Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

some turbulence here Captain:

What on earth is going on with the Rex share price today? (fool.com.au)

Rex share price paused as rumors swirl

It looks as though the "news article" that Rex is referencing might be an article published in The Australian on Saturday.

This article alleges that Rex may have "invited a turnaround team from Deloitte to rifle through its books and try to stop the proverbial plane from crashing into the mountain". This comes after what has reportedly been an unsuccessful attempt to expand into providing flights between Sydney, Melbourne and Brisbane.

The article goes on to allege that "Deloitte's partners are in a fever attempting a restructure solution as a rescue package. That too, we hear, is teetering towards failure".

This is the second trading halt in as many months that the Rex share price has gone through. Back in June, we covered the trading halt that was implemented following the release of some updated financials from the airline.

After initially forecasting an operationally profitable FY2024, Rex revealed that it now expects to book a $35 million loss. The company blamed a "global shortage of pilots and engineers, along with supply chain shocks post-COVID" for that downgrade.

So, we'll have to wait for Rex's response to the article's assertions later this week to find out what's going on. But there's little doubt that Rex shareholders will not welcome these developments.

At the last Rex share price of 56 cents, the company was nursing a year-to-date loss of 22.52%. That's in addition to a 50% cut from where the shares were this time in 2023.

Let's see what happens when the airline returns to trading.

11-March-2024: Rex-Announces-Interline-Agreement-with-Etihad.PDF

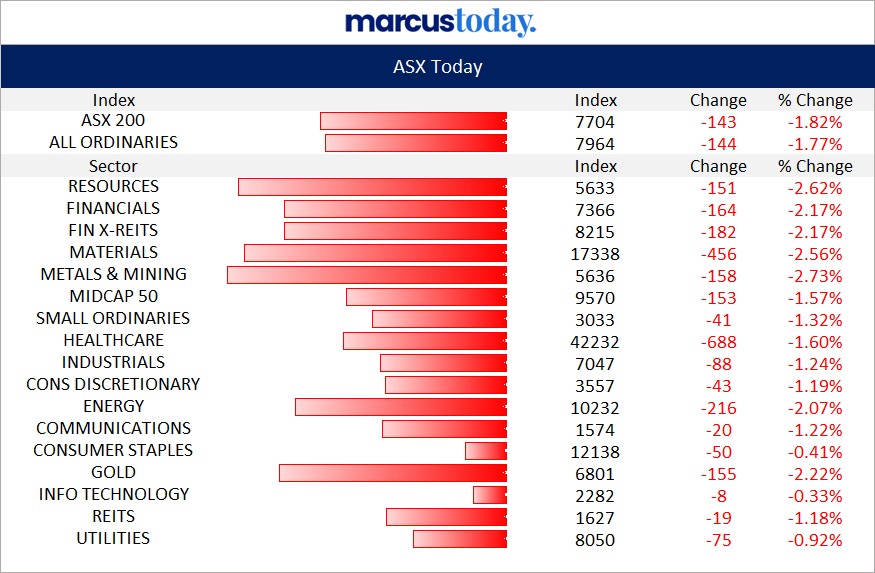

REX +5.06% today from 79 cps to close at 83 cps (up 4 cps). Nice relative strength in a market that saw every sector in the red today:

