11-March-2024: Rex-Announces-Interline-Agreement-with-Etihad.PDF

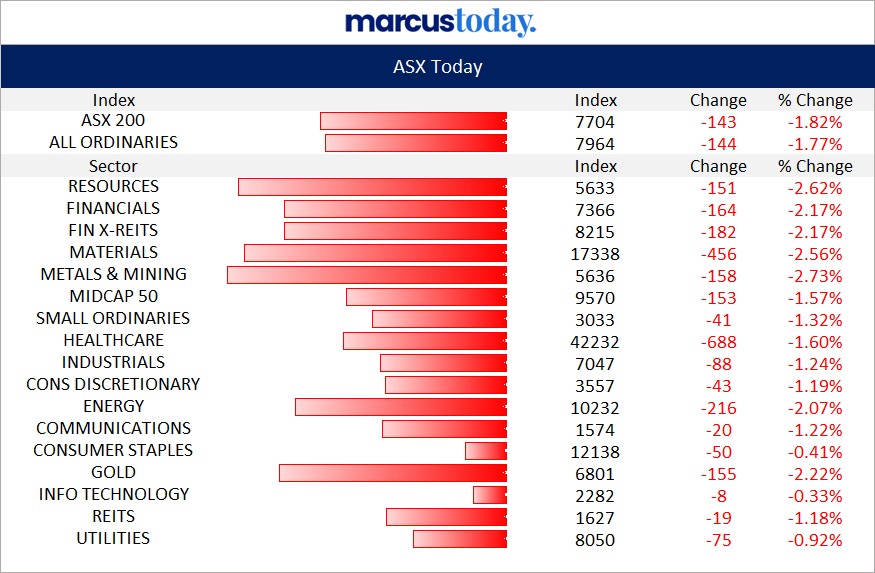

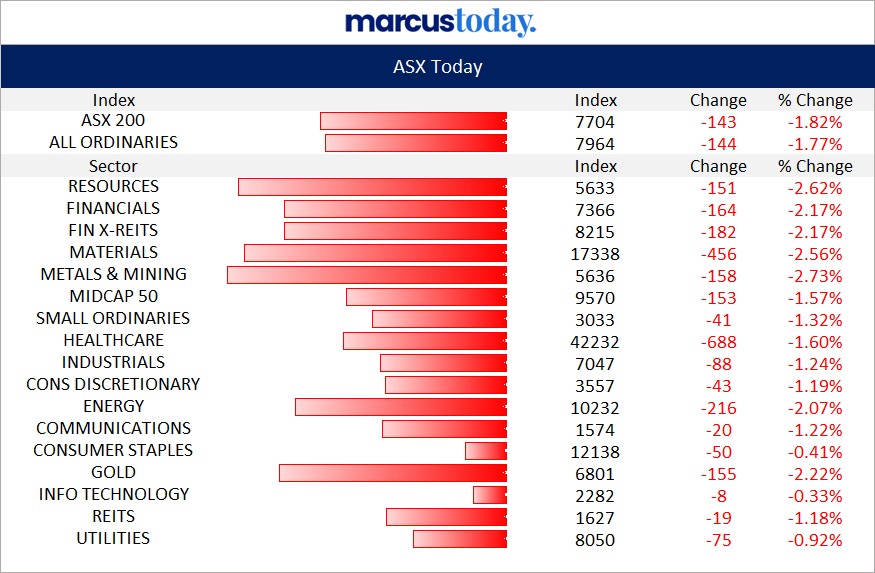

REX +5.06% today from 79 cps to close at 83 cps (up 4 cps). Nice relative strength in a market that saw every sector in the red today:

