Here are some notes from today's meeting with CEO, Sean Halpin.

SciDev is all about water treatment solutions -- be that for materials extraction, construction or site remediation. As with EGL, they also specialise in PFAS removal.

Their chemicals and processes are proprietary and have IP protections, although they do also do more commodity-like solutions to broaden their appeal across the customer base.

They operate two business segments - chemical services (~80% of revenue) and water technologies (~20% of revenue).

The chemical services business provides proprietary chemistry that improves operational efficiency and water usage for heavy industries. The water technologies business remediates legacy contamination issues by removing harmful contaminants from water sources.

Chemicals are the major variable cost for a lot of customers in oil & gas, and SciDev's products can allegedly yield significant savings.

The relationships with customers vary by industry. Mining customers typically have 3-year fixed contracts as SciDev's products are key consumables in their core processes, providing revenue visibility. Oil & gas is more transactional. Water technologies is project-based revenue with build-operate contracts of 6-36 months.

PFAS contamination remediation is a major growth opportunity, and Sean echoed similar sentiments to Jason at EGL. Both have said the opportunity is large enough to accommodate many players --especially in the US and Europe as regulations tighten. Management is taking a disciplined approach, putting resources in place ahead of an expected uptick in demand as regulations advance. If successful, this could be transformative (but, as always, execution is key).

Sean remarked that the business is still sub-scale, but that he didn't expect a lot of increase in fixed costs given the capacity of capital equipment and facilities they currently operate.

SciDev's focus on higher-value proprietary solutions is paying off. Profit margins are expanding - specialty chemicals range from 20-40% gross margin, with water projects up to 90% in some cases. Commodity products are being de-emphasized. This strategic shift, along with operational leverage, is driving strong EBITDA growth and positive free cash flow, despite recent market challenges. The company appears self-funding at this stage.

The business is now cash flow positive, and they have ~$6m in cash available.

The business model has elements of recurring revenue which provides some visibility. Mining customers are on 3-year contracts as SciDev's products are critical to their operations. This 'stickiness' was emphasized. Oil & gas is more transactional but SciDev's unique products foster retention. Water projects are 6-36 month contracts.

Wise capital allocation is a priority for management. Organic growth is the main focus - investing in the right products, regions and projects. Acquisitions are evaluated opportunistically to accelerate growth, add tech capabilities or build scale in key markets. The company's improved cash generation provides flexibility.

Organizational culture was highlighted as critical to success, especially during this growth phase. Management is working hard to foster shared values, engagement and innovation. The employee share plan aligns incentives. Still, scaling a specialized workforce across regions is an execution risk to monitor.

SciDev appears to have a differentiated offering in a growing market, with multiple levers for growth. The company's recent financial performance is certainly encouraging. Management seems to be taking a thoughtful approach to balancing growth investments with risk management. Key things to watch going forward include: 1) Traction in the PFAS opportunity, especially in new geographies, 2) Maintaining margin improvements and capital discipline as the business scales, 3) Any M&A activity and subsequent integration, and 4) Competitive response.

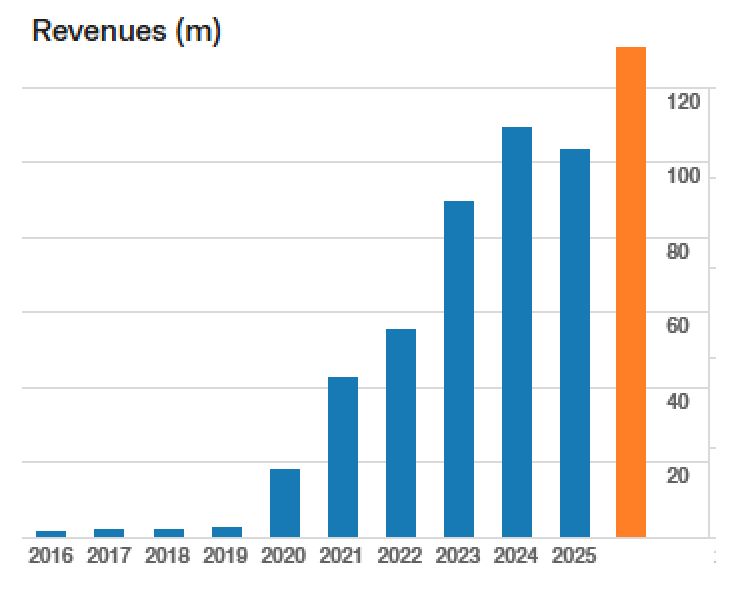

All told you have a $65m business doing ~$100m (pro-rata) in revenue, with potential for some decent operating leverage. As with EGL, there appears to be some good tailwinds. The company is on a EV/EBITDA of roughly 10x -- which doesn't seem too bad assuming the growth trajectory is maintained.