.5 billion upgrade to KCGM's Super Pit Fimiston processing plant - ABC News 22-June-2023) that they believe that with the increased capacity, the Super Pit is primed to supersede Boddington Gold Mine as Australia's largest gold operation and join it as one of the top five gold producers (mines) in the world by 2029. And that will propel NST further up the world rankings in terms of top 10 global gold miners. Depending on what sources you use and the recency of the reporting, NST sits somewhere between 7 and 11 currently, however I believe they will be at #6 by 2030, and possibly higher if there is further M&A within the current top 6.

So the target is that NST will be a top 7 gold miner (likely #6 IMO) and be operating one of the world's largest 5 gold mines by 2030. Could be sooner than that depending on progress with the Super Pit expansion. It is already underway and due for completion in 2029, with full ramp-up being completed in 2030.

In June last year (see here) they said they had 120 million tonnes of pre-mined ore, estimated to hold about 3 million ounces of gold, at the Fimiston Mill (a.k.a. the Super Pit mill), and their chief technical officer (CTO) Steven McClare said that stockpile would be a "key feed source" for the new mill and provide certainty for the miner. Steve said, "If we stopped mining today, we could process that material and it would take more than nine years to actually get through that stockpile."

And they didn't stop mining obviously, so the stockpile continues to grow due to the current capacity constraints of the existing mill, however they are spending $1.5 Billion to upgrade that mill from 13 million tonnes a year to 27 million, so more than doubling annual ore processing capacity. And that is just ONE of their gold mines.

Disclosure: I hold NST shares, both here and in my largest two real money portfolios.

06-May-2022: (Friday): Interesting ABC News article on Wednesday (04-May-2022): Miner Northern Star Resources strikes gold beneath Kalgoorlie's Super Pit - ABC News

Plain Text: https://www.abc.net.au/news/2022-05-04/gold-miner-drills-beneath-kalgoorlie-super-pit/101035098

Miner Northern Star Resources strikes gold beneath Kalgoorlie's Super Pit

ABC Goldfields / By Jarrod Lucas

Posted Wed 4 May 2022 at 3:05pm, updated Wed 4 May 2022 at 3:23pm

Underground access was restored from within the Super Pit last year through a portal on the western wall. (ABC Goldfields: Jarrod Lucas)

It has been described as the "first glimpse" of a new world-class gold system beneath Kalgoorlie's famous Super Pit.

Despite more than a century of mining on the historic Golden Mile, there has been limited exploration outside of the rich deposits which have yielded more than 21 million ounces since the Super Pit began production in 1989.

Underground access portals on the western wall were developed last year to provide new drilling platforms for testing north-west of the existing pit.

The work represented the first significant underground mining activity on the Golden Mile in more than 30 years.

The investment by Perth-based gold miner Northern Star Resources is starting to pay off after it said it hit pay dirt.

In the company's annual reserves and resources statement to the ASX this week, Northern Star said drilling had increased the underground resources 20 per cent to 5 million ounces.

Northern Star Resources chief operating officer Simon Jessop inspects the entrance to the new underground portal inside the Super Pit in May last year. (ABC Goldfields: Jarrod Lucas)

Northern Star managing director Stuart Tonkin said the portals had been developed 1.5km in length and drilling only began last November.

"It's really not been a lot of time drilling and we're obviously continuing to drill now," he said.

"But we've already added a million ounces of inferred material."

He said there was 5 million ounces of Fimiston underground resource.

"So again it shows us the thin end of the wedge," he said.

"That investment is starting to show great signs of where the future can be underground there."

Deepest workings 1.4km underground

More than 3,500km of tunnels and shafts have been created underneath the Super Pit — equivalent to driving from Perth to Sydney- in a century of mining the area.

The deepest historical workings extend about 1400m below the surface.

But drilling has hit gold mineralisation as deep as 2km below the surface.

Northern Star has made no secret of its ambitions to eventually restart underground mining and is taking delivery of 39 new haul trucks as part of a $250 million fleet overhaul.

Northern Star Resources chief executive Stuart Tonkin inspects the Fimiston Mill.(ABC Goldfields: Jarrod Lucas)

"We're really only looking at the one quadrant at the moment," Mr Tonkin said.

He said the company would put more drill drives to the south as well as onto the eastern side beneath the plant.

"At the moment it's like trying to eat an elephant, you've got to pick off bits and really focus in on it, and this drill drive is the first part of that," Mr Tonkin said.

Mine life beyond 2035

The current reserves at the Super Pit and neighbouring Mt Charlotte mine stand at 11.9 million ounces.

There are 27 million ounces of resources which require further geological work to prove up as reserves under the JORC Code.

The significance of the latest underground drilling results is the fact they are outside the current mine plan, which will result in further cutbacks of the Super Pit until at least 2035.

Drilling from the underground portal has already defined one million ounces of new gold resources. (ABC Goldfields: Jarrod Lucas)

"This is currently not in the plan, so it's important we get in and do this work over the next couple of years to define it and start to work out the scale and magnitude and how it can come into the mine plan," Mr Tonkin said.

"This is on top of the confidence we already have for the future of the Super Pit."

He said he was not surprised by the latest find.

"We're really confident we have multiple decades ahead of us," Mr Tonkin said.

"There is no geological reason why this terminates at depth."

The drilling results were released as Northern Star prepared to announce the results of a feasibility study into a potential expansion of the Fimiston Mill in coming months.

The Fimiston processing plant is one of the biggest in Australia and was commissioned in 1989.

It has since undergone two expansions and treats more than 13 million tonnes of ore a year from the Super Pit and Mt Charlotte.

Mr Tonkin said expanding to 23 million tonnes a year was among the options being considered.

Key points:

- Northern Star Resources is Australia's second-biggest gold producer behind Newcrest Mining

- The company paid $1.1 billion for a 50 per cent stake in Kalgoorlie's Super Pit in 2019

- Northern Star Resources and Super Pit co-owner Saracen Mineral Holdings completed a $16 billion merger last year (meaning that Northern Star now own 100% of the Super Pit).

--- ends ---

The Kalgoorlie Super Pit is just one of NST's mines of course, but there wouldn't have been too many people who viewed it as a future growth option for NST, but it has just become exactly that with the gold they are discovering under the existing pit.

Disclosure: I hold NST in all of my main RL portfolios and NST is also the largest position in my Strawman.com virtual portfolio.

