Been looking closely at a few software and tech companies that have underperformed recently and in particular the management incentives.

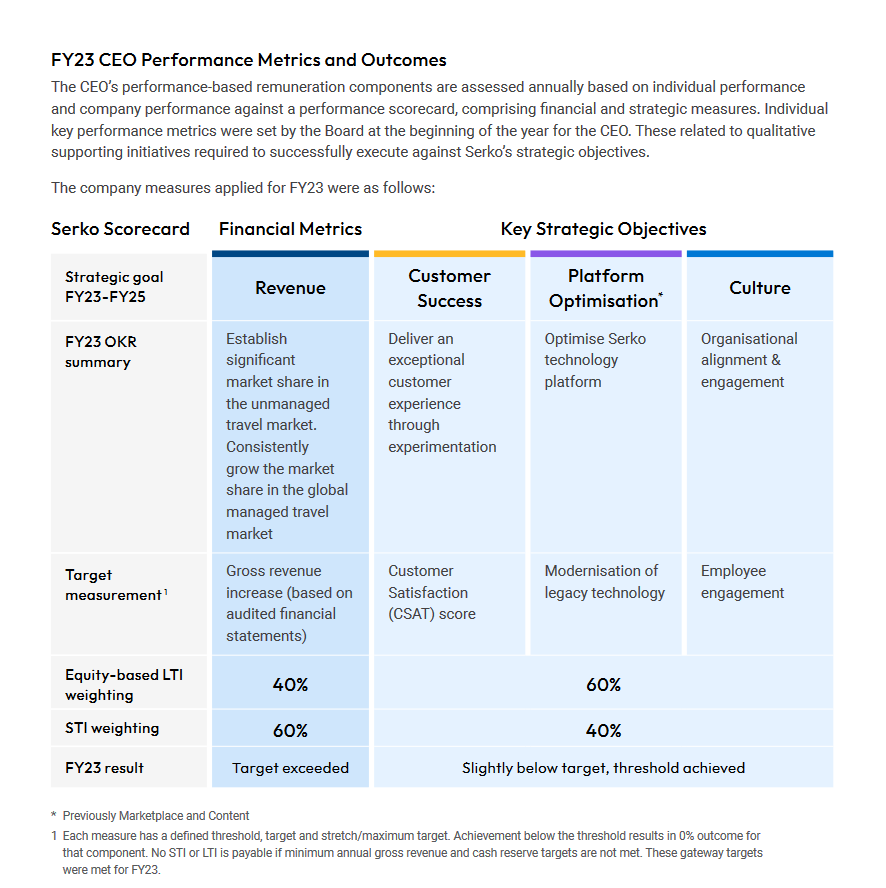

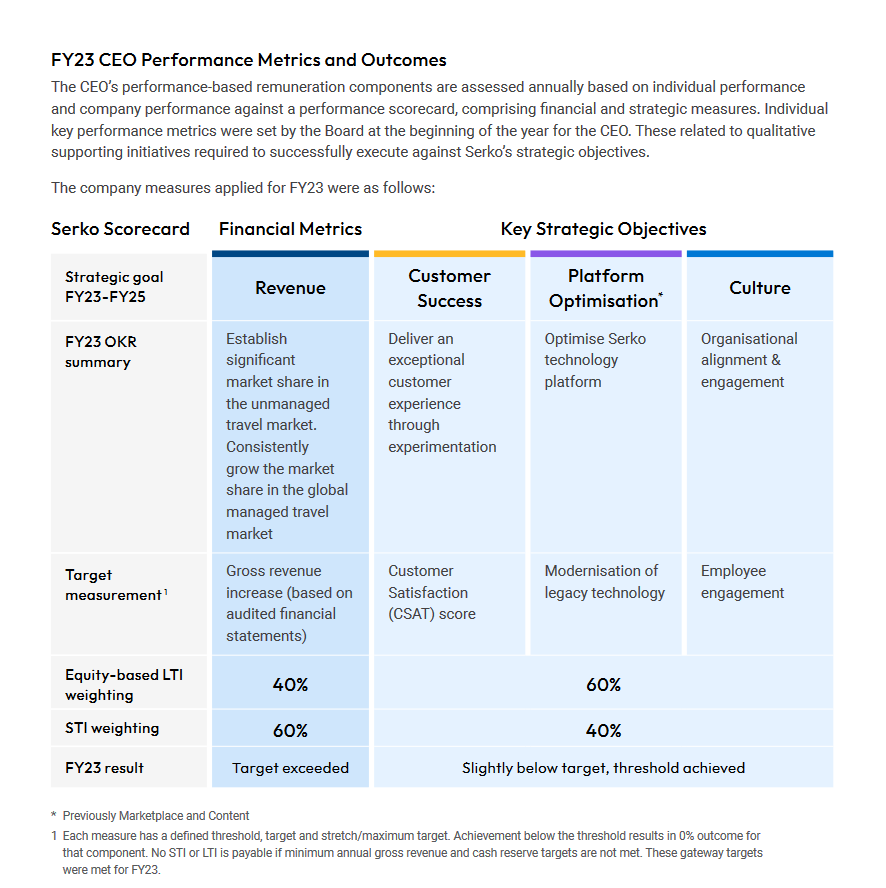

Serko appears to have the most interesting incentives for the CEO as it is revenue based.

Not right in my opinion especially when you are burning cash and still get awarded on the slightest hint of revenue growth.

Should really be EPS based or weighted on the share price performance I think such as Gentrak

Could explain the insider selling recently.

Not sure if I like this one due to this incentive - unless there is an additional condition on the performance that I've missed and someone can point me out on it.

However I know this could go cashflow positive if corporate travel continues to recover.

[held GTK but not this one]