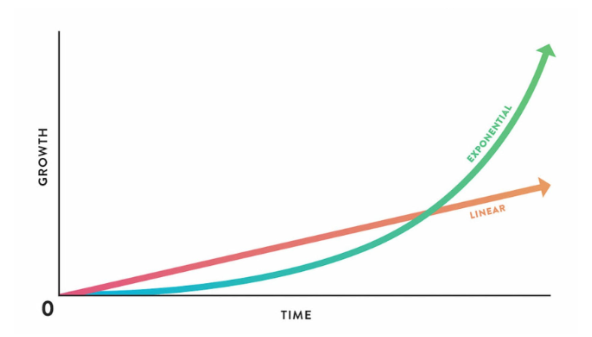

If you could fold a piece of paper just 42 times, it’d be thick enough to touch the moon. Fold it 52 times further and it’d reach across the entire observable universe.

Exponentials break your brain, and thinking in those terms doesn’t come naturally.

Still, most investors tend to get it, at least as it applies to compound returns.

But there are other exponential forces at play, and we may, potentially, be rather near the edge of both significant risk and reward as investors.

For the vast bulk of human history, a person’s technological environment was indistinguishable from that of their great grandmother or, indeed, their great grandchildren. A time traveller going from, say, 482 AD to 982 AD would be hard pressed to notice any obvious technological progress. But if you transported someone from 1923 to 2023 they could barely recognise the world around them.

Today, we take it as a given that technology will get better and better each year. Even the gadgets that were at the cutting edge only five years ago seem quaint relative to the latest generation of devices. And the pace of change is only getting faster.

That’s because knowledge and knowhow are cumulative. You can’t begin to comprehend calculus without first understanding how to count. And the more you know, the more you can figure out.

Knowledge also tends to cross-pollinate; advances in one area can lead to breakthroughs in another. For example, you may understand lift dynamics perfectly, but you still can’t build a jumbo jet without also having some knowledge of materials science, electronics, thermodynamics, and a whole lot more besides.

Like interest, or our folding piece of paper, science and technology compound. Things really got started during the scientific revolution and have been accelerating ever since. It’s just hard to grasp the nature of things when you’re at a single point on the curve.

And as you move further towards the right of the curve, the gradient really starts to pick up. The first few folds of our piece of paper increased the thickness by a few millimeters, but the last fold before the moon grew the width by almost 200,000km.

Now, I understand that every generation sees their time as special, and each new breakthrough excites our starry-eyed optimism. But it feels like we’re at, or very close to, an interesting juncture in history. One where the explosion in communications and data is about to crash into an explosion in intelligence.

I’m talking, of course, about AI.

Yes, there’s a lot of unreasonable hype surrounding artificial intelligence at present (and a lot of drama too, if you’re following the OpenAI/Sam Altman saga). But there is also genuine — and very rapid — progress.

And we need to understand that this technology is qualitatively different from what we’ve seen before. Not only is it incredibly broad in its applicability, but it can also iterate and improve on itself.

Furthermore, AI is not so much a product, as it is a platform. People are already taking general models and customising the tech in creative ways. Importantly, you can connect one model to any number of others, and task groups of agents to do things that are beyond the capacity of any one entity.

Perhaps we hit an unforeseen ceiling in the near future, and the utility of this tech caps out well below what many of the experts believe is possible.

Or maybe it won’t.

And if that’s true, because this technology is advancing exponentially, both the timing and magnitude of things is going to really surprise our linear brains.

Remember, prior to the last “fold”, you’re only halfway to your destination.

It’s hard to think of a domain that won’t be radically shaken up by this tech. Indeed, though it sounds hyperbolic, it has the potential to radically reshape society as we know it.

So what does this mean for investors? Honestly, I have no idea.

I suspect companies with proprietary data sets will be at an advantage. Providers of the underlying infrastructure — data centres and the like — also seem likely to have somewhat of a tailwind. I can also see AI as a very centralising force — that is, a very significant amount of the value created could be captured by only a handful of giant tech companies.

I do wonder how strong the ‘moats’ of traditional software providers will be in a world where an AI agent can spin up bespoke applications and ingest differently formatted datasets with relative ease.

But these are all guesses. Like many such things, it’ll probably evolve in unanticipated ways.

What’s clear is that change is coming, and probably a lot faster than you think will be possible. The best stance for investors is to maintain an open (yet rational) mind, while maintaining a good degree of agility.

Things are likely going to get wild in the coming years.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2023 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211