Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Proposed scheme of arrangement to acquire 100% of SLH shares @ $2.14 per share. While fairly new to DCF world, which means my arithmetic is probably wrong, I had a value of over $3 by FY 28.

The Board is recommending shareholders approve the bid in the absence of a higher offer.

It still has to be approved by the FIRB....here's the announcement for those who are interested.

https://investorpa.com/announcement-pdf/20241111/65356.pdf

After reviewing H2 FY24 results, sadly I think my thesis is busted for Silk Logistics.

They may still come good over the next 5 years and things possibly get better from here but I am no longer confident this has a high probability of beating the market in the foreseeable future.

Key issues below -

- ROE/ROC are trending down and are now below 10%

- Debt levels continue to grow and the interest payments have nearly doubled YOY, dragging on EPS.

- Depreciation is up 50% on a couple of years ago which is also dragging down EPS

- Despite them working hard at it, the warehouse utilisation rates have dropped down to 75% and don't seem to be improving yet

- Operating expenses keep growing at the same rates as revenue, so they aren't gaining efficiencies yet

- One of the founders who was CEO had to leave the role this half due to health reasons, which has weakened the leadership group

- As a result of much of above, despite revenue doubling since listing, EPS hasn't quite doubled and the balance sheet is proportionally riskier now.

May come to regret selling at a low point but given what the trends are, I will be more disappointed if I don't exit on a broken thesis and take even bigger losses down the road.

I hold SLH in real life and am now underwater. I suspect I have been seduced by fancy ROE numbers when in fact I should also have been looking at the totality of the business and its history.

Look at the graph and this has been a shocker (weekly over 5 years).

A listing price of $2.50 has seen a plethora of acquisitions reduce the SP to just $1.40. Talk about buying yourself into poverty.

Yep, I get it that the management team have been buying shares and that is a good sign, but is it a NECESSARY demonstrable act of presumed confidence to encourage the market? One sentence buried deep in the notes implies the external debt covenants may be in peril - quote - "The continued covenant compliance is dependent on the Group continuing to trade in line with its forecast" Hmmm, not a rolled gold endorsement! At the very least, this might curtail acquisitions whilst they get debt and 'acquisition bedding down' issues under control.And this will be a good thing. Maybe this industry is undergoing quite some change as the big get bigger & the small get out.

The 1HFY24 results were a shocker, but there were extraneouus issues on the dockside which upset normal operations. Also, the greater confidence in supply lines have resulted in many companies now reducing stocking levels & hence warehousing requirements - utilisation now down ot 77.4% (but this seems to be on a par with a another logistics compoany I follow).

I am hanging in there but expect to see a marked improvement in 2H results and (hopefully) the Red Sea issues and the need to re-route shipping via Cape of Good Hope will be another reminder to Aussie businesses that supply lines can be easily interrupted. I understand container rates are rising.

I note that the 3 analysts covering SLH still maintain favourable IV's, but are they acolytes/guns for hire. One of them has such a reputation.

Between the 29th Februray and 4th March, Co-Founder and Director, John Anthony Sood bought 200,000 shares on-market averaging $1.51 per share, totalling $301,855 (indirectly, through various family holdings). Silk Logistic Holdings (ASX:SLH) went ex-dividend on 1st March 2024 (2.8cps fully franked) - ASX Announcement.

Previously John held 10.8 million shares or 13.3% of the business. The additional purchases will bring John’s total holdings to 11 million shares, or 13.5% of the business. Co-founder and CEO, Brendan Boyd also holds 13.3% of the business which brings the total ownership by the co-founders to 26.8%. In August last year non-executive director Cheryl Hayman bought 50,000 for $92,000. There has been no insider selling in the past 12 months.

The co-founder’s recent purchases has given me the confidence to add more shares today at an all time low of $1.41.

While Silk Logistic Holdings has had a tough year, and the share chart looks woeful, I agree with @Karmast’s reasons for holding, and valuation of $2.05 per share. At the current share price of $1.41, I am hoping for a return of approx. 17% per year as business conditions improve and retailer inventory levels normalise.