14-April-2022 - Just to add to the straw by @edgescape on NST's announcement yesterday that they have agreed to sell their Paulsens Gold Operation (Paulsens) and Western Tanami Gold Project (Western Tanami) to Black Cat Syndicate Ltd (ASX: BC8) for $44.5m. This deal is subject to BC8 achieving finacing and if that occurs, NST will receive $14.5m plus 8,340,000 (i.e. 8.34m) fully paid ordinary shares in Black Cat (BC8) at a deemed issue price of $0.60 per share which is worth an additional $5m (or $5,004,000 to be exact). BC8 closed at 68c/share today. The other $25m is made up of $10m worth of milestone payments (details below) which are dependent on future gold production from both mines and $15m "deferred consideration" to be paid on 30 June 2023, so NST are really selling Western Tanami and Paulsens (which was their original company-making foundation asset) for just $14.5 million, plus around $5m worth of BC8 shares, plus another $15m to be paid in the middle of next year (total value: $34.5m). If BC8 produce gold from both mines in the future then NST can be paid up to an additional $10m in milestone payments as those milestones occur, as follows:

- $2.5 million cash on production of 5,000 ounces of refined gold from Paulsens;

- $2.5 million cash on production of 5,000 ounces of refined gold from Western Tanami;

- $2.5 million cash on production of 50,000 ounces of refined gold from Paulsens; and

- $2.5 million cash on production of 50,000 ounces of refined gold from Western Tanami.

Don't know about you, but I don't reckon I'd ever heard of Black Cat Syndicate before yesterday...

It should be noted that Paulsens and Western Tanami have both been on C&M ("care and maintenance", i.e. mothballed) as the AISC was too high for the gold that remained there in each case. A smaller company could perhaps give those assets the love and attention they need to become money makers once again - which is clearly what BC8 intend to do - however for NST, Australia's second largest gold mining company (behind NCM) and now one of the top 10 largest gold producers in the world (in terms of both market cap and ounces of gold produced per annum), they have bigger fish to fry now.

Source: https://www2.asx.com.au/markets/company/nst [14-Apr-2022]

Still look like good value here to me!

Disclosure: I hold NST in my 3 largest RL portfolios as well as in my Strawman.com portfolio. They are still my number one gold producer pick, even with Bill Beament gone.

Northern Star CEO Stuart Tonkin, executive chairman Bill Beament and former chairman Chris Rowe in 2016 posing for a Mining Journal article titled, "Beament not going anywhere" They were right for the next 4 years at least, but Bill did leave in 2021 to head up Venturex, now called Develop Global (DVP), and Stuey took over as MD (retaining his CEO position also). Bill B was replaced by Michael Chaney AO, who is also the Chairman of Wesfarmers and had been Wesfarmers' MD for 13 years (from 1992 to 2005). Chaney (pictured below) was also previously the Chairman of NAB and Woodside (WPL) and was a former director of BHP. He started his career originally as a petroleum geologist.

That's all folks... For now...

Except: Paulsens the DNA of Northern Star - MiningNews.net

And: Northern Star hits gold at Paulsens (businessnews.com.au)

Those articles are from circa 2015/2016. Bill Beament bought Paulsens off Intrepid Mines for $40m in 2010 and built Northern Star up from that one foundation asset. NST's market cap today is $12.8 billion.

Intrepid to sell Paulsens mine for A$40M - The Northern Miner

Intrepid to sell Paulsens mine for A$40M - The Northern Miner

Paulsens

Paulsens

Paulsens

Paulsens

Pogo Mine reaches 4 million ounce

Pogo Mine reaches 4 million ounce

26-May-2021: Investor Presentation - KCGM Site Visit

Also - two days ago (24-May-2021): Northern Star appoints Michael Chaney as Non-Executive Chair

In their KCGM (Kalgoorlie Consolidated Gold Mines, i.e. the Kalgoorlie Super Pit) Site Visit Presso, NST took the opportunity to reconfirm their FY21 guidance, saying KCGM was...

- On track to achieve FY21 production guidance; 440-480koz at AISC A$1,470-A$1,570/oz

- Operation being de-risked and productivities are increasing with multiple production sources; Production to rise to +675kozpa by FY28

- KCGM leads Reserve and Resource growth:

- 11.6Moz Reserves (up 20% over 9 months)

- 26.3Moz Resources (up 38% over 9 months)

- Underpins ~13 year mine life

- Further growth via Resource conversion (KCGM Inferred Resources 8.6Moz), host of strong intersections outside Resources and Reserves, backlog of assays pending due to congested assay labs…

- ...and focused exploration across a >90Moz gold camp.

And KCGM is just ONE of their assets.

[I hold NST shares, and I like their choice of Michael Chaney - who used to head up Wesfarmers {WES} - as NST's new non-executive Chairman, now that Bill Beament is moving to head up Venturex {VXR}.]

[P.S. I wonder whether the "backlog of assays pending due to congested assay labs" is positive for XRF Scientific {XRF} or ALS Limited {ALQ}...]

By the way, at the bottom of the below image (the KCGM asset overview; click on the image for a larger version) - you can see the northern end of the town of Kalgoorlie - the streets and houses - which puts the Super Pit into some perspective. It is BIG!

04-May-2021: Northern Star Resources (NST) Investor Presentation - Macquarie Australia Conference

Good overview of the company and the investment proposition, and what to expect over the next few years in terms of gold production from NST. With the Saracen merger now complete, NST remain Australia's second largest gold miner, but they have now also become one of the top 10 largest gold producing companies in the world. Newcrest Mining (NCM) is the only other Australian-HQ'd gold miner in that list.

[Disclosure: I hold NST shares.]

12-Feb-2021: Implementation of Scheme

MERGER OF NORTHERN STAR AND SARACEN IMPLEMENTED

Northern Star Resources Ltd (ASX:NST) is pleased to advise that the scheme of arrangement (Scheme) in relation to the merger of Northern Star and Saracen Mineral Holdings Limited (Saracen), has today been implemented.

Scheme Consideration

In accordance with the Scheme, all Saracen shares have now been transferred to Northern Star, and eligible Saracen shareholders have been issued the Scheme consideration of 0.3763 Northern Star shares for each Saracen share held on the Scheme record date. The newly issued Northern Star shares are expected to commence trading on ASX on a normal settlement basis from Monday, 15 February 2021.

In addition, Northern Star has issued the Northern Star shares otherwise payable to "Ineligible Shareholders" (as defined in the Scheme Booklet) to a nominee who has been appointed to sell those shares so that the net proceeds of sale can be distributed to applicable Saracen shareholders in accordance with the process set out in the Scheme Booklet.

Changes to Northern Star Board Composition

Northern Star has appointed the following Saracen Directors to the Northern Star Board with effect from today.

- Raleigh Finlayson, as Managing Director.

- Anthony Kiernan, as Lead Independent Director.

- John Richards, as Non-Executive Director.

- Sally Langer, as Non-Executive Director.

In addition, with effect from today, Peter O'Connor retires from the Northern Star Board. Mr O'Connor joined the Board as a Non-Executive Director in May 2012, when Northern Star had a share price of approximately 40 cents and annual production of approximately 72,000 ounces.

