Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I tagged along to the SOM AGM today. There’s no virtual option and I wanted to see the new CEO(s) in action.

I went a couple of years ago and there were not many in attendance which I always like, and I wanted to go last year but couldn’t make it so there I was.

They upgraded FY25 Revenue guidance by 5% from $100m to $105m and EBITDA (excl leases) by 40% from $5m to $7m before the open. The share price dutifully rose 46% in response!

SOM has been on a rollercoaster this year from lows at $0.21 at which they raised, then up to $0.45 before hitting $0.27 the day before the AGM and back up to $0.40 on the upgrade today.

It’s a real mixed bag this year. They’ve had significant capacity constraints meaning they couldn’t supply customers who promptly switched to competitor devices (more on this later).

So with Revenue and reputation taking a self inflicted hit, cash reserves getting dangerously low and high interest debt climbing, the CEO was exited.

2 NED’s parachuted into Co-CEO roles and promptly did a massive Cap raise for 100% of issued equity at a 45% discount! The CFO then moved on and the supply issues were addressed so revenue could grow again.

This salvage job has now been largely completed and further improvements to capacity and exec ranks are under way. New CFO Was announced at the AGM alongside the upgrade. This was good timing for the board to face shareholders as this relatively good news seemed to soften up the mildly hostile shareholders in the room.

As soon as the first questions were taken on resolution 1, the floodgates were opened and all sorts of questions, concerns and comments were raised.

The Chair is a seasoned campaigner and handled them all well.

Strategy has shifted away from pursuing the potentially company making / breaking “Rest Assure” product at all costs to rebuilding the foundations of the core business.

This did not seem like good news to most shareholders as the potential upside has been capped for now so the potential downside can be limited.

The board seems to think it makes sense to mend the leaks before hoisting another sail but that does not seem to align to the risk appetite of most shareholders who asked almost exclusively about this new “Rest Assure” product which is going back to the FDA next year with hopes of beta testing in FY26 and launch in FY27. Lots of questions about the share price too and most must have been well under water (SP was down 90% over 7 years with share count up more than 3x in that time).

The big takeaway for me is that the oral device for OSA they have is the best and possibly accounts for 25-30% of the fragmented markets they service. BUT, the turnaround time from fitting to delivery is often a bigger swing factor for ‘customers’ who will quickly switch to a faster solution if SOM cannot deliver their Somnodent product fast enough. This turnaround time has been improved by 30% but there are limits as they have one ‘milling’ factory in the Philippines that cannot compete with faster deliveries from inferior competitors based closer to the ‘customers’ in the US, Europe and APAC.

These ’customers’ are dentists and their patients are given what the dentist recommends. The dentist wants to get paid fast as they are typically running a small business on the smell of an oily cash flow.

So it seems that SOM do not have a sustainable competitive advantage and should be valued accordingly.

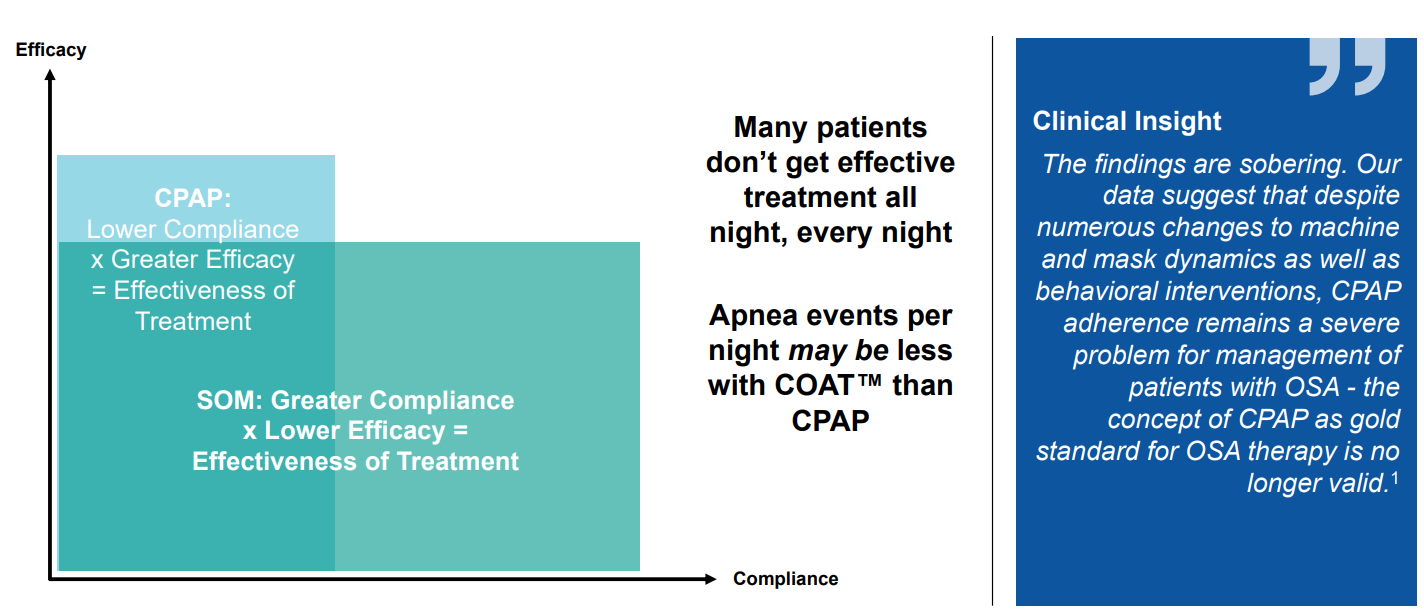

“Rest Assure” has the capacity to bring oral devises in line with the industry standard CPAP peddled by Resmed and others (CPAP is ~90% of the OSA market) in terms of measuring patient compliance and efficacy – critical in an industry focused on reimbursement.

So “Rest Assure” does have a chance to shake up the industry – eventually but it’s unclear what sort of market response it will generate from ‘customers’ and sleep physicians (expect very positive), and what competitive response it will elicit from bigger competitors (who sell CPAP and will be watching closely).

If / when this “Rest Assure” finally gets approved there should be a lot of noise and SOM may get taken out (if cheap), or their competitors may get taken by Resmed, Phillips, Fisher & Paykel, etc and CPAP smarts put into their devices to go head to hear with SOM.

Resmed also have oral devices (SnoreRx) so presumably could pivot to putting their high tech smarts for monitoring compliance and efficacy into a modified version of these as Somnomed have done?

Disc: Held (Small position)

place your bets… trading better or worse than previously expected…

Market Announcement

27 March 2024

27 March 2024 Market Announcement 1/1

ASX Limited ASX Customer Service Centre 131 279 | asx.com.au

#10709173v1

SomnoMed Limited (ASX: SOM) – Trading Halt

Description

The securities of SomnoMed Limited (‘SOM’) will be placed in trading halt at the request of SOM, pending it

releasing an announcement. Unless ASX decides otherwise, the securities will remain in trading halt until the

earlier of the commencement of normal trading on Tuesday, 2 April 2024 or when the announcement is

released to the market.

Issued by

ASX Compliance

27 March 2024

Listings Compliance ASX Limited

Email: [email protected]

Dear Sir/Madam,

SomnoMed Limited ACN 003 255 221 (ASX:SOM) – Request for trading halt

SomnoMed Limited (Company) requests ASX grants an immediate trading halt of its securities pursuant to ASX

Listing Rule 17.1.

The Company provides the following information for the purposes of ASX Listing Rule 17.1:

• The trading halt is requested pending the Company making an announcement regarding a trading update and

earnings guidance.

• The Company requests the trading halt remain in place until the earlier of the Company making the

announcement referenced above, or commencement of trading on Tuesday, 2 April 2024.

• The Company expects that release of the announcement referenced above will end the trading halt.

• The Company confirms that it is not aware of any reason why the trading halt should not be granted or of any

other information necessary to inform the market about the trading halt.

Terry Flitcroft

Company Secretary

SomnoMed Limited

Looking through the trading update and quarterly for SomnoMed some positive indicators which may see results improve considerable going forward and thus see share price improve accordingly.

Firstly SomnoMed although operating in a competitive landscape has reached 860,000 pataints worldwide and are clearly meeting the needs for sufferers of Obtrusive Sleep Apnea (OSA) whom do not require CPAP.

Revenue for the half ending 31st December were 45.1m up 13% (7% constant currency). In annualising this we are approaching 100m in revenue and with a gross margin of 61-62% this revenue is SHOULD be meaningful enough to allow positive operating cashflow and in turn profitability to flow though over the next year.

What is of interest ?

- Operational Impacts in Q2 - In Q2 SomnoMed operationally were impacted by 8/23 milling machines being down for 2 weeks (which are all back up and running). Growth run rate to that point was 15% with an estimated revenue impact off 900k for the quarter. This has been resolved and do not expect to see such impacts to results moving forward.

