The major market indices may still be hovering near all-time highs, but below the surface, there are more than a few stocks doing it tough.

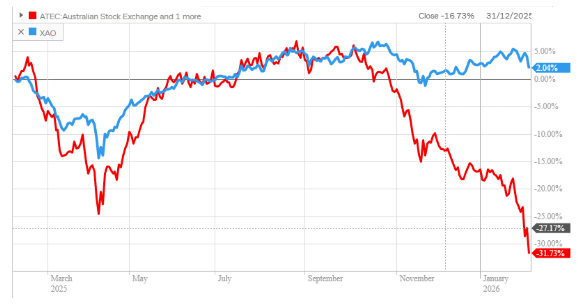

As highlighted recently, it’s mainly tech stocks that are bearing the brunt of investor pessimism, with concerns over AI-driven disruption knocking some former high-flyers down a peg or two. As a group, measured by the Betashares S&P/ASX Australian Technology ETF (ASX:ATEC), we’ve seen Aussie tech down ~36% in the last 3 months alone.

The Strawman Index has held up much better, down ~10% over the same time period. But, as always, there’s a lot of variation across the group.

My Strawman portfolio (Andrew here) is holding up okay, but my real-world portfolio is in much worse shape since October thanks to a one-two punch from two of my biggest positions. Namely, Catapult (ASX:CAT) and Bitcoin, which have been cut in half. And with double-digit percentage falls from other portfolio heavyweights Stealth Group (ASX:SGI) and AI-Media (ASX:AIM) on Friday, I am once again facing the reality of my net worth taking a serious bruising.

The thing is, at this point, I’m largely (though not entirely) numb to the pain. Having experienced falls of these magnitudes at least four or five times previously, this ain’t my first rodeo. And, importantly, as crappy as the experience is, it hasn’t stopped me from achieving some sizeable market outperformance.

Yeah, I know that sounds like a bit of “cope”, as the kids like to say. And maybe that’s partially true. But given a lot of members are likewise doing it tough right now, and with lots of uncertainty as to how this current rout plays out, it’s an experience worth sharing. One that hopefully provides a few important lessons.

The truth is, this is a rather common experience for investors. Here’s Charlie Munger reflecting on the