Having successfully raised $200 million from institutional investors, digital audio specialist Audinate (ASX:AD8) is now offering existing retail shareholders the chance to buy new shares at the same price.

But is it a good deal, and should shareholders participate?

A ‘sound’ company

Before we explore the merits of the share purchase plan (SPP), it’s first worth reviewing the business.

Audinate provides professional digital audio networking technologies. The flagship Dante platform “distributes digital audio signals over computer networks, and is designed to bring the benefits of IT networking to the professional AV industry.”

It is the global leader in what is estimated to be a $400 million global market, but management believe they have only scratched the surface. Recently the company estimated it had a market penetration of just 8%.

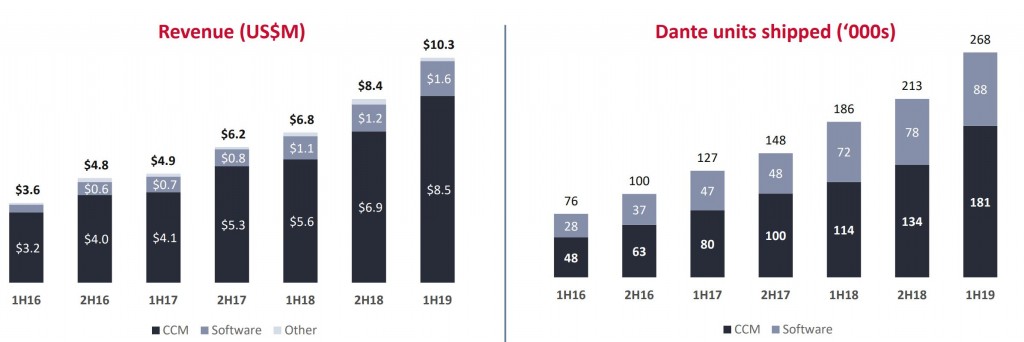

Importantly, sales have been exceedingly strong. At the most recent half, Audinate reported it shipped 44% more Dante units compared with the previous corresponding period, resulting in a 51% uplift in sales. As of the most recent quarter, the company was generating positive operating cash flow and had zero debt.

The offer

Investors who were on the register as of the 5th of June have the opportunity to purchase up to $15,000 worth of shares at $7 each. At the time the offer was first announced, that represented a 5.9% discount to the market price. However, since then shares have climbed to over $8 per share, making the deal even more compelling.

Of course, what really matters is how the SPP price compares with a sensible notion of value.

At the current market price, shares are on a price-to-sales (P/S) ratio of ~27x, based on the trailing 12-months. By that measure, Audinate doesn’t appear cheap. However, as we’ve previously outlined, traditional measures of value tend to have limited value for fast growing businesses that have the potential to scale well, especially when the market opportunity is substantial.

If we use an estimate of FY19 sales, and use the SPP price, the P/S ratio is a more savoury 21x.

With Audinate on the cusp of profitability, a newly bulk-up balance sheet and 40%-odd top-line growth, earnings growth could easily ‘back-fill’ some of these apparently lofty valuation metrics in the coming years.

Aside from value, investors must also consider their current portfolio weightings. If Audinate already represents an over-sized position, it may not be prudent to further increase the exposure.

Another consideration is that there will be some dilution for shareholders that do not participate. That being said, given the relatively small upper limit to the SPP, this won’t be significant.

The bottom line

Audinate is demonstrating significant traction and looks to have a very bright future. Although shares appear expensive, they are underpinned by exceptional growth and a rock-solid balance sheet.

It’s certainly difficult to pass up the opportunity to buy more shares at a more than 12% discount to the market price.

Ranked #12 on Starwman, Audinate is definitely a favourite within the community and has delivered some exceptional returns since it was added to the Strawman index.

Although shares are presently above the consensus valuation on Strawman, the SPP offer price still compares favourably. Click below to learn more…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223