Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Interesting to see AFIC purchasing Objective. Sold Wisetech on governance concerns.

Tony Walls will be speaking, among a host of other CEOs. Not something he commonly does.

Based on the ARR multiple methodology using Objective Corporation's FY2025 annual report data:

Share Price Valuations Calculated

Bear Case (12x ARR): $16.13

Fair Value (16x ARR): $21.16

Bull Case (21x ARR): $25.40

Methodology:

ARR FY2025: $120.2M

Shares Outstanding: 95.6M

Cash: $99.2M

No Debt

Valuation Rationale:

Rule of 40 Score: 54.1% (15.1% ARR growth + 39% EBITDA margin)

Score justifies premium multiples versus typical SaaS companies.

Other Factors Supporting Higher Multiples:

84% recurring revenue with 100% subscription software

Mission-critical government software with high switching costs

Profitable growth during SaaS transition

Strong R&D investment (30% of revenue)

Debt-free with significant cash position

Growth Catalysts:

33 on-premise customers remaining for conversion (1.5-2.5x ARR uplift each)

Scottish Government migration validating cloud strategy

Australian expansion of Objective Build

AI integration creating competitive moats

11:40 am asx market: up ~ 18% a 'stamp of approval' from the market here today

OCL = Return (inc div) 1yr: 76.44% 3yr: 11.43% pa 5yr: 16.42% pa

Objective Corp reported results this morning. From their presentation:

I think this was a solid result for OCL with them hitting their ARR target of 15% growth following a strong 2H.

Software revenue is now at 100% subscription which should drive further growth. Revenue growth was a bit subdued compared to last year but this should increase substantially in the coming FY given that ARR for each segment grew by more than 10% each which should see this reflected in revenue growth for the coming year.

Cash flow perhaps on the weaker side with less cash receipts compared to last year, may be related to their transition to 100% subscription model. However the cash on hand is still very strong and management did say they may take the opportunity for further bolt on acquisitions.

Haven't had a chance to listen to the earnings call yet but will go through it when/if the recording is up.

Disc: Held IRL and on Strawman.

