What does Serko do?

“Serko is a technology company that simplifies the complex world of corporate travel management. Serko’s software platform is used by millions of travellers around the world to book and manage their work trips, and by thousands of companies to manage their corporate travel programs.” (blurb from serko.com home page)

Serko Mission: Annual report 2024

“Build the world’s leading business travel marketplace” A big aspiration………………

Looking forward - Catalysts & Bright Spots:

- Cash balance 80.6m

- Revenue increasing as per guidance

- Cash flow positive next year?

- Booking.com renewed license for 5 years recently

- Insider ownership/founders

- Value of 10+ years of data and trends

I did an analysis of Serko when it was listed. My interest was sparked by conversations with a friend in the travel industry who was integrating travel management systems for large corporations and government departments.

My observations at the time were:

- The travel industry didn't love the Serko platform, but the end customers did.

- Good marketers? The annual report, website and marketing material was slick.

- Strategy: Target the end customer, and the middle guy has to cop it.

- Success depends on cracking the international market and maintaining a leading customer-friendly interface

- Competition: Significant, especially in the US.

Friend's Insights (2019):

- Serko: Local online tool for corporate travel, catering mainly to AU and NZ markets.

- Popular with customers due to its suitability for this market.

- TMCs (Travel Management Companies) disliked working with Serko due to poor integration with other tools (e.g., profile management, expense management).

- Charged for every change (profitable for Serko, challenging for travel agencies).

- Back-end configuration was difficult for TMCs but was improving over time.

- Unique approach: Targeted customers directly, unlike other tools promoted via TMCs.

- Excelled in the AU market compared to global tools and smaller companies prioritized functionality over global consistency.

Since 2019 things have obviously changed.

- Introduction of Zeno, integrating expense tracking and other features.

- Onboarding of international customers:

- Booking.com using the platform for SME business

- Large international corporates (e.g., American Express Business Travel, Helloworld)

