FY23 Results

On the 22nd August Silk Logistics Holdings (SLH) announced its full year results. It was below analyst expectations but I thought it was still a great result given the economic headwinds this year.

• Revenue of $488.6 million, an increase of 23.8% on the prior corresponding period (‘pcp’)

• Underlying EBIT of $35.5 million, an increase of 14.5% on pcp

• Underlying NPAT of $15.9 million, an increase of 0.6% on pcp

• Final dividend of 3.10 cps – fully franked

• Annual dividend yield – 4.0%

• Strong cash generation, with 86% (pre capex) cash to underlying EBITDA1 (after lease payments)

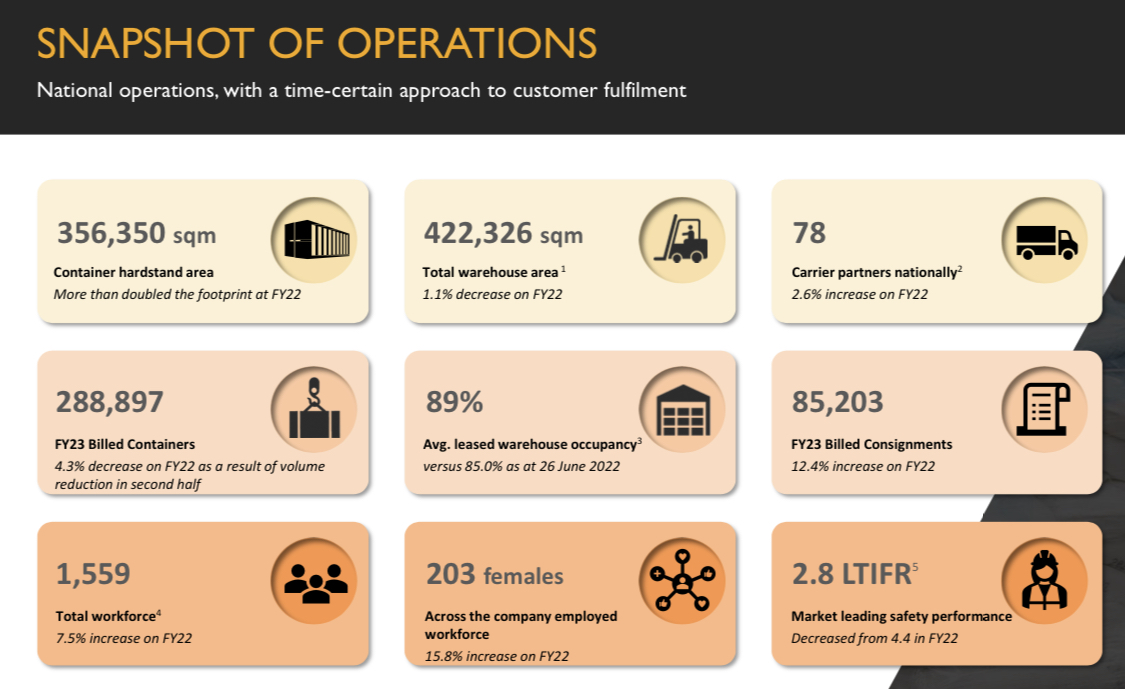

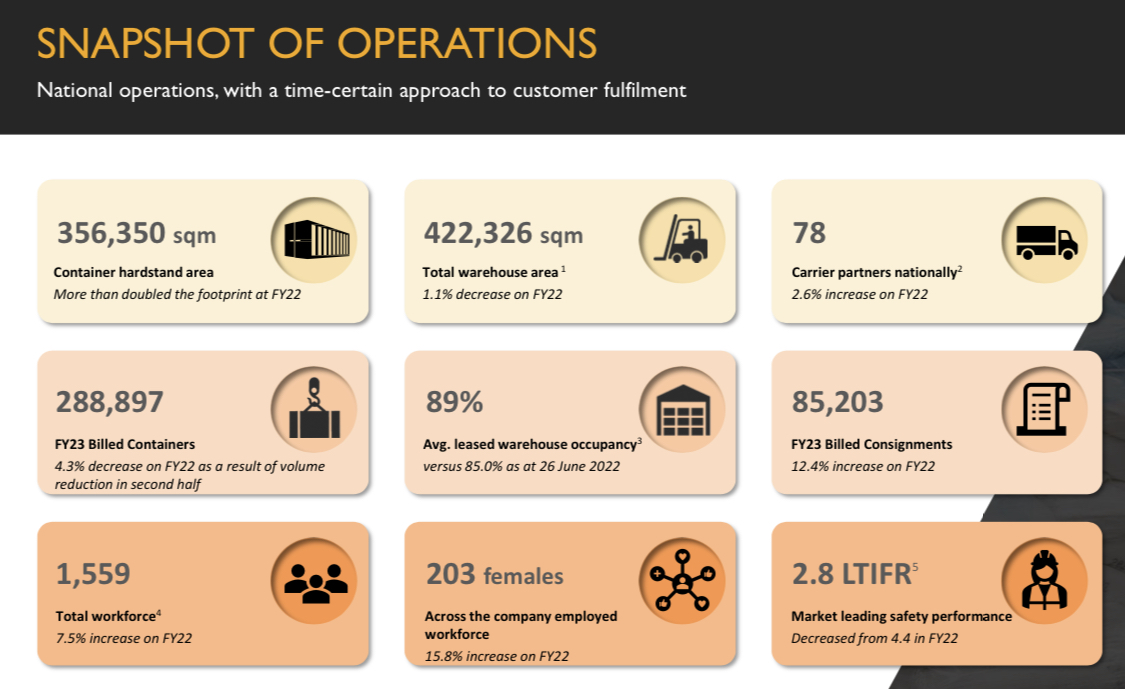

• Lost Time Injury Frequency Rate (‘LTIFR’) of 2.8, an improvement from 4.4 in FY222

• Headroom for growth with $30.5 million cash and leverage of 0.6x3

Missed Analyst Forecasts

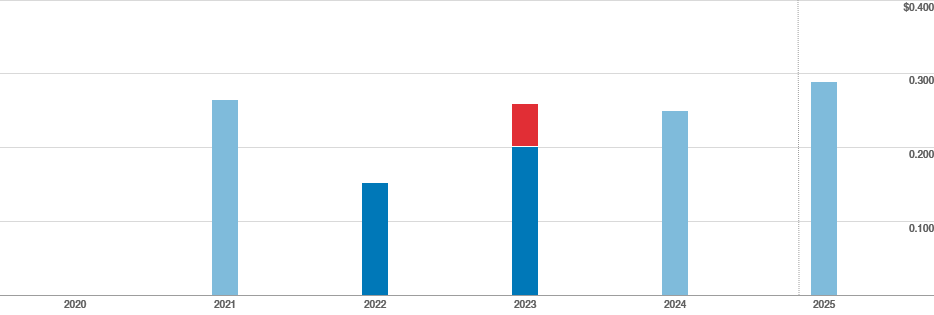

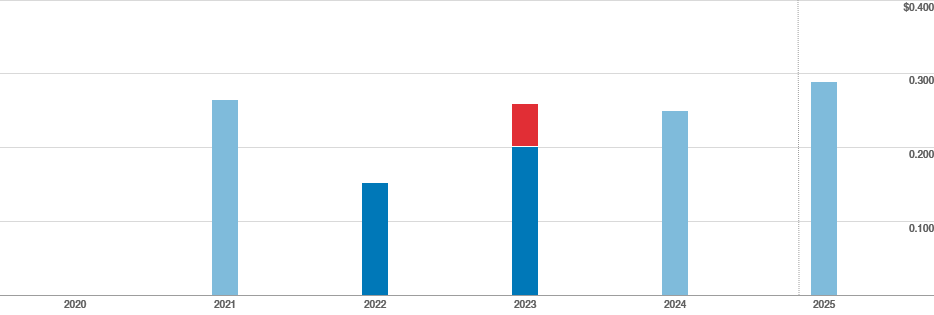

While the results looked OK, earnings were 18% below analyst expectations and the share price has been absolutely pummelled over the last six months.

