I’ve been a bit loathed to talk about SomnoMed, because it has one of the poorest liquidity levels that I’ve come across. But since both @Strawman and @SleepEasy have put content up with a fair bit of insight, I may as well throw in my two cents on the bull case.

- Robust underlying growth over the past 5 years with evidence that it’s out-growing the CPAP market darlings. Obscured by a strategy misstep and negative impacts from the pandemic.

- Has recovered from earlier missteps, and with the pandemic easing, is looking to accelerate top-line growth.

- A refreshed board and management team with some big hitters.

- Undemanding valuation metrics.

- Consumer awareness for sleep apnea is nearing a tipping point.

Obscured robust underlying growth

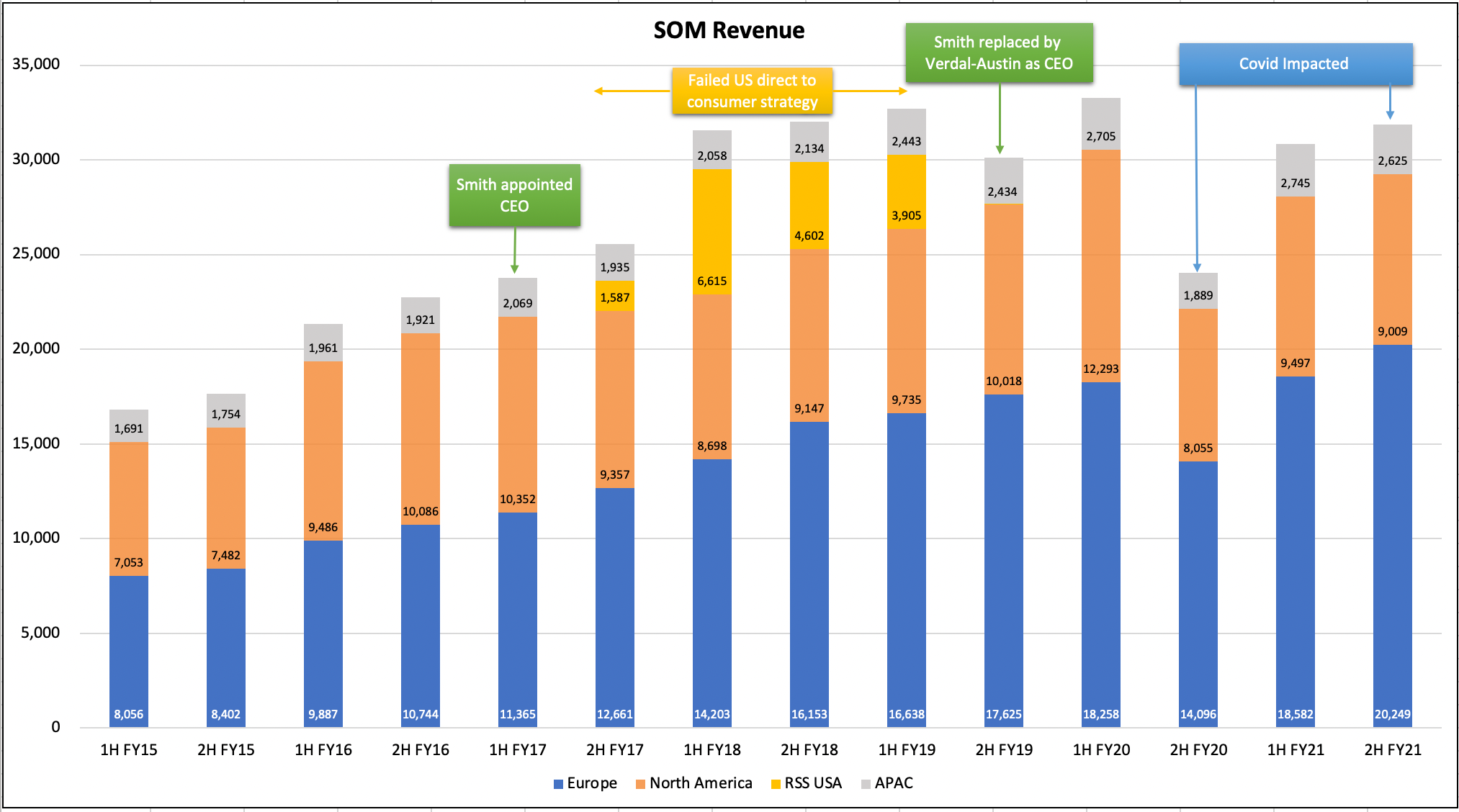