Northern Star Executive Chair Bill Beament welcomed Mr Finlayson, Mr Kiernan, Mr Richards and Ms Langer to the Northern Star Board and thanked Mr O’Çonnor for his invaluable contribution.

“Peter has been an outstanding Director,” Mr Beament said. “His wisdom, experience and commercial acumen saw him play a vital role in the creation and execution of Northern Star’s growth strategy.

“His deep understanding of financial markets and the sound advice he provided based on many years of experience made him invaluable, particularly in times of intense merger and acquisition activity.”

Mr Beament said the Board looked forward to working with the new Directors as the Company embarked on its next chapter of growth.

“We have a diverse Board, with each Director bringing particular skills and experience,” he said. “This composition will help ensure we continue growing returns for all Stakeholders using our first-class team of people, exceptional asset base, strong cashflow and robust balance sheet.”

Delisting of Saracen

An application has been made to remove Saracen from the official list of ASX, which is expected to take effect on and from Monday, 15 February 2021.

--- ends ---

(There is also an appendix which includes a summary of the material terms of Mr. Finlayson's employment agreement - the new NST MD, who came with Saracen. Click on the link at the top to read the full announcement, which includes that appendix. Bill Beament continues in his role as Executive Chairman of NST.)

[I hold NST shares.]

10-Feb-2021: On today's episode of Ausbiz's "The Call", Henry Jennings from Marcus Today (in the studio) and Andrew Wielandt from DP Wealth Advisory in Toowoomba, Queensland (via Skype) both gave NST the thumbs up (a "Buy" call), so it's been added to the Ausbiz "The Call" portfolio today. NST and SAR both reported well this morning and the merger is now complete (this week) with the two companies reporting as one company as from this coming Friday, 12-Feb-2021. As the guys say, if you like gold, this is the one to own, and I do.

Click on the link above to watch today's episode. The commentary on NST starts from the 7 minute mark.

[I hold NST shares.]

10-Feb-2021: Half Year Results Summary plus Half Year Results Presentation

and Half Yearly Report and Accounts

RECORD PROFITS, CASHFLOW AND INTERIM DIVIDEND

Growth strategy on track, with completion of Saracen merger paving way for increase in production to 2Mozpa, underpinned by organic sources and low capital intensity All results relate only to Northern Star; Saracen and Northern Star financial results to be combined from 12 February 2021 (merger implementation date)

HIGHLIGHTS

- Record underlying net profit after tax (NPAT) of A$194.4M for the December Half, up 63% from previous corresponding period (pcp)

- Earnings per share of A25¢; up 27% from pcp

- Record statutory NPAT of A$184.5M, up 46% from pcp

- Record underlying free cashflow of A$226M, up 94% from pcp, after record investment of A$108M in exploration and expansionary capital to grow production by 40% over the coming three years

- Record Group EBITDA of A$472.2M, up 47% from pcp

- Revenue of A$1.1B, up 34% from pcp

- Interim dividend increased to A9.5¢ (fully franked), up 27% from pcp; Based on payout policy of 6% of revenue and calculated on the pre-merger issued capital base

- Significant financial, operational and Company growth achieved while maintaining superior returns, with annualised average return on equity of 17.4%

- Gold sales of 480,431oz at an average price of A$2,386/oz; 39% of gold sold into the hedge book, reducing hedging to ~10% of next three years’ production

- Outstanding results across operations; EBITDA from operations of A$517M, up 42% from pcp; EBITDA margin of 46%

- Cash, bullion and investments of A$372M at 31 December; Bank debt A$375M

- On track to meet NST FY2021 production guidance of 940,000-1,060,000oz

- Northern Star will host an interim results conference call today at 8:00am AWST (11:00am AEDT). The call can be accessed at https://webcast.boardroom.media/northern-star-resources-ltd/20210210/NaN6017468828cb65001a531637

--- click on the links at the top for more ---

[I hold NST shares. As stated at the top, although the merger between NST and SAR (Saracen) is now complete, these results are only for the 6 month period ending 31-Dec-2020 so do NOT include any contribution from SAR. Very impressive! NST are still the Second Largest pure-play gold producer listed on the ASX and the best run (managed) gold producer by a LONG way, and they are now also a Top-10 global gold producer as well post the merger.]

21-Jan-2021: December 2020 Quarterly Activities Report

PRODUCTION AT TOP END OF GUIDANCE, UNAUDITED NPAT OF A$100M AND DEBT CUT BY A$125M

Gold sales of 252,899oz; Standout performance at Pogo in face of COVID-19 challenges; Strong balance sheet with corporate debt cut to A$375M and A$372M in cash, bullion and investments

HIGHLIGHTS

- Gold sold in the December quarter up 11% to 252,899oz; This was at the upper end of the published December quarter guidance range of 226,000-254,000oz

- Strong performance at all operations:

- Australian Operations (including 50% KCGM) sold 198,701oz at an AISC of A$1,526/oz (US$1,115/oz)*

- Pogo Operations sold 54,198oz at an AISC of US$1,365/oz

- Group all-in cost (AIC) of A$1,825/oz (US$1,333/oz) (including substantial investments in production growth), KCGM open pit material movement increased 22% over previous quarter; significant progress achieved on Pogo mill expansion to 1.3Mtpa; Pogo’s Jameson cell installed and gold recoveries +91%

- Average realised price of A$2,295/oz in the December quarter; This included 48% of gold sold (~122,000oz) into hedged positions, reducing hedge book to ~10% of the next three years’ production

- Strong underlying free cash flow of A$93M generated during December quarter; This was despite investing ~A$63M in growth capital and exploration

- Unaudited NPAT of ~A$100M; Operating mine cashflow of A$290M; Net mine cashflow of A$169M

- Cash, bullion and investments of A$372M at 31 December 2020 after repaying A$125M of corporate bank debt, A$40M in stamp duty/M&A and A$10M for FY20 tax balancing payment during the quarter

- December quarter production:

- Yandal Gold Operations:

- 65,396oz mined and 68,405oz sold at an AISC A$1,203/oz (US$879/oz) with AIC of A$1,407/oz

- KCGM Gold Operations (50% Ownership):

- 48,460oz mined and 58,565oz sold at an AISC A$1,359/oz (US$993/oz) with AIC of A$1,561/oz

- Kalgoorlie Gold Operations:

- 71,709oz mined and 71,731oz sold at an AISC A$1,968/oz (US$1,437/oz) with AIC of A$2,132/oz

- Pogo Gold Operations:

- 58,744oz mined and 54,198oz sold at an AISC US$1,365/oz with AIC of US$1,629/oz

- Yandal Gold Operations:

- Second court date to finalise merger with Saracen Mineral Holdings (ASX: SAR) set for February 2, 2021

- Combined group on track to achieve annual production guidance of 1.6Moz with pathway to 2Moz while unlocking synergies of A$1.5-2B

- Northern Star will host a quarterly conference call today, 21 January 2021, at 12:00pm AEDT (9:00am AWST). The call can be accessed at https://webcast.boardroom.media/northern-star-resourcesltd/20201027/NaN5fff9378aec8340019d1c1dc

--- click on the link at the top for the full report ---

[I hold NST and SAR shares.]

