1st July 2025: Objective-to-acquire-Isovist.PDF

Looks like another decent acquisition by Objective Corp (OBJ) which has done well over the past 10 or so weeks, moving back into a strong uptrend after being in a strong downtrend for 4 months (early December to early April).

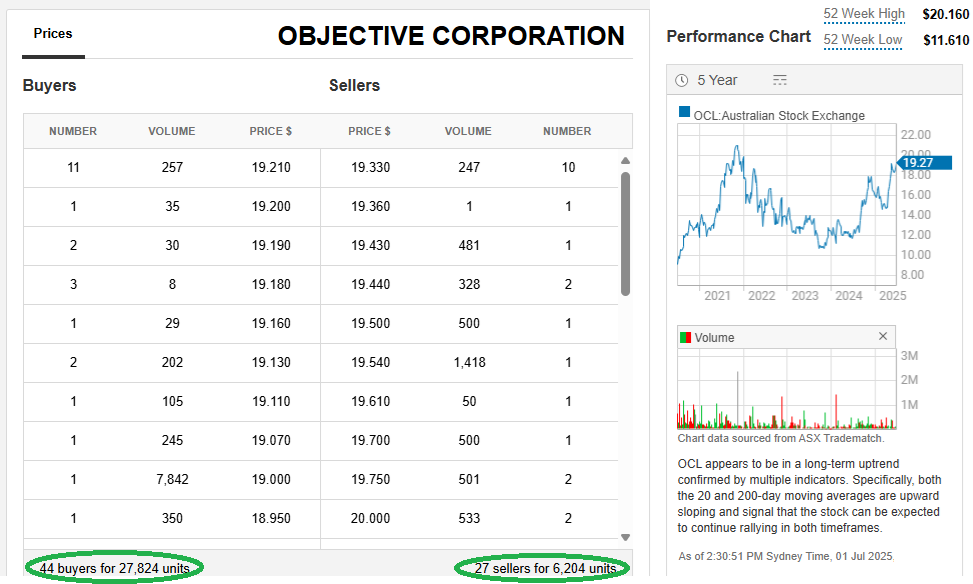

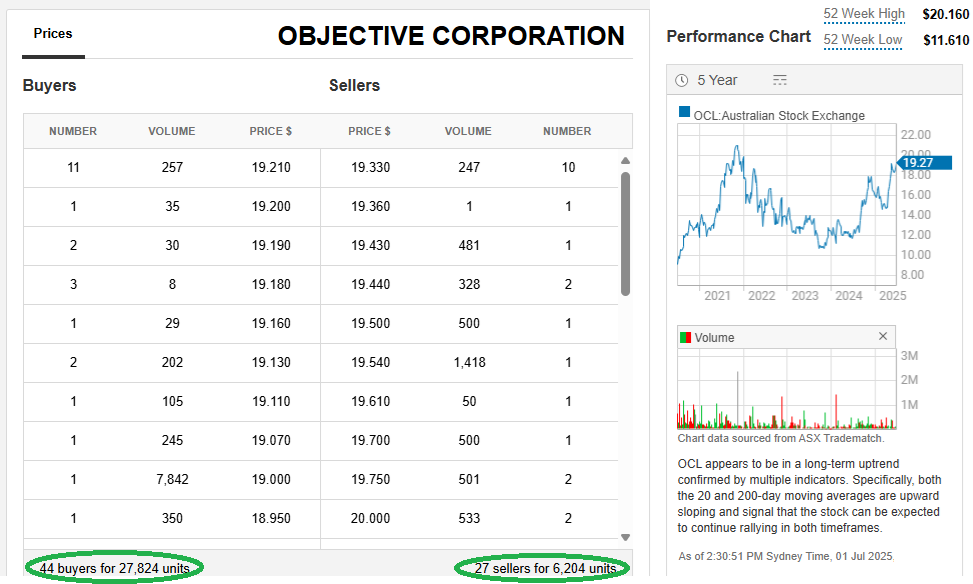

Currently more than 4 x the volume on the buy side than on the sell side.

The OBJ share price is moving around a fair bit but is currently up +17 cents/share (+0.89%) @ $19.33/share.

The chart above uses weekly data points so does not show today's rise.

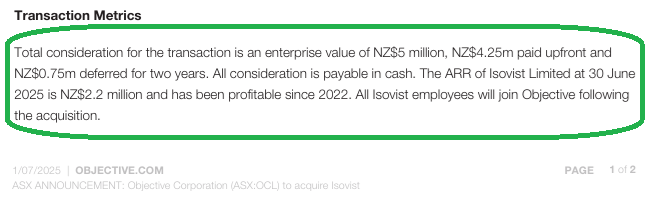

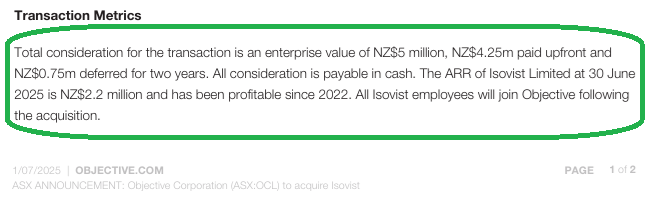

Here's the announcement - note the transaction details - in particular the consideration terms, which I've highlighted in green below:

--- ends ---

Source: Objective-to-acquire-Isovist.PDF [01-July-2025]

I love to see part of the money paid for an acquisition paid later as a deferred payment, particularly when those deferred payments are tied to an EBITDA, EPS, TSR or other growth-oriented hurdle. This one may not have a hurdle, however the total price is only $5 million (NZ dollars), not much more than 2x Isovist's ARR, so it's not a major acquisition by any stretch - just a small bolt-on by the looks of it. All good.

Disclosure: Not held.