Source: Simply Wall Street

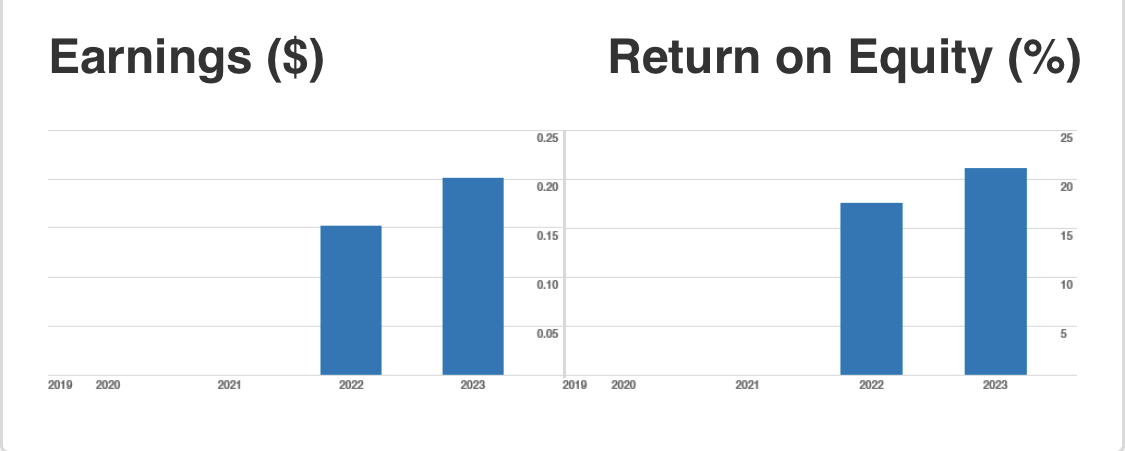

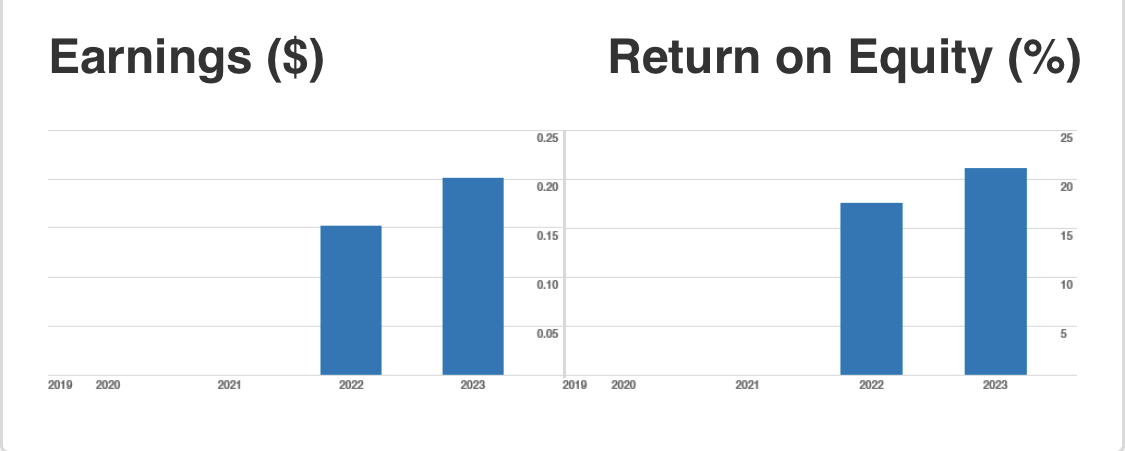

EPS came in at 20.1cps while analysts were expecting around 25cps. However, EPS were up from 15cps last year and are forecast to continue rising from here (Commsec chart below).