- Growth in revenue across the globe is solid at low double digit however currency movement has provided significant assistance.

- What is of interest is the move to finally reign in costs. Neil flagged this at AGM in November 2023 and stated we will see significant costs eliminated in the second half of 2024.

Unpacking this there were some positive signs in the release of 4C for Q2 whereby product costs fell 30% to $6,345,000 comparable to Q1 and if they can hold this % will be a significant contributor to the improved financial results going forward.

To further elaborate on Neil's comments re shareholders reaping the benefits of significant cost improvements in the second half i am anticipating costs as a % of revenue to be at 95% of lower.Over the past eight quarters costs as a % of revenue has varied enormously from as low as 83% to 144%.

If costs of 95% to revenue were to be achieved, consistently operating cashflow will be positive to the tune of $1.1m -$1.2m for Q3 and Q4. The assumption regarding revenue is that SomnoMed will grow revenue at 10% above Q3 and Q4 last year.

The consistency regarding cost control is key for SomnoMed and when combined with 10% growth in revenue should see 2024-2025 Operating Cashflow exceed 5million.

Is this was to occur it the current market capitalisation of 53.8m presents value as i would expect a higher multiple to be paid for the cash being generated.

Disc- Hold in RL and SM

SOM - Quarterly-Appendix-4C-Cash-Flow-Report.pdf

Took the opportunity to top up stock today at 64c.

Although the price of the capital raise (60c) and the dilution it is representing (SOI increase from 78.6m to 100m or 27%) is not what i would be attracted to but I can understand the purpose.

SomnoMed future sits with Rest Assure.

This is not new and well understood and was instrumental to drove the valuation to just shy of 200m market capitalisation in November 2021.

As it currently sits the MC is 62.9m prior to capital raise.

It may be that concerns are well and truly baked into the share price and time will tell if this proves to be a great opportunity.

Why i topped up ?

Overall the for me the thesis is still in check although there are concerns to keep a watch on including :

- competition impacting growth and

- the Rest Assure roll out not gaining traction across the globe.

Revenue year on year has risen since 2014 ( 26m 2014 to 83m 2023) and EBITDA remains positive across the past 5yrs.

Looking forward management are targeting 12% revenue growth in 2024 which is on track as stated in the market update last week.

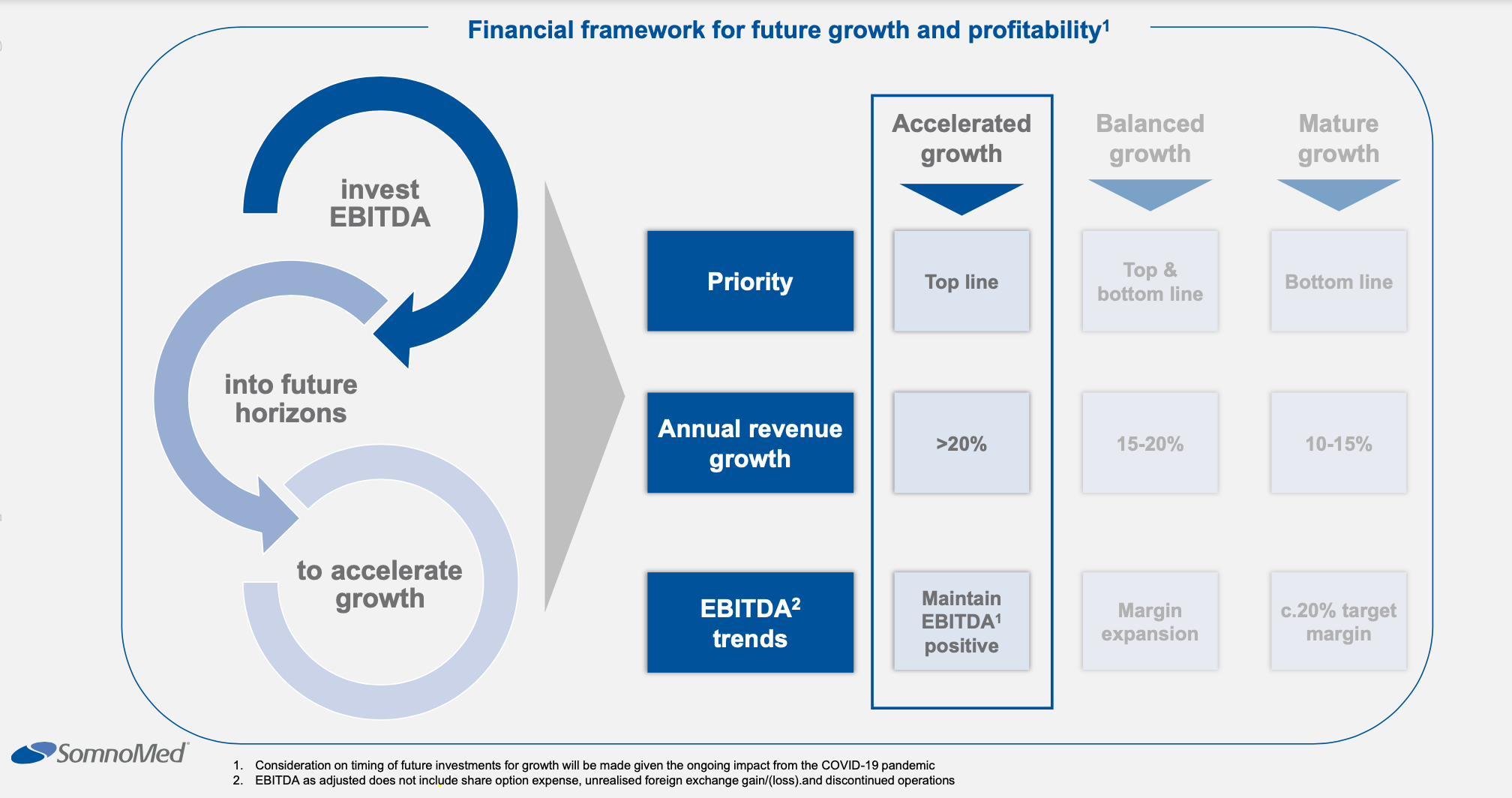

More broadly management are targeting 20% CAGR with 10% EBITDA in 2027.

If this was to occur we would see revenue reach approximately 160m and EBITDA 16m.

This may be a stretch as we currently stand but if this was to transpire or to the mid point I believe current SP and pessimism would reflect good value.

Interested to know other's views in current developments.

Disc: Hold in RL and SM

Speaking of companies that may be impacted by these new GLC-1 compounds.

Somnomed hasnt had a good run and is now seeking more money from investors. I have to duck into a meeting, but the quick take is:

Not a great time to do a raise given the current price.. (obvs)

Will involve diluting shareholders by over 31%

Results seem in line with expectations, but company said that revenue growth (which got a bit of a free FX kick) is bing impacted by increased competition, unexpected medicare reimbursement changes and a tough economy..

https://announcements.asx.com.au/asxpdf/20230831/pdf/05tbbnmwx12sl4.pdf

Somnomed FY results released this morning and has gone into trading halt this pending capital raise $15.5m @ 60c

Investor call at 430pm today

Plenty to digest ...

Look forward to working through the detail ...

Valuation $2.02

Revenue 2026 circa $150m

EBITDA $15mill

Multiple to EBITDA 15x

Discounted back 10% p.a

SOI increase 1% pa to 80.97

SomnoMed Q4 and FY results were released this week.

Looking back to see what was guided at AGM for FY23

Som AGM-Investor-Presentation.PDF

FY23 guidance • Revenue growth of at least 20% • EBITDA1 of at least $2m • CAPEX investment c.$7m

Actual FY 23 Results

- GrowthRev growth 15% .

- EBITDA 2mil plus .

- Capex 6.4m

Two out of three areas achieved with positive display of cost control.

Revenue miss for the year was driven predominantly by Q4 where growth reduced 10% (constant currency 3% ).

Why ?

Change in Nth America of the reimbursement rules (ie, non refundable) and coding structures for oral appliances.

Management have submitted new application for the FULL reimbursement coding for the Somnomed Avanti as action point to address this slowdown.

Will look to the FY results for a update for Q1 2024.

In Europe growth was reduced due to two specific markets which management explain has been addressed and expected to be improved. The markets themselves weren't mentioned and the issue itself wasn't outlined ?

In assessing if the cause of the revenue miss impacts the underlying thesis , i would say no but we we will need to closely monitor the coming quarters to see if this low growth rate is not a new trend indicating slowing growth rates to persist.

Management have historically been reliable and delivered on commitments reflective of 810,000 people using a Somnomed product.

Q4 outside this was solid with receipts $21,884,000 taking FY 23 receipts to $82,497,000.

Costs

Product Manufacturing costs were lower by 9.2% comparative to the FY 23 costs which i assume reflects good inventory position. Similarly administration and corporate costs were also well down for the quarter.