Held IRL (2.8%)

Valuation based on 17c of EPS, 10% p.a. earnings growth over 5 years and a PE of 10.

Updated valuation in Feb 2024 after disappointing half year report.

Notes Feb 2024 - Good to see the revenue increase but the depreciation impact (mostly leases they said) has really hampered the EPS, so the two numbers went in opposite directions. The other big shift they talked to was inventory reductions by customers, meaning the warehouse utilisation dropped from 90% 6 months ago to 77% now.

So the good news is topline sales were up and they added 5% more customers to the base. The bad news was costs/depreciation increased faster and the warehouses are only 3/4 full now.

Thesis has been weakened but not busted yet. Close watch in the next 6 months - can they add some more customers and fill the warehouses up again, which will add meaningfully to EPS. And can they stabilise the cost trajectory so that the revenue growth drops to the bottom line again...

Guidance has been conservative historically and the upper end of the latest guidance would see EPS still increase 5 to 10% for the full year. Time will tell but I am OK giving them some more time for now.

Why do I own it?

# Logistics / shipping / warehousing business with very experienced management now running business as owners.

# Founders own 35% of business with a sensible remuneration plan well aligned with shareholders.

# Industry is likely to persist and grow for many years as population and online shopping increases. The business might slow over the next year or so if the anticipated recession eventuates however they should be fine with these tailwinds over 5 + years.

# They have a national footprint and their facilities are new and high quality.

# Business has a very strong focus on customer experience - actively tracking NPS and investing in systems and people to further improve the value they provide their customers. This is a big point of difference from most logistics companies.

# Good track record of high ROE / ROC and balanced dividend payout ratio

# Excellent MOS at entry point given low PE and PS so should comfortably exceed our 15% p.a. return target if they can continue to execute like they have been

What to watch?

# Have higher debt to equity ratio than we usually like however this is mostly lease liabilities on their warehouses to Goodman Group. Something to watch as renewals come up.

# Progress on NPS from the investments in customer experience they are making

# Net profit margin is 3.6% so while they doesn't leave lots of room for competitors it does mean cost increases not offset by price rises are a risk

# Might be able to make sensible acquisitions given fragmented nature of the industry or could be an acquisition target themselves if multiple gets too low

This little hopeful had a tough half! We need the economy to improve before Silk Logistics thrives again. Founder led, the CEO has a lot of skin in the game and I think they are managing the cycle well. It’s not expensive at todays price so I’m going to hang in there, collect the fully franked dividends, and wait for the cycle to improve. I might even add a few more on the lows. Not sure yet. Need to do some more scenarios.

• Revenue of $276.5 million, an increase of 9.0% on the prior corresponding period (‘pcp’)

• Underlying EBITDA1,2 of $47.7m, an increase of 7.9% on the pcp

• Underlying EBIT1 of $18.2m, compared to $19.7m in the pcp

• Strong cash generation, with 79.0% (post capex) cash to underlying EBITDA (after lease

payments)

• Increase in trading customers to 594, compared to 569 at June 20233

• Completed acquisition of specialised Port Logistics business - Secon

• Lost Time Injury Frequency Rate (‘LTIFR’) of 0.6, an improvement from 2.8 in FY234

Half Year FY24 Results

Silk reported revenue of $276.5 million for the first half of FY24, representing a 9.0% increase on pcp. This was underpinned by $23.6 million in (annualised) new business wins and an increase in trading customers to 594 (excluding Secon Freight Logistics (‘Secon’)). Despite industry headwinds, Silk remained focused on driving operational efficiencies, winning new customers and capturing a greater share of existing customer spend. Underlying EBITDA1 was $47.7m, increasing 7.9% compared to pcp. Underlying EBIT1 was $18.2 million, decreasing 7.6% compared to pcp and underlying NPAT was $7.6 million, a reduction of 22.4% against pcp, primarily driven by additional right-of-use (property lease) depreciation expense. The Company remained resilient during the half and was able to maintain underlying EBITDA margins as a result of its variable cost business model.

