Somnomed (ASX:SOM) develops and manufactures medical devices for the treatment of Obstructive Sleep Apnea (OSA). Unlike Resmed and others that use CPAP (Continuous Positive Airway Pressure), Somnomed have a mouthguard like device that is based on COAT (Continuous Open Airway Therapy). The advantage being that it is more comfortable, makes no noise and requires no power. It's also much cheaper.

So instead of sleeping with this on your head:

You have this:

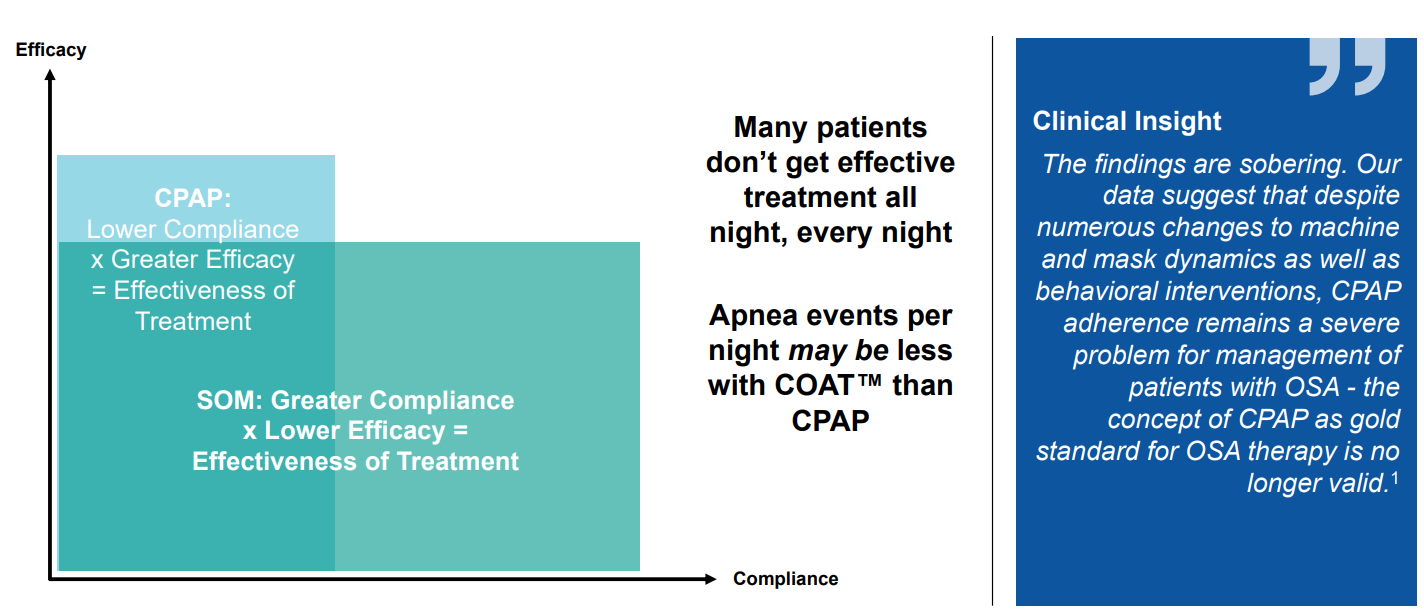

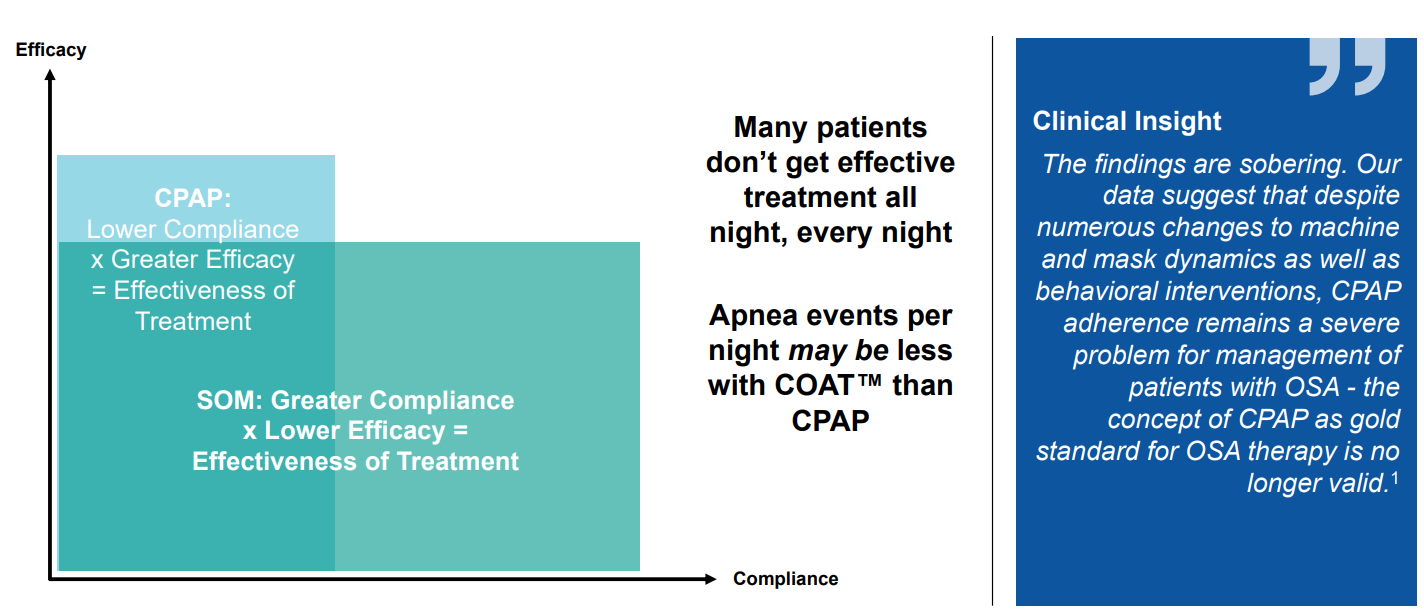

Each appliance is custom made and the treatment has been proven to be very effective. It's not quite as good as CPAP therapy, but given 50% of people using CPAP quit within a year due to the discomfort, it's arguably more effective overall.

