I'm just getting my head around Pureprofile's update today, the headline being the shutting down of Pure.amplify Media in Australia. This follows the shut down of that business in the UK in the previous quarter. Pure.amplify Media is (soon to be was) a digital advertising business, fairly generic and typical of the breed. In the past it has contributed around 10% of the Company's revenue and a similar proportion of EBITDA. It's being wound down because it is currently contributing around 6% of revenue and negative EBITDA.

The half glass full version of that move is it removes a lower quality, fairly generic, non-core part of the overall business and allows management to focus on Data and Insights and the SaaS business. Certainly that's the way they spin it. The glass half empty version is that they're reacting instead of being proactive and making the right move at the wrong time. On balance I don't fault the logic, I just wish they'd made that move at a time Pure.amplify was actually worth something to another party. Now they will not only not receive anything for the business but incur the costs of winding it up. However, if the best time to divest the business was before, the second best time is now. I do give them credit for making the difficult decision and not trying to remediate it or hang on until conditions improve.

Goodwill, customer lists etc. had all been previously written down to zero so apart from the actual costs involved in winding up the business there shouldn't be major impairments in the FY result.

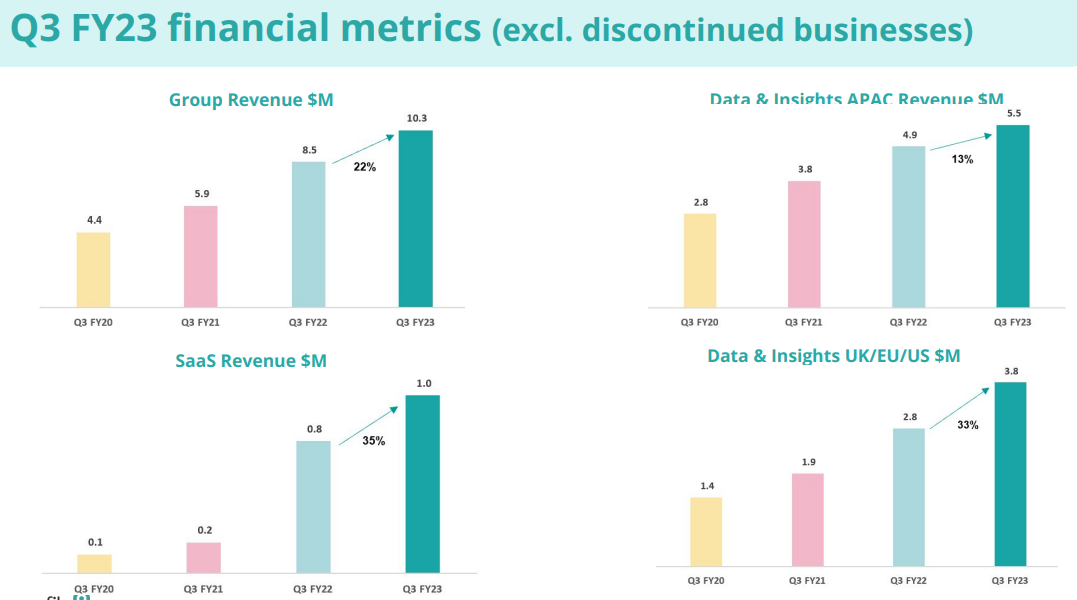

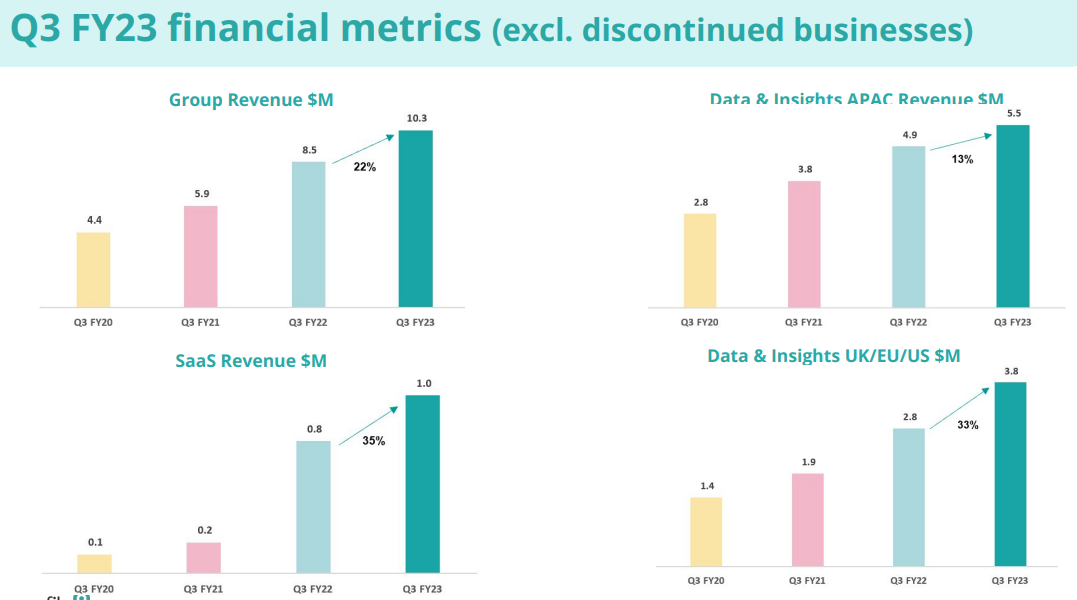

What is left is a higher quality business that is more likely to earn more predictable revenue at potentially higher margins. It also leaves three business units that are all still growing double digits and blended continuing revenue is up 22% vs Q3 FY22. I think visually so here's a picture:

It all looks great (from a continuing business perspective) but what they don't say is both D&I and Platform revenues are both down on the immediately previous quarter. Q3 has tended to be softer in previous years, with Q4 much stronger so hopefully this is the case here.

In light of the travails of Pure.amplify guidance was narrowed to the bottom of their previous disclosures. Revenue is expected to come in at $48m (previously $48-52m) and EBITDA margin at 9% (previously 9-10%). They are a bit of a serial share-based remuneration payer (below EBITDA) and they're not super capital light either so that should all get factored in. Overall I think the thesis still holds but it's getting very close to put up or shut up time. FY24 is shaping as an important year for them.

[Held]