Advertising costs in Q4 were up over 20% comparative to FY 23 run rate which plays into the slowing uptake and need to gorw the pipeline of sales. Staff costs were steady fort he quarter.

Interest costs have been rising and in Q4 were $505,000 up over 10% for the quarter comparative to FY 23 .

Q4 saw Somnomed post cash flow positive result of 2.5m.

Opportunity

Rest Assume looms and is within reach for a roll out by years end with the submission to FDA occurring in the coming weeks and an answer expected to be provided in 120 days.

FY 26 Aspiration

Over 1.5 million patients treated • >20% CAGR revenue growth to c.$150m • Stable product gross margin • Target EBITDA1 margin >10% of total revenue to c.$15m Invest EBITDA1 into future horizons to accelerate growth Advance the acceptance and adoption of technology enabled oral appliance treatment solution for OSA patients Actual

Providing management a pass to address the revenue issues and recommence the journey of 20% revenue growth.

Additionally when factoring in the Rest Assure approval in North America which may come through in due in Q2 FY24 may prove to be the catalyst to propel growth to the 2026 targets.

If 20% revenue is achieved over next three years to FY2026 the aspiration $150m revenue will be within reach.

Similarly if EBITDA of 10% is achieved by 2026 this would equate to 15mill.

From a valuation stand point at 89c (28th July 2023) and MC 73m Somnomed is trading at

5x 2026 EBITDA and less 0.5 x sales.

Valuation $2.02

Revenue 2026 circa $150m

EBITDA $15mill

Multiple to EBITDA 15x

Discounted back 10% p.a

SOI increase 1% pa to 80.97

Disc: Held IRL 4% and SM 8%

SomnoMed still on track.

Good traction in North America and Europe, with revenue there up 12% and 15% respectively for the quarter (quite a bit better too when you factor in FX movements).

Cash flow from operations breakeven, compared to -$2.2m in the pcp.

The reiterated guidance represents >50% growth in EBITDA for FY23 and has been consistent since the issue of last year's results.

Rest Assure validation has now been completed and regulatory filings have begun. It's been some time in the making, but they're getting very close to commercialisation of this new product now. It's hoped this will help overcome some of the prescription and reimbursement hurdles, and gives them a real point of difference.

Shares are presently on <0.9x sales, which is rather low given the top line growth. Then again, the EV/EBITDA ratio is 37 so from a valuation perspective a lot is riding on the success of Rest Assure. So far it's all upfront cost and added expenditure, but if it sees any traction and they can get anywhere close to their stated targets (FY26 rev of $150m in revenue and 10% operating margin) there's good value here.

Disc. Held.

Agree all of that @Strawman.

I think the swing factor here is that they appear to be swinging for the fences with Rest Assure and have drained their debt facility to do it.

I was at the AGM in Nov and asked about the debt. CEO (ex-CFO) and Chair said it's front of mind and they want to get this down ASAP but it's required for the Rest Assure Dev and commercialisation (assuming timely reg approvals).

The Debt is a key source of risk in my mind and I think largely explains the share price weakness. I see it as almost a race against time to see if they can get traction before the money runs out.

Looking more and more like 3 potential outcomes to me:

a) If Rest Assure is successful and timely, sky is the limit.

b) If Rest Assure doesn't gain significant traction but they offset this with enough revenue growth in US & Europe they could muddle through and tread water / grind higher for a while.

c) If they miscalculate and run out of money, cost cutting and other growth killing measures will be required I expect.

My takeaways from the AGM remain relevant to my thesis:

1) This is a big bet on the Rest Assure product being successful in terms of 1) Dev, 2) FDA Approval, 3) Commercialisation via Insurance approvals, etc.

2) Only then will SOM be able to grow revenue, demonstrate operating leverage and reduce debt.

Disc: Held.

Shares in Somnomed are down 6% after releasing results (see here), now at a 3 year low.

You'd think the results were a disaster!

All regions saw double digit growth, with a record result in Europe. Also improved gross margin and EBITDA positive, which is trending above guidance. This is despite a big investment into sales and marketing and R&D.

Still, it's only been about 7 orders worth $17k that has driven the price action on the ASX today, but the shares just cant seem to catch a bid!

Management did say that they had a challenging end to Q2 in the US, which is facing increased competition from lower cost providers, plus a few supply chain issues. And they've secured more debt to help fund their growth initiatives (although given the share price that's a better funding option than issuing new shares). But I dare say that's why the market has reacted as it has.

They are guiding for FY revenue growth of 15-20% (last year was 16%). EBITDA is expected to remain positive at $2m, compared to $1.3m last year. That'd put shares on a P/S of roughly 1x, but an EBITDA multiple of 43x.

If you expect sales momentum to more or less continue, and some operating leverage to emerge, it seems good value. For context, management reiterated the FY26 aspirational goal of $150m in revenue and 10% operating margin. If they did that, you'd only need shares to trade on an EBITDA multiple of about 9x at that point to get a 15% average annual capital gain.

Held.

Quarterly update and cashflow statement was out earlier in the week. Overall the results fine, but there were a few things mentioned that is not ideal:

- Revenue guidance for the full year downgraded from 20%+ to 15-20%. EBITDA guidance of $2m+ is maintained.

- Rest Assure, the new digital product, is probably 3-6 months behind schedule due to CE mark testing taking longer than expected.

- A weak Q2 performance in the US blamed on supply chain, logistics and macroeconomic pressures and increased competition.

The last point and especially the word “competition” sounds ominous.

I’ve had some clarification from management on this, and feel they could have communicated the US situation a bit better.

Essentially the company had a few logistical issues converge in Nov-Dec 2022. Fedex/UPS from the Philippines (manufacturing plant) to the US blew out from 2-3 to 6-10 days, staffing issues and covid at the US distribution hub, staffing issues and covid at the Philippines plant. All these issues blew out the time for patients to receive a SomnoMed oral appliance. Dentists were desperate to fulfil orders before the end-of-year reimbursement deadline so some went with cheaper products that were in supply. Most of the logistical issues have or are in the process of being resolved. The CEO is confident that this is a temporary shift in behaviour, and that the dentists will be back now the delivery times have normalised.

Of more concern is the poor global economic environment and its impacts on consumer discretionary spending. Oral appliances are not fully reimbursed in the US, and patients need to contribute to a co-payment. Recently there have been more instances of patients pushing back on these co-payment. Much of the business in Europe is fully reimbursed and does not experience this same dynamic.

Not the best update. Hopefully it’s just a small bump in the road. This time next year it could very well be self-funded, with Rest Assure generating accelerating growth rates and the market could be looking at it very differently.

Strong growth!!! Loving that America is growing so strongly 30% excluding currency effects

25 October 2022

North America’s Q1 revenue growth leads the way

SomnoMed Limited (ASX “SOM”, or the Company), a leading company in the provision of oral appliance treatment solutions for sleep-related breathing disorders and obstructive sleep apnea (‘OSA’), is pleased to provide its quarterly activities report for the period ended 30 September 2022 (Q1 FY23).

Financial Highlights

• Q1 FY23 revenue of $18.5 million, up +19% (+21% in constant currency) versus the previous corresponding period (pcp)

• North America Q1 FY23 revenue of $7.3 million, up +44% (+33% in constant currency) versus pcp, demonstrates strong sales momentum in the region driven by best-in-class products and service

• The strong group quarterly performance versus pcp reflects the impact of the sales and marketing initiatives in all regions and the trend of growing patient and medical clinician adoption of Continuous Open Airway Therapy (“COATTM”) for the treatment of OSA

• SomnoMed’s FY23 guidance, including +20% revenue growth, remains unchanged

• Available cash of $12 million as at 30 September 2022, sufficient to fund growth opportunities and the development of Rest Assure® with a further $6 million of the new debt funding arrangement to be drawn down towards the end of Q2 FY23

Operational Highlights

• The Company hosted the second annual SOM Summit which brought together the leading Sleep Medicine practitioners from North America and globally to drive awareness and education of COATTM for the treatment of OSA

• Total patients treated worldwide now exceeds 740,000

• Development of Rest Assure®, the Company’s first ever in-built technology-enabled oral appliance, remains on schedule with the focus on the preparation of documentation required for regulatory submissions

• The Company continues to proactively deliver on a range of initiatives to secure our supply chain with the aim of limiting any negative impact of inflation pressure on margins

Commenting on the results, SomnoMed’s Managing Director, Mr Neil Verdal-Austin said: “The September quarter saw the Company deliver financial growth in line with guidance, increase the awareness of COATTM for the treatment of OSA and progress the development of our technology-enabled oral appliance, Rest Assure®.”

“Whilst the Northern Hemisphere summer represents a seasonally lower revenue quarter in Q1, total group revenue was up 19% year on year. Our strong sales results and growing level of patients treated validates our Medical InitiativeTM strategy and confirms that the exceptional ‘first time fit’ quality and durability of our product range is superior and preferred by clinicians and patients world-wide for the treatment of mild to moderate OSA.”