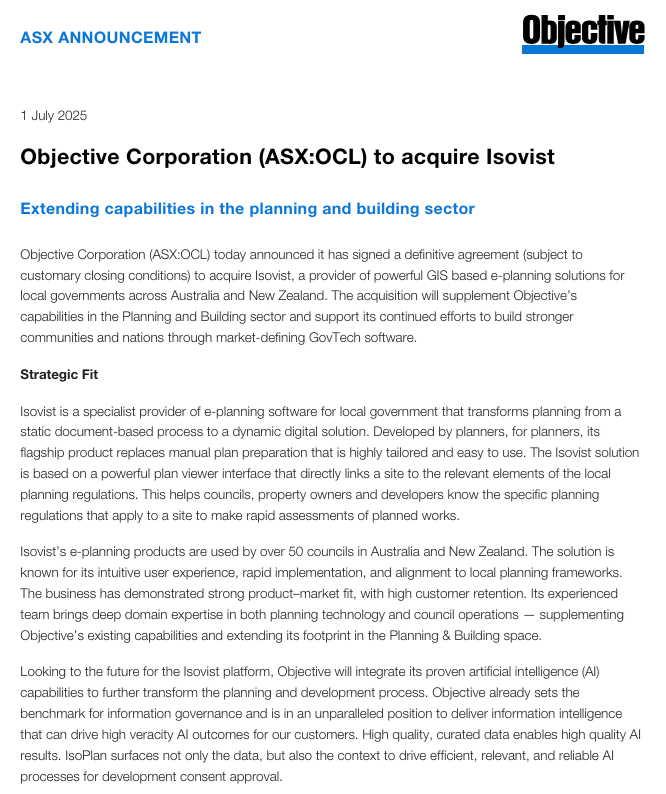

1st July 2025: Objective-to-acquire-Isovist.PDF

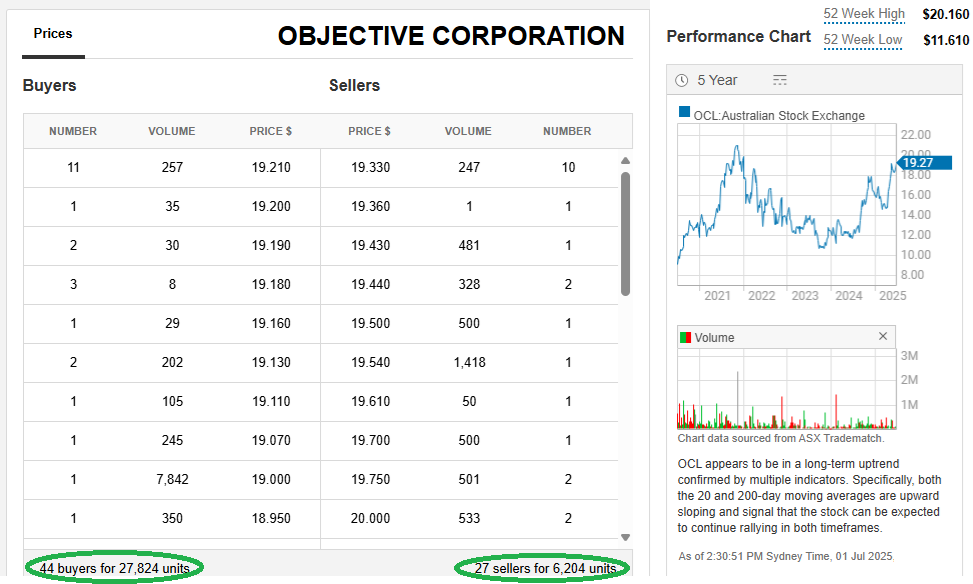

Looks like another decent acquisition by Objective Corp (OBJ) which has done well over the past 10 or so weeks, moving back into a strong uptrend after being in a strong downtrend for 4 months (early December to early April).

Currently more than 4 x the volume on the buy side than on the sell side.

The OBJ share price is moving around a fair bit but is currently up +17 cents/share (+0.89%) @ $19.33/share.

The chart above uses weekly data points so does not show today's rise.

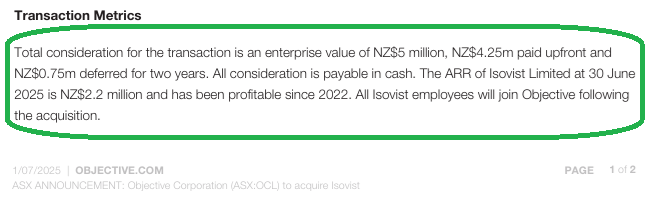

Here's the announcement - note the transaction details - in particular the consideration terms, which I've highlighted in green below:

--- ends ---

Source: Objective-to-acquire-Isovist.PDF [01-July-2025]

I love to see part of the money paid for an acquisition paid later as a deferred payment, particularly when those deferred payments are tied to an EBITDA, EPS, TSR or other growth-oriented hurdle. This one may not have a hurdle, however the total price is only $5 million (NZ dollars), not much more than 2x Isovist's ARR, so it's not a major acquisition by any stretch - just a small bolt-on by the looks of it. All good.

Disclosure: Not held.

Objective Corporation Limited (OCL) reported 1H FY25 results last week. From their presentation:

Results were probably a little weak although they still believe they are on track to hit their target of 15% ARR growth by the end of FY25. Cash flow was also on the weaker side with cash receipts less than pcp but this may be related to the timing of cash payments as a result of the transition to SaaS.

The report also did state that they may look at some non-organic growth opportunities given their balance sheet flexibility and have been doing some due diligence on a few opporunities.

Given that this company has historically been run very well under CEO Tony Walls I'm happy to chalk this half down as an odd weaker half and will wait until the full year results for further analysis.

Disc: Held IRL and on Strawman.

Saw this on LinkedIn. Looks like a first win in the UK for their RegWorks product acquired from Itree several years ago.

We’re delighted to welcome the Gambling Commission to the Objective family!

The Commission has selected specialist SaaS regulatory platform, Objective RegWorks, to help digitise and futureproof its regulatory practices across Great Britain.

The partnership will:

- Deliver a flexible and integrated case management solution to support the end-to-end digital journey for gambling licence applicants.

- Modernise and automate processes to reduce regulatory burden and operational costs.

