Few points before a look at the 4C:

- Share Price for SciDev has dropped from the 90c-$1 range to about 27c in the past year for a myriad of reasons but nothing structural.

- CEO resigned on the release of the March quarter results so there is an interim CEO in charge

- Share price ran up in the four days leading up to the release of the June quarter results (17.5c to 26.5c) including 23% and 16% in the previous two days. Loose lips anyone!!

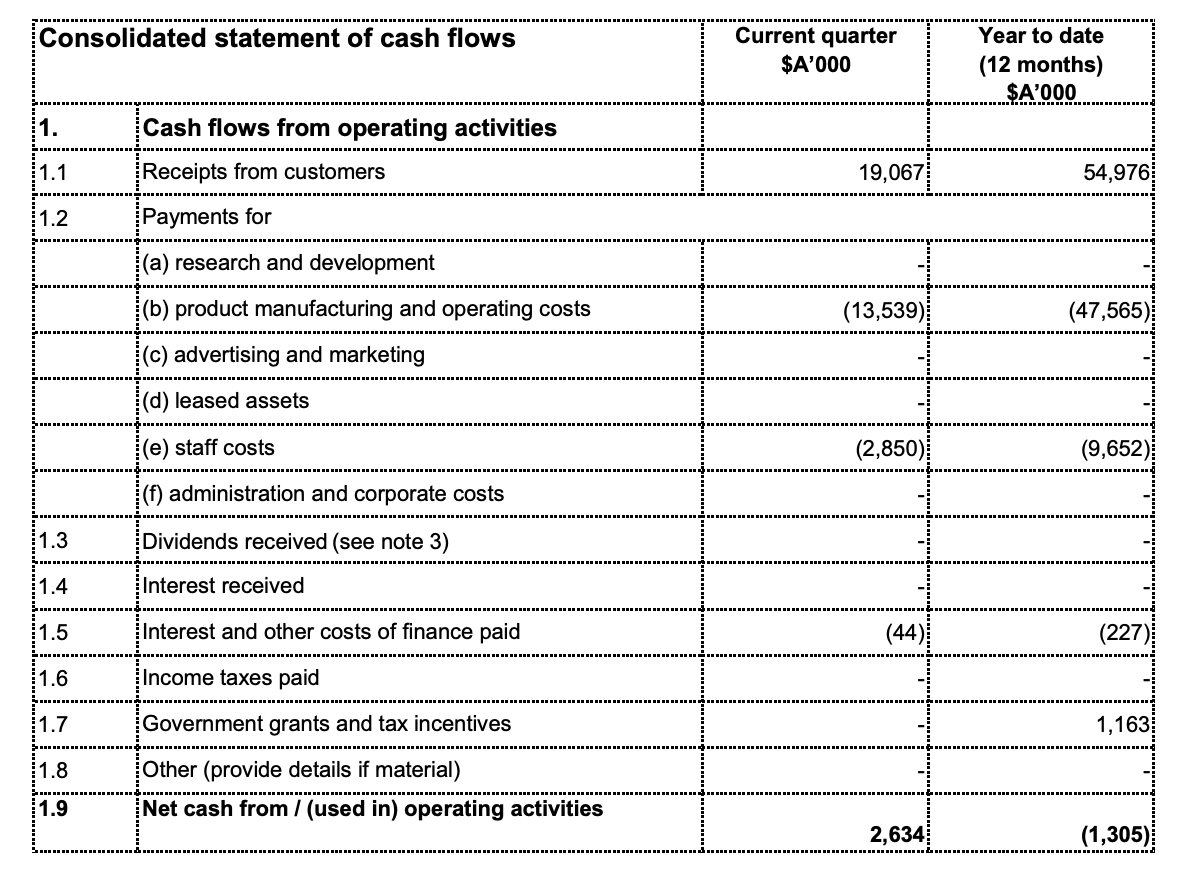

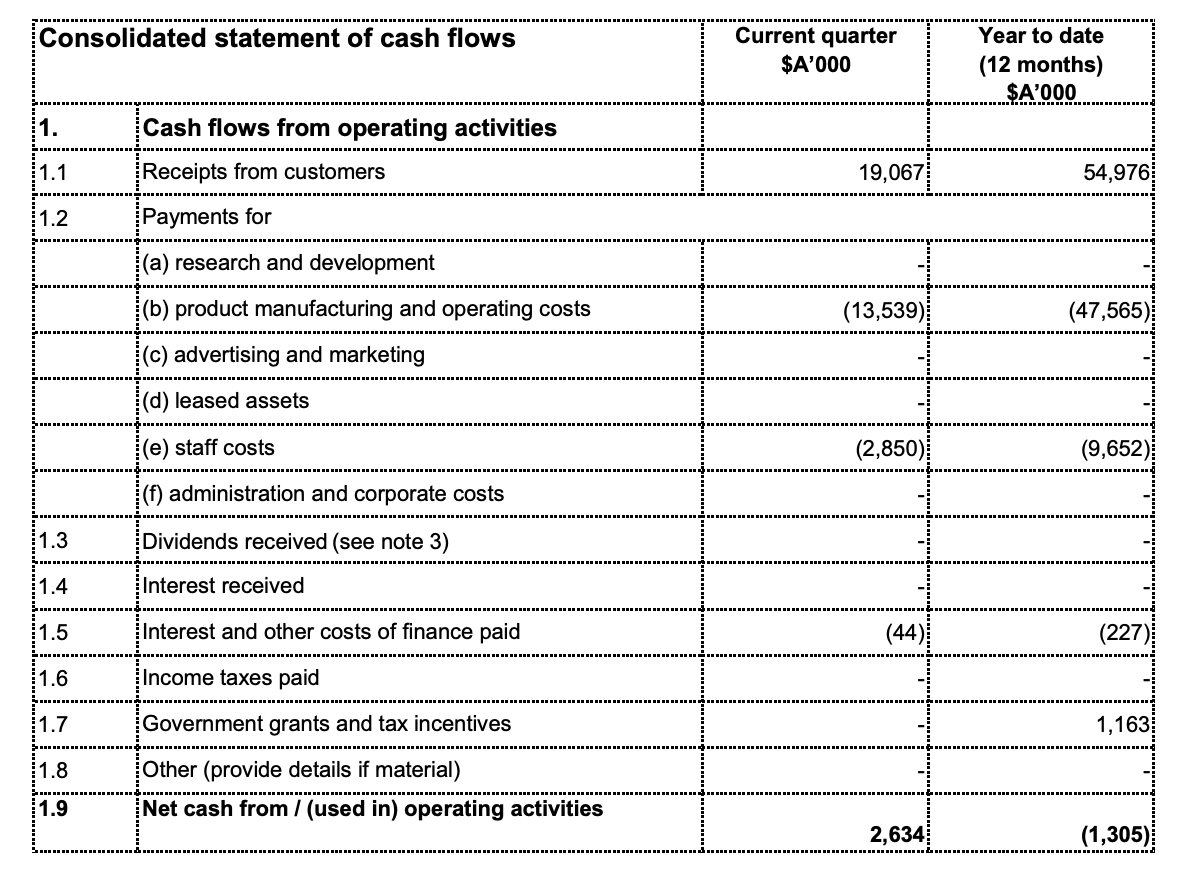

- This business has grown receipts from less than $1m/quarter in 2019 to almost $20m/quarter. That is impressive growth.

I am bullish on the long term potential of this company simply because of the sector and technology. It is a water environmental company. So it is no surprise to me that the receipts have taken off (thanks partially to acquisitions but also organically)

The FY22 June quarter IS the best quarter the company has experienced.

Record cash receipts and operational/free cash flow positive. Gross margin still fairly low at around 25% but I would expect it to grow over time.

For full disclosure: I am a current shareholder BUT I think the bottom has been reached and sentiment could be shifting to the positive (unless overall market sentiment craters).

Thus I have put in a few bids to add to my holdings