Financial Review

Q1 FY23 revenue of $18.5 million, up +19% (+21% in constant currency) versus pcp reflects the growing demand for our COATTM technologies, AVANTTM and Herbst Advance EliteTM, and the investment the Company has made into sales teams and business development channels in all regions.

Revenue (A$000's)

Q1 FY23

Q1 FY22

% Change

% Change

(A$000’s)

(A$000’s)

Actual

Constant Currency

North America

Europe

APAC

Total group revenue

7,345 9,679 1,529 18,553

5,105 +43.9% 9,308 +4.0% 1,167 +31.0% 15,580 +19.1%

+33.4% +12.3% +32.6% +20.8%

Cashflow from operations was negative $1.9 million after excluding one-off payments relating to annual license fees and bonuses. Cash investments in R&D were mainly related to the Rest Assure® technology of c.$1 million. The Company maintains the forecast for FY23 EBITDA1 of at least $2 million and a CAPEX investment of c.$7 million, which includes expected technology innovation spend of c.$3 million.

SomnoMed remains well funded to execute on our growth priorities with available cash of $12 million as at 30 September 2022, and a further $6 million of the new debt funding arrangement to be drawn down towards the end of Q2 FY23.

Operational Review

Business conditions continued to improve across SomnoMed’s key regions of North America, Europe and Asia Pacific as the impacts of COVID-19 on the medical sector and broader dental community continued to reduce.

SomnoMed’s position within the OSA market remains strong, with the potential to further increase the addressable market by providing an alternative to the traditional default CPAP recommendations by most sleep physicians.

SomnoMed’s “treatment focused” part of our mantra ensures our commitment to provide a best-in-class, durable oral appliance for the treatment of OSA. The Company has continued to experience positive engagement within the medical sector, which is driving further acceptance of COATTM.

During the quarter, the Company continued to proactively deliver on a range of initiatives to secure our supply chain with the aim to limit any negative impact of inflation pressure on our cost structures to protect margins and cash flow.

North America

The North America market experienced another positive quarter with revenue up +44% (+33% in constant currency) versus pcp, driven by increased investment in sales and marketing efforts in the region driving demand for the product range, especially the AVANTTM and Herbst Advance EliteTM.

The direct impact of the Medical InitiativeTM continues to validate the Company’s strategic direction. The additions made to both the business development team and account management personnel indicate the depth and strength that the Company has over its competitors in integrity, value-based sales methodologies across both the medical and dental communities.

1 EBITDA as adjusted does not include share-based payments, discontinued operations, and other expenses

Europe

Revenue for the quarter was up +4% (+12% in constant currency) versus pcp. Patient demand for the Company’s COATTM technology remains strong across core countries within Europe, driven by strong positive reimbursement trends and a growing acceptance of the benefits of oral appliances for mild and moderate OSA patients. An investment was made this quarter in sales training across the region involving a strategic methodology approach to solution selling which is informed by our customer needs.

Asia Pacific

Asia Pacific quarterly revenues were up +31% (+33% in constant currency) versus pcp. This region has returned to deliver impressive growth for the quarter while continuing with its clinical education program and the investment in new sales and marketing resources to advance the adoption of oral appliances within the medical sector.

Rest Assure®

SomnoMed introduced Rest Assure®, its first ever in-built technology-enabled oral appliance, in February 2022. Rest Assure is designed to address the lack of overnight monitoring and objective data in COATTM, which has been a major barrier to prescription and reimbursement rates to date.

This innovative technology underpins the “technology driven” part of our mantra. The second patient validation study has been completed and the results are currently being analysed by the principal investigators. The Rest Assure® project remains on schedule, with SomnoMed’s focus now on the preparation of documentation required for regulatory submissions to the FDA (USA), TGA (Australia) and for CE marking (Europe). Rest Assure® will be commercialised once these approvals are received.

SOM Summit 2022

During the quarter, SomnoMed was proud to host and partner the second annual SOM Summit, a conference that brings together the leading Sleep Medicine practitioners from North America and globally. The summit is a key pillar in the awareness and education process for delivering COATTM for the treatment of OSA, allowing SomnoMed to further develop relationships within the medical field that will build on the Medical InitiativeTM strategy and to “treat more patients more effectively”.

---ends---

This release has been approved by the Board of SomnoMed Limited.

For further information please contact

Corporate

Mr. Neil Verdal-Austin

CEO SomnoMed

+61 406 931 477 [email protected]

About SomnoMed

Investors

Mr. Craig Sainsbury

Automic Markets

+61 428 550 499 [email protected]

SomnoMed is a public company providing treatment solutions for sleep-related breathing disorders including obstructive sleep apnea, snoring and bruxism. SomnoMed was commercialised on the basis of extensive clinical research. Supporting independent clinical research, continuous innovation and instituting medical manufacturing standards has resulted in SomnoDent® becoming the state-of-the-art and clinically proven medical oral appliance therapy for more than 740,000 patients in 28 countries. For additional information, visit SomnoMed at http://www.somnomed.com.au

The final annual report for FY22 was released yesterday. I had a read through, and refreshed my understanding of the unvested options situation. Others may find this interesting.

In June 2021, a vote was passed to grant board members, the CEO and key staff members a whole heap of options.

- Vested over 5 years, with 1/3 vested over the 3rd, 4th and 5th anniversaries.

- Exercise price is $2.00

- Vesting condition is the share price will need to exceed $3.50 for a period of time

- At the time was worth around $0.15/option - so translates to $90k/year over 5 years for the CEO, and $18k/year for non-exec directors.

Bottom line: Everyone is very well incentivised to get the share price over $3.50 by mid-2026.

Details of the options grant: https://www.asx.com.au/asxpdf/20210422/pdf/44vs4btr6r2ln5.pdf

Updating my valuation (for FY22 results - quick look only so far).

A great Q4 and a good year recovering from COVID and their new marketing strategy.

However, their aspirations were not quite as high as mine. I'm underwhelmed by the 2026 target because:

- companies rarely meet aspirational targets so I wouldn't expect anything better than this

- EBITDA margin is only 10% by 2026 on $150m or revenue, I was expecting them to scale better than this. Sure they said >10%, but if they believed it they'd stick a 15 there surely

Maybe its due to lumpiness, but the Q4-22 EBITDA margin was ~19% (3.7m on 19m receipts from the 4C). And, all the costs of developing rest assure and no doubt a lot more R&D over the years will come after EBITDA, leaving little room for cash returns!

The result is a cold shower for my valuation, with the following adjustments to my model.

- removed the dilution, cash and debt facility should see them through, but still a risk (positive)

- decreased EBITDA and NPAT margins to align to aspirational target, with EBITDA margin still ramping to 20% by 2029. (significant negative vs last time)

After this I land at ~$2/share, with no profits until 2027 its definitely playing the long game - which is fine, there should be a long tailwind here - but it leaves a lot of time for things to go wrong and that equals risk. I prefer to use DCF than EBITDA multiple, for something like medical devices that require large amounts of research and capital there is a risk that profits never make it through to shareholders and the DCF makes you put a number on that.

I'm hoping (dangerous word) that their paper aspirations are conservative and that they'll be aiming higher and working more aggressively internally.

______________________

May-22 valuation below

Simple valuation from rough DCF of about A$270m based on 90m shares on issue (~10% further dilution). Naturally could go wildly either way

Summary

I think risk is to the upside here, based on successful launch of Rest Assure & Industry tailwinds. High quality Chairman, Key investors and high insider ownership.

What I like

Somnomed has been around for a while and is generating growing revenues on a proven product (albeit loss making).

Product is low cost vs CPAP, I expect this to be a tailwind in a world of spiralling health costs (govt and users must be pushing for this) and increased awareness of sleep apnoea (OSA).

Digital enabled version - "rest assure" sounds like a great idea and on track for commercialisation, this is a key part of thesis that will support growth in revenue and margin.

Backed by TDM growth partners - 25% ownership. 30% owned by Directors and KMP. Insiders buying heavily over the last year, except for CEO selling in March ("only" $80k).

Guy Russo as chairman. Fresh eyes non-medical background, street smart, experienced business man. Turned around K-Mart. Great interview on TDM growth partners podcast (I'm outing myself as a fan-boy). Backed up by long term industry/company knowledge on board and exec.

Cycling a few bad years, keeping it under the radar. Mushroom Panda's presentation was very insightful. Looking to pickup a company that has invested heavily in its product over a long time as it finally approaches profitability.

What I don't like

This industry can be really slow to adopt better products, competition from incumbents, influence from large CPAP companies. I don't know the medical industry but my perspective is its tough for small companies.

Company has been treading water in terms of share-price for a decade - decent growth offset by costs and dilution. So something needs to change (Chairman, Rest Assure, cycling some hard work and bad years and eventually reaching inflexion point). Risk they continue to make losses and dilute - but think insider ownership and TDM will support good long term capital allocation.