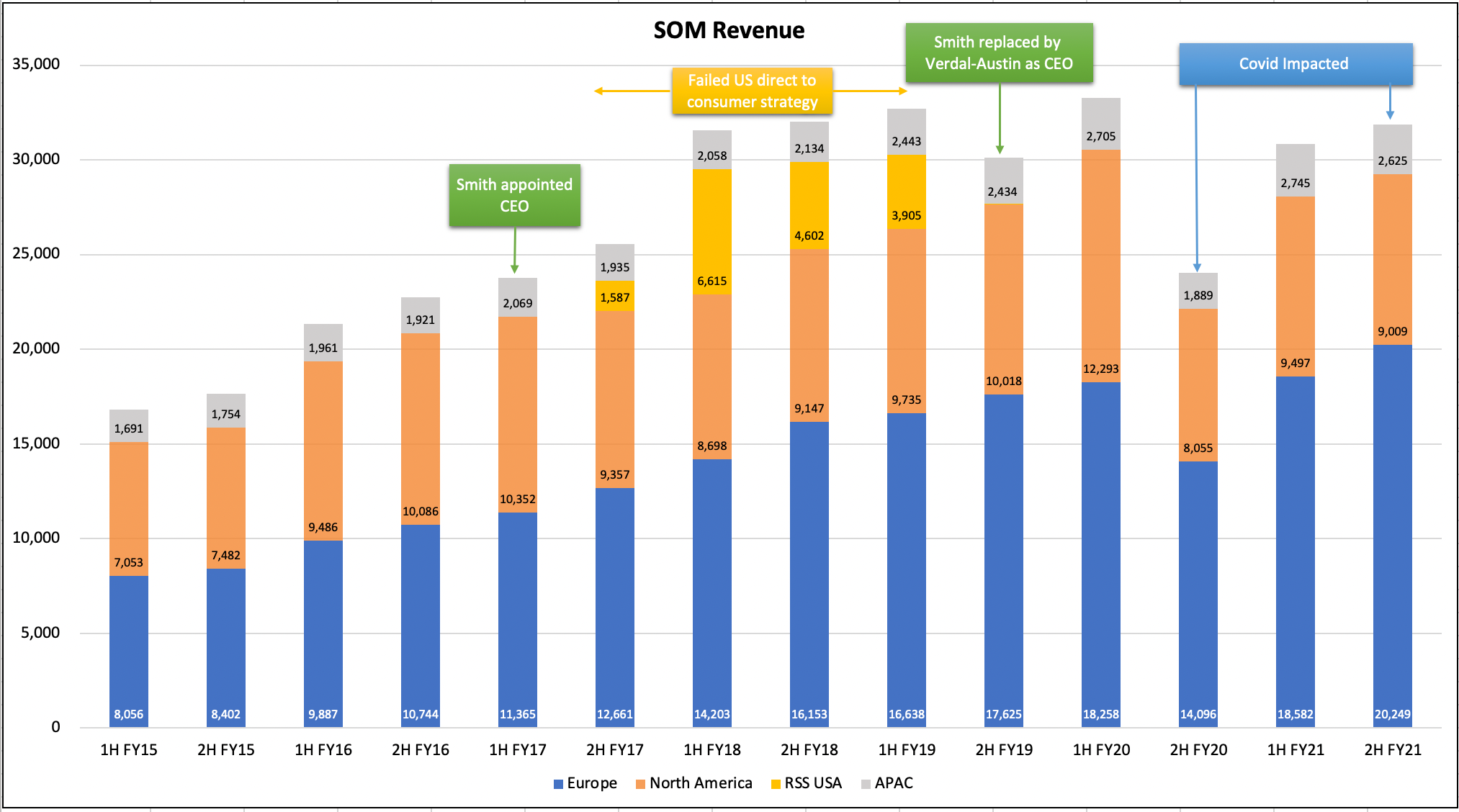

In 2017, when there was an equal sales split between North America and Europe, the company embarked on a strategy in the US to establish its own sleep centres to target patients that rejected CPAP as a solution for sleep apnea. Part of this was to prevent US dentists from price gauging. Long story short, dentists saw this arrangement as a threat and started boycotting the product. SomnoMed admitted defeat less than 3 years later, a new CEO was appointed, and the failed strategy was rolled back in the US. A year later, the company had clawed back ground in the US, and Europe had grown to be a significantly larger percentage of sales. And then the pandemic hit - hospitals, dentists, medical practices were impacted heavily, and oral appliance sales were hit hard.