25-Nov-2020: Update on Proposed Merger of Equals

Saracen Mineral Holdings Limited (ASX:SAR, “Saracen”) and Northern Star Resources Ltd (ASX:NST, “Northern Star”) refer to their joint announcement dated 6 October 2020, in which Saracen and Northern Star announced execution of a binding Merger Implementation Deed (“MID”) under which Northern Star will acquire 100% of the shares in Saracen via a Saracen scheme of arrangement (“Scheme”).

Saracen and Northern Star are pleased to confirm that all Northern Star financier consents and Material Saracen Facilities and Relevant Agreements consents required under items 7 and 8 of clause 3.2 of the MID have now been obtained, and those conditions precedent are now satisfied.

The Scheme remains subject to the remaining conditions precedent in clause 3.2 of the MID, which include approval being obtained from Saracen shareholders and Court approval in relation to the Scheme.

As set out in the previous joint announcement, Saracen is expecting to circulate a scheme booklet (containing information about the Scheme and the basis for the Saracen Board's unanimous recommendation, as well as an Independent Expert's Report) to Saracen shareholders in December 2020. The Scheme is currently expected to be implemented in February 2021, subject to Saracen shareholders approving it and all other remaining conditions being satisfied.

The Scheme continues to be:

- unanimously recommended by the Saracen Board, subject to no superior proposal emerging for Saracen and the Independent Expert concluding (and continuing to conclude) that the Scheme is in the best interests of Saracen shareholders; and

- unanimously endorsed and supported by the Northern Star Board, subject to no superior proposal for Northern Star emerging.

Saracen and Northern Star will continue to update Shareholders about material developments in relation to the Scheme. Saracen shareholders do not need to take any action at this time.

Authorised for release to the ASX by Bill Beament, Executive Chair (NST) and Raleigh Finlayson, Managing Director (SAR).

[I hold both NST and SAR shares.]

Also: 25-Nov-2020: NST AGM Presentation and Chair's AGM Address

I note that the steep falls in the NST share price appear to have stopped with today's rise, however they still look like very attractive buying at sub-$13/share. They were trading at $16.84 only 17 days ago (their closing price on Monday 9-Nov-2020 was $16.84). At $12.91, where they are trading right now, as I type this, they are 23% below that level.

17th August 2020: Dumile Capital ("Growth is Value"): Northern Star Resources – Do Better than Buffett

Thanks to Chagsy for bringing this excellent write-up on NST by Dumile Capital to our attention over in the "Gold as an investment" forum.

[I hold NST shares. I also hold SAR shares. SAR & NST are due to merge early in the new year (CY: 2021) after a Saracen (SAR) shareholder vote.]

This article centres around Berkshire Hathaway's recent smallish investment (for them) in Barrick Gold (NYSE:GOLD), one of the world's two largest listed gold producers (second largest gold company by market cap, and largest by EV when the article was written in August 2020). I'm 99% convinced that it was NOT Warren Buffett who made that investment decision, as I've mentioned elsewhere here previously and as this article suggests early on. WB has entrusted much of the Berkshire Hathaway (BH) everyday investment management decisions to his investment lieutenants,Todd Combs and Ted Weschler, as explained in this September 2020 article on BH's $US570 million bet on Snowflake (at IPO).

As with WB's aversion to gold, he also actively avoids early-stage technology companies, yet Berkshire is now getting in on such tech companies at IPO, and investing US$564m in Barrick Gold (20.9m x NYSE:GOLD).

Berkshire also recently (as in - in the past few years) invested in the USA's four largest airlines, something that NOBODY would have reasonably expected after reading ANY of Warren's comments on airlines, particularly that anybody who had shot the Wright brother's first successful plane flight out of the sky would have been doing future investors a huge service. Then Berkshire exited all of them (sold out of all 4 airlines) near their lows earlier this year - a move which significantly contributed to Berkshire posting a $US49.7 billion loss for the quarter ending March 31, 2020.

However, back to this Dumile Capital article on NST. Here is the best bit:

Northern Star Resources ($NST.ax), perhaps the industry’s biggest success story of the past decade, has achieved staggering returns for shareholders by executing a totally different approach. The stock’s 10-year return now stands at +15,755% (+66% annualized, not including dividends), while physical gold has risen 56% (4.5% CAGR), and Barrick has registered a cumulative loss of -42% (maybe a bit better if you add up dividends).

Northern Star has built its entire business around acquiring mispriced end-of-life assets from bloated operators like Barrick and making prudent capital investments to unleash the assets’ full potential by lowering extraction costs and extending their mine lives. The meteoric rise of NST highlights the utmost importance of management quality in a commoditized industry, as the major drivers of returns on capital are management decisions around mine transactions, operations, and gold hedging activities.

Former CEO and current Chairman Bill Beament was instrumental in formulating NST’s business model. Beament’s background as an underground mining engineer gave him a unique advantage to spot value where others couldn’t. With the support of a senior management team built with a focus on underground mining expertise, the Company has demonstrated that their ability to buy non-core “tired, unloved assets” from other companies and quickly turn them around into major performers that have a significant impact on NST shareholder value is not just a matter of getting lucky, but rather a repeatable process.

--- end of excerpt ---

I highly recommend reading the ENTIRE article - which includes Jundee as a good example of the NST model at work. As I always mention, I hold NST, and they are my favourite gold producing company, so my opinion is likely biased towards them, however you can NOT argue against their outstanding total shareholder return numbers over so many different timeframes. Bill Beament has done very well out of NST, no question, but so has every other NST shareholder who has held the stock for any decent length of time.

