Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Skimpy top-line upgrade, but the business seems to be tracking well overall, especially with their international expansion, amidst a mature ANZ market.

Danny Kontos has increased his stake by a further 1%, taking his interest in the company to 20.51% ahead of results next week. Interesting.

I asked my business assistant, after enhancing the prompt via a certain cowboy;

[starter prompt] Can you understand the business from the share price history 5yr+?

Can we understand the business from its share price history? Pureprofile’s stock history tells a tale of early struggle followed by recent recovery:

- IPO and Collapse: PPL listed around July 2015 at $0.50/share (market cap ~$29m)stockhead.com.au. After a brief period of meeting forecasts, the company made an $18m acquisition (Cohort in 2016) and growth underwhelmed (FY17 revenue +13%)stockhead.com.austockhead.com.au. The market’s reaction was brutal: over 2017–2019, Pureprofile’s share price fell by over 90%, wiping out most initial investors’ capital. In fact, at one point the stock was down ~97% from three years priorsimplywall.st. This collapse was due to strategic missteps and heavy losses – the company “tore up ~$40m” in the failed expansion and had to recapitalize (a major 8-for-1 rights issue in 2019, massively diluting shares, as indicated by the share count ballooning to ~1.15 billion).

- Reinvention and Turnaround: Around 2020, new leadership (CEO Martin Filz) came on board and refocused the business on its core research platform. The finances slowly improved from FY21 onward. The share price stabilized in the low single cents. Over the last 3–5 years, PPL has essentially been flat to slightly up – it’s up ~15% over 3 years and ~100% over 5 yearssimplywall.st (from a very low base). This indicates the company stopped the bleeding and investors began to tentatively re-rate it as prospects improved.

- Recent Rally: In the last 12 months, PPL’s stock has shown signs of life, rising about +57% year-on-yearsimplywall.st (trading around A$0.04–0.05 recently). This corresponds with the company’s return to profitability and record revenues in FY25. Essentially, as Pureprofile’s results have strengthened, the market has rewarded it – though the stock is still only A$0.045 (as of Nov 2025), a far cry from the IPO price. For context, the stock remains ~91% below its IPO levelsimplywall.st, reflecting that early overvaluation and dilution.

- Business inference from chart: The share price chart looks nothing like a stable “stalwart” growth line. It shows a huge drop (2015–2019) then a long flat bottom and a recent uptick. This “fallen angel” pattern suggests a company that went through near-death and is now recovering. It also implies that earlier management overpromised and underdelivered, whereas current management might be hitting targets (hence renewed investor interest). One can infer the business had serious issues that are now being resolved.

- Name/strategy changes: The company has not renamed or pivoted to a completely different industry – it’s always been about consumer data and marketing insights, though it did expand offerings (media buying, lead generation via Cohort) and is now emphasizing its tech platform. So the core concept remained, but execution and focus changed over time.

In summary, the share price history reveals Pureprofile as a high-risk turnaround story. Early investors were badly burnt, but those who bought in at the lows (pennies per share) in recent years are now seeing significant percentage gains. The history underscores the importance of management and strategy: PPL’s fortunes only improved after a leadership and strategy overhaul in 2020. It’s a reminder that while the stock’s past was rocky, the future could be quite different if the turnaround continues – but also that one must keep an eye on execution to avoid another collapse.

Assessment: Watch. (The volatile history means we approach with caution. However, the recent uptrend aligned with improved fundamentals is encouraging – it warrants watching for further confirmation of sustained success before a full commitment.)

Director Adrian Gonzalez bought ~$50k worth on market.

ASX Announcement

28 July 2025

Pureprofile delivers record FY25 results, achieves guidance with 19% revenue and 18%

EBITDA growth on pcp

Pureprofile Limited (ASX: PPL or the Company) is pleased to present its FY25 & Q4 FY25 business

update for the period ended 30 June 2025

All commentary and financial metrics are presented on a preliminary, un-audited and

continuing business basis (excluding discontinued Pure.amplify Media businesses). EBITDA and

EBITDA margin excludes significant items which include share based payments

● FY25 delivered record full-year revenue of $57.2m, up 19% on pcp, an acceleration from

10% growth on pcp for FY24. This performance reflects consistent momentum across key

regions and the successful execution of our growth strategy

● FY25 record EBITDA of $5.2m, up 18% on pcp was driven by continued revenue

momentum, focused investment and diligent cost control. EBITDA margin was flat on pcp

at 9%, reflecting the balance between strategic investment and profitability as we

continue to scale our global operations

● Rest of World (ROW) delivered a 28% uplift in revenue on pcp to $26.4m, driven by strong

growth in the UK and US, two strategically important markets. This performance reflects

growing demand for our solutions in these regions and the successful execution of our

global expansion strategy

Stock Ideas...

