Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

What does Serko do?

“Serko is a technology company that simplifies the complex world of corporate travel management. Serko’s software platform is used by millions of travellers around the world to book and manage their work trips, and by thousands of companies to manage their corporate travel programs.” (blurb from serko.com home page)

Serko Mission: Annual report 2024

“Build the world’s leading business travel marketplace” A big aspiration………………

Looking forward - Catalysts & Bright Spots:

- Cash balance 80.6m

- Revenue increasing as per guidance

- Cash flow positive next year?

- Booking.com renewed license for 5 years recently

- Insider ownership/founders

- Value of 10+ years of data and trends

I did an analysis of Serko when it was listed. My interest was sparked by conversations with a friend in the travel industry who was integrating travel management systems for large corporations and government departments.

My observations at the time were:

- The travel industry didn't love the Serko platform, but the end customers did.

- Good marketers? The annual report, website and marketing material was slick.

- Strategy: Target the end customer, and the middle guy has to cop it.

- Success depends on cracking the international market and maintaining a leading customer-friendly interface

- Competition: Significant, especially in the US.

Friend's Insights (2019):

- Serko: Local online tool for corporate travel, catering mainly to AU and NZ markets.

- Popular with customers due to its suitability for this market.

- TMCs (Travel Management Companies) disliked working with Serko due to poor integration with other tools (e.g., profile management, expense management).

- Charged for every change (profitable for Serko, challenging for travel agencies).

- Back-end configuration was difficult for TMCs but was improving over time.

- Unique approach: Targeted customers directly, unlike other tools promoted via TMCs.

- Excelled in the AU market compared to global tools and smaller companies prioritized functionality over global consistency.

Since 2019 things have obviously changed.

- Introduction of Zeno, integrating expense tracking and other features.

- Onboarding of international customers:

- Booking.com using the platform for SME business

- Large international corporates (e.g., American Express Business Travel, Helloworld)

- Customer base now across many countries and companies

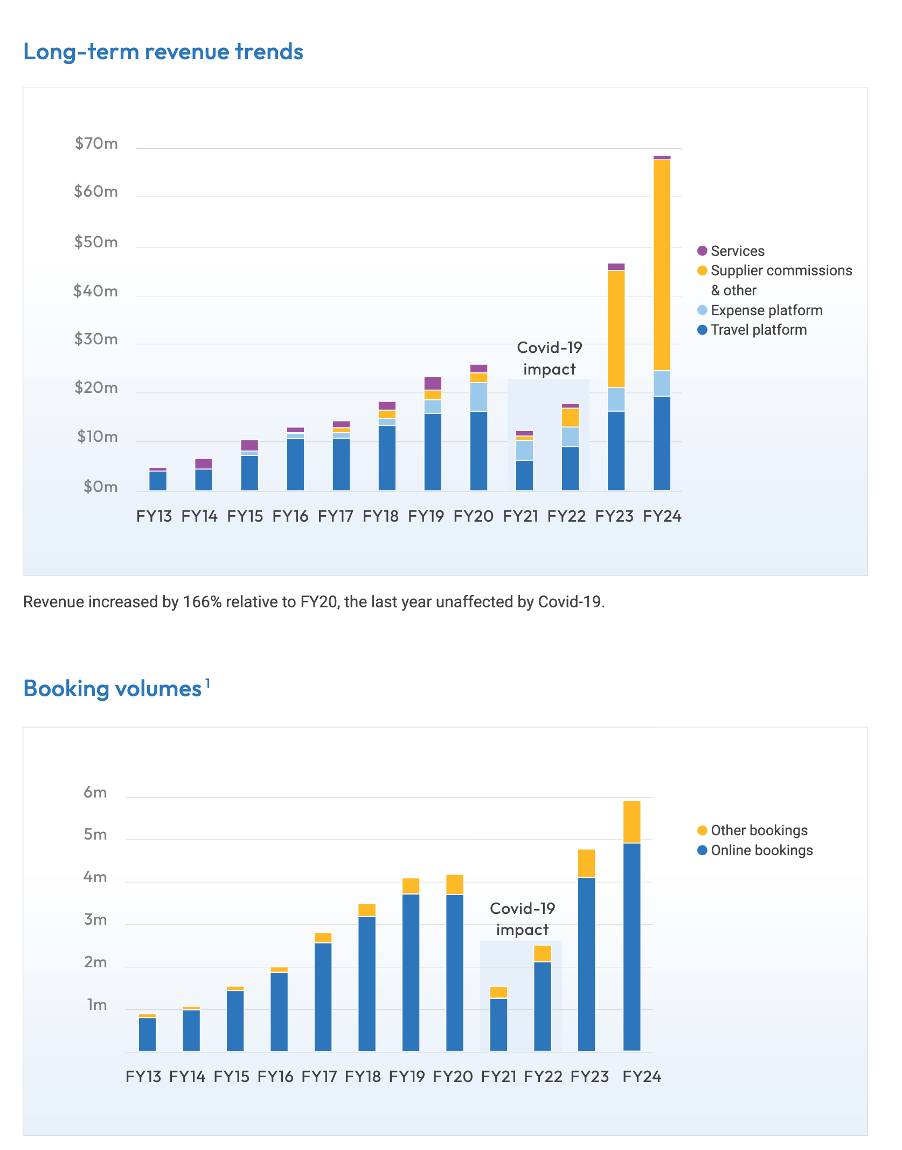

- Revenue and booking volumes returning to trend, ref graph FY24 Fin results 28/5/24

Does anyone have user experience with the platform? (My friend has since moved into a different industry)

I held a position back then, but COVID challenged my conviction, and I sold out. I have bought a small research position this week.