Modelling Assumptions

Simple DCF for what its worth. As per my note at the top I acknowledge this could go wildly either side but worth doing it to keep some perspective.

Significant revenue growth averaging 20% to 2028, backed by rest assure and tailwinds. Slightly bullish and requires good execution.

Terminal revenue of ~A$250m by 2031. Conservative as tailwind will exist for longer.

Profitable by 2025, with one more dilution event of 10% prior to that. This is probably bullish.

Eventual NPAT margins growing to around 15% by 2029.

Discount factor 10%

@Strawman provided a great summary of the result, so I won't go over the same ground.

One thing that stood out to me was the strength in the North America segment. Management have always said NA would be more difficult than Europe due to price gouging from dentists and not having relatively weaker insurance and government healthcare systems.

However NA was the standout this year, and in the conference call Neil mentioned it'll again be the faster grower in FY23. Reading between the lines it should be >25% top line since it's a smaller segment than Europe. They've really cracked something here and it was mentioned that they've been able to change the prescription behaviour of sleep physicians to direct more traffic to oral appliance over CPAP.

Europe won't be a slouch either especially with a recent favourable change to reimbursements in Germany. Bodes well that they have the two largest segments (>90% revenues) firing for next year.

[EDIT -- changing future EBITDA multiple assumption]

The market is hard to impress.

FY22 revenue was up 16% to $72.6m (up 17% in constant currency, and ahead of guidance for 15% growth). The second half, as seen below, was especially strong and represents a record result.

North America was the standout, showing 33% revenue growth for the year and 42% growth in the second half. They really seemed to have recovered from their strategic stumble and are returning to very solid growth.

EBITDA was $1.3m versus guidance for breakeven. In FY21 EBITDA was $3.9m, but they said at the time that EBITDA would be flat for FY22 due to increased investment in growth (primarily in Rest Assure). To wit, Somnomed grew sales & marketing expenses by 27%, and corporate and head office expenses (mainly R&D) by 40%.

Importantly, Gross margin steady at 70% and the investment in growth seems to be paying off. The CEO said he expected 20% revenue growth for FY23. They are also targeting EBITDA of $2m (50% growth).

Looking further ahead, Somnomed is targeting FY26 revenue of $150m -- about 20% compound growth between now and then -- with an EBITDA margin of 10%.

A lot depends on how well Rest Assure goes -- which still has some hurdles to pass before commercialisation. But following our conversation with CEO earlier this year, i think there's good reason to be optimistic here.

Shares are presently on a P/S of 1.5x or an EV/EBITDA of 76 (although that's a very variable figure given how close they are to break even). Taking the company at it's word, and assuming EBITDA of $15m in FY26, and applying a multiple of 15 (which is fairly conservative, i think), you get a target price of $2.71. That's $1.85 per share when discounted back at 10%.

Makes the current market price of $1.30 seem pretty cheap.....if they can deliver to expectations.

Still, quite a decent margin of safety.

Full results presentation here.

Disc. Held IRL & on SM

Working through Somnomed results this morning.

Very impressive.

Q4 Rev up 32% to 21.3m (even with Asia impacts due to China and Australia lockdowns)

Europe and USA rev up 37% and 42% respectively

CF positive 3.3m . Wow

FY rev 72.58m and expect to be EBITDA breakeven when results officially released next month.

Balance sheet 15.66m cash and now growing

Trading at 1.35x revenue FY 22 and what looks to be 1x FY23 revenue.

715,000 patients to date worldwide

What is most impressive is the work work with Rest Assure and its next phase ....

Love what the business is doing and how this is translating to good business performance .

Disc. Holder SM and RL

Call out to Michael . Cheers

So I've had a look through the articles attached to Somnomed's website @Strawman

Disclaimers: I'm a an anaesthetist so OSA is an important issue in my work but I'm no sleep specialist.

That said, from my perspective:

Clinically:

CPAP is absolutely the standard of care as acknowledged by everyone in the discussion.

I am seeing occasional patients who use an Oral Airway Device in place of CPAP. I will ask them why from now on out of interest.

The evidence:

I didn't complete a literature review outside of the evidence attached to the Somnomed website (If I was reviewing this as a clinician I absolutely would as it's important to see all the evidence).

Generally speaking doctors look at industry sponsored studies with scepticism and I note that some of the studies at least involve monetary donations in addition to supply of the products (although in this respect Resmed supplying CPAP machines and Somnomed supplying OADs seem to cancel eachother out).

Prospective Randomised Control Trials are the gold standard in medical research. I was surprised to find the number of CPAP vs OAD RCTs that have been done. In general they demonstrate that CPAP is more effective in reducing Apnoeas and Hypopnoeas (Ie pausing breathing altogether or reduction in ventilation to a low level). Interestingly the Australian Study in 2013 included moderate - severe OSA patients and didn't demonstrate any real difference between the two (they suggested that a balance was struck between the increased effectiveness of CPAP with the better adherence of OAD that in the end leads to pretty equivalent therapy).

The review article published 2014 is a good summary of the literature (until 2014).

If I get time I will do a lit review of the more recent literature but I've answered my original question, which was simply 'is there evidence that OADs actually improve AHI in CPAP patients (the health benefits generally are all assumed to flow from this)?

The answer, there is good quality evidence to support their effectiveness. Very reassuring. Now hold IRL.

Following on from earlier post regarding getting a somnomed device fitted i received my somnomed weekend after easter with a home visit

It was a seamless process and took approx 20min overall.

Understanding how the device works and ability to alter the length of the bands to provide the result of bringing the jaw line forward and in turn opening up the airways was important to understand.

The mould provided fits tight and firm without being invasive . Easy to maintain.

From the first night I have seen improvements both via measuring via snore lab app and personally comparing my quality of sleep before and after.

The comfort when using it is easy to get use to and you feel the way the the device works as you breath as it provides better airflow.

My snoring reduced by 90% especially in the severe and loud threshold.

Over the past week i have been able to sleep right through each and every night which varies from 6-8hrs per night and the quality of my sleep has no doubt improved with deeper sleep transpiring. (this was not the case prior)

The benefits as a result throughout the day are obvious in the sense i am more alert and attentive and higher energy levels.

Most importantly my wife is herself enjoying a good night sleep . Happy wife Happy life ....

When i wake and remove the mouth piece its fair to say you can feel the way the device works as my bite is not normal . The return to normal only takes approx 30min .

Big tick and one of the best investment i have personally made on my health and one that my wife says we should have done earlier.

The exciting aspect is no doubt the rest assure technology which will provide me data as the user on my nightly quality of sleep.

I also see this as the opportunity to obtain regular income .

Snore lab is $5.99 per month or $19.99 for the year.

Good long runway to go and can see the attraction

Thanks Michael for the pitch and providing the inspiration to reach out and do something about this .

I’ve just caught up with the interview between @Strawman and Neil (CEO).

great interview and really enjoyed it. It’s hard not to be impressed and excited about the opportunity.

I will listen to Michael’s presentation when I get the chance and apologies if the answers are therein but the one question the strawman interview left me with was efficacy.

As a doctor I hold PAR with conviction that their drug zilosul has efficacy based on clinical studies and monitoring of effects in Patients who’ve been able to access the drug through the special access scheme in Australia.

is their trial evidence to support the efficacy of oral devices in osa? Have they been show to reduce the apnoea hyponoea index when used with good adherence? What level of evidence exists to support their use? I guess hearing the emphasis on obtaining data was great to hear but made me wonder whether the basis for the devices has been established?

may be way of base here and perhaps this was all assumed prior knowledge

Gaz

Looks like a decent result for Somnomed, with a 10% lift in third quarter revenue, or a 14% lift on a year to date basis. In fact, third quarter sales were over 20% higher when you strip out a Covid related allowance from the previous corresponding period is removed.

The US, which accounts for roughly 1/3 of revenue, saw an especially pleasing result:

The company also reaffirmed guidance for full year revenue growth of at least 15% and breakeven EBITDA. The business remains well capitalised with $14.8m in cash on hand, and a net cash position of $8m.

The business was cash flow negative for the quarter, and reported -$5.5m in free cash flow, due to investment into the Rest Assure product and also the timing of insurance, legal and audit fees, as well as a $500k increase in working capital (inventory) to allow for supply chain disruptions.

Rest Assure was apparently well received when displayed at the World Sleep conference in Rome and patents were lodged in all commercial jurisdictions. Commercialisation is still a ways off, with the company needing to first lodge regulatory filings, which it expects to do in FY23.

Based on guidance, Somnomed is on roughly 2.3x forward sales.

Following Mushroompanda presentation i was keen to see how such a device could help me personally as i knew i had some form of sleep apnoea and it was getting worse (wife was keen for sure).

Unlike Rhino once making the phone call to SomnoMed in the south east of Melbourne via email a representative from SomnoMed by the name of John Harrison (Dentist) called me back the next working day .I believe John new and worked with the founder of SomnoMed . John is older and a retired Dentist and travels different areas of Melbourne doing 3-5 consults per week working as a contractor for somnomed.

