Objective corp is no doubt a very high-quality company with a very aligned CEO who owns a significant portion of the business. Historically, Objective corp has bought back its Shares on market at a very opportune time and they are currently going through a buyback program that intends to buy 10% of outstanding shares on market. Does that mean management thinks business isn't valued appropriately by the market?

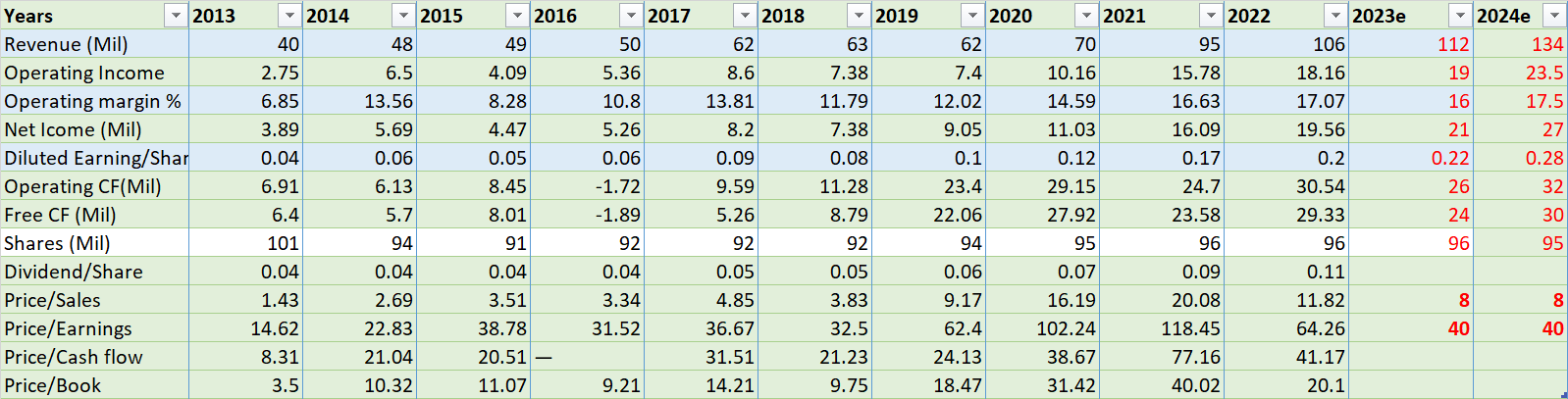

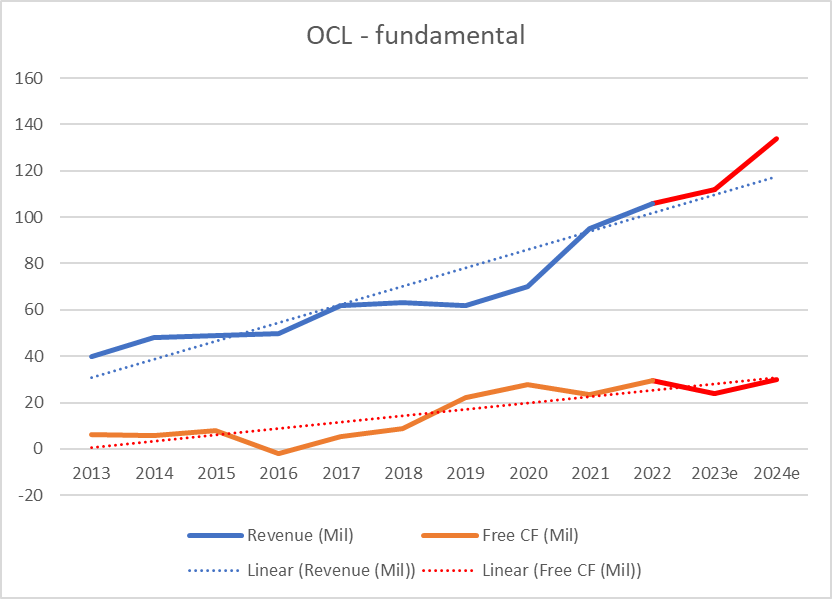

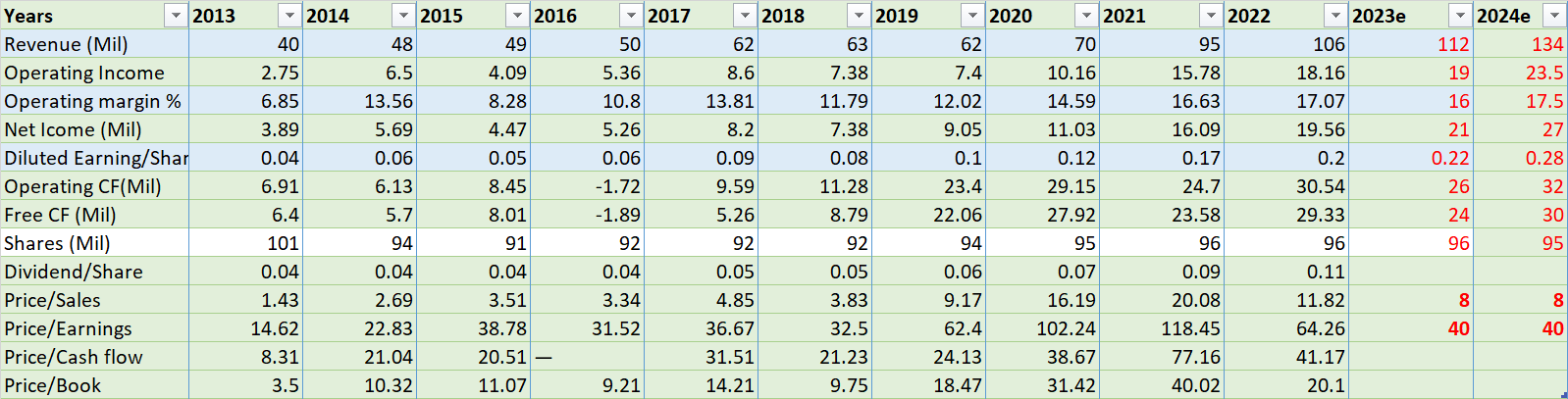

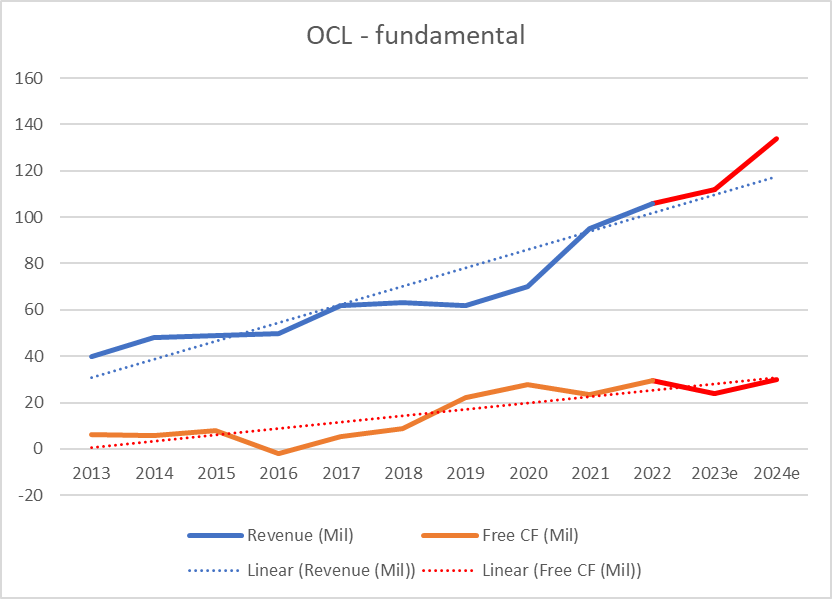

So I have analyzed OCL's FY2013 to FY2022 results and put some of my FY2023 and FY2024expected figures to see

Objective Revenue and Free CF graph tells how the company has performed and what my expectation for the next 2 years.