- Futureproof digital activities to support the Commission’s evolving needs

Technically, the shares have responded well after a slow start since the FY earnings report.

They are sitting at/near new 52w highs, and above a well known area of resistance up to $14 which has been a barrier a few times looking back 12-18 months.

There is further overhead resistance at several points up to the all-time high above $20, but assuming the company delivers on its targets, it should get above those levels eventually.

Contracts delayed, my heart's in doubt,

But if they win, I'll dance and shout.

My faith's on the line, but still I do cling,

Hoping Objective makes shareholders sing.

Objective Corporation released their FY24 results this morning. From their presentation:

Overall a solid result headlined by a very strong cash flow compared to FY23. On my numbers FCF came in around $37.5m compared to $20m in FY23.

Remember that OCL changed their accounting policy to only expense 50% of R&D in the P&L which makes the comparison of NPAT between the 2 periods a bit misleading. However, on a like for like basis, I have NPAT using the old method of accounting of around $27.2m which is still 29% higher than FY23 ($21.1m).

In his letter to shareholders, CEO Tony Walls indicated that although they did not quite reach their targets of 15% growth in ARR, they were also more efficient in deployment of their services which in term lead to a decrease in costs. They attributed this miss to a softening in economic conditions in NZ. They do think that going forward, a 15% growth in ARR is the target.

Disc: Held IRL and on Strawman.

I have written a new article about Objective Corp and buyback history.

https://www.growthgauge.com.au/p/is-objective-corporation-asxocl-a

Objective Corp reported last week. From their presentation:

Remember that OCL changed accounting policies in terms of expensing R&D. Changing from expensing 100% to 50%.

In 1H FY24, total R&D spend for $13.557m with $7.2m being expensed through the P&L. On a comparative basis, NPBT would have been around $13.3m compared to $10.7m in 1H FY23 had the R&D expense been expensed in the period. NPAT would be around flat only due to an increased tax expense in the current period.

Personally I thought this result was pretty good although I think it will be better to wait until the full year results for a better comparison given the seasonality of OCL's customers (public sector customers usually pay during the 2H).

In the shareholder letter from CEO Tony Walls, the outlook provided was strong with management targeting ARR growth of 15%. They also provided an update in regards to potential acquisitions with them having done some due diligence on a few potential candidates but ultimately deciding to focus on building the business organically.

Disc: Held IRL and on Strawman.

Objective release its FY23 result this morning. As guided to market the result will be muted compare to other years.

Revenue:

Customer Receipts

Operating Cash

No. Of Shares on issues

Objective corp is no doubt a very high-quality company with a very aligned CEO who owns a significant portion of the business. Historically, Objective corp has bought back its Shares on market at a very opportune time and they are currently going through a buyback program that intends to buy 10% of outstanding shares on market. Does that mean management thinks business isn't valued appropriately by the market?

So I have analyzed OCL's FY2013 to FY2022 results and put some of my FY2023 and FY2024expected figures to see

Objective Revenue and Free CF graph tells how the company has performed and what my expectation for the next 2 years.

Let's see how market sentiment has shifted for this company.

Now, Even for my projection revenue and Net profit for FY23 and FY24, I give Price/Sales = 8 and PE = 40 valuation comes in between $9.13 and $11.32 ( Not sure if the market will give this valuation in the future - but OCL is a very high-quality company run by high-quality management with recurring revenue serviced to very defensive customers and expensing 100% of R&D (~20% of Revenue) deserve premium )

So I am a bit baffled that Objective is buying back its share in the range of ~$12.00 - $12.80. It will be interesting to see how the next couple of years unfold and will give us insight as to how to value such a company.

PS: I has similar thought when $PME were buying back their shares at ~$25 in 2019. look at it today - even in a bear market, it returned 100%.

Objective CEO's recent letter has an interesting comment about the market.

Objective announced that they are expecting slowdown in revenue growth and margin compression for fy23 and i am not sure if this is going to be the story of FY23 for the most companies.. but it does look increasingly that way or this is probably because of Objective's strategic direction of offloading implementation to partners instead of inhouse for scale.?

Objective is very high quality company with very aligned founder in Tony. Although it is trading on very high multiple for single digit growth but again they are expensing 100% of their R&D.