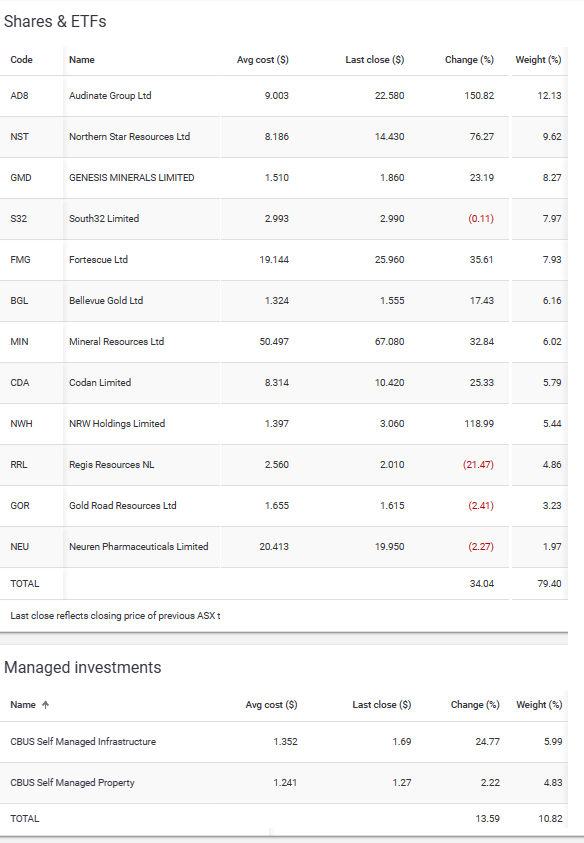

It was a public holiday in SA (Adelaide Cup Day) but the market was open in Sydney so I did a little trading. I sold all of my RMS in my SMSF and topped up my NEU today, Neuren Pharma also showing some relative strength after recently dropping from around $25/share back to around $19.70/share. Today's 12cps rise in a falling market suggests to me that the sell-down might be over for now. NEU traded as low as $19.54/share today and as high as $20.42 (a wide range) before closing at $20.07, just 12 cents above Friday's $19.95/share close.

I sold out of RMS today because I'd rather be on the sidelines while they sort out this M&A with TSX-listed Karora Resources Inc - I'm concerned that RMS are engaging in M&A at the top of the market and their hand is being forced by the short mine lives at their existing Australian gold mines. I may jump back on board RMS later once things are a little clearer but I still have exposure to NST, GMD, BGL, RRL and GOR in my SMSF, so plenty of gold exposure really.

Below are my direct shares and the infrastructure and commercial property managed funds within my SMSF; there is also cash and positions in CBUS' "Balanced Growth" and "High Growth" strategies:

Those closing prices were Friday's closing prices by the way, as they only update them after market close, like the Strawman.com site does, and that was captured in the middle of the day today. I recently trimmed Codan, which was the second largest position, and sold out of ARB at the same time, and rotated some of those funds into S32 which I think are near their low point again. As you can see, this SMSF is dominated by large quality companies, with some high quality mid-caps and a couple of smaller speccies, like NEU and BGL. All of those are ASX300 companies, which is a requirement.

I have a larger real money portfolio that does not have that restriction, so that one holds companies like LYL, GNG, DVP, EGL, GNX and XRF. That larger portfolio also contains a few of those companies listed above (that are in my SMSF) plus ALU, ARB, CSL, DRR, JLG, MAQ, NCK, REA, SWP, TNE and WES. It's travelling OK too. Companies in that PF that showed relative strength today included JLG, XRF, ALU, GMD and GNG.

Always interested in companies that manage gains on big down days across the market. Especially when they do it in the absence of any announcements.

Years ago, I recall being at Bathurst for the great race. watching a Rex (ok at the time it was Hazelton) Saab fly from the top of the mountain down Conrod Straight to the delight of the crowd. Bathurst airport is packed for race weekend, and this was one of the airports Rex “owned”.

This ownership is changing – as has been reported in the media – Rex is claiming the Qantas is being predatory. Another term for it is competitive. On the back of this Rex is withdrawing from several ports including Bathurst, as well as larger centres such as Lismore and Ballina.

In NSW most of the routes that were previously regulated are now no longer regulated. This is different in Queensland where most of the inland regional ports remain regulated. Rex managed to pick up a slew of these routes, winning the 5 year contracts from QantasLink, commencing services are the start of this calendar year. It is noted Qantas were winding back services on some of the routes, so it makes me question the profitability – appreciating this was in 2021 when we were all remaining close to home.

The company is also undergoing pressure from the pilot association, predominately on job preservation on the back of these withdrawn routes. Lismore was once a pilot “base”.

This is a tough place to play, and the business has many balls in the air:

- Considerations for SaaB fleet replacement

- Newly established jet services now operating on the most competitive trunk routes globally

- Ongoing pilot discussions

- Ongoing load factor pressure

- Competitor pressure (Qantas and subsidiaries))

- New entrants (Bonza- not unique to Rex)

- Escalating fuel costs (not unique to Rex)

The travelling public are becoming fickle and are now familiar with and comfortable to travel on carriers with different tail liveries. The tie up with Delta, channelling all these interline pax to Rex will be critical.

The ASX notification was 'Rex revises profit guidance'. This caught my attention as I immediately wondered how they were still operating profitably. The revision was actually increasing the loss estimate from 15M to 18M for FY21 with results due to be released on 31 August.

There is an expression in aviation...how to make a small fortune with an airline? Start with a big fortune.

Rex is the largest operator of Saab 340B aircraft, currently 'operating' more than 25% of the global fleet of this type. The latest companh update has most (2 are on lease) being fully owned. All the more recent 737NG are leased.

The operating expenses, even with aircraft grounded, much of which is in USD, cannot be understated.

This straw probably should have waited until the end of the month and the updated results. It was trigged by media reports of further furlow of staff. This is tragic for those involved, investors and anyone who is reliant on these air services.

Unfortunately the result release at the end of the month will not be an improvement.