27-Oct-2020: September 2020 Quarterly Activities Report

To view that report without the ASX's "FOR PERSONAL USE ONLY" obscuring the text, you can download it directly from the NST website, however they haven't uploaded it to the site yet (as I type this) - when they do, you will see it appear here:

https://www.nsrltd.com/investor-media/reports/quarterly-reports/

STRONG QUARTER WITH PRODUCTION AT UPPER END OF GUIDANCE

Production on track to rise 40% over next three years with costs to fall 10%

Gold sales of 227,532oz at upper end of quarterly production guidance; All-in cost of A$1,752/oz and average realised price of A$2,493/oz; Hedge book reduced to just 13% of next three years’ production

HIGHLIGHTS

- Gold sold in the September quarter of 227,532oz; This was at the upper end of the published quarterly guidance range of 207,000-233,000oz

- Outstanding performance at Yandal and Pogo:

- Australian Operations (including 50% KCGM) sold 176,526oz at an AISC of A$1,544/oz (US$1,081/oz)

- Pogo Operations sold 51,006oz at an AISC of US$1,199/oz, quarterly costs were 14.5% lower than FY20

- Group all-in cost (AIC) of A$1,752/oz (US$1,226/oz), demonstrating low capital intensity for growth

- Average realised price of A$2,493/oz in the September quarter; This included sales of ~65,000oz into hedged positions, reducing the hedge book to approximately 13% of the next three years’ production

- Strong underlying free cash flow of A$132M generated during September quarter; This was despite investing ~A$42M in growth capital and exploration

- Unaudited NPAT of ~A$100M; Operating mine cashflow of A$254M; Net mine cashflow of A$170M

- Cash, bullion and investments of A$470M at 30 September 2020 after repaying A$200M of corporate bank debt on 6 July and paying out A$200M (or A27cps) in fully franked dividends in the quarter

- September quarter production:

- Yandal Gold Operations: - 79,946oz mined and 73,743oz sold at an AISC A$1,209/oz (US$846/oz)

- KCGM Gold Operations (50% Ownership): - 46,018oz mined and 53,959oz sold at an AISC A$1,461/oz (US$1,023/oz)

- Kalgoorlie Gold Operations: - 64,064oz mined and 48,824oz sold at an AISC A$2,116/oz (US$1,481/oz)

- Pogo Gold Operations: - 59,988oz mined and 51,006oz sold at an AISC US$1,199/oz

- Annual production forecast to grow at industry-leading rate of 40% to 1.25Moz over next three years, with low capital intensity; Costs expected to fall by 10%

- Reserves double to 10.8Moz (on price of A$1,750/oz (US$1,225/oz)); Resources increase 67% to 31.8Moz

- Strong September quarter results from Northern Star and Saracen (ASX: SAR) highlight the outstanding combined growth profile and cash generating capacity of the companies under the proposed merger

- Northern Star will host a quarterly conference call today, 27 October 2020, at 11:00am AEDT (8:00am AWST). The call can be accessed at https://webcast.boardroom.media/northern-star-resourcesltd/20201027/NaN5f8e63ecd7fcb30019896f4c

Northern Star Resources (ASX: NST) is pleased to report strong operating and financial results for the September quarter, 2020.

Gold sales of 227,532oz were comfortably in line with the Company’s published guidance for the quarter of 207,000oz – 233,000oz (22% of the annual guidance of 940,000oz – 1,060,000oz).

This strong operating performance, including all-in costs of A$1,752/oz, was complemented by an average realised price of A$2,493/oz. This resulted in robust margins which in turn led to underlying free cashflow of A$132 million after investing A$42 million in growth capital and exploration.

Northern Star finished the quarter with cash, bullion and investments of A$470 million and corporate debt of A$500 million compared with A$770 million and A$700 million respectively at June 30. During the September quarter, the Company repaid A$200 million in debt and paid fully franked dividends totalling A$200 million, or A27¢ a share. These comprised the postponed interim dividend, the final dividend and the special dividend.

The Company also continued to reduce its hedge book, which now represents just 13 per cent of forecast production for the next three years, as part of the ongoing strategy to increase its exposure to the significantly higher spot price.

Northern Star Executive Chair Bill Beament said the results highlighted the ongoing strength of the Yandal Operations, the successful ramp-up of production at Pogo and further benefits from the changes being implemented at KCGM.

“Jundee is simply one of the great gold mines of Australia, as shown by sales of more than 73,000oz in the quarter at an AISC of A$1,209/oz,” Mr Beament said.

“We are also delighted with the results at Pogo, which continued to improve on every metric as the benefits of the new bulk mining method and other changes we have introduced flow through. Costs for the quarter are 14.5 per cent lower than in FY20 and the project is generating strong free cashflow.

“Our changes with Joint Venture partner Saracen at KCGM are also paying dividends, with costs beating guidance.”

Mr Beament said the results at the Kalgoorlie Operations reflected mine sequencing which resulted in lower grades and reduced overall tonnages. Gold sales were also reduced due to a planned roaster shutdown. However, this increased the inventory of concentrate, which will be poured in the current quarter.

“Overall, we expect to increase production at the Kalgoorlie Operations each quarter this year and ultimately meet our full year guidance there.”

Northern Star’s production is set to rise by 40 per cent over the next three years to 1.25Moz and costs are forecast to fall by 10 per cent.

“We have one of the strongest growth profiles in the global gold industry and we will achieve this with one of lowest capital intensities in the global gold industry,” Mr Beament said. “This combination enables us to deliver strong growth in production and free cashflow while maintaining our superior financial returns.”

Mr Beament said Northern Star’s strong quarterly performance, combined with the excellent September quarterly results released by Saracen last week, provided further insight into the significant strengths of the proposed merged group.

“Both companies have again demonstrated the tier-1 quality of our assets,” he said. “Our combined production is growing to 2Moz a year by FY27 while most of our peers have a falling production profile. Our costs will continue to reduce and our combined scope for further organic growth in tier-1 locations is exceptional.” (*)

Notes:

- (*) Refer to the ASX release by Northern Star and Saracen entitled “Northern Star and Saracen agree to A$16B merger-of-equals” dated 6 October 2020 and available at www.nsrltd.com, www.saracen.com.au and www.asx.com. The proposed merger is to be implemented by way of a Saracen scheme of arrangement (Scheme). Key conditions of the Scheme include approval being obtained from Saracen shareholders in general meeting, scheduled to occur during January 2021. Further information about the Scheme (including key risks for Saracen shareholders) will be provided by Saracen to Saracen shareholders and released to ASX in due course, in the form of an explanatory statement (as that term is defined in section 412 of the Corporations Act) and notice of meeting (Scheme Booklet). The Scheme Booklet will also include or be accompanied by an independent expert's report that will opine on whether the Scheme is in the best interest of Saracen shareholders.

--- Click on the link at the top (one of them) for the full report ---

[I hold NST and SAR shares.]

12-Oct-2020: NST + SAR joint Investor Presentation - Diggers & Dealers Conference, Kalgoorlie

The ASX's new website (launched today) had a few hiccups, and one of them is the way they're adding their "FOR PERSONAL USE ONLY" watermark to the left edge of all ASX announcements by everybody. They are covering up text and making announcements hard to read, and when the announcement is a slideshow like this one, they don't even fit the watermark up the left hand edge - it just says "IAL USE ONLY" on each page instead. Quite sub-par really.