Silk Managing Director & CEO Brendan Boyd said, “First half trading conditions were mixed and were characterised by strong export volumes, improved warehouse handling and distribution margins, and new Secon customers onboarded. These positives were balanced with an extended inventory adjustment period, subdued import container volumes and sustained cost pressures.

Our ability to deliver on revenue and maintain our Underlying EBITDA margin highlights the strength and agility of our business model. As we enter the second half of FY24, our focus remains on driving cost efficiencies and delivering on our strong customer service ethos. We will continue integrating Secon and extending capability to other states which has already delivered cross-sell opportunities and new business wins. We anticipate further recent Secon customer wins will onboard from the commencement of FY25.”

Outlook

Silk continues to focus on the prevailing market conditions. It expects to deliver revenue and underlying EBITDA growth in FY24, subject to no further adverse changes in economic conditions and the assumptions underpinning its FY24 forecasts.

Silk provides its full year guidance:

• Revenue - $540.0m - $560.0m

• Underlying EBITDA5

- $92.0m - $98.0m

• Underlying EBIT5

- $34.0m - $37.0m.

Full year guidance includes the 2HFY24 impact from the lease accounting treatment of the new site lease at Kenwick, WA commencing March 2024 which, before taking into account any revenue contribution, will be an additional cost of c. $0.3m to EBITDA and c. $1.1m to EBIT. Underlying earnings excludes the impact from provisional fair value uplift accounting adjustments on acquisition of Secon (refer to 1HFY24 statutory to underlying earnings reconciliation).

Trading conditions are expected to remain challenging for the remainder of FY24. Silk will focus on preserving profitability through increased operational efficiencies, driving organic growth and integration of acquired businesses to realise synergy benefits. Silk maintains a positive outlook with respect to its business development pipeline and its customer value proposition to win further new business.

Held IRL (2.2%)

I attended the AGM yesterday and overall was very happy with the interactions. In my view the company is well ahead of most similar size listed businesses when it comes to governance. It’s a skilled and capable Board. The rem plan is well aligned with shareholders and incentivises sustainable growth. They didn’t use discretion this year to pay out short term incentives despite getting close to the targets. The Board and management seem well aware of cyber risks and are pro actively working at mitigation. They are measuring customer satisfaction with NPS and injury rates are roughly 80% below the industry average. Not a perfect business as none are. They cancelled the expansion project in NSW this week as they couldn’t complete the deal on mutually favourable terms. However given the current market cap and short time as a listed business they are very well set up for a successful and sustainable future and the valuation upside is in tact in my view.

@Rick I thought you might like to add this broker report to your thesis. Looks good value to me too.

Silk logistics broker report Oct 2023.pdf

Nessy

Disc - not held yet

08/09/2023

(See also my straw ‘Deep Value and Quality?’)

Silk is currently facing some headwinds with lower discretionary spending and higher costs putting pressure on the bottom line. Through their agile variable cost overheads model, the founder led management have been able to contain costs and take some pressure off the margins.

I expect Silk to continue facing headwinds for a while yet but I expect margins to improve as interest rates ease (if they do!) paving the way for excellent ROE over the next 3 years (+22%).