Source: Commsec

Margins

Silk said they were able to largely preserve underlying margins despite continued economic challenges through its agile business model. Gross Profit Margin was 41.5% and Net Profit Margin was 3.36% (Simply Wall Street data).

Founder led, MD & CEO Brendan Boyd, who owns 13.6% of the business, said “Industry and softened discretionary spend created substantial headwinds in the second half of the year”.

ROE

Return on equity (ROE) has improved since Silk’s debut on the ASX in July 2021. Increasing from 17.6% in FY22 to 21.1% in FY23. Working on analyst earnings forecasts over the next 3 years ROE should further improve to 22%.

Source: Commsec

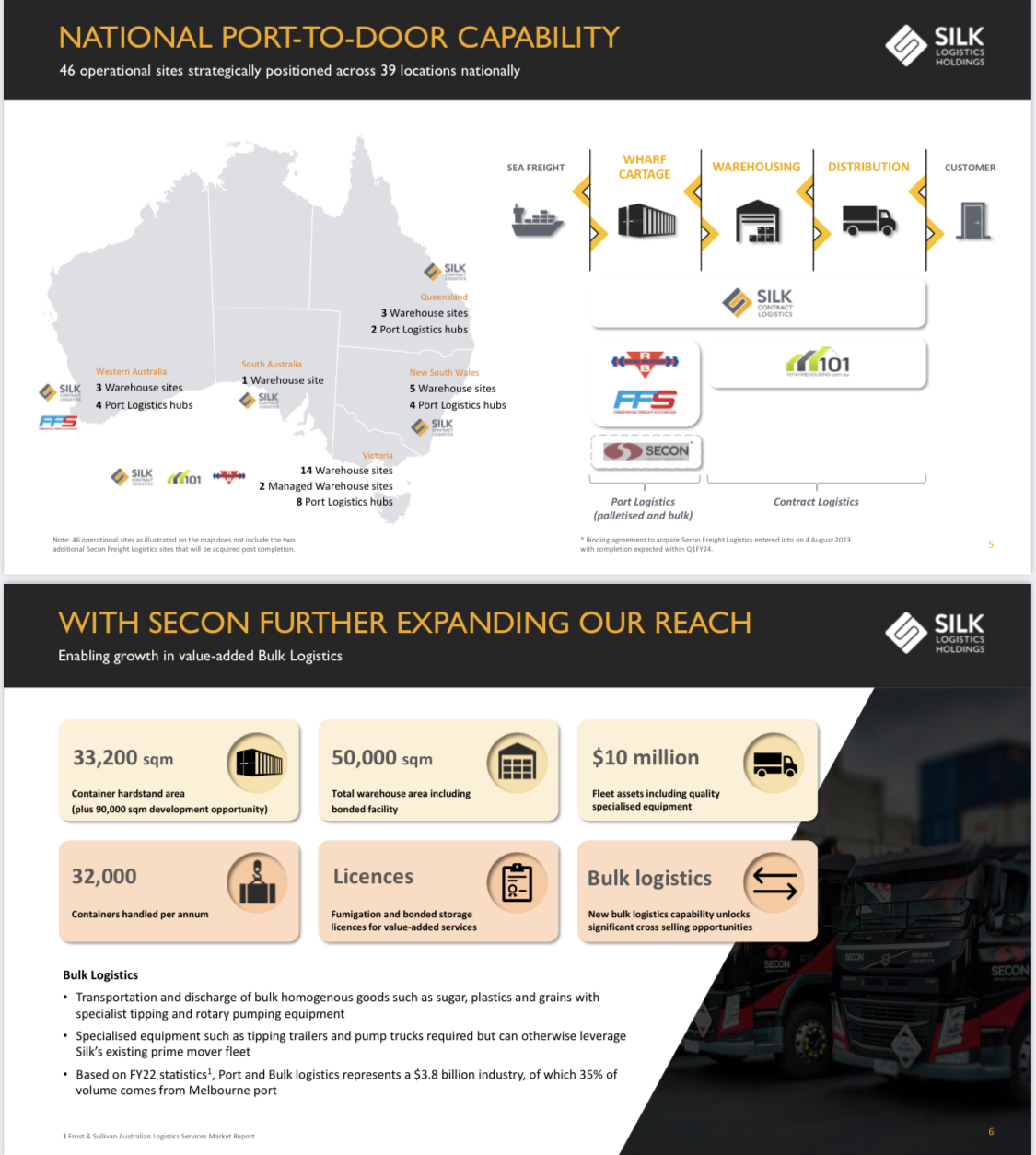

FY23 Operations

Outlook

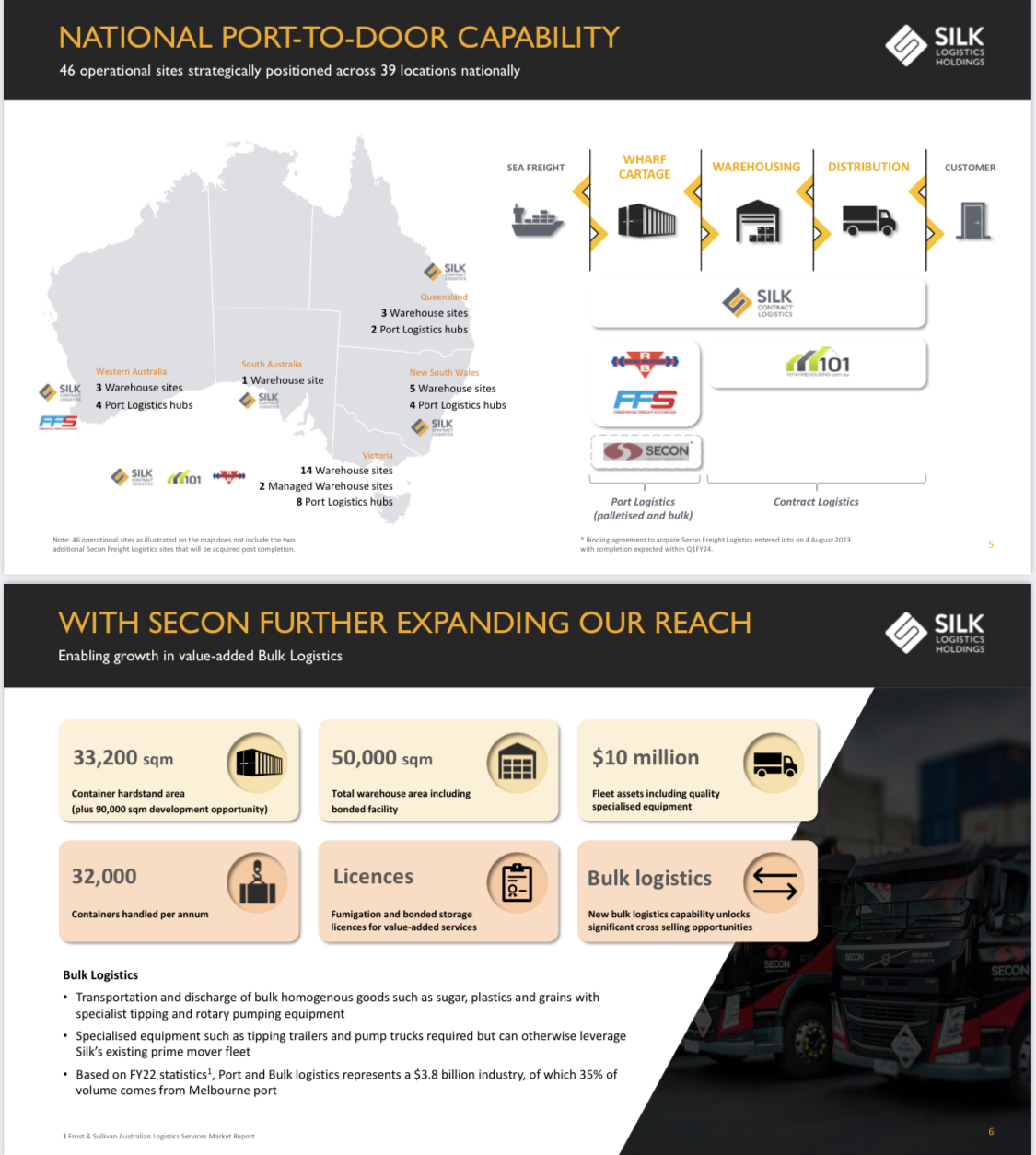

Silk expects to continue to grow revenue and earnings in FY24, subject to no further adverse