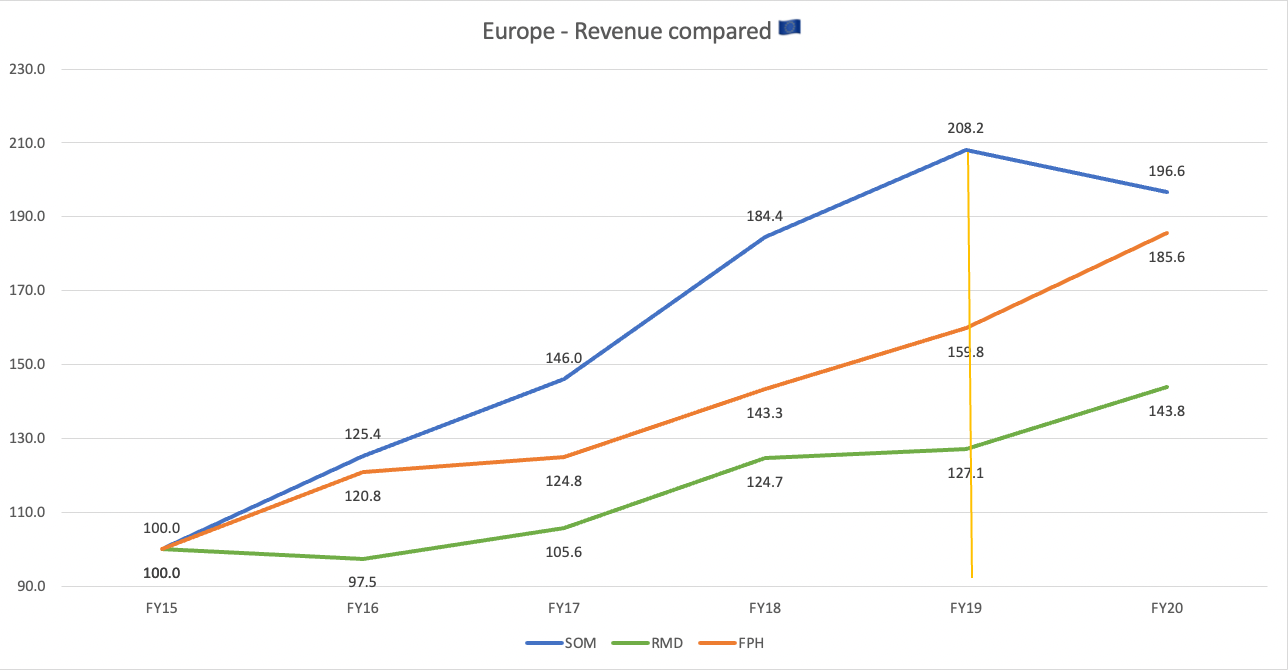

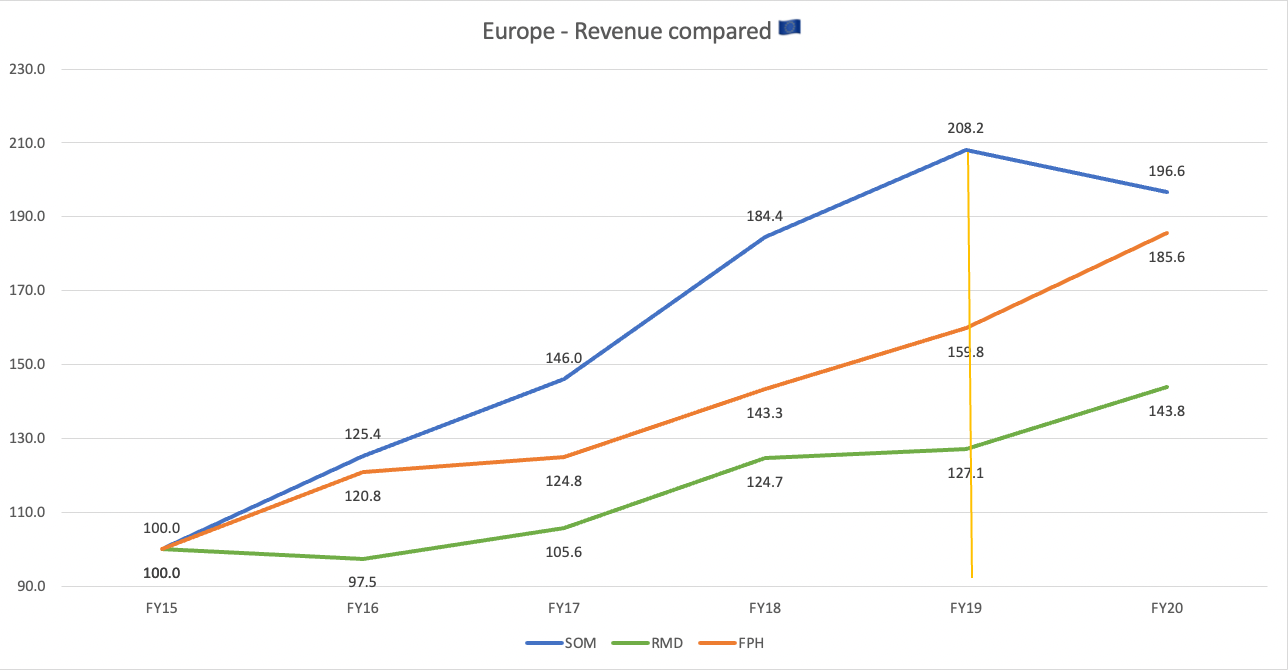

What is obscured from the turmoil is a European business that grew at a strong 17.8% CAGR for the 5 years preceding the start of the pandemic. In fact, growth was considerably faster than both RMD and FPH in Europe. Outside of the US, SomnoMed was actually gaining market share, not losing it.