I finally got around to watching the online presentation of results with Q&A.

Martin spoke to their business uniqueness. Basically his waffle was trying to say that large companies (eg Google) can provide the raw statistics, ie the what, but without the human interaction, they cannot get the why, and that is where businesses like PPL have a place.

Positive NPAT of $4k. Flag; This is an excellent outcome in the context of the business since FY21.

ANZ growth flat, all growth from O/S. Flag; Watch for a stall in O/S revenue.

Shift from equity STI to cash STI continues as flagged in FY23 AGM. No LTI program in FY24. Flag; Shift to cash good, no LTI bad.

Actual close dates for the “amplify” business units was in July 23. Flag; This has made the results a bit muddy, as some details are ‘inclusive’ and some are ‘exclusive’ of Amplify.

Martin and Melinda both presented. Flag; Melinda is the power base. She is articulate and clear in her language, a warning flag if she was to depart. Martin is a wet sock. He rambles, is non-specific in his language and inspires no confidence. However, both have been constant since FY21 and that’s a good thing.

Note. Melinda remarked that cash flow is “slow” in first half, and they make ‘most of their cash flow’ in H2. Flag; to meet guidance of 46-51mil, with 1H revenue of 24mil … the maths is a bit off, as that would be another 24-26mil in 2H… so that same as 1H?

Note. Melinda reiterated guidance of 46-51mil revenue. FY23 was 43.7mil, therefore a increase to the lower end of 46mil would be a 5% increase in full year revenue. That would be a very good outcome, considering it would be higher on a single business unit, as FY23 had 3x business units to generate revenue.

Overall, PPL is showing the signs of a positive turnaround. Still many risks at play.

Quick 5yr DCF models at 20% growth with 10% discount show ranges from $0.16 to $0.41 in share price, depending on variables.

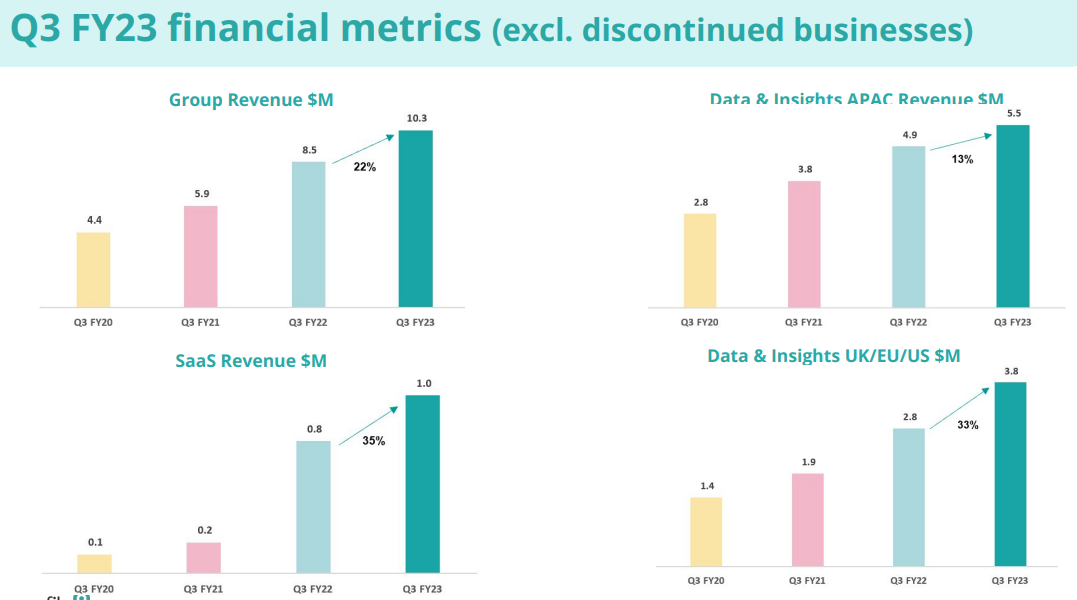

Nice little business these guys have built here. They've now gotten rid of all the dead wood and we are left with just the Data & Insights business. Modest debt, easily serviceable given the asset light cash generative nature of the core business, plenty of cash, and growing rapidly. For an advertising exposed business to have grown its topline 22% and PBT ~30% in the last year is very impressive, imo. A $35m market cap with their operating business generating ~$10m in PBT and growing rapidly.