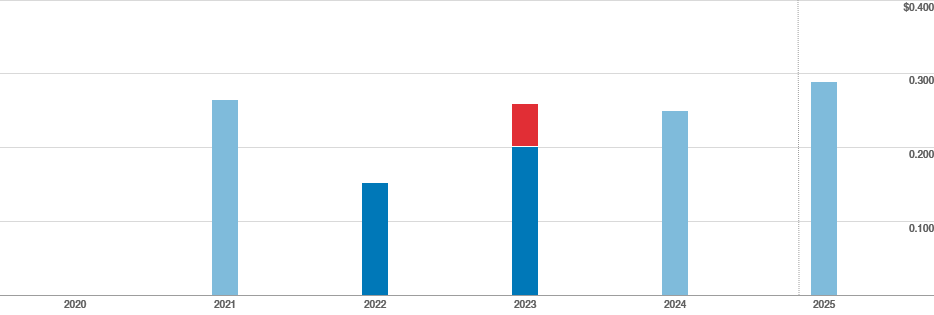

Silk is currently trading on a very conservative PE of 8x FY23 earnings. Over the last 2 years the average annual PE was 14.8 annd 11.1 (ComSec). The industry average PE is 13.9x (Simply Wall Street). Analysts expect FY25 EPS to be c. 29cps (Consensus of Morgans and Shaw & Partners, Simply Wall Street data). At a conservative 8x earnings Silk could be trading at over $2.30 in two years from now (potential 45% upside). I think 8x earnings is a low multiple for a founder led business like Silk which has a ROE of 22% and a healthy balance sheet (Holds $30.5 million in cash, and Net debt on equity is a mere 0.6%). Analysts are expecting earnings to grow at 14% - 15% per year over the next 3 years. If the PE were to expand to 10x on FY25 earnings of 29cps Silk could be worth $2.90 in two years time (potential 80% upside)

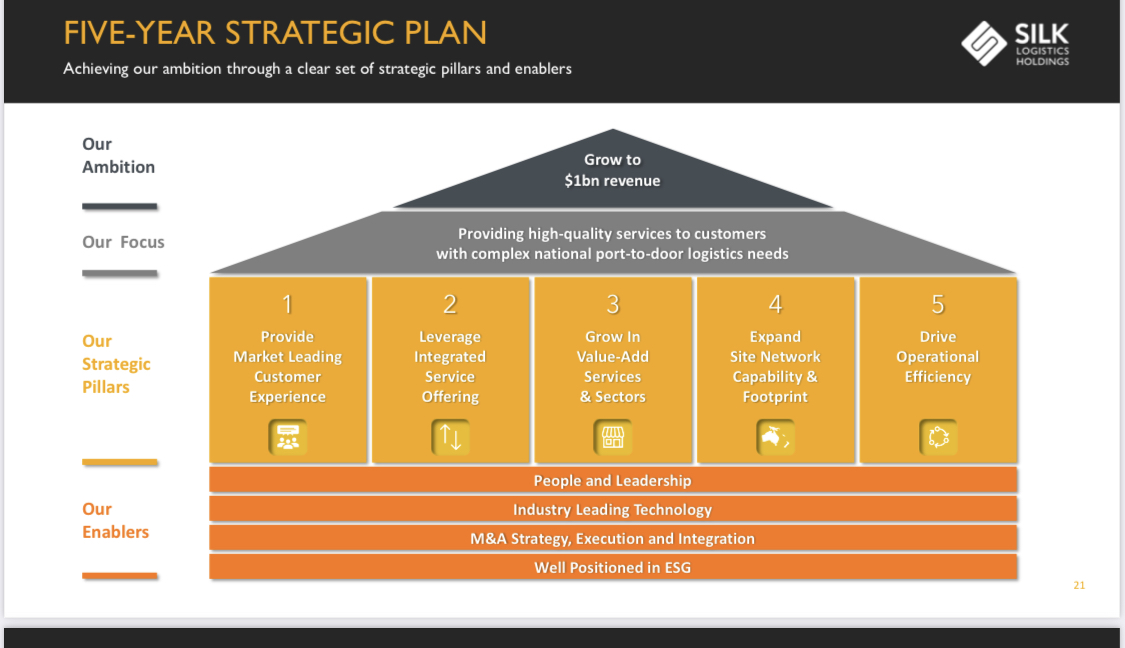

While it might take some time for the multiple and share price to readjust, in the meantime investors could expect dividends of 5% fully franked (ie. 7% grossed up) on a very conservative payout ratio of 50%. Management’s revenue target is $1 billion by FY27. That’s more than double the FY23 revenue of $488 million. I hope they don’t push this at the expense of shareholder ROE!