Somnomed operates in 28 countries and has helped over 650,000 patients. The majority of sales come from North America and Europe (32% and 61%, respectively), with APAC making up the remainder.

OSA is a huge problem globally, with an estimated 900+ million sufferers. Untreated, it can lead to increased risk of stroke, heart attack, depression and diabetes. (if your partner values a good night's sleep, it'll also likely undermine your relationship...)

At present, only 8-10% of OSA treatments use COAT-based solutions. As such, the growth potential is meaningful -- the question is whether it can be effectively exploited by Somnomed...

The real challenge is to overcome the default recommendations of CPAP therapies by sleep physicians and better establish the COAT treatment as a viable alternative with recognised advantages. Interestingly, COVID has impacted the availability of CPAP machines in places like North America (I assume because manufacturing was diverted to ventilators?), and this could provide an opportunity to help promote Somnomed's solutions.

It's worth noting that Somnnomed is a relatively small company, with a current market capitalisation of ~$180m (at time of writing). It's also very thinly traded -- over the last year the average daily value traded is less than $100k. It's not uncommon to see less than $10k traded in a day and the buy/sell spread can be significant.

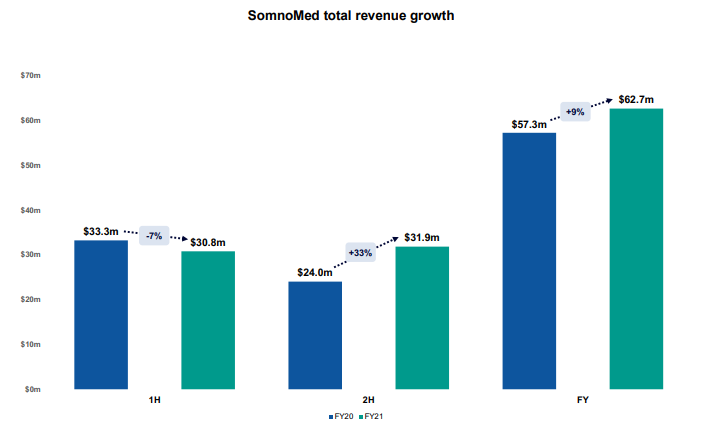

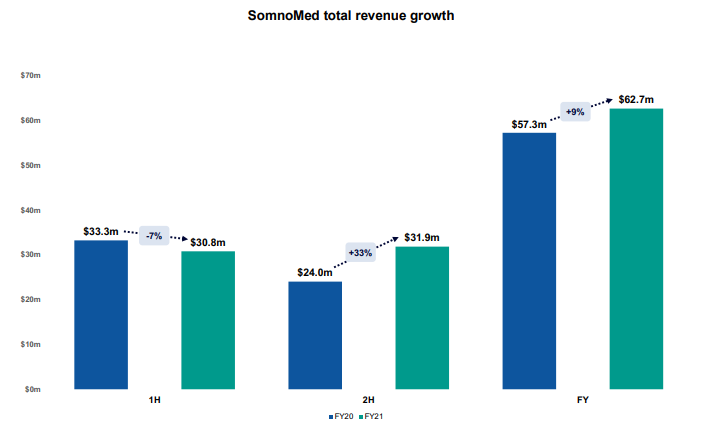

The company listed all the way back in 2004, and since then has grown revenues from (essentially) zero to $62m in FY21. That being said, revenues took a bit of a hit over the last few years and although reporting a modest net profit between 2010-2016 has been mostly a loss making operation. It is therefore no surprise that they have been a prolific issuer of shares. In fact, the share count has grown by ~28% over the past 5 years alone.

Nevertheless, in the recent full year we've seen some evidence of a return to sales momentum:

In the most recent quarter, revenue was up 16% in constant currency terms.

The risk here is that this is going to forever remain a "gunna" company. Always on the cusp of delivering attractive and growing cash flows, but never quite getting there. The company continues to invest heavily into R&D, and although that will dampen profitability it is necessary for long term success. So that's cool, but it'd be great if the company can stop relying on capital raisings. On a free cash flow basis, they look like they are right at that inflection point.

Somnomed has $17m in cash with approximately $2.3m in long term debt.

Overall, the company appears to be well placed in a large market with a unique and compelling product set -- one that may finally be seeing increased adoption.

The CEO is Neil Verdal-Austin who has been at the company for 13 years; 10 years as the CFO and the last 3 as CEO. He has 1.7m shares.

The biggest shareholder on the board is TDM Growth partners, a private investment firm that took a substantial stake in the business in 2012 and has a couple directors on the board. it owns 26% of Somnomed.

The company is presently trading on 3x sales, and has guided for 15% revenue growth in FY22, with an EBITDA at breakeven as the business invests further in growth.

These are all early thoughts. I'll continue to investigate and would welcome any insights from others.

disc: not held