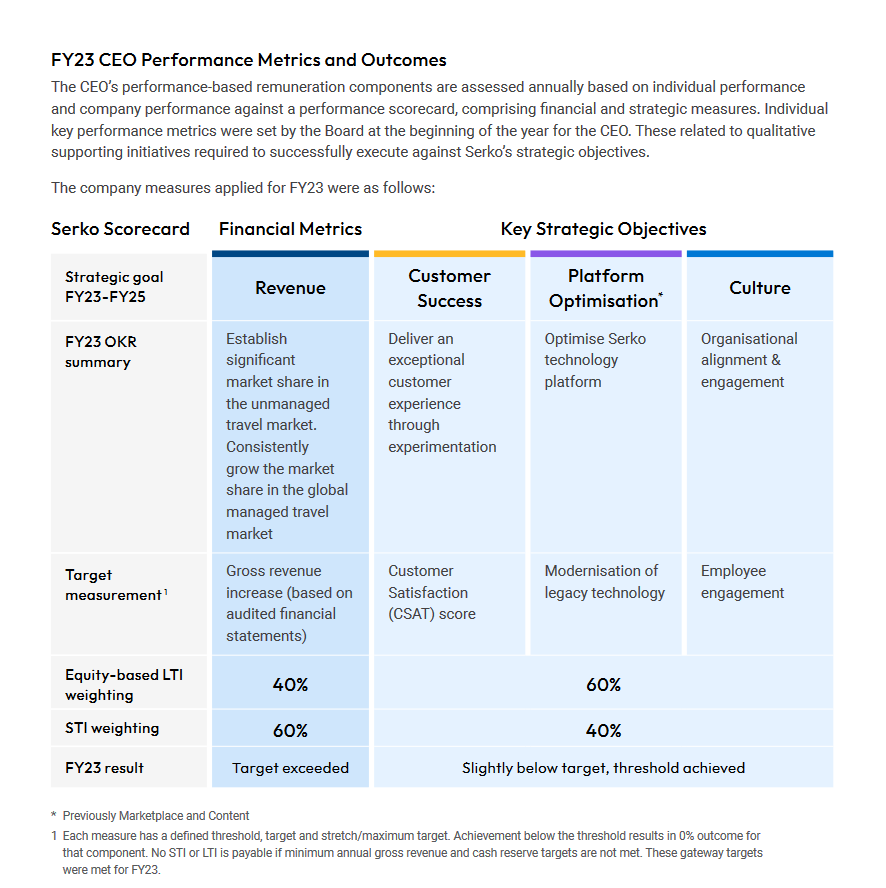

Been looking closely at a few software and tech companies that have underperformed recently and in particular the management incentives.

Serko appears to have the most interesting incentives for the CEO as it is revenue based.

Not right in my opinion especially when you are burning cash and still get awarded on the slightest hint of revenue growth.

Should really be EPS based or weighted on the share price performance I think such as Gentrak

Could explain the insider selling recently.

Not sure if I like this one due to this incentive - unless there is an additional condition on the performance that I've missed and someone can point me out on it.

However I know this could go cashflow positive if corporate travel continues to recover.

[held GTK but not this one]

The key Booking.com agreement is up for renewal in May 2024 - the key driver of growth in recent years.

Seems a bit binary (but more likely it will get renewed) but if so and the current economics play out it will tip into profitability (inflection point) in FY25 (absent a world travel disaster - war/recession).

One to watch as could be interesting - especially if Booking.com eventually makes a takeover offer too.

Transaction volumes showing positive uplift

Serko Limited (NZX/ASX:SKO), a leader in online travel booking and expense management for business, today provided a trading update, noting that transaction volumes are showing a positive uplift.

Mr Grafton, Serko’s CEO, said: “During March we have seen transaction volumes increase, with transactions month-to-date averaging 68% of the transaction volumes recorded for the same period in March 2019, which were unaffected by Covid-191 . As previously announced, Serko has assumed in its forecasts that travel volumes will be transacting in the range of 40-70% of pre-Covid levels by March 2021, so we are pleased to see transactions currently tracking to the higher end of this range.

“We are also seeing daily transaction volumes reaching their highest rate since Covid started materially impacting Serko’s travel volumes in mid-March 2020, and are pleased to note that some of this uplift is reflective of continued onboarding of new customers in Australasia despite the effects of Covid.

“These positive trends follow ongoing volatility over the past few months as a result of further Covid-related travel restrictions, which saw transaction volumes range from 58% of prior year volumes for the month of December 2020, 40% for January 2021 and 51% for February 2021.”

“We continue to closely monitor travel trends and hope to see these positive trends continue with the vaccination programs underway in key markets and travel restrictions progressively lifting.”

DISC: I Hold