Thankfully, the better companies also allow you to download these announcements directly from their own website. NST are one of these better companies, and the announcement (their joint NST+SAR Diggers and Dealers Company Presentation) - without the annoying watermark - can be viewed by clicking on the following link:

Because the two companies are merging, and the merged entity will be called "Northern Star Resources" and have the NST ticker code, I am not going to post straws under SAR (Saracen Mineral Holdings) as well as NST, just under NST from now on.

[NST and SAR are among the gold producers that I hold shares in. NST has been my favourite ASX-listed gold producer for the past five years - and I've done VERY well out of them. This merger will only make them even bigger, even more relevant, and better. They are going to be on a lot more overseas investors' radars now as well, which isn't a bad thing, because their fundamentals, when compared to other large global gold miners, look excellent. Bill Beament has always run NST as a business first, and a miner second. Sustainable and growing profitability and way above average total shareholder returns have been a feature of NST for the past 5 or 6 years. NST compares very well with the vast majority of other ASX-listed companies, not just gold producers. Northern Star has been a consistent outperformer.]

09-Oct-2020: KCGM Site Visit Presentation - Diggers & Dealers, October 2020, Kalgoorlie, WA.

[I hold both NST and SAR, who are 50/50 JV partners in KCGM - Kalgoorlie Consolidated Gold Mines, which owns the massive Kalgoorlie Super Pit - and NST & SAR are about to merge, and they have both been bid up significantly since that announcement on Tuesday (6-Oct-2020). It came as no surprise to me, as I have been expecting this to occur since they became JV partners in KCGM.]

06-Oct-2020: Presentation - SAR and NST agree to Merger of Equals

plus: Saracen and Northern Star agree to Merger of Equals

and: Saracen AGM Presentation - "There's nothing like Tier 1 Gold"

Transaction rationale

The scale and liquidity to attract both gold and generalist investors.

- Top-10 global gold miner with sector-leading production growth; pathway to 2Mozpa

- Size and liquidity to attract generalist as well as gold-focused global investors and Australian large cap funds

- Increased investor relevance and capital markets presence

- One of the few global gold companies of this scale with operations exclusively in Tier-1 jurisdictions

- Long-life producer with over 19Moz in Reserves and 49Moz in Resources

- Combined market capitalisation of ~A$16.0 billion with strong global share register

- Strong balance sheet with pro-forma net cash of A$118 million (as of 30 June 2020)

- Strengthened platform to capitalise on accretive M&A opportunities.

A compelling combination - Takeaways

A unique opportunity exclusively available for both companies to unlock significant value, and build a major global gold producer with an exceptional high-margin growth profile.

Benefits to Northern Star shareholders

- Exposure to high-quality, de-risked operations and infrastructure at Thunderbox and Carosue

- Saracen’s open pit expertise.

Benefits to Saracen shareholders

- Stronger near-term cash flows

- Exposure to growth and North American platform through Pogo

- Northern Star’s underground expertise.

Benefits to both sets of shareholders

- Top-10 global producer, with 19Moz in Reserves and 49Moz in Resources

- Complementary Board and management teams to drive growth and continued sector-leading returns

- Diversification of production and cash flows across a number of high quality, low-risk Tier-1 jurisdictions

- Transaction unlocks A$1.5-2.0B NPV in pre-tax synergies to be delivered via geographic, operational, and strategic synergies

- Leading approach to environmental, social and governance principles and practices

- Consolidation of ownership at KCGM for the first time [NST & SAR own KCGM 50/50 - which includes the Kalgoorlie Super Pit]

- Dominant position in greater Kalgoorlie district, targeting 1.1Mozpa in production

- Rationalised ownership of the Yandal belt, spanning Jundee, Bronzewing and Thunderbox

- Significant organic growth pipeline across a merged portfolio with enviable geological endowment

- Enhanced financial strength and flexibility to pursue accretive M&A

- Increased investor relevance and capital markets profile

--- click on links above for more --- [and there is a lot more]

[I hold both NST & SAR shares, and I flagged this merger as a possibility last year and again earlier this year after the two companies became JV partners in KCGM - i.e. the Kalgoorlie Super Pit. It just makes sense. Very positive IMO.]

24-Sep-2020: Northern Star Resources Annual Strategy Day Presentation

[I hold NST shares.]

22-Sep-2020: Investor Presentation - Gold Forum Americas 2020 ("An Australian Gold Miner, For Global Investors")

[I hold NST shares.]

19-Aug-2020: FY2020 Financial Results and FY2020 Financial Results Presentation

plus 2020 Annual Report to Shareholders and Appendix 4E

NORTHERN STAR DECLARES SPECIAL DIVIDEND AS UNDERLYING NPAT SOARS 69% TO A$291.0M

Final dividend of 9.5¢ plus special dividend of 10¢, both fully-franked

Northern Star set for more significant growth in cashflow on back of leveraged exposure to gold price, increasing production to ~1.3Mozpa and Resources of 31.8Moz in Tier-1 locations

HIGHLIGHTS

- Record underlying net profit after tax up 69% to A$291.0 million (FY19: A$171.9 million)

- Record statutory net profit after tax up 67% to A$258.3 million (FY19: A$154.7 million)

- Underlying free cashflow surged 190% to A$423.1M, up by A$277.3M, on averaged realised gold price of A$2,208/oz; free cashflow yield forecast to increase further given spot price is now A$2,750/oz

- Group EBITDA up 55% to record A$745.4 million (FY19: A$479.7 million); Australian operations achieved an EBITDA margin of 49%; Pogo achieved an EBITDA margin of 22%, up from 7% in FY19

- Operating mine cash flow up 53% to record A$901.6 million (FY19: A$587.6 million1 ); Net mine cash flow up 54% to A$559.2 million (FY19: A$362.0 million1 )

- A$769.5 million in cash, bullion and investments at 30 June 2020 (30 June 2019: A$361.4 million) after investing A$1.3B in acquisition and growth comprising A$1.1B for a 50% interest in KCGM and associated assets, A$177.7M in takeover of Echo Resources and A$206M in growth capital/exploration

- FY20 final fully-franked dividend increased 27% to A9.5¢ per share (FY19: A7.5¢ per share), taking fullyear payout to A17¢ per share. Plus, special fully-franked dividend of A10¢ per share

- Industry-leading financial returns sustained: FY2020 average return on equity of 21% when normalised for the transformational KCGM acquisition

- Total Resources increased by 67% (12.7Moz) to 31.8Moz (after depletion of 912,000oz), Resources per share have grown by +179% over past five years; Importantly, Measured and Indicated Resources increased 94% to 20.8Moz, underpinning replacement of Reserves in coming years

- Group Reserves increased by 102% (5.5Moz) to 10.8Moz (after depletion of 912,000oz); Results underpin strong growth in forecast production and long mine life visibility, Reserves per share have grown by 348% over the past five years (despite production of 3.6Moz)

- Northern Star Shareholders now benefit from the second-biggest ASX-listed production profile underpinned by this world-class mineral inventory, significant leverage to gold price, a clear pathway to annual production of 1.3Moz and one of the lowest capital intensities in the industry

- Northern Star will host the full year results call today, 19 August 2020 at 8.30am AWST (10:30am AEST); The call can be accessed at https://webcast.boardroom.media/northern-star-resourcesltd/20200819/NaN5f34ebbc59132c0019f81c9b

--- click on links above for more ---

[I hold NST - they are the best run gold mining company in Australia, and probably globally.]