Accelerate top-line growth

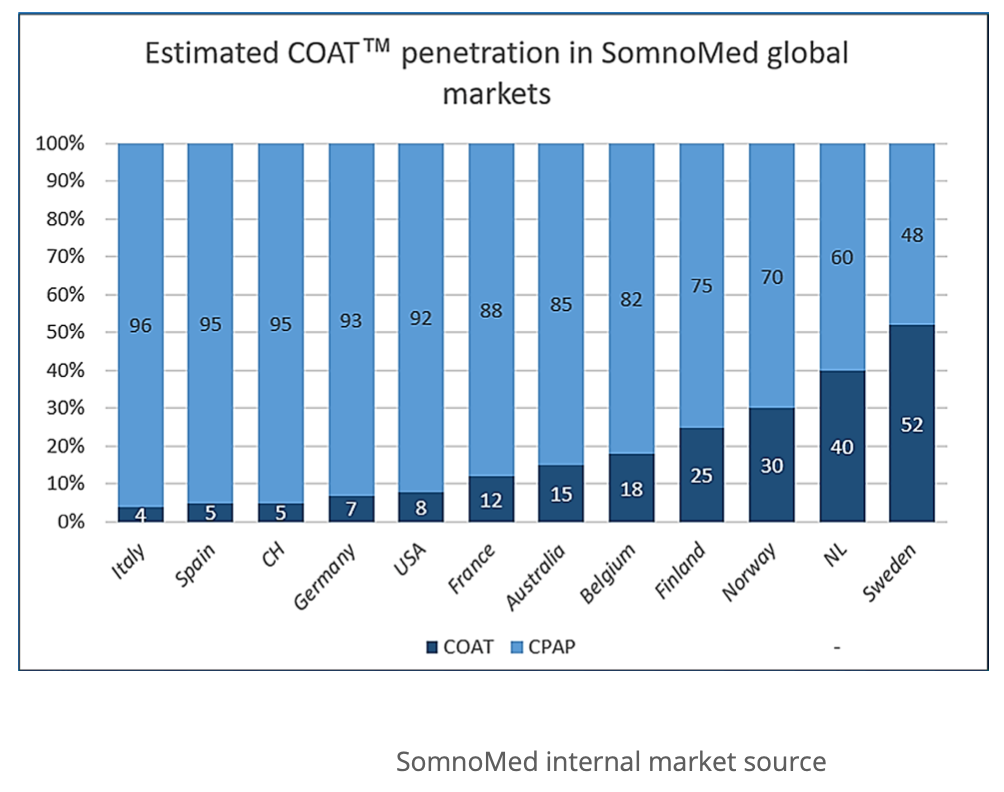

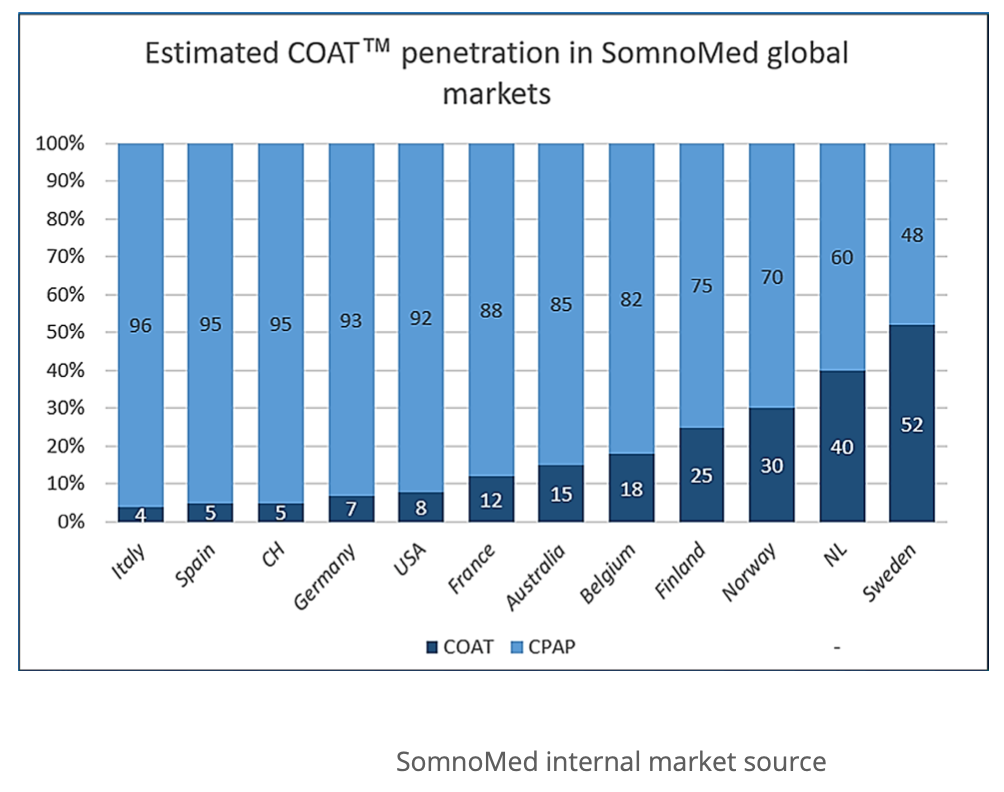

The most compelling argument for oral appliances are the prescription rates for the Nordic countries. While in the US only 8% of OSA cases are prescribed an oral appliance, it's 25% in Finland, 30% in Norway, 40% in the Netherlands and 52% in Sweden. This really demonstrates the potential upside in prescription rates.

The biggest bull case for this company is if you believe the Nordic countries are leaders in the treatment for mild-moderate OSA, and that Western Europe and North America are likely to follow in the coming decade, then there will be an enormous tailwind.