Using McNiven’s Formula and assuming forward underlying ROE of 22%, 50% reinvested earnings, fully franked dividends, equity of 95cps, and a required return on investment of 13.5%, I get a valuation of $2.37.

Silk is now one of my top value quality picks given the quality of the business and the thrashing it’s received after missing earnings consensus.

Disc: Held IRL (1.5%) and accumulating.

FY23 Results

On the 22nd August Silk Logistics Holdings (SLH) announced its full year results. It was below analyst expectations but I thought it was still a great result given the economic headwinds this year.

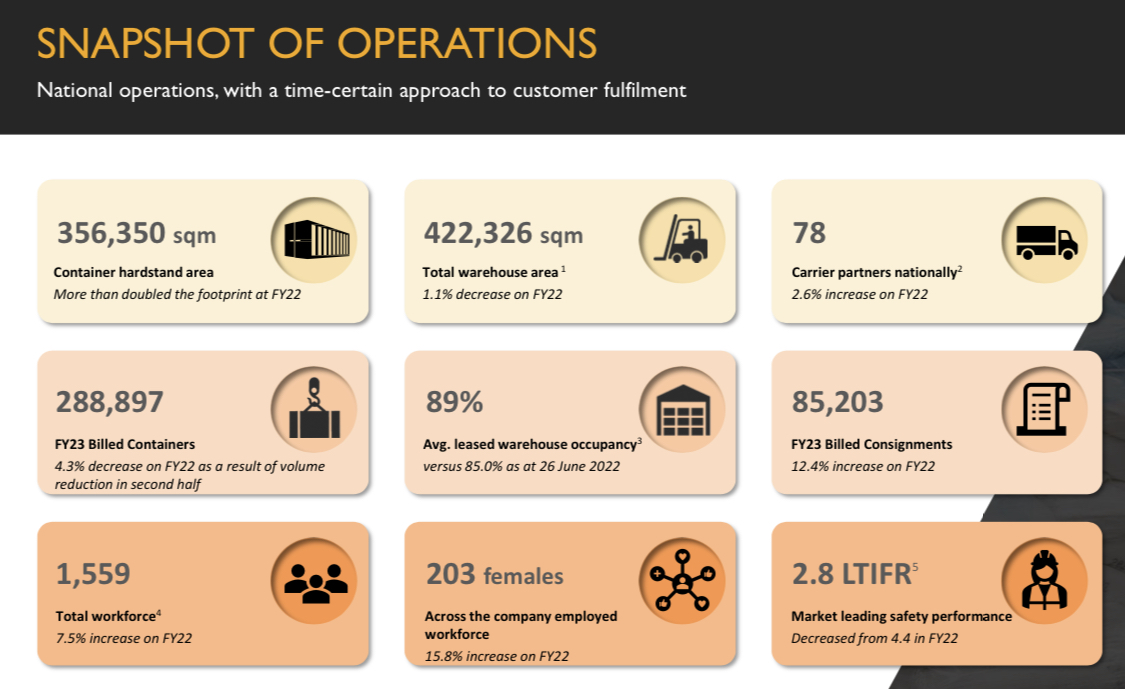

• Revenue of $488.6 million, an increase of 23.8% on the prior corresponding period (‘pcp’)

• Underlying EBIT of $35.5 million, an increase of 14.5% on pcp

• Underlying NPAT of $15.9 million, an increase of 0.6% on pcp

• Final dividend of 3.10 cps – fully franked

• Annual dividend yield – 4.0%

• Strong cash generation, with 86% (pre capex) cash to underlying EBITDA1 (after lease payments)

• Lost Time Injury Frequency Rate (‘LTIFR’) of 2.8, an improvement from 4.4 in FY222

• Headroom for growth with $30.5 million cash and leverage of 0.6x3

Missed Analyst Forecasts

While the results looked OK, earnings were 18% below analyst expectations and the share price has been absolutely pummelled over the last six months.