Not sure if this is a issue for SomnoMed from an investment perspective in that having qualified dentists signing up clients comparative to the monies they would earn as a dentist ? The fee John charged for the home visit and follow up fitting ( which is yet to happen) is $665 with SomNoMed mouth piece costing $1285.

So far i have undertaking a sleep study which cost $521 but my medicare eligibility will return $300 .

Interesting without sleep scientist to do this you would not receive the rebate or any returned monies from your private health insurance.

Chris whom is the owner of Home Sleep came to my home and installed the unit on me at 9pm (many points of measure and thorough in his approach) and compiled the data the next morning when i when and met in Cheltenham. This process took approximately 1 hr. Data was very good and gave a good snapshot as to the problem and dangers .

Chris was extremely knowledgeable on the industry and is a strong believer that dentists are the key to enabling this need to be fulfilled.

Interesting Chris outlined it is uncommon to see patients like myself in which they are taken a more proactive approach to importance and value this solution can provide for myself and partner. He indicated he sees more extreme CPAT cases which come his way.

Chris did comment that one thing that can have an immediate improvement in the results can be simply sleeping on your side and not on your back allowing your passage way to not close as easily, something i have kicked into religiously.

Chris then referred me to John Harrison the Dentist to come and visit me again at my home and conduct the moulds necessary to get my mouth guard in order to address my sleep apnoea.

John spent 45 minutes discussing the process and what he needed to do which was take three moulds of my mouth and confirm my bite to forward onto SomnoMed to make the mouth piece. This is expected to take two weeks.

I will provide an update after being fitted with the device and its effectiveness.

It is expected with me sleeping on my side and the use of SomnoMed device and having a pillow which keeps my head supported there is 80-90% success rate .

So far a really good experience and easy to navigate and a worthwhile investment if it pays off.

SomnoMed did +10% top line growth for the 1H FY22. Mainly held back to a soft Europe result. In the European markets, a lot of the sleep apnea diagnosis happens in a hospital setting and, along with dental (for oral appliance fitting) cancellations, was heavily hit by Omicron. North America was very strong - partly to do with seasonal reimbursements and partly due to a maturing sales and business development team.

With omicron easing in Europe, the company is confident in hitting their +15% top line full year guidance which means they’ll need to do ~20% in 2H. Revenue is now back to pre-covid levels, and 2H should put them well and well ahead for a record half.

The hot new thing is the disclosure of the new Rest Assure device. It's a oral device with an enclosed set of sensors that will measure adherence (whether you're wearing it) and effectiveness (measured apnea events). This will provide a slew of sleep data for the patient and their sleep doctor to monitor how well the treatment is progressing. Essentially bringing it slightly above par to a cloud connected CPAP machine.

Management is betting that this will unlock adoption on a few fronts:

- Bring the oral appliance on par with CPAP in its ability to monitor efficacy and adherence.

- In turn this will reduce the biggest barrier that sleep doctors have in prescribing oral appliances.

- Over time use the collected data to improve reimbursements with insurance companies and therefore reducing out of pocket expenses.

Although the commercialisation of the digital device is still a year off, the company appears well positioned to start hitting its straps in the coming years.

SomnoMed reported positive operating cash flow for the 3 months to Dec 31, 2021 at $2.2m.

With 0.9m in investing cash flows, it generated $1.3m in free cash flow and has $17.5m of cash at hand.

4C is here

For the half, the company was essentially break even on an operating cash flow basis, and due to higher investment in Q1 reported -2.6m in FCF for the past 6 months.

A part of that cash was likely related to the development of the world's first "technology enabled oral appliance" which was announced today (a mouthpiece that wirelessly collects patient data for compliance and treatment effectiveness purposes -- an area the company identified as a key limitation for the uptake of oral devices). More info will be released in late February, but hopefully this will help improve adoption.

For context, the past 2 years of cash flows are as follows (negative quarters impacted by COVID)

You can clearly see the increased investment being made. Hopefully this proves worthwhile over time.

If you are interested in the sleep apnea/snoring space the following book is worth a read

Breath, the new science of a lost art, James Nestor

It was mentioned in LW article this week

https://www.livewiremarkets.com/wires/forager-s-2021-book-recommendations

The basic premise of the book is that most people breath incorrectly, the worst issue being consistent mouth breathing. The simplest method to remedy this is sleeping with some tape over the mouth. This point of view is contrary to using an oral appliance to prevent snoring.

Most of the research in the book is anecdotal, however when I read it a few months ago it was the final catalyst for me to sell my SOM shares.

The other issues I had directly with Somnomed

- With so many options available in this space and how do you compete to get market share even if your product is better.

- Lack of direct exposure to users of mouthguards and cpap, so no real insight into products

- And finally the thought of doing product dd again was nauseating, how did I end up in a company with a product I have no interest in researching!

Reminder to self, stick to stuff you enjoy

Thanks for sharing your experience @Rhin20! I’m personally interested to know how the SomnoMed product is better than the cheap alternatives if you don’t mind elaborating. :D

Agreed that the customer experience in NZ sounds poor. And agree that Align is a super impressive company, with huge reach with their vertically integrated proprietary scanner to manufacturing process. Though the market opportunity of oral device OSA treatment for a USD$50b company is trivial and may add complexity to their value proposition to dentists (The price of an acquisition of SOM would also be trivial). So unsure if it’s a move they’d ever consider. There’s a great episode about Align on the Business Breakdowns podcast.

In terms of manufacturing, the company’s flagship SomnoDent Avant product (https://somnomed.com/en/avant/) is a “fully digital” product. A 3D scan is taken of the patient’s mouth, similar to the Invisalign process. The scan is immediately sent over the interwebs to SOM’s manufacturing plants in the Philippines where an oral device is digitally milled. The milling process is similar to how the chassis of an Apple MacBook is made - a solid block has materials subtracted until the end product is shaped. The whole scan to delivery process is less than 2 weeks.

Milling is essentially reverse 3D printing. You have all the advantages of a fully digital, automated process. With the added benefit of being stronger since the process is subtractive not additive.

In Australia, SomnoMed have dentist partners that travel across the major cities doing 3D scans for potential patients. The costs are generally cheaper than normal as they’re doing greater volumes. Not sure what the situation is in NZ, but it might be worth reaching out to the local SomnoMed sales rep if you’re interested.

I’ve been a bit loathed to talk about SomnoMed, because it has one of the poorest liquidity levels that I’ve come across. But since both @Strawman and @SleepEasy have put content up with a fair bit of insight, I may as well throw in my two cents on the bull case.