I'm just getting my head around Pureprofile's update today, the headline being the shutting down of Pure.amplify Media in Australia. This follows the shut down of that business in the UK in the previous quarter. Pure.amplify Media is (soon to be was) a digital advertising business, fairly generic and typical of the breed. In the past it has contributed around 10% of the Company's revenue and a similar proportion of EBITDA. It's being wound down because it is currently contributing around 6% of revenue and negative EBITDA.

The half glass full version of that move is it removes a lower quality, fairly generic, non-core part of the overall business and allows management to focus on Data and Insights and the SaaS business. Certainly that's the way they spin it. The glass half empty version is that they're reacting instead of being proactive and making the right move at the wrong time. On balance I don't fault the logic, I just wish they'd made that move at a time Pure.amplify was actually worth something to another party. Now they will not only not receive anything for the business but incur the costs of winding it up. However, if the best time to divest the business was before, the second best time is now. I do give them credit for making the difficult decision and not trying to remediate it or hang on until conditions improve.

Goodwill, customer lists etc. had all been previously written down to zero so apart from the actual costs involved in winding up the business there shouldn't be major impairments in the FY result.

What is left is a higher quality business that is more likely to earn more predictable revenue at potentially higher margins. It also leaves three business units that are all still growing double digits and blended continuing revenue is up 22% vs Q3 FY22. I think visually so here's a picture:

It all looks great (from a continuing business perspective) but what they don't say is both D&I and Platform revenues are both down on the immediately previous quarter. Q3 has tended to be softer in previous years, with Q4 much stronger so hopefully this is the case here.

In light of the travails of Pure.amplify guidance was narrowed to the bottom of their previous disclosures. Revenue is expected to come in at $48m (previously $48-52m) and EBITDA margin at 9% (previously 9-10%). They are a bit of a serial share-based remuneration payer (below EBITDA) and they're not super capital light either so that should all get factored in. Overall I think the thesis still holds but it's getting very close to put up or shut up time. FY24 is shaping as an important year for them.

[Held]

A post dilution valuation equal to 6c per share at the current share count. This is a DCF value of $92m which after dilution is worth $66m, which is 6cps today. Sorry for the mouthful!

One of the things I like least about PPL is the share count growth and the fact they don't really report it until you read the financial statements. I have allowed for a further 40% growth in the share count over time via "share based payments" and perhaps raisings, which I think is conservative but is a real risk while the share price is so low and given PPLs bias towards staff conditions and retention (ie. likely to keep paying out shares). I've assumed revenue growth is strong over the next 3 years, 15-20%, which for an advertiser in an economic downturn would be a good achievement. Growth moderates after that, eventually down to a terminal 2%. Small after tax profits from 2024 and proper 13% NPAT margins, meaning NPAT A$5-10m from 2027. I've also run a low case, with no revenue growth for a couple of years and more significant dilution, 55% of share count and I still get a business slightly under-valued.

What I like

Growing business with industry tailwind due to tightening privacy laws from google and apple making 3rd party data hard to come by. Advertisers more likely to go to PPL.

Growth strategy has been working, top line growing well of late. SaaS arm showing some promise as a value add to their offering, I like the deal with Asian Parent as a driver for revenue growth.

CEO has international industry experience, important as they're trying to grow internationally. He and CFO appear a balanced team. She seems conservative and focused on cashflows.

Customer reviews are good, staff retention & benefits good. These are all things that will make the business resilient - service differentiates the product as they grow into bigger international markets.

I think its undervalued, most measures I can put on it suggest a lot of bad news priced in.

What I don't like

Leaky share count with share based payments, if these are being calculated on a cash basis (eg. if each employee gets $1000 as part of salary), then its going to be even more leaky this year at a share price of ~3c (last year an additional 5% of shares came on the register). Management bonuses might be down (see my next point).

CEO remuneration is high considering the market cap. He took home $1.4m last year incl shares which is between 4 - 5% of the current market cap. Its a sign this is either undervalued or he's overpaid! You can't ever give good returns to shareholders if the CEO is swiping nearly 5% each year.