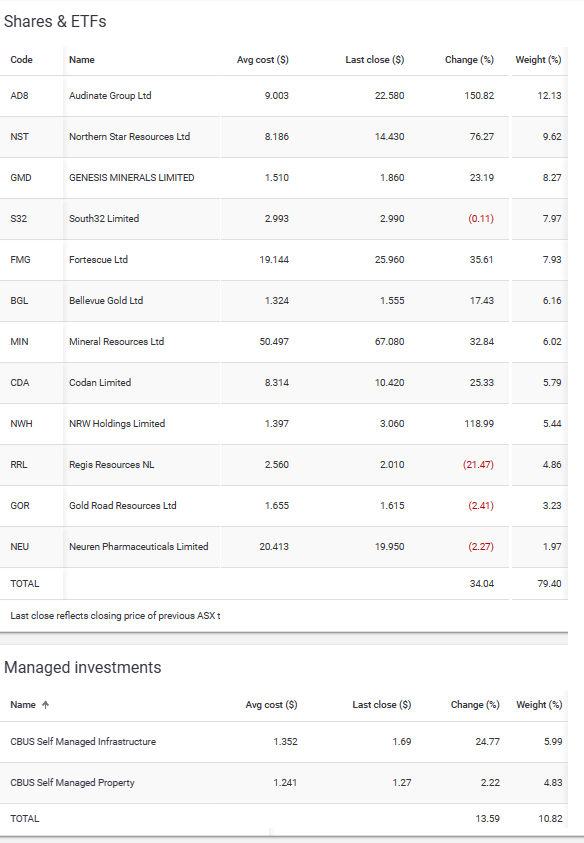

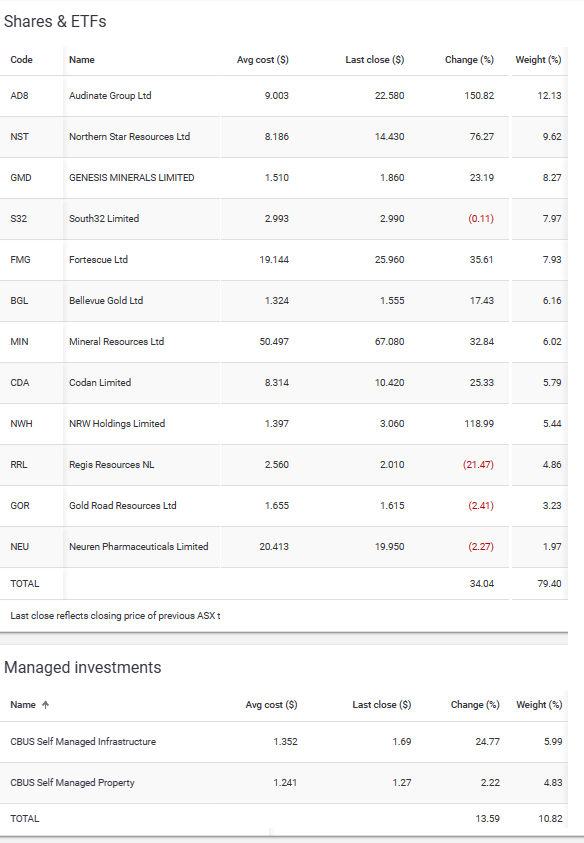

It was a public holiday in SA (Adelaide Cup Day) but the market was open in Sydney so I did a little trading. I sold all of my RMS in my SMSF and topped up my NEU today, Neuren Pharma also showing some relative strength after recently dropping from around $25/share back to around $19.70/share. Today's 12cps rise in a falling market suggests to me that the sell-down might be over for now. NEU traded as low as $19.54/share today and as high as $20.42 (a wide range) before closing at $20.07, just 12 cents above Friday's $19.95/share close.

I sold out of RMS today because I'd rather be on the sidelines while they sort out this M&A with TSX-listed Karora Resources Inc - I'm concerned that RMS are engaging in M&A at the top of the market and their hand is being forced by the short mine lives at their existing Australian gold mines. I may jump back on board RMS later once things are a little clearer but I still have exposure to NST, GMD, BGL, RRL and GOR in my SMSF, so plenty of gold exposure really.

Below are my direct shares and the infrastructure and commercial property managed funds within my SMSF; there is also cash and positions in CBUS' "Balanced Growth" and "High Growth" strategies:

Those closing prices were Friday's closing prices by the way, as they only update them after market close, like the Strawman.com site does, and that was captured in the middle of the day today. I recently trimmed Codan, which was the second largest position, and sold out of ARB at the same time, and rotated some of those funds into S32 which I think are near their low point again. As you can see, this SMSF is dominated by large quality companies, with some high quality mid-caps and a couple of smaller speccies, like NEU and BGL. All of those are ASX300 companies, which is a requirement.

I have a larger real money portfolio that does not have that restriction, so that one holds companies like LYL, GNG, DVP, EGL, GNX and XRF. That larger portfolio also contains a few of those companies listed above (that are in my SMSF) plus ALU, ARB, CSL, DRR, JLG, MAQ, NCK, REA, SWP, TNE and WES. It's travelling OK too. Companies in that PF that showed relative strength today included JLG, XRF, ALU, GMD and GNG.

Always interested in companies that manage gains on big down days across the market. Especially when they do it in the absence of any announcements.