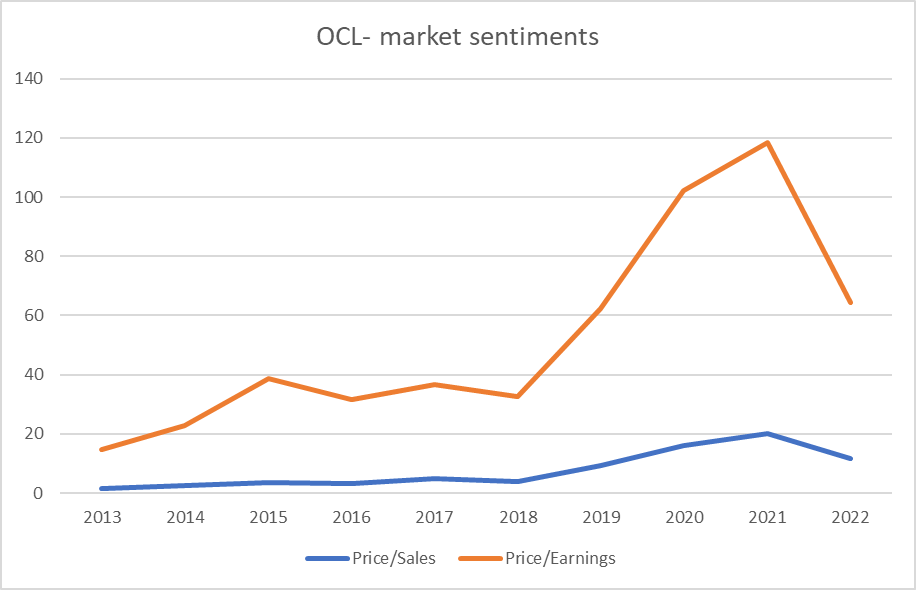

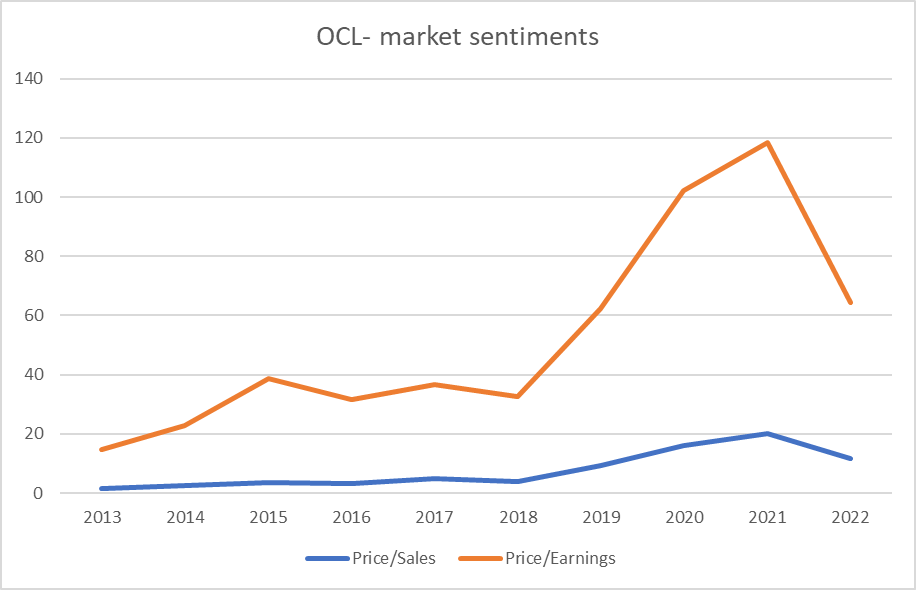

Let's see how market sentiment has shifted for this company.

Now, Even for my projection revenue and Net profit for FY23 and FY24, I give Price/Sales = 8 and PE = 40 valuation comes in between $9.13 and $11.32 ( Not sure if the market will give this valuation in the future - but OCL is a very high-quality company run by high-quality management with recurring revenue serviced to very defensive customers and expensing 100% of R&D (~20% of Revenue) deserve premium )

So I am a bit baffled that Objective is buying back its share in the range of ~$12.00 - $12.80. It will be interesting to see how the next couple of years unfold and will give us insight as to how to value such a company.

PS: I has similar thought when $PME were buying back their shares at ~$25 in 2019. look at it today - even in a bear market, it returned 100%.