Advertising is traditionally susceptible to economic downturn so could underperform some expectations on the revenue side. My feeling is this could be highly dilutive if they get into cash flow troubles.

Disc: purchased on market today

There is a focus on staff engagement, evident in Martins SM’s talk, the latest results and webinar. (Recording is available on PPL website) I have no doubt that staff retention is crucial, hidden costs to business’s are high if staff turnover is also high.

It is difficult to judge culture from the outside but here are a couple of points that may back up managements “talk” about caring for employees.

Recent results slide on employee benefits. I haven’t been in the corporate world for a while, but these look generous to me. There are a couple I would have been happy to have back in my working life. Any comments?

Glassdoor reviews also point to a positive work environment, rating of 4.6 stars with 100% recommendation of CEO and 88% would recommend the company as a good place to work. There were 41 reviews, and the bulk were positive, reviews in the last year rated highly. The one that stood out was a person who felt the environment was too laid back, “come and go as you please”. PPL’s response was that it valued autonomy in its workplace. This is interesting as the biggest complaint I see with most companies on Glassdoor is micromanagement. My takeaway is, not every culture suits everyone. The Glassdoor reviews gave an overall impression that backs managements claim of high employee engagement.

I then moved onto researching the product panellists, ie. reviewers, technically not employees. What stood out to me was the paid surveys by PPL were considered good value in Aust, that is, it is worth completing the surveys for the compensation received.

I thought I’d sign up and see how easy the platform was to use etc. After reading the privacy disclosure I decided against it. It appears you can opt out of cross tracking from other sites, but I was unable to determine how easy that was. The privacy statement was the easiest I have read in simple language, although I reckon most people probably don’t read it.

Interestingly the overseas reviews from panellists were at odds with the Australian experience. Most reviewers said there was not enough surveys/rewards to warrant the time spent and rated the other big companies as better compensation. My take on this is PPL has a historical Australian focus. So does this make it harder to recruit panellists overseas and how does this impact the quality of the data for international customers. Alternatively, once they increase the survey options for overseas, perhaps they attract more participants. There seems to be a large contingent of people tracking these sites and talking about them on social media platforms. It was common to see a company considered the best in one country and insignificant in another.

Lastly the question that emerges to me is how do you reach all demographics? It seems to me the people completing the surveys do so because they need the economic benefit, I’m thinking similar to CSL’s blood collection in the US. Although this is probably an issue for all the companies in the space, not unique to PPL.

On the results call, I don’t think anything new emerged that we hadn’t heard in the SM meeting. Results were ok, Revenue and Ebitda increased, loss after tax (2.2)m

Am catching up on some CEO meetings and Martin Fitz is a real standout for me. As a shareholder I have heard him speak a number of times and have been impressed but this slightly longer format gave an opportunity for him to explain things in more detail. There were a couple of things that stood out.

First, they plan to grow the topline at 30%+ a year and EBITDA at higher levels as they get operational leverage. Other than this year my valuation doesn't assume anything like that and I'm still getting a valuation around double what it is now.

Second, the way he spoke about employee engagement and their net promoter score. He does talk about this at every opportunity and I'll admit that when he does I tend to think 'that's nice but show me the money'. However, given the opportunity to talk about at greater length I get how that is their point of difference. That is the money (or will be) in terms of how it produces better client outcomes and how it results in longer staff retention. At my last employer I went through four restructures in just two years. Unfortunately I kept being translated into new roles (would rather have taken a payout) but plenty didn't and morale dropped so much that others decided to leave of their own accord. The IP drain was enormous. If you can keep people happy it's going to have a monetary benefit in terms of productivity and keeping people focused on their core roles and not having to retrain others constantly.

I think the recent selloff has resulted in many companies coming back to more sustainable multiples but there are some that are looking properly cheap - even in this new reality. I haven't started buying back in to the market yet (IRL) but when I do I feel like PPL is one I would happy to top up on.

[Held IRL only]

Some quick initial thoughts following the discussion with CEO Martin Filz today (recording will be on Meetings page soon).

First off, I thought he was very candid. It wasn't on his watch, but he didn't hold back on the early days as a listed company and the poor acquisition and capital management. The recapitalisation of the business saw a LOT of new shares issued (now over 1 billion on issue, compared with around 162m a couple years ago) -- but it's a much leaner and stronger business today. Moreover, it's one with a keen eye towards capital management and cash flow.