Source: Simply Wall Street

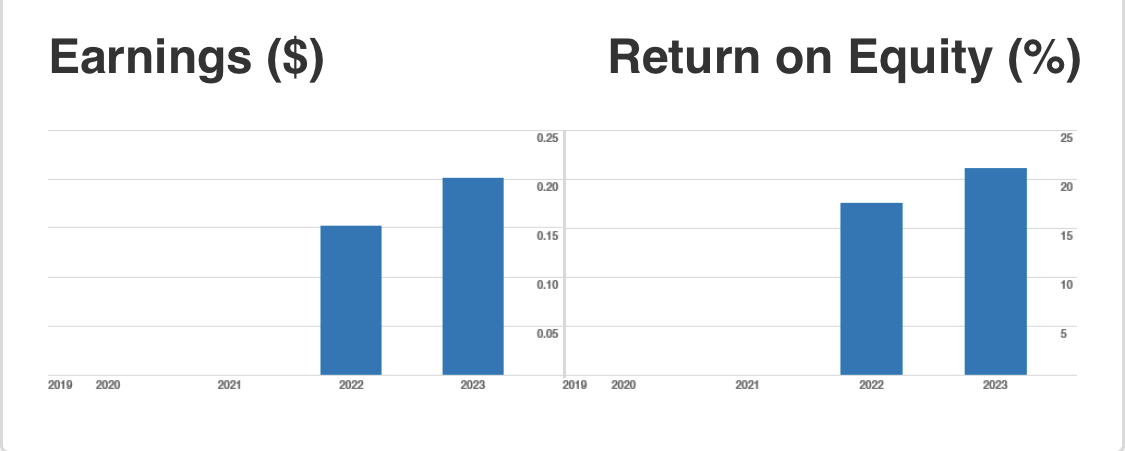

EPS came in at 20.1cps while analysts were expecting around 25cps. However, EPS were up from 15cps last year and are forecast to continue rising from here (Commsec chart below).

Source: Commsec

Margins

Silk said they were able to largely preserve underlying margins despite continued economic challenges through its agile business model. Gross Profit Margin was 41.5% and Net Profit Margin was 3.36% (Simply Wall Street data).

Founder led, MD & CEO Brendan Boyd, who owns 13.6% of the business, said “Industry and softened discretionary spend created substantial headwinds in the second half of the year”.

ROE

Return on equity (ROE) has improved since Silk’s debut on the ASX in July 2021. Increasing from 17.6% in FY22 to 21.1% in FY23. Working on analyst earnings forecasts over the next 3 years ROE should further improve to 22%.

Source: Commsec

FY23 Operations

Outlook

Silk expects to continue to grow revenue and earnings in FY24, subject to no further adverse changes in economic conditions (which I think is quite possible according to Dr Philip Lowe’s half-cup handover speech) and the assumptions underpinning its FY24 budget.

Although conditions will remain challenging in FY24, Silk will focus on preserving profitability through increased operational efficiencies, driving organic growth and exploring targeted M&A consistent with its corporate strategy.

Silk remains committed to investing in the business to deliver on its ambition of achieving $1.0 billion of revenue by FY27.

Valuation

Silk is currently facing some headwinds with lower discretionary spending and higher costs putting pressure on the bottom line. Through their agile variable cost overheads model, the founder led management have been able to contain costs and take some pressure off the margins.

I expect Silk to continue facing headwinds for a while yet but I expect margins to improve as interest rates ease (if they do!) paving the way for excellent ROE over the next 3 years (+22%).