Short term pain ahead for long term gain? May be one to watch out and dust off valuation for potential opportunity ?

Sold out completely. I’m concerned that government procurement has slowed down across all IT since COVID due to distractions. IT is focused on working from home desktop rather that digital transformation projects. I’ll watch from the sidelines for the next few reporting cycles

ASX Announcement for significant contract win for their RegTech business (formerly Itree Pty Limited). Looks like the Itree acquisition is working out. I understand NZ Police have significant contracts with PEGA Systems and ServiceNow so the fact that they chose a new vendor for this project is interesting especially with such a high profile project in Firearms in NZ in the wake of 2019 shootings. Note that the ARR for this contract has already been reported at 1HY2022.

Objective selected for firearms legislative reform

Objective RegWorks, a specialist end-to-end regulatory platform, has been selected by New Zealand Police to develop the firearms registry Sydney, Australia – Following a competitive multi-phase tender process, Objective Corporation (ASX:OCL) has been awarded a 5 year, circa $13M NZD contract for the implementation of the Arms Information System.

Objective RegWorks will be used by Police to manage the end-to-end regulation of registration and licensing for firearms as part of a programme that includes the establishment of a new Arms Information System (AIS) to support the effective regulation of New Zealand’s licensed firearms community (approximately 250,000 licence holders). The Arms Information System will be a secure digital platform that will manage the information related to arms (firearms, parts, ammunition and other restricted weapons), firearms licensing, and any activities associated with the possession and use of firearms. It will ultimately give Police a clear picture of all firearms transactions in New Zealand, and over time, all the legally owned firearms in New Zealand.

Ben Hobby, Global Vice President, RegTech at Objective said “Our team is deeply aware of the significant outcome this project will generate, which directly aligns with our company mission to drive stronger communities and nations with outstanding digital government software. The harrowing events of 2019 suddenly brought in to focus the need for reform and for an Arms Information System that will assist to underpin continuing freedoms that the people of Aotearoa have enjoyed for generations. We are extremely proud to be partnered with New Zealand Police to make this vision a reality.”

Objective and New Zealand Police have established a delivery partnership and are actively working on developing delivery phases now. This contract was recognised in Objective Corporation’s ARR result reported at 1HY2022, corresponding with the contract start date during that period. Under the terms of the contract, Objective agreed not to disclose the specific customer details at that time.

-ends-

Forgot to do a Straw for the results which came out a few weeks ago and saw no one else had done one either.

Another solid HY result for OCL. Results from their presentation below:

NPAT came in slightly above what they guided for in January but this was excluding $1.4m which they had to pay as part of a NZCC Settlement so reported NPAT was around 8.6m which is only a 20% increase compared to PCP.

I am willing to maintain my valuation from January of $12.30 as I believe this is a high quality company that is still growing its top and bottom line at good rates however the current price is still a bit rich for me so am waiting patiently for a good entry point.

Disc: Not held

@techbunny - Was a Seveneves reference there?

Twas I ignored for being a bunny?

The multiple now, 'tis very funny.

The buyers might have been some funds

But the founder hasn't yet sold one.

So I'll hold it for the yolo ark

Right or wrong; it'll be a lark.

Objective Is Mostly Owned By Its Founder,

For $1.7b this one has low float.

The high valuation makes some investors flounder

But index huggers are all in the same boat!

They'll have to buy shares whatever the price

For long term holders, that should be nice.

One of the best unknown tech stocks on the ASX, Objective Corp is again on track to deliver another year of solid growth.

(I held years ago, and never got back in due to a stupid anchoring bias!!)

The company has reported preliminary results for FY21:

- Revenue up 36% to $95.1m

- ARR up 31% to $74.2m

- NPAT up 45% to $16m

- Cash balance of $48m

- R&D spend of 24% of revenue (all expensed)

CEO Tony Wallis said he expected a "material lift in revenue and profitability" in FY22.

You can read the ASX announcement here

At >100x earnings, my only problem with OCL is the price. That being said, with a high cash balance, fast growth, high quality cash flows and fully expensed development costs, that mulitple could fairly be normalised lower.

Congrats to all long term investors. Shares are up >10x in the last 5 years, and the company has returned 17% of the cost base in dividends (excluding franking credits!)