- Customer base now across many countries and companies

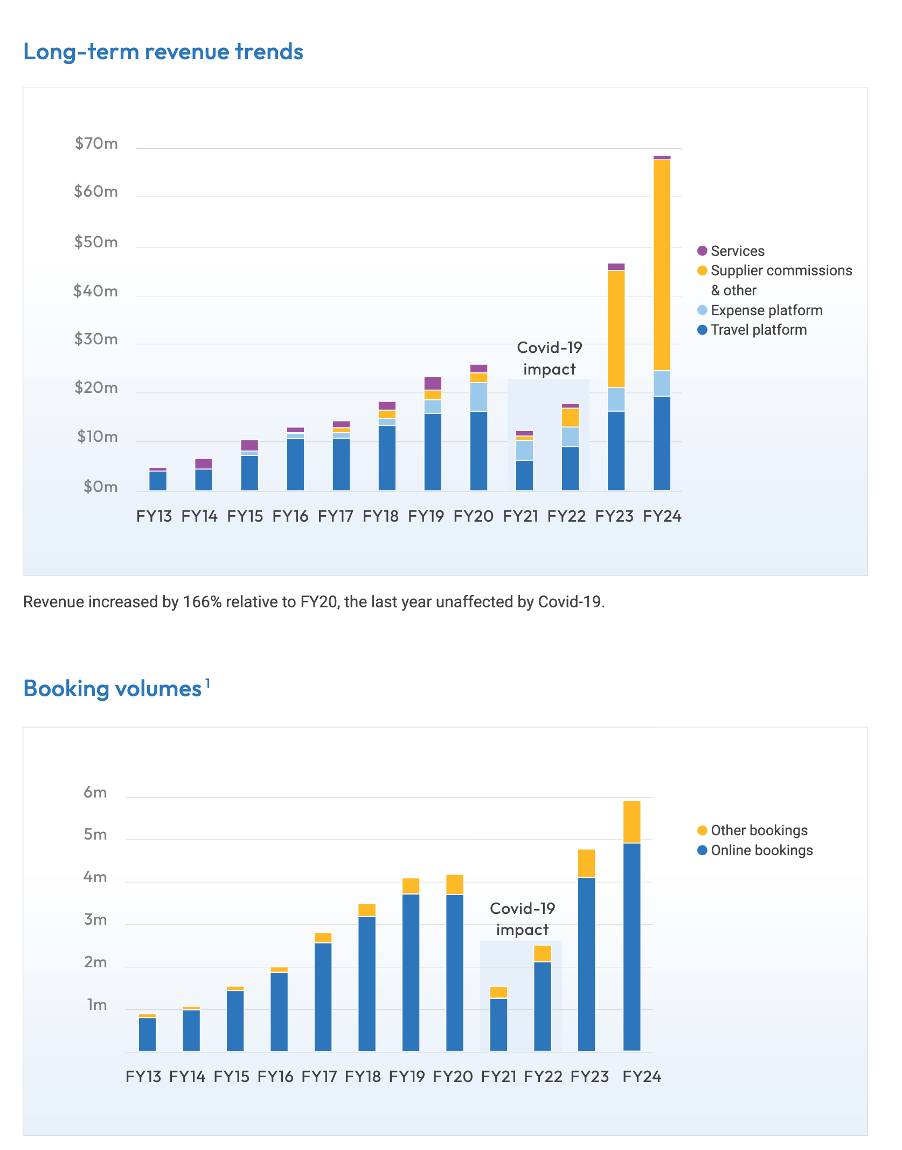

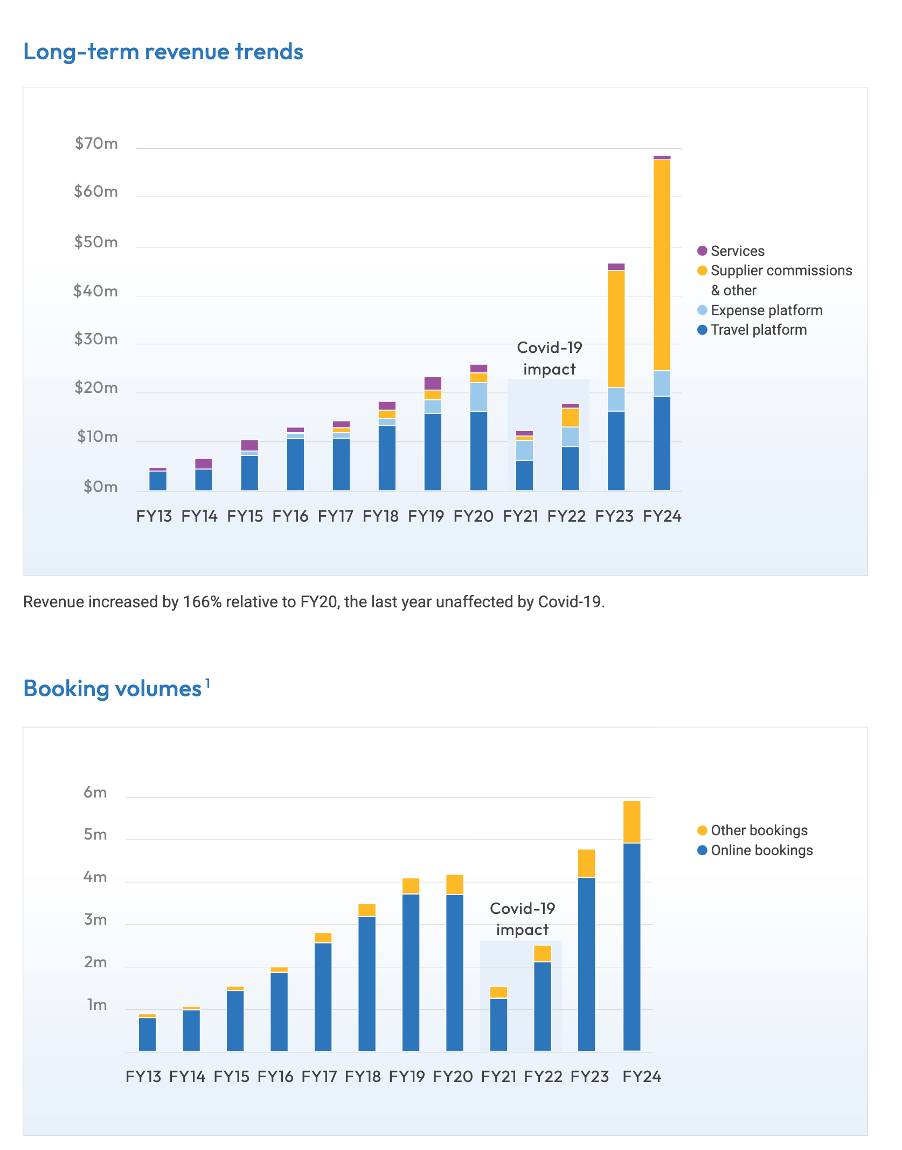

- Revenue and booking volumes returning to trend, ref graph FY24 Fin results 28/5/24

Does anyone have user experience with the platform? (My friend has since moved into a different industry)

I held a position back then, but COVID challenged my conviction, and I sold out. I have bought a small research position this week.