Silk is currently trading on a very conservative PE of 8x FY23 earnings. Over the last 2 years the average annual PE was 14.8 annd 11.1 (ComSec). The industry average PE is 13.9x (Simply Wall Street). Analysts expect FY25 EPS to be c. 29cps (Consensus of Morgans and Shaw & Partners, Simply Wall Street data). At a conservative 8x earnings Silk could be trading at over $2.30 in two years from now (potential 45% upside). I think 8x earnings is a low multiple for a founder led business like Silk which has a ROE of 22% and a healthy balance sheet (Holds $30.5 million in cash, and Net debt on equity is a mere 0.6%). Analysts are expecting earnings to grow at 14% - 15% per year over the next 3 years. If the PE were to expand to 10x on FY25 earnings of 29cps Silk could be worth $2.90 in two years time (potential 80% upside)

While it might take some time for the multiple and share price to readjust, in the meantime investors could expect dividends of 5% fully franked (ie. 7% grossed up) on a very conservative payout ratio of 50%. Management’s revenue target is $1 billion by FY27. That’s more than double the FY23 revenue of $488 million. I hope they don’t push this at the expense of shareholder ROE!

Using McNiven’s Formula and assuming forward underlying ROE of 22%, 50% reinvested earnings, fully franked dividends, equity of 95cps, and a required return on investment of 13.5%, I get a valuation of $2.37.

Silk is now one of my top value quality picks given the quality of the business and the thrashing it’s received after missing earnings consensus.

Disc: Held IRL (1.5%) and accumulating.

The most recent director buying was on the 25th August (post the FY23 results announcement, and pre dividend) when non-executive director Cheryl Hayman purchased 50,000 shares at $1.84 per share, totalling $92,000. This is a reasonably large purchase in comparison to the $12,500 per year Cheryl receives as a non-executive director on the Board.

The last director purchase was on the 9th September 2022, by non-executive director Louise Thurgood who bought 52,500 shares at $2.18 per share, totalling $114,421. This purchase is well covered by the $136,480 per year she receives as non-executive director.