18-Aug-2020: KCGM Reserves grow to 9.7Moz, output rising to plus 675kozpa

Also: Resource Reserve and Guidance Update including KCGM

Resources and Reserves, Production and Cost Guidance Update (inc KCGM)

RESERVES DOUBLE TO 10.8MOZ, UNDERPINNING ~40% INCREASE IN PRODUCTION AND 10% FALL IN COSTS

FY21 production guidance is 940koz-1,060koz; Production forecast to rise to ~1.15Moz in FY22, ~1.25Moz in FY23 and ~1.3Moz by FY27; AISC to fall 10% over next 2 to 3 years; Resources increase by 12.7Moz, underwriting longer mine lives and increased cashflow

HIGHLIGHTS

Resources at June 30, 2020

- Group Resources increased by 67% (12.7Moz) to 31.8Moz (after depletion of 912,000oz and acquisitions of KCGM and the Bronzewing Project); Resources per share have grown by +179% over the past five years

- Importantly, Measured and Indicated Resources increased 94% to 20.8Moz; This underpins continued replacement of Reserves in coming years

- Increased inventory will underpin further organic production growth, longer mine lives and cashflow

- Resources breakdown: KCGM at 9.6Moz

- All other assets up 3.2Moz to 22.3Moz

Reserves at June 30, 2020

- Group Reserves increased 102%, or 5.5Moz, to 10.8Moz (after depletion of 912,000oz); Results underpin strong growth in forecast production and long mine life visibility

- Reserves per share have grown by 348% over the past five years (despite production of 3.6Moz)

- Reserves are calculated conservatively using an assumed gold price of A$1,750/oz and US$1,350/oz compared with the current spot price of ~A$2,700/oz (US$1,940/oz)

- Reserves breakdown: KCGM at 4.85Moz

- All other assets up 12%, or 600,000oz, to 6Moz

- Considerable opportunity to further grow Reserves with conversion of the 31.8Moz Resource base

Guidance

- FY21 production guidance for Australian operations is 760,000-840,000oz at AISC of A$1,440-A$1,540/oz (US$1,035-US$1,107/oz)

- KCGM (50%) 220,000-240,000oz at A$1,470-A$1,570/oz (US$1,057-US$1,129/oz)

- Jundee Operations 270,000-300,000oz at A$1,200-A$1,275/oz (US$863-US$917/oz)

- Kalgoorlie Operations 270,000-300,000oz at A$1,650-A$1,750/oz (US$1,186-US$1,258/oz)

- FY21 production guidance for Pogo is 180,000-220,000oz at AISC of US$1,200-US$1,400/oz; Guidance takes into account the impact of COVID-19 on operational restrictions

- FY21 expansionary capital budget of A$198M, comprising:

- A$99M at KCGM, majority associated with pit cutbacks to de-risk operation and provide multiple mining fronts

- A$99M for all other assets (ex-KCGM)

Exploration and Production Growth

- A$101M is budgeted for exploration in FY21 as part of the strategy for ongoing growth in production, mine lives and cashflow; Includes; Pogo A$21M, Jundee A$28M, Kalgoorlie $A35M, Regional A$11M, KCGM (50%) A$6M

- Northern Star’s total production is forecast to rise to ~1.15Moz in FY22, ~1.25Moz in FY23 and ~1.3Moz by FY27; AISC forecast to fall by 10% to ~<US$1,000/oz over next two to three years due mainly to the increased production base.

- In FY22, the additional capital required to achieve the 1.25Mozpa run rate is only A$300M, Non-sustaining capital drops away significantly after then.

--- click on links above for the full reports ---

[I hold NST shares}

13-August-2020: Resources & Reserves, and Guidance Update (ex-KCGM)

PRODUCTION SET TO INCREASE 30% OVER NEXT TWO YEARS AND COSTS TO FALL 10%

FY21 production guidance (ex-KCGM) is 720koz-820koz; Production (ex-KCGM) is forecast to rise to ~900koz in FY22 and ~1Moz in FY23, driving down AISC by 10%; Resources increase by 3.2Moz, underwriting longer mine lives and increased cashflow.

HIGHLIGHTS

Resources at June 30, 2020

- Group Resources increased by 3.2Moz to 22.3Moz (after depletion of 912,000oz and acquisition of Bronzewing Project); Resources per share have grown by +120% over the past five years (ex-KCGM)

- Importantly, Measured and Indicated Resources increased 29% to 13.8Moz; This underpins continued replacement of Reserves in coming years

- Increased inventory will underpin further organic production growth, longer mine lives and cashflow

- Resources breakdown:

- Pogo up 13% to 6.7Moz at 9.8gpt; This is the largest Resource in Pogo’s history

- Jundee up 16% to 5.3Moz, with a further 1.6Moz at Bronzewing to be included as part of the Yandal Operations

- Kalgoorlie Operations at 6.8Moz

- Kanowna up 16% to 2.2Moz, 100% Kundana at 1.2Moz, 51% Kundana at 1.0Moz, South Kalgoorlie at 1.9Moz

- In FY20, NST acquired the 1.6Moz Bronzewing Project and agreed to divest the 1.6Moz Mt Olympus Project

Reserves at June 30, 2020

- Group Reserves increased 12%, or 600,000oz, to 6Moz (after depletion of 912,000oz); Reserves per share have grown by 180% over the past five years (despite production of 3.6Moz)

- Reserves are calculated conservatively using an assumed gold price of A$1,750/oz and US$1,350/oz compared with the current spot price of ~A$2,700/oz (US$1,940/oz)

- Reserves breakdown:

- Jundee up 25% to 2Moz (despite depletion of 379,500oz), with a further 800,000oz at Bronzewing to be included as part of the now consolidated Yandal Operations

- Pogo Reserve of 1.5Moz (despite depletion of 200,700oz), grade up 7% to 8gpt, despite only drilling 62% of budgeted drill metres due to COVID-19 restrictions