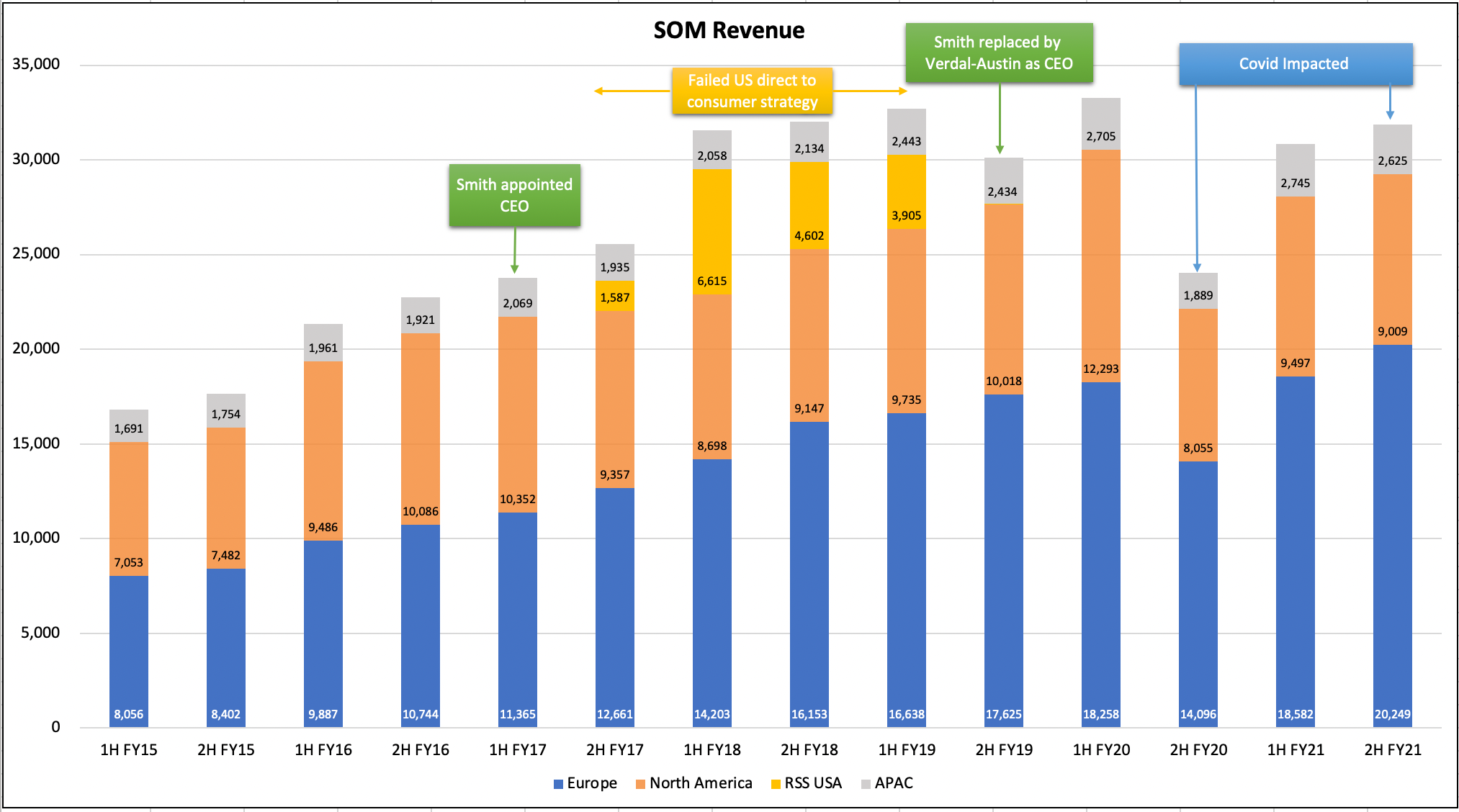

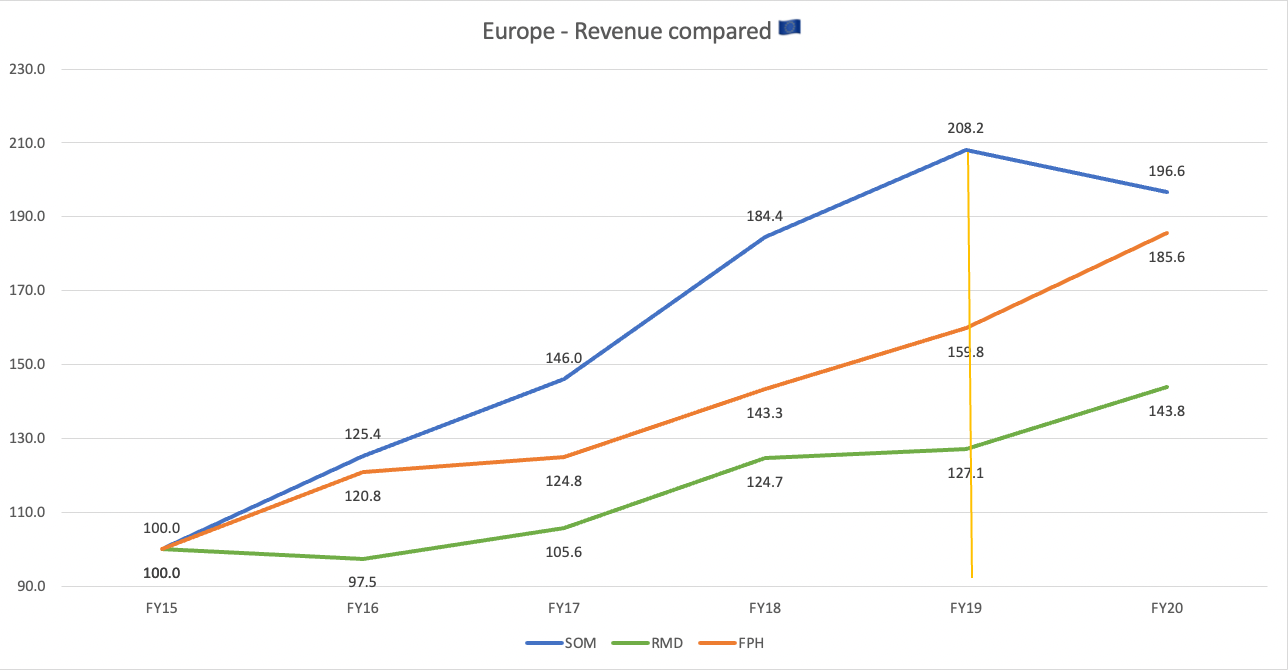

- Robust underlying growth over the past 5 years with evidence that it’s out-growing the CPAP market darlings. Obscured by a strategy misstep and negative impacts from the pandemic.

- Has recovered from earlier missteps, and with the pandemic easing, is looking to accelerate top-line growth.

- A refreshed board and management team with some big hitters.

- Undemanding valuation metrics.

- Consumer awareness for sleep apnea is nearing a tipping point.

Obscured robust underlying growth

In 2017, when there was an equal sales split between North America and Europe, the company embarked on a strategy in the US to establish its own sleep centres to target patients that rejected CPAP as a solution for sleep apnea. Part of this was to prevent US dentists from price gauging. Long story short, dentists saw this arrangement as a threat and started boycotting the product. SomnoMed admitted defeat less than 3 years later, a new CEO was appointed, and the failed strategy was rolled back in the US. A year later, the company had clawed back ground in the US, and Europe had grown to be a significantly larger percentage of sales. And then the pandemic hit - hospitals, dentists, medical practices were impacted heavily, and oral appliance sales were hit hard.

What is obscured from the turmoil is a European business that grew at a strong 17.8% CAGR for the 5 years preceding the start of the pandemic. In fact, growth was considerably faster than both RMD and FPH in Europe. Outside of the US, SomnoMed was actually gaining market share, not losing it.

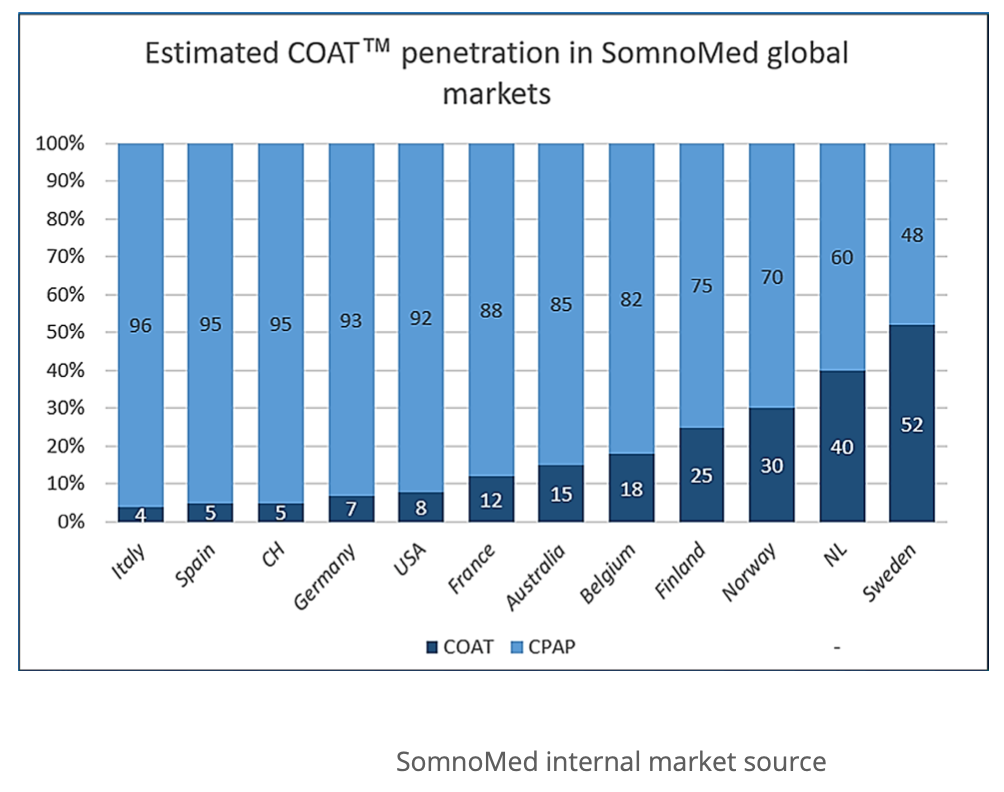

Accelerate top-line growth

The most compelling argument for oral appliances are the prescription rates for the Nordic countries. While in the US only 8% of OSA cases are prescribed an oral appliance, it's 25% in Finland, 30% in Norway, 40% in the Netherlands and 52% in Sweden. This really demonstrates the potential upside in prescription rates.

The biggest bull case for this company is if you believe the Nordic countries are leaders in the treatment for mild-moderate OSA, and that Western Europe and North America are likely to follow in the coming decade, then there will be an enormous tailwind.

With the pandemic easing, management is seeking to increase investment and accelerate revenue growth to above 20% for the coming years.

Europe has historically grown at a rate only slightly lower than 20%, and as long as there's no further strategic mishaps in the US - I see no major reason to believe that a 20%+ growth rate over the next few years is out of reach.