changes in economic conditions (which I think is quite possible according to Dr Philip Lowe’s half-cup handover speech) and the assumptions underpinning its FY24 budget.

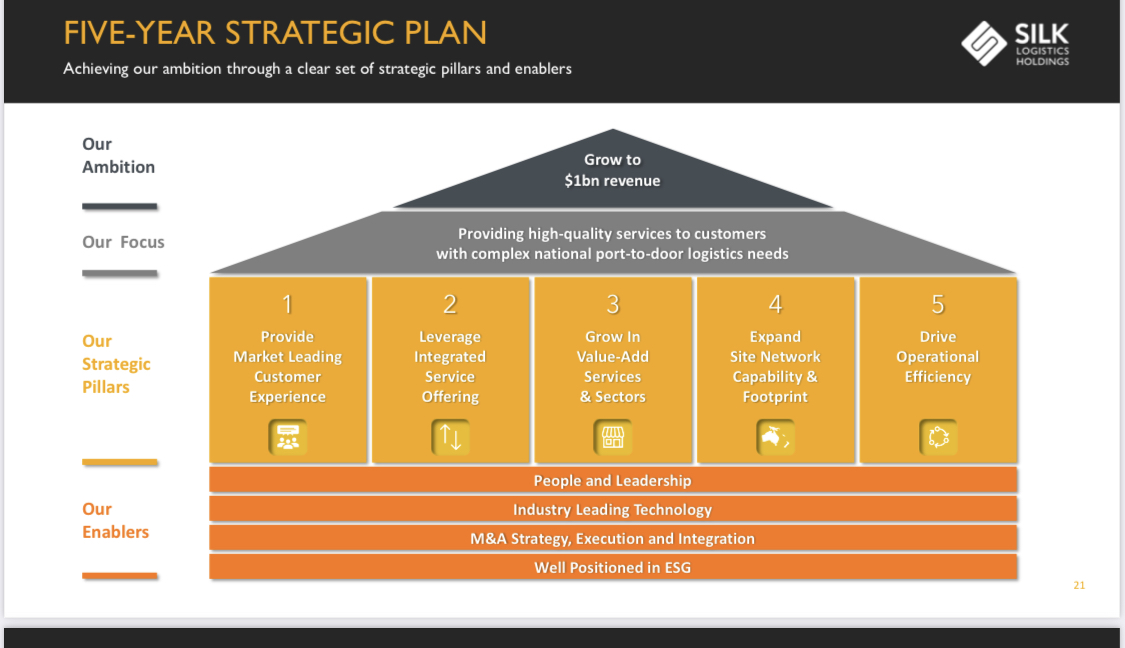

Although conditions will remain challenging in FY24, Silk will focus on preserving profitability through increased operational efficiencies, driving organic growth and exploring targeted M&A consistent with its corporate strategy.