- Kalgoorlie reduced 25% to 1.6Moz (after depletion of 330,200oz); New estimate reflects a significant reduction in the Raleigh Reserve and a higher cost base used in the calculations

- Kanowna at 700koz, 100% Kundana at 300koz, 51% Kundana at 400koz and South Kalgoorlie at 200koz

- Considerable opportunity to further grow Reserves with conversion of the +22Moz Resource base

Guidance

- FY21 production guidance for Australian operations (ex-KCGM) is 540,000-600,000oz at AISC of A$1,425- A$1,525/oz (US$1,025-US$1,096/oz)

- Jundee Operations 270,000-300,000oz at A$1,200-A$1,275/oz (US$863-US$917/oz)

- Kalgoorlie Operations 270,000-300,000oz at A$1,650-A$1,750/oz (US$1,186-US$1,258/oz)

- FY21 production guidance for Pogo is 180,000-220,000oz at AISC of US$1,200-US$1,400/oz; Guidance takes into account the impact of COVID-19 on operational restrictions

- FY21 expansionary capital budget of A$99M, comprising:

- A$50M (US$35M) at Pogo, with most of this applied to increasing processing capacity to 1.3Mtpa

- A$37M at Jundee, predominantly for surface infrastructure upgrades and bringing on new production areas

- A$12M at Kalgoorlie Operations for capital works

--- click on the link at the top for the full announcement ---

[I hold NST - they are my #1 Australian Gold Producer pick, and have been for the past decade.]

23-7-2020: June 2020 Quarterly Activities Report

[I hold NST shares]

8-July-2020: June Quarter Trading Update

This time last year, the massive Kalgoorlie Super Pit, which used to be the largest OP (open pit) gold mine in Australia (recently overtaken by Newmont's Boddington Gold Mine) was owned by the two largest gold mining companies in the world - Barrick and Newmont - via their JV company known as Kalgoorlie Consolidated Gold Mines - or KCGM. However those two giants of the industry have now sold their respective shares of KCGM to Northern Star (NST) and Saracen (SAR), Australia's 2nd and 4th largest gold producers (70%+ in gold). Both companies have updated the market this morning. I have already posted a straw about Saracen's update, and briefly mentioned the further positive gold price movement overnight.

This straw is about NST's update, which the market seems to be more excited about so far, mainly because Bill Beament seemed very cautious and worried about the impacts of COVID-19 when he last provided a comprehensive update (and deferred their interim dividend payment). This wasn't as obvious in their announcement at the time, but was very clear during the associated conference call with analysts and shareholders which I (as an NST shareholder) participated in.

My view at the time was that Bill was being very conservative and was positioning the company to be able to get through COVID was as little damage as possible, and that his position and attitude was an excellent response to a very fluid and uncertain situation. NST got sold down to close to $10/share (during that first week of April), almost re-testing their March low. I took the opportunity at that time to top up my NST positions (I hold them in all of my portfolios, including my super).

Today we will likely see a decent relief rally in NST, because things weren't nearly as bad as Bill thought they might be, and he's brought forward that interim dividend payment now to next week. I would expect NST to finish the day somewhere between $14.50 and $15. I love it when a plan comes together.

NST: June Quarter Trading Update

UNDERLYING FREE CASHFLOW OF A$217.9M FROM SALE OF 262,717 OUNCES

Postponed FY20 interim dividend of A7.5¢ to be paid on July 16, 2020

Northern Star Resources (ASX: NST) advises that its cash, bullion and investments rose by 40% to A$769.5 million at June 30, 2020, up from A$551.4 million at March 31, 2020.

As a result, the Company’s balance sheet was net cash positive at June 30, 2020, with corporate bank debt of A$700 million.

Northern Star generated underlying free cashflow of A$217.9 million in the June quarter from the sale of 262,717oz. This took total sales for the 2020 financial year to 900,388oz while gold produced totalled 905,177oz. This was ~1.6% below the lower end of the FY20 guidance, which was withdrawn due to uncertainties stemming from COVID-19 (see ASX release dated March 26, 2020).

In light of this solid result, Northern Star will pay its FY20 fully-franked interim dividend of A7.5¢ a share on July 16. Payment of this dividend, which totals A$55 million, was postponed when the Company withdrew its guidance.

The Company expects to resume dividend payments in the ordinary course of business.

As part of its COVID-19 measures, Northern Star also drew down an additional A$200 million in debt in the March quarter. The Company has repaid that A$200 million on July 6, reducing its corporate bank debt to A$500 million.

In the June quarter, Northern Star reduced its hedge book to 536,426oz at A$2,085/oz (170,080oz, or 34% of ounces sold, in the June half came from hedged positions) as part of the Company’s strategy to increase its exposure to the spot price. Pushed-out hedged positions are being brought back and deliveries will continue to be accelerated in FY21. The Company has one of the smallest hedge books as a percentage of annualised production in the Australian gold industry, with just 15% of the next three years production committed.

Northern Star Executive Chair Bill Beament said the Company’s staff and business partners had done an outstanding job in very difficult circumstances. This enabled Northern Star to maintain the full employment of the Company’s workforce and business continuity for all stakeholders.

“The health and safety of our people and the communities in which we operate is always our first objective and the measures we adopted in response to COVID-19 reflected that,” Mr Beament said.

“As we foreshadowed at the time, these measures incurred additional costs, reduced productivities and restricted production.

“We also adopted a prudent approach to managing our balance sheet, as reflected in the decision to postpone the interim dividend and drawdown the additional debt.”

Mr Beament said that as well as protecting its people, these measures were aimed at maximising the Company’s ability to continue operating at all its sites throughout the pandemic.

“To generate quarterly free cashflow of A$217.9 million in these circumstances is an outstanding result which reflects the performance of our staff and business partners, our success in being able to operate continuously throughout the pandemic and the underlying strength of our assets,” he said.

“The results at our Pogo mine in Alaska were particularly pleasing given the challenging circumstances emanating from COVID-19 where we effectively managed safe operations with 36 confirmed cases through the quarter.

“Despite the considerable impacts of COVID-19 at Pogo, the underlying trend of rising production and productivity continued. This further demonstrates the huge potential of this asset in more conventional circumstances.

“The teams at our Jundee and Kalgoorlie Operations excelled and we made strong progress towards our goal of unlocking the significant upside at KCGM.”

--- click on the link at the top of this straw for the rest of this announcement ---

[I hold NST shares]

22-June-2020: Northern Star Divests Ashburton Project

Northern Star Resources Limited (ASX: NST) advises that it has agreed to divest the Mt Olympus Project comprising most of the Ashburton Project in Western Australia to Kalamazoo Resources Limited (ASX: KZR) for a deferred contingent cash consideration of A$17.5 million.

The deferred cash consideration is as follows: