Just when the fund managers are pulling out the charts to show clients why they should be selling bank stocks due to historical poor performance (the Call), I’m going to say Westpac is close to a BUY!

Not just because I like to be contrarian, but because by investing in Westpac now there is a high probability you could double your money in 5 1/2 years (in a tax free account). If you are hoping for better returns than that you should probably avoid this boring old bank and stop reading here!

Westpac is within a whisker of trading at book value. The book value is about $20.50 and the share price is $21.50. When Westpac trades below $21.00 I think it is a BUY.

Over six years from 2014 to 2020 Westpac’s return on equity fell from 15.8% to 4.6%. Now that is absolutely terrible! This is the reason why total returns for Westpac have been dismal.

The good news is that ROE is turning around for banks. For Westpac ROE has been 9.2% and 9.3% over the last two years and it is forecast by analysts to be over 10% for the next 3 years. Out of the big four, Morgans think Westpac is most likely to improve ROE (See article by James Mickleboro from The Motley Fool):

“Morgans is a fan of the company and has an add rating and $25.80 price target on its shares. It commented:

We view WBC as having the greatest potential for return on equity improvement amongst the major banks if its business transformation initiatives prove successful. The sources of this improvement include improved loan origination and processing capability, cost reductions (including from divestments and cost-out), rapid leverage to higher rates environment, and reduced regulatory credit risk intensity of non-home loan book.

Morgans is expecting this to lead to a fully franked dividend 153 cents per share in FY 2023. Based on the current Westpac share price of $21.79, this will mean a sizeable 7% yield.”

Ignoring Morgans share price target, I will show you why it is highly probable you could double your investment in Westpac in 5 1/2 years.

Let’s assume you buy Westpac at book value and ROE can be sustained at 10% for the next 6 years. I don’t think that is too demanding.

Westpac generally pays out about 70% of its earnings as dividends and reinvests the other 30% into growth.

The 70% paid as dividends gives you a 7% return (70% x 10%). If you include the franking credits that gives you a 10% return (7% divided by 0.7).

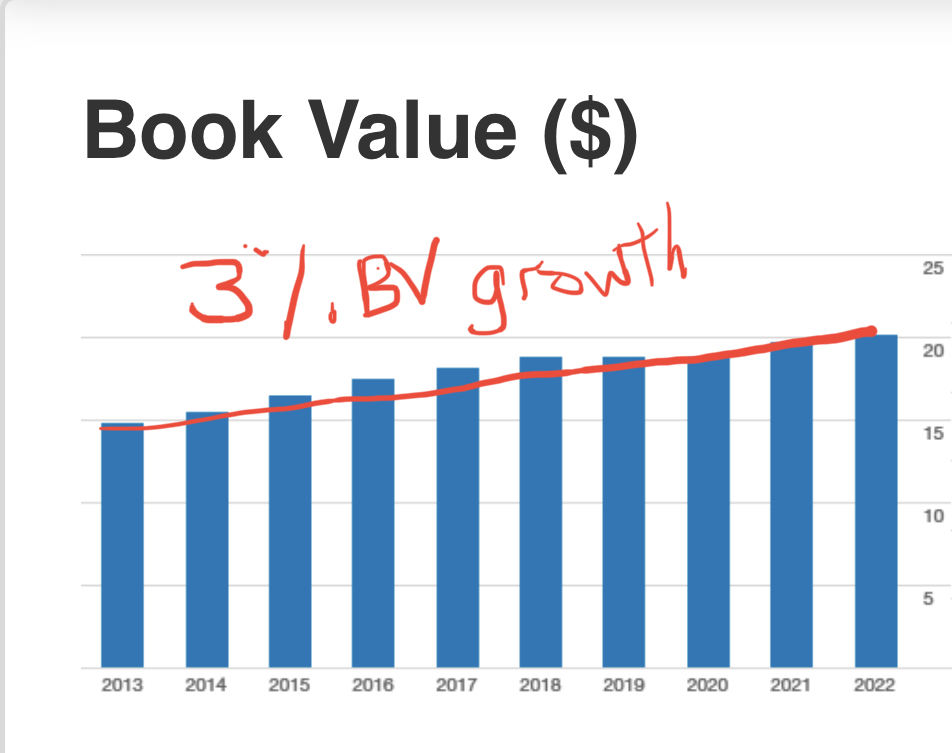

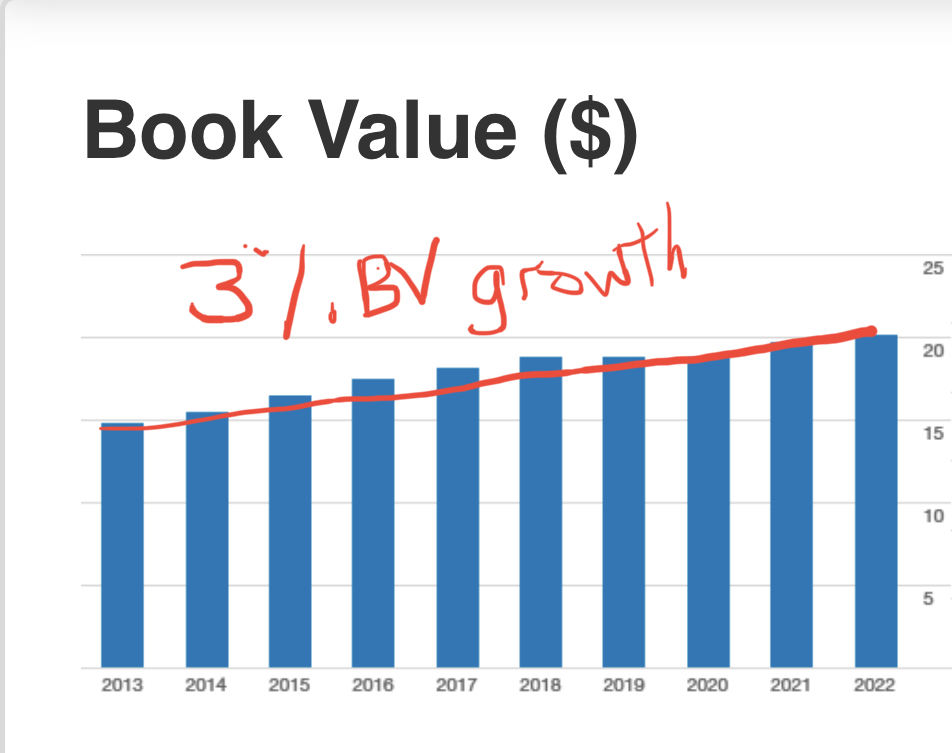

The remaining 30% of the earnings is reinvested to add 3% to the book value (10% by 30% = 3%). Let’s assume that Westpac will continue to trade at around book value for the next 6 years with share value growing at 3% per year. That doesn’t sound too demanding either and it is similar to the last 10 years (Commsec chart below).

So the total return for Westpac would be the 10% grossed up dividend (which includes the franking credits) plus the 3% added to book value each year. That gives you a total return of 13% per year. Let’s assume all grossed up dividends are reinvested back into Westpac shares tax free (a pension stream account…with less than $3million…ha ha!).

You could use a compound interest calculator to work out how long it takes to double your original investment at 13% per year, or you could simply use the Rule of 72 where you divide 72 by the rate of return (13%). Providing Westpac can continue to deliver a 10% ROE over the next 6 years you should double your investment in 5 1/2 years. The risk/reward sounds reasonable to me so I have decided to jump in a little early. With the SVB collapse jitters still in the air I think Westpac is likely to trade at or below book value this week.

As an added bonus, Westpac should pay a grossed up dividend close to 5% in June!

Disc: Taking a nibble!