Source: https://thebull.com.au/18-share-tips-14-august-2023/

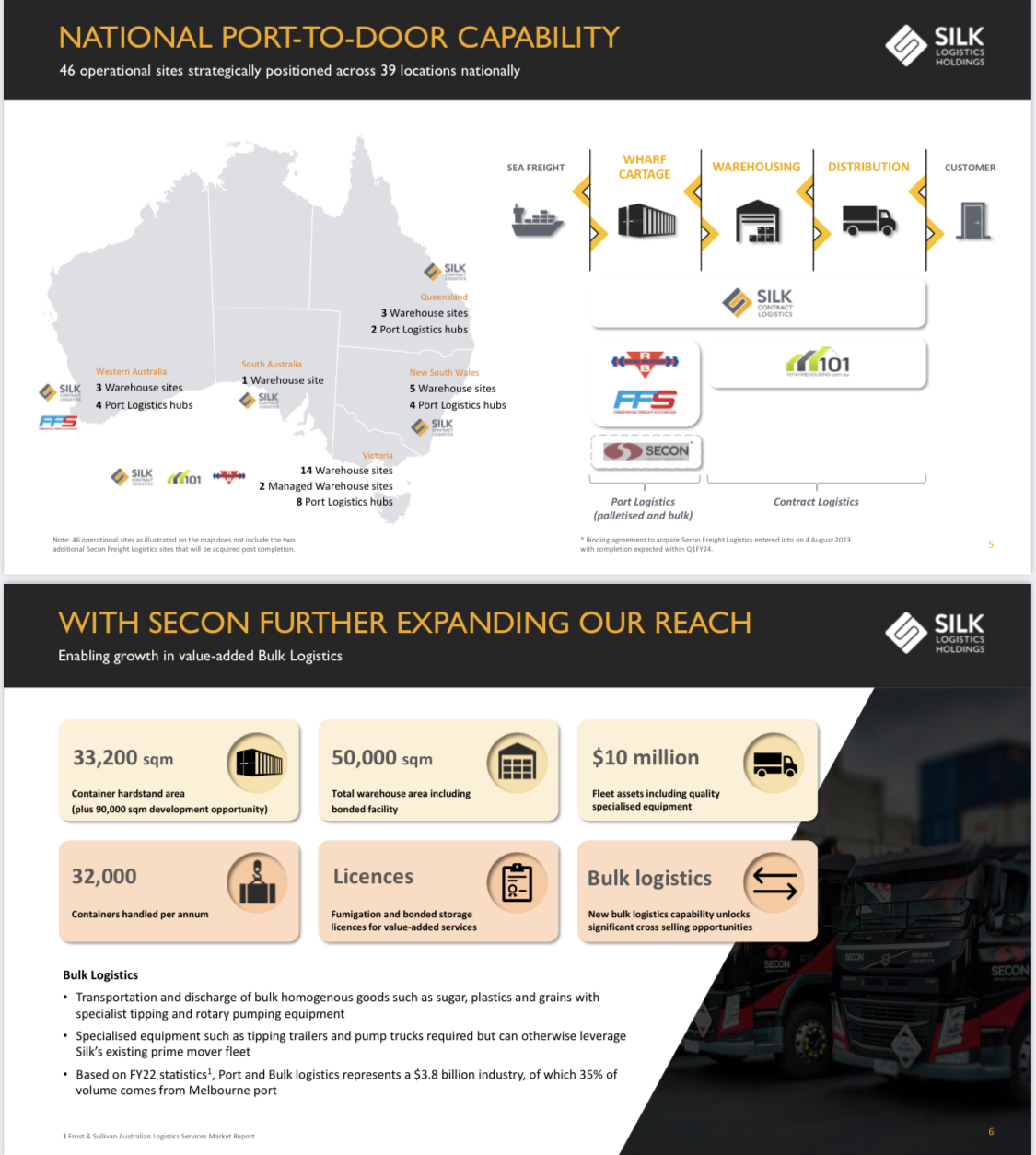

BUY – Price Target $3.45

This integrated logistics provider has entered into a binding agreement to acquire Secon Freight Logistics for $35 million. Secon generates more than $65 million in annual revenue. The acquisition is expected to be more than 10 per cent earnings accretive in the first year. It will provide SLH with a stronger position in the Victorian port logistics market and access to the bulk logistics market. Growth potential exists. The transaction is expected to be completed on September 30, 2023. Our 12-month share price target is $3.45.

I forget to mention the strong free cash flows in my ‘Good Metrics’ straw. You can’t overlook +10% free cash flow! :)

Source: Simply Wall Street

Thanks for your valuation @Karmast. I’ve had Silk Logistics on my watchlist for a while. I took a nibble IRL yesterday. I like the metrics for the business and at the current share price I expect total returns to be c. 14% per year (based on Simply Wall Street data)

- Past ROE 26%

- Forecast ROE 23% (next 3 years) with 50% of earnings reinvested

- Forecast EPS growth 12%

- Gross Margins 41%

- Net Profit Margin 4%

- PE 8.7

- PB 2.3

- PEG 0.6

- Debt to Equity 39%, but holds more cash ($34 million) than it has debt ($27.7 million)

- Forecast FY23 Dividend 5.4% fully franked

Nice metrics if the business can sustain them. CEO & MD Brendan Boyd owns 13.6% and Executive Director John Anthony Sood owns 13.7%.

Strong insider buying over the last 3 months.

Analyst consensus target price of $3.48 (2 analysts, Simply Wall Street). I wouldn’t be that optimistic!

I think it’s a reasonable buy for the quality of the business with potential for a good balance of growth and dividends and a total return of 14% per year at the current price.

Disc: Took a nibble (0.2%)

- Silk Logistics Holdings Limited (SLH) is a Australian-owned logistics business providing an integrated 'port-to-door' service to some of the world's brands. Price/Operating Cash is 3.83

- Consistent Financial Health

- Record Low PE in the last 3 years

- New 3Pt Upturn

- Growth/PE > 1.5

- Consistent Incr Equity

- Health Stable or Increasing in Stock Dr

High Board Ownership