Bear in mind that this also makes the share price chart deceptive. Shares were trading at 20c in mid-2017, compared to 4.5c today. BUT, in terms of market capitalisation (shares on issue x share price) the business is today worth $45m vs $30 in 2017.

I was also very impressed by his focus on customer and employee satisfaction. As a people business, this is important, and the promoter scores certainly reflect the efforts made here. I wont over-egg that particular pudding, but I feel he's right to ensure his team are motivated and valued.

This was also the first time I can remember a CEO detailing the major competitors by name and revenue. PureProfile is #6 in a US$62b industry, with the number one player having around US$600m in revenue. There's a lot of opportunity for them if they execute well.

The move offshore seems to be being prosecuted with a great deal of discipline. Very small upfront costs, with cash flow breakeven targeted within 2 months of landing. It was also very interesting to hear that the way they looked to gain a foothold was to focus on a particular niche in a new geography, rather than trying to be all things to all people. I think that's very smart.

Martin's comments on the threat from big tech were also illuminating. Increasing awareness re privacy and changing regulations are headwinds for the likes of Facebook, but good tailwinds for a business like PureProfile.

After i ended the recording, Martin made some very interesting comments regarding their shareholder base and how he looks at the share price. (i wish i had kept the recording going!). Essentially though, he is more interested in cultivating the right shareholder base that share the long term vision, and not about courting those after a quick profit. I wish more CEOs had that attitude. He felt a higher price would make bolt on acquisitions easier, but other than that it wasn't too important as they weren't likely to need cash anytime soon.

We ran out of time, but I wanted to ask Martin about the nature of the industry. I suspect it's reasonably cyclical and their customers could and would cut their spend during tough times. There's a good deal of customer and geographic diversity, which will help, but it's something to watch out for.

Finally, they are on a revenue run rate of $45m -- that's 1x sales. And the business is on a 10% EBITDA margin and CF positive. Revenues are currently growing at around 40%pa.

Thanks for suggesting the company @GazD

Net Promoter Score (NPS) of 84 as per today's presentation. I see this as hugely positive in a growth business, particularly with the tailwinds of limited access to 3rd party data etc.(and they were very keen to underline the BALANCE between growth and cashflow considerations, that prudence is reassuring)

Relatively solid steady growth from Pureprofile.

- Revenue up 31% to $10.6m vs pcp (up 44% to $20.8m half vs 1H 21)

- all divisions had revenue up at least double digit

- EBITDA up 82% to $1.4m vs pcp (up 53% to $2.5m half vs 1H 21)

- Operating cash up 386% to $0.9m vs pcp (up 829% half vs 1H 21)

Two new partnerships were announced in the quarter with theAsianParent being a really crucial future growth driver, in my opinion, being able to tap into a market of highly motivated panelists.

This was the most interesting graphic for me showing a full year of consistent operating cash generation (with low capex requirements) - presumably no more 4Cs though.

They have plenty of volume to churn through at 0.064 and above but when you have a profitable and growing business short-term share price movements (which this experiences a lot of) don't keep you up at night.

The new management have set a very clear aspiration to align their financial metrics to their peers by FY24, which would mean without any revenue growth at all in the second half annual EBITDA would be $16m, which is about 4.3x current market cap. However, if they were to make revenue of $40m this year (they will do better than that) and revenue growth were to slow to 15% over the next two years (they'll probably do better than that), they would be be only 3x current MC. Mr Market is definitely angry at this company for past indiscretions but even he can't hold a grudge forever.

[Held IRL only]

Pureprofile joins forces with theAsianparent in Singapore

Pureprofile Limited (ASX: PPL or the Company) is pleased to announce a new partnership with theAsianparent (TAP), the largest content and community platform for parents in Southeast Asia which reaches more than 35 million users per month in Singapore, Malaysia, Thailand, Indonesia, Philippines, Vietnam, India, Sri Lanka, Hong Kong, Taiwan, Japan and Nigeria.

The partnership will utilise Pureprofile’s SaaS technology, as used by Flybuys, Raiz and News Corp, to create an exclusive, standalone research community for theAsianparent. TAP members will be invited to access Pureprofile surveys through a dedicated website, allowing them to collect points that can be redeemed for e-gift vouchers that are accepted at more than 700 retail outlets.