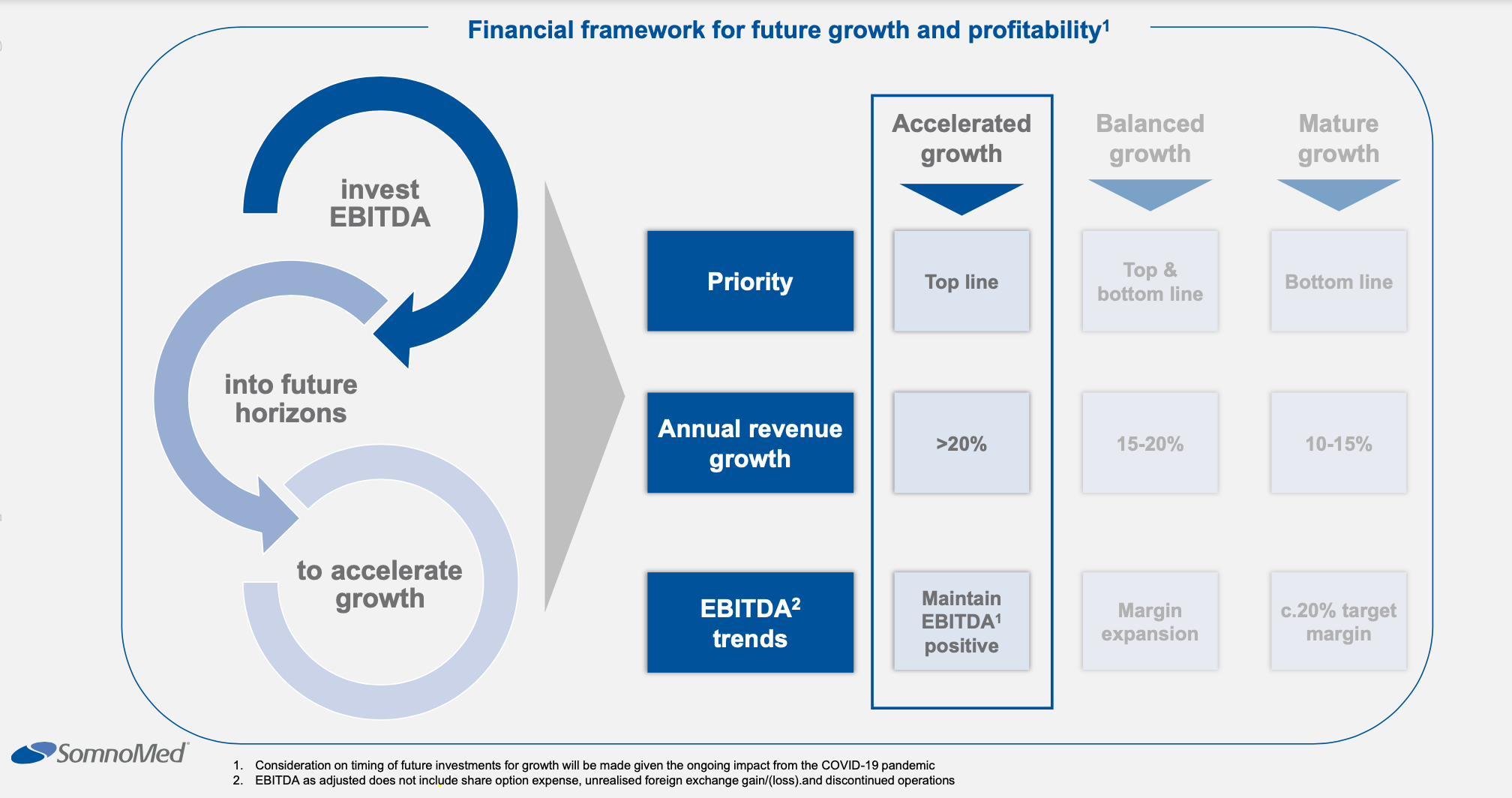

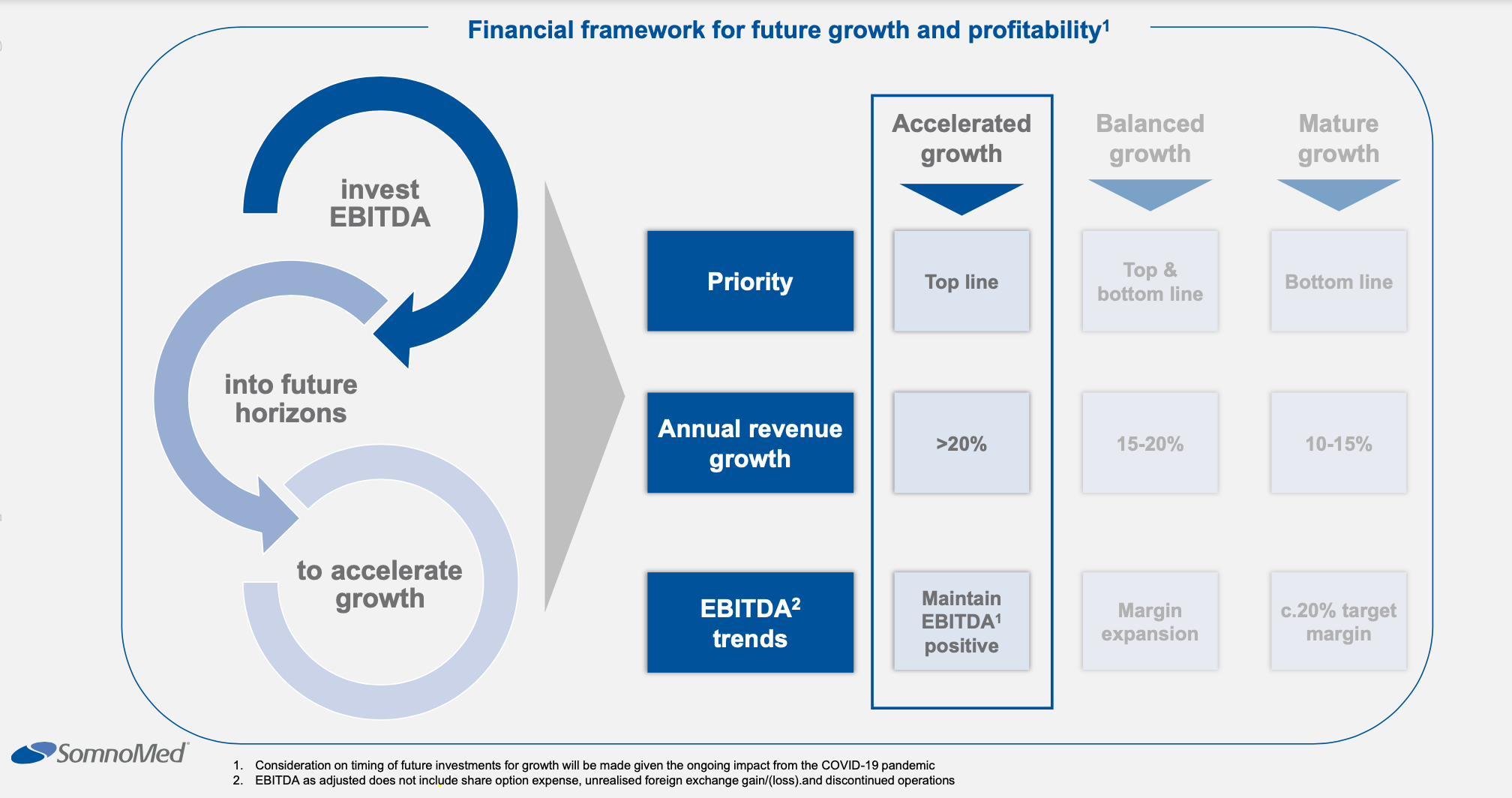

With the pandemic easing, management is seeking to increase investment and accelerate revenue growth to above 20% for the coming years.

Europe has historically grown at a rate only slightly lower than 20%, and as long as there's no further strategic mishaps in the US - I see no major reason to believe that a 20%+ growth rate over the next few years is out of reach.

A significant portion of the reinvestment will go into a new “technology project” to be revealed in early 2022. If I was a betting man, I’d say it’s likely to be a device that records compliance/effectiveness and allows for sharing of the data with physicians. Which brings it at least on par with the high end CPAP machines, and addresses a major gap. It will also provide objective data that can be used to convince physicians of the overall effectiveness of oral devices over CPAP for mild to moderate OSA sufferers.

Board refresh

A big board renewal happened in August 2020, with some accomplished people entering including Guy Russo as chairman. A few new board members purchased not insignificant amounts of stock following their appointments, ranging from AUD$80k to $200k.

Guy Russo had a long history with McDonald's that culminated in the position of the Australian President and later the Greater China President. He is known for a highly successful turnaround of Kmart in Australia during his time heading up the department store from 2008 to 2016. A straight talker that is very attuned to people, culture and customers, but ultimately measures success on sustained long-term "Sales, EBIT and ROC". He purchased A$500k worth of stock on market a few weeks ago.

Undemanding valuation metrics

3x sales, 60% gross margins, EBIT breakeven, Europe has demonstrated it can grow at 17% pa and is now 64% of group revenues. Looking to accelerate top line group revenue to 20%+ for the coming years.

Consumer awareness of sleep apnea near tipping point

Consumer wearables have come a long way in the past decade. I’m a bit of a health metrics nut, and currently have an Apple Watch to track sleep. It’s amazing that I'm able to pin point alcohol consumption just by looking at overnight heart rate stats.

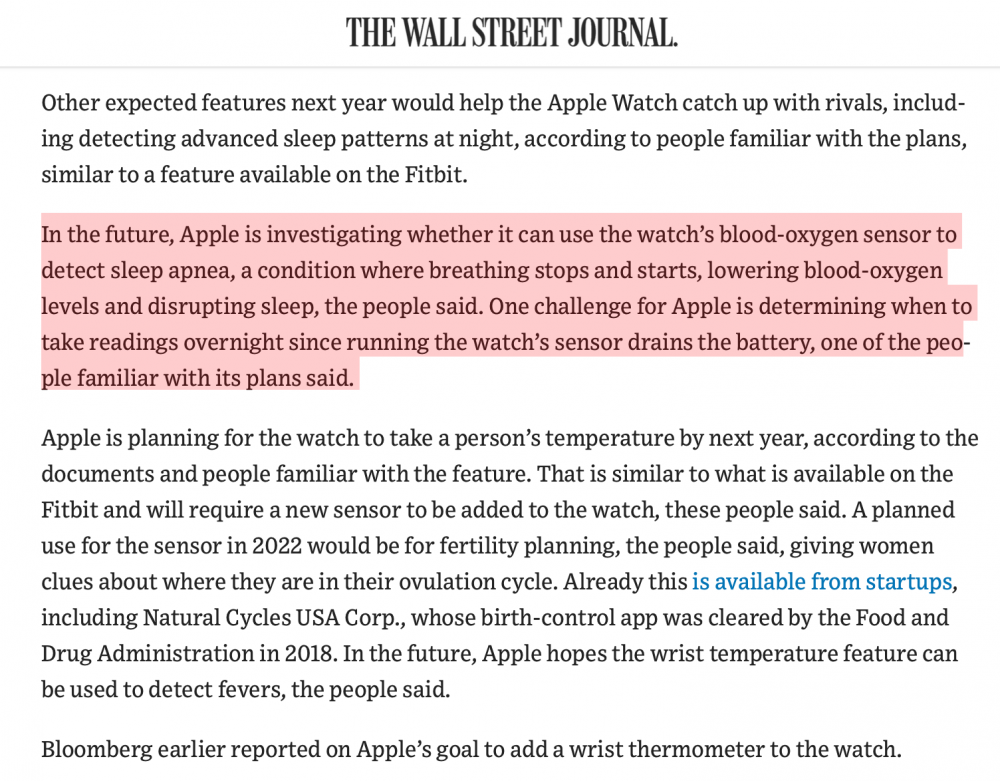

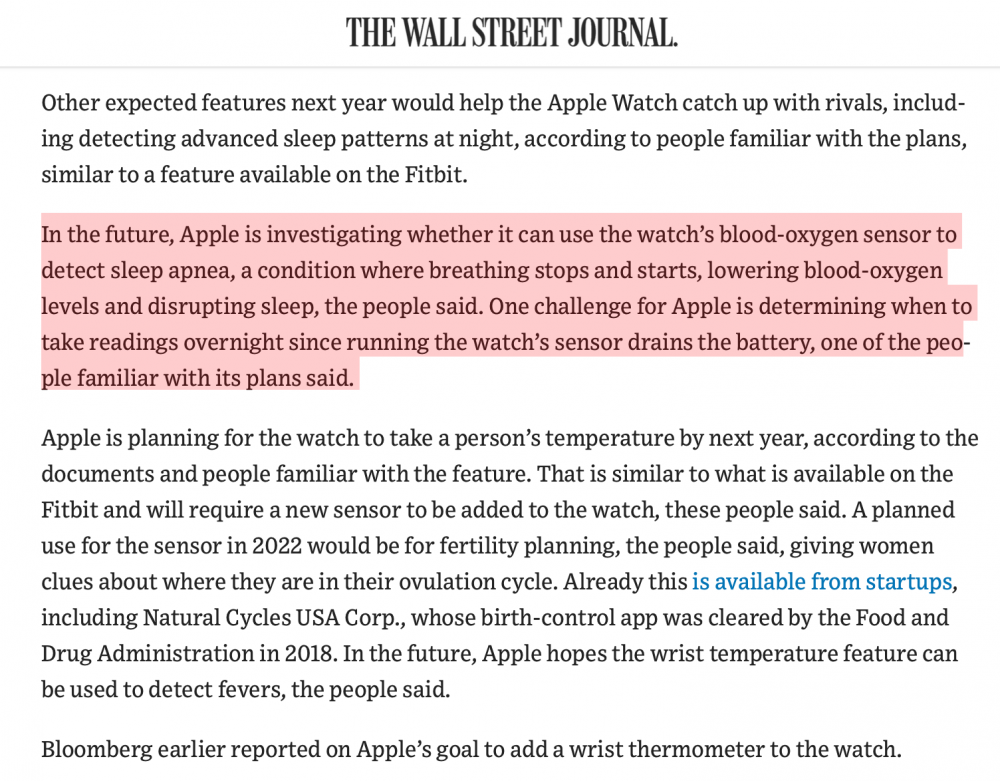

The Apple Watch introduced sleep tracking in 2020 along with an oxygen monitor sensor in that year’s model. This year they introduced the recoding of “Sleeping Respiratory Rate” data simply by training machine learning models on the watch’s accelerometer data. In my opinion, they’re not far away from surfacing sleep apnea notifications to end users - as they’ve already done with atrial fibrillation.

WSJ (paywalled) also wrote about this according to information from insider sources: https://www.wsj.com/articles/apple-plans-blood-pressure-measure-wrist-thermometer-in-watch-11630501201

Should this happen, then a lot more people will be seeking medical treatment for sleep apnea. Oral device and CPAP makers will be flooded with increasing demand