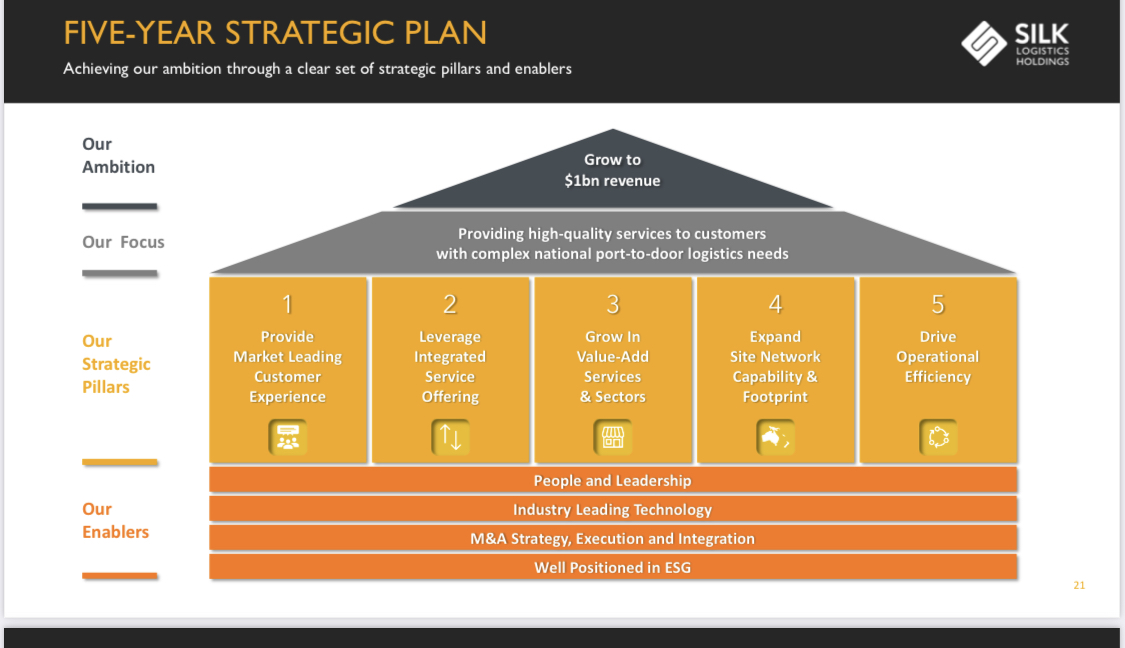

Silk remains committed to investing in the business to deliver on its ambition of achieving $1.0 billion of revenue by FY27.

Valuation

Silk is currently facing some headwinds with lower discretionary spending and higher costs putting pressure on the bottom line. Through their agile variable cost overheads model, the founder led management have been able to contain costs and take some pressure off the margins.

I expect Silk to continue facing headwinds for a while yet but I expect margins to improve as interest rates ease (if they do!) paving the way for excellent ROE over the next 3 years (+22%).

Silk is currently trading on a very conservative PE of 8x FY23 earnings. Over the last 2 years the average annual PE was 14.8 annd 11.1 (ComSec). The industry average PE is 13.9x (Simply Wall Street). Analysts expect FY25 EPS to be c. 29cps (Consensus of Morgans and Shaw & Partners, Simply Wall Street data). At a conservative 8x earnings Silk could be trading at over $2.30 in two years from now (potential 45% upside). I think 8x earnings is a low multiple for a founder led business like Silk which has a ROE of 22% and a healthy balance sheet (Holds $30.5 million in cash, and Net debt on equity is a mere 0.6%). Analysts are expecting earnings to grow at 14% - 15% per year over the next 3 years. If the PE were to expand to 10x on FY25 earnings of 29cps Silk could be worth $2.90 in two years time (potential 80% upside)

While it might take some time for the multiple and share price to readjust, in the meantime investors could expect dividends of 5% fully franked (ie. 7% grossed up) on a very conservative payout ratio of 50%. Management’s revenue target is $1 billion by FY27. That’s more than double the FY23 revenue of $488 million. I hope they don’t push this at the expense of shareholder ROE!

Using McNiven’s Formula and assuming forward underlying ROE of 22%, 50% reinvested earnings, fully franked dividends, equity of 95cps, and a required return on investment of 13.5%, I get a valuation of $2.37.

Silk is now one of my top value quality picks given the quality of the business and the thrashing it’s received after missing earnings consensus.

Disc: Held IRL (1.5%) and accumulating.