The partnership is expected to create the largest insights panel of parents and expectant parents in Singapore, giving brands and businesses the unique ability to understand the thought processes and behaviours of millions of families.

Pureprofile CEO Martin Filz says:

“We are thrilled to partner with theAsianparent to aid brands and companies uncover insights from parents and their important everyday decisions, beliefs and sentiment. TheAsianparent’s 35 million strong member base have a voice that companies want to hear.”

The contract between TAP and Pureprofile is initially for 12 months with an automatic renewal. There are no material conditions that need to be satisfied in order to proceed with the contract. This is a revenue share agreement where Pureprofile will offer their customer surveys to TAP members. The first TAP country which will be enabled with the SaaS software enabling members to earn rewards for completing surveys is Singapore. Once this is established other countries in the networks will be rolled out. Singapore development is expected to be completed in Q3 and Pureprofile will update the market as to the financial impact in the next quarterly report. Having access to the extensive TAP network for surveys significantly increases the capacity for Pureprofile to conduct surveys for clients. In addition, the aim of the partnership is to create the worlds largest parent opinion panel for brands, governments, and institutions to gather insights. No other Data and Insights company has access to such a large and specific audience.

This announcement has been authorised for release to the ASX by the Board of Directors. - ENDS -

Disc: I hold

Martin Filz will be presenting at the ASA on 11/11.

https://www.australianshareholders.com.au/webinars

On the back of strong QoQ numbers, this one won't be under the radar for much longer.

It's got the potential to be a major multibagger. Unlisted peer Quantium has a circa A$800m valuation, and Dynata has a circa US$3b valuation. Pure profile has a current market cap of $78m, even after yesterday's pop.

Either way, this is a high growth turnaround that is looking to gobble up smaller players, or a future acquisition target for one of the larger ones.

Disc: Held on SM and IRL

Pureprofile is very much an under the radar microcap that deserves a place on a growth oriented watchlist, if not a portfolio. Essentially a big data informed market research play, I've been watching the numbers for a while and am ready to jump in. Also looks like some instos have been buying with decent volumes in recent weeks, which apart from pushing up the price, gives me confidence to open a starting position.

Perhaps long forgotten as it has crashed from it's listing price of $0.40 in 2016 to being a penny stock today, new CEO Martin Filz seems to making the right noises with notable global expansion.

Numbers look impressive. Revenues stable and growing with no apparent COVID slow down, net profit and EBIT heading in the right direction from substantial losses to a small profit with decent growth forecast, and beating guidance a few quarters running.

It's currently trading on 1.5-2x FY21 revenues which makes this too much of an opportunity to ignore.

Disc: Held.

Pureprofile partners with Flybuys to launch Pureprofile Perks

Pureprofile Limited (ASX: PPL or the Company) is pleased to provide an overview of a new partnership with Flybuys, the Australian loyalty program and a joint venture between Wesfarmers and Coles.

The particulars of the partnership focus on the use of Pureprofile’s SaaS technology to create an exclusive research community for Flybuys members. Flybuys members can access Pureprofile surveys through either the Flybuys app or website, allowing them to collect Flybuys points that can be redeemed for over 1,000 reward options.

The partnership is expected to create the largest insights panel in Australia. Allowing more brands and businesses to unearth the attitudes and behaviours of real Australians.

Pureprofile CEO Martin Filz says:

“Fluctuating consumer sentiment is an ongoing Australian consumer trend, which is why it's imperative that brands regularly check in with their base and nimbly respond to what the data may reveal. We are excited to work alongside Flybuys and their loyalty members and to find out what’s important to them in 2021 and beyond.”

Q2 FY2021 Result*

Revenue $8.2m ^ 26%

EBITDA $0.7m ^ 866%

Cash at Bank $3.1m ^ 386%

()

Q2 FY21 Revenue*

Data and Insights APAC $4.7m ^ 30%

Data and Insights UK $1.7m ^ 15%

Media $1.1m ^ 46%

Platform $0.2m ^ 90%

*Versus prior comparable period Q2 FY20

https://pureprofile.investorportal.com.au/#latest-announcements

New CEO

Costs reduced

Op cash flow positive

FCF negative

Large BOD for tiny ($2M MC) company

MC $2.2M, debt of $24M

Current financials unaudited and have asked for an extension until Oct 2020