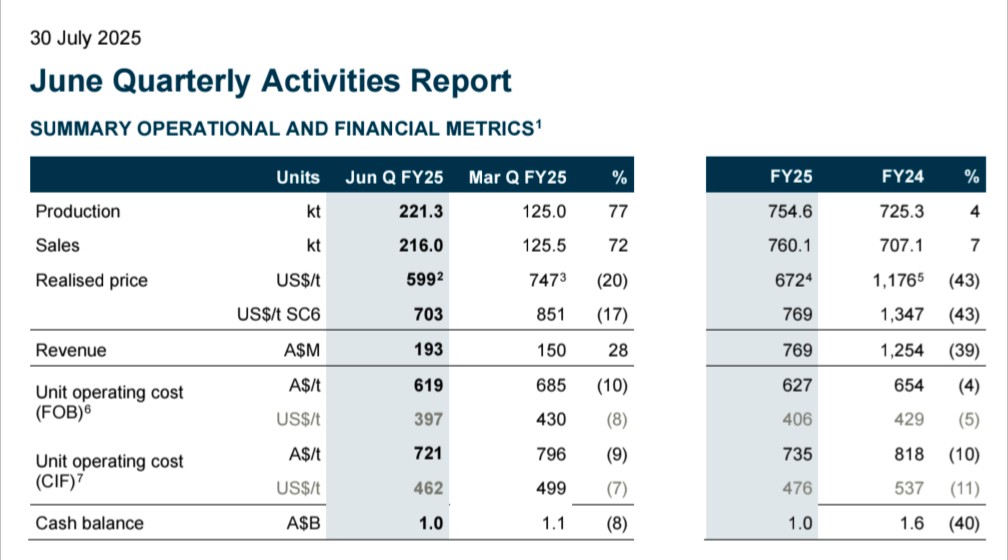

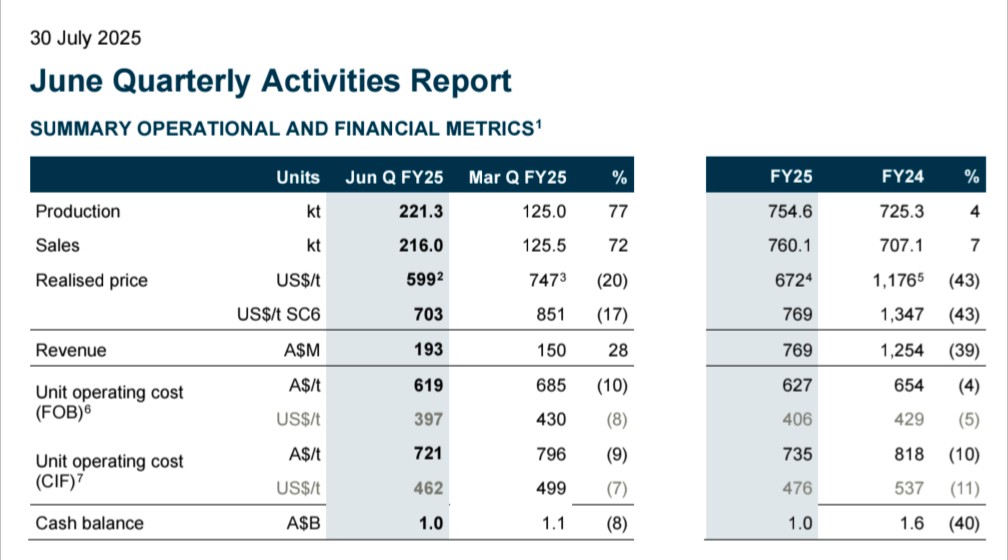

This is a really strong result IMO. Management are delivering on everything that is under their control. Costs down, production up, strong cash balance. Even at these unsustainably low prices, they are profitable. Cash balance only fell due to capex spent on increasing production further.

Also very positive is a large increase in reserves, as well as improved quality

They are guiding for further increases in production, with further decreases in unit operating cost. Getting very close to Greenbushes, which is widely regarded as the best lithium mine in the world

The current market cap of $5.5 billion doesn't look that cheap. But if you subtract the $1 billion cash and model a long-term lithium price that would incentivise production (I am no expert, but most estimates are at least in the range of US$1000 to $1200), then things start looking pretty good.

I am happy to hold onto my small-moderate position