Objective Corporation (ASX:OCL) provides the following trading update for the first half of financial year 2021 (1HY2021), based on unaudited management accounts as at December 31, 2020.

The expected headline results for 1HY2021 are a revenue increase of 40% to $46.5m (1HY2020: $33.3m) with an EBITDA increase of 74% to $11.8m (1HY2020: $6.8m).

Annual Recurring Revenue (ARR) at 31 December 2020 was $70.1m, representing an increase of 30% over 31 December 2019 ($54.1m). Perpetual right to use (upfront licence) fees continued to decline as a percentage of revenue, representing only 3.6% of total revenues in 1HY2021 (7.4% in 1HY2020).

Cash balance at 31 December 2020 was $27.7m. During 1HY2021, Objective paid $18.4m as consideration for the acquisition of Itree Pty Limited and fully franked dividends of $6.6m.

Objective Corp has acquired Australian 'RegTech' business iTree for $18.5m, or about 1.3x FY21 sales. It's customers include the Dept. of Home Affairs, Queensland Rail and Worksafe Tasmania.

iTrees products will be integrated into Objective's Content Solutions suite, and Objective will market these solutions to a wider market opportunity.

Objective has a great track record of making sensible bolt-on acquisitions, and this appears no different.

iTree is profitable and like Objective fully expenses R&D costs. The acquisition will be cashflow positive, EPS accretive and will be funded from existing cash reserves.

ASX announcement here

20-Dec-2019: CCZ Equities Research: Objective Corp (OCL): No Objections to ARR growth and expanded margins

- Recommendation: Buy

- Valuation: $7.16

- Market cap: $611m

- Share price: $6.58 (31-Jan-20: $6.50)

Excerpts:

- Initiating coverage: Objective Corporation (OCL) is a multinational software business focused on providing content management and governance solutions with over 30 years of operational experience. OCL now provides software across Australia, New Zealand, the UK and the US to over 1,000 customers and 500,000 users in regulated industries. This supported revenue of $62M in FY19 (70% ARR) and close to 300 full time staff working across Australia, New Zealand, Singapore and the UK. OCL has been driven by the steady hand of founder and majority owner (~67%) Tony Walls since 1987 and has been listed on the ASX since 2000.

- Supporting CCZ’s buy recommendation is the upside risk to our forecasts which do not include growth via acquisitions. With a clean balance sheet OCL looks primed to add further products to the portfolio.

- The recent Alpha and MBS acquisitions in New Zealand (NZ) highlight OCL’s ability to create value. The acquisitions allow OCL to become the development approval (DA) process market leader in NZ with 74% of councils as customers. The development of a digitised end to end solution for the DA process through the combination of their Trapeze software along with the software acquired as part of the Alpha and MBS acquisitions should be a source of significant revenue growth into the future.

- The opportunity for OCL to cross sell products to current customers is significant. The majority of OCL’s customers only utilise one product of the 10 on offer in OCL’s portfolio. Most customers would benefit from utilising more products within the OCL portfolio and the software purchasing decision makers generally already have a relationship with OCL. CCZ expect that most of the revenue growth in future years will come from existing customers.

- OCL’s transition from the sale of perpetual licence products to SaaS (Software as a Service) annual licence fees has been a handbrake on revenues and earnings growth for the past few years. We expect negative effect of this transition to diminish with perpetual software sales only representing ~11% of revenue in FY19 and 70% of revenue being SaaS ARR (annual recurring revenue)

- The strong management team’s focus on providing solutions for customers, educating customers, high spend on R&D (over 20% of revenue all expensed) and specialised product offering act as a moat and have enabled OCL to develop world class products and a loyal customer base.

---------------------------

Disclosure: I don't hold OCL shares currently, but they're on my watchlist.

A master at capital management

Objective Corp. has reduced its share count by a massive 32% since 2008, starting with the company aggressively repurchasing 11% of shares outstanding during the GFC.

Those that didn’t sell into the buy-back have seen their stake in the company — and their share of the profits — increase by about 47% over the past 9 years. So while profits have grown 310% in the period, per share profits have climbed 500%.

It did this all while being essentially debt free, and making numerous bolt-on acquisitions -- something that it's capital light nature greatly enables.

Incredibly shareholder friendly and prudent capital management