A significant portion of the reinvestment will go into a new “technology project” to be revealed in early 2022. If I was a betting man, I’d say it’s likely to be a device that records compliance/effectiveness and allows for sharing of the data with physicians. Which brings it at least on par with the high end CPAP machines, and addresses a major gap. It will also provide objective data that can be used to convince physicians of the overall effectiveness of oral devices over CPAP for mild to moderate OSA sufferers.

Board refresh

A big board renewal happened in August 2020, with some accomplished people entering including Guy Russo as chairman. A few new board members purchased not insignificant amounts of stock following their appointments, ranging from AUD$80k to $200k.

Guy Russo had a long history with McDonald's that culminated in the position of the Australian President and later the Greater China President. He is known for a highly successful turnaround of Kmart in Australia during his time heading up the department store from 2008 to 2016. A straight talker that is very attuned to people, culture and customers, but ultimately measures success on sustained long-term "Sales, EBIT and ROC". He purchased A$500k worth of stock on market a few weeks ago.

Undemanding valuation metrics

3x sales, 60% gross margins, EBIT breakeven, Europe has demonstrated it can grow at 17% pa and is now 64% of group revenues. Looking to accelerate top line group revenue to 20%+ for the coming years.

Consumer awareness of sleep apnea near tipping point

Consumer wearables have come a long way in the past decade. I’m a bit of a health metrics nut, and currently have an Apple Watch to track sleep. It’s amazing that I'm able to pin point alcohol consumption just by looking at overnight heart rate stats.

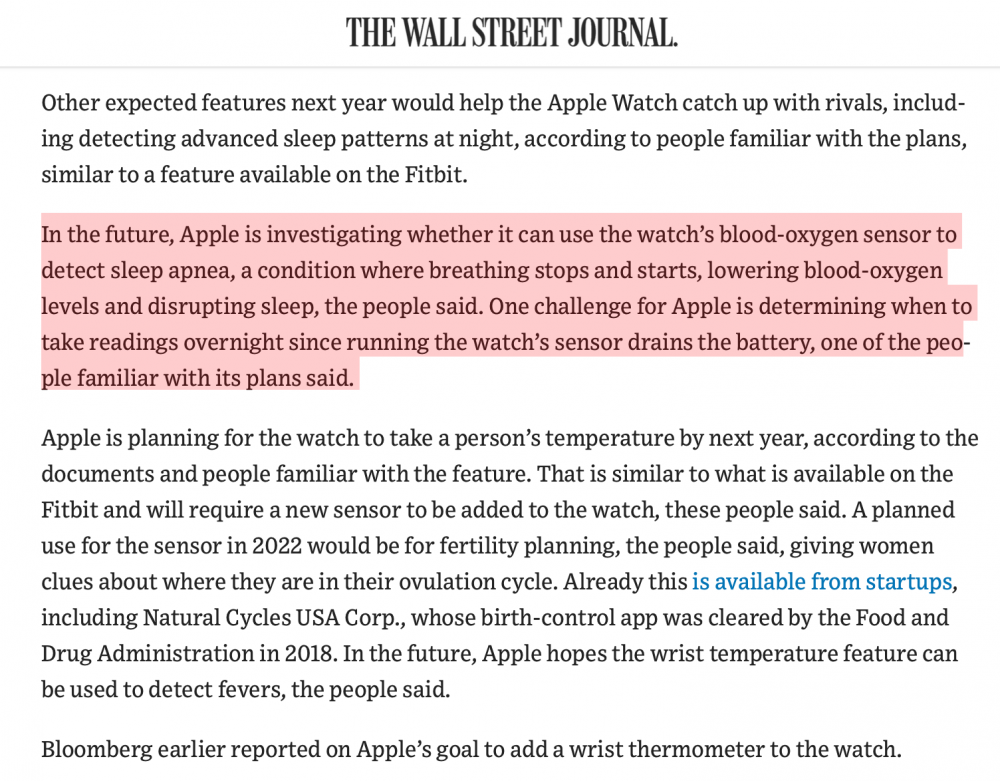

The Apple Watch introduced sleep tracking in 2020 along with an oxygen monitor sensor in that year’s model. This year they introduced the recoding of “Sleeping Respiratory Rate” data simply by training machine learning models on the watch’s accelerometer data. In my opinion, they’re not far away from surfacing sleep apnea notifications to end users - as they’ve already done with atrial fibrillation.

WSJ (paywalled) also wrote about this according to information from insider sources: https://www.wsj.com/articles/apple-plans-blood-pressure-measure-wrist-thermometer-in-watch-11630501201

Should this happen, then a lot more people will be seeking medical treatment for sleep apnea. Oral device and CPAP makers will be flooded with increasing demand

Somnomed (ASX:SOM) develops and manufactures medical devices for the treatment of Obstructive Sleep Apnea (OSA). Unlike Resmed and others that use CPAP (Continuous Positive Airway Pressure), Somnomed have a mouthguard like device that is based on COAT (Continuous Open Airway Therapy). The advantage being that it is more comfortable, makes no noise and requires no power. It's also much cheaper.

So instead of sleeping with this on your head:

You have this:

Each appliance is custom made and the treatment has been proven to be very effective. It's not quite as good as CPAP therapy, but given 50% of people using CPAP quit within a year due to the discomfort, it's arguably more effective overall.

Somnomed operates in 28 countries and has helped over 650,000 patients. The majority of sales come from North America and Europe (32% and 61%, respectively), with APAC making up the remainder.

OSA is a huge problem globally, with an estimated 900+ million sufferers. Untreated, it can lead to increased risk of stroke, heart attack, depression and diabetes. (if your partner values a good night's sleep, it'll also likely undermine your relationship...)

At present, only 8-10% of OSA treatments use COAT-based solutions. As such, the growth potential is meaningful -- the question is whether it can be effectively exploited by Somnomed...

The real challenge is to overcome the default recommendations of CPAP therapies by sleep physicians and better establish the COAT treatment as a viable alternative with recognised advantages. Interestingly, COVID has impacted the availability of CPAP machines in places like North America (I assume because manufacturing was diverted to ventilators?), and this could provide an opportunity to help promote Somnomed's solutions.

It's worth noting that Somnnomed is a relatively small company, with a current market capitalisation of ~$180m (at time of writing). It's also very thinly traded -- over the last year the average daily value traded is less than $100k. It's not uncommon to see less than $10k traded in a day and the buy/sell spread can be significant.

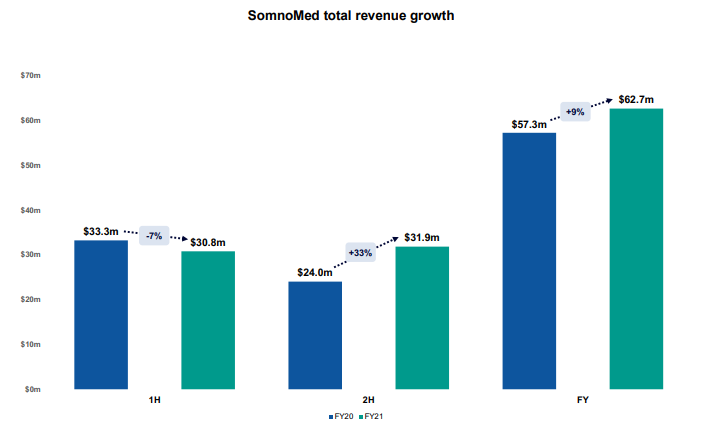

The company listed all the way back in 2004, and since then has grown revenues from (essentially) zero to $62m in FY21. That being said, revenues took a bit of a hit over the last few years and although reporting a modest net profit between 2010-2016 has been mostly a loss making operation. It is therefore no surprise that they have been a prolific issuer of shares. In fact, the share count has grown by ~28% over the past 5 years alone.

Nevertheless, in the recent full year we've seen some evidence of a return to sales momentum:

In the most recent quarter, revenue was up 16% in constant currency terms.

The risk here is that this is going to forever remain a "gunna" company. Always on the cusp of delivering attractive and growing cash flows, but never quite getting there. The company continues to invest heavily into R&D, and although that will dampen profitability it is necessary for long term success. So that's cool, but it'd be great if the company can stop relying on capital raisings. On a free cash flow basis, they look like they are right at that inflection point.

Somnomed has $17m in cash with approximately $2.3m in long term debt.

Overall, the company appears to be well placed in a large market with a unique and compelling product set -- one that may finally be seeing increased adoption.

The CEO is Neil Verdal-Austin who has been at the company for 13 years; 10 years as the CFO and the last 3 as CEO. He has 1.7m shares.

The biggest shareholder on the board is TDM Growth partners, a private investment firm that took a substantial stake in the business in 2012 and has a couple directors on the board. it owns 26% of Somnomed.

The company is presently trading on 3x sales, and has guided for 15% revenue growth in FY22, with an EBITDA at breakeven as the business invests further in growth.

These are all early thoughts. I'll continue to investigate and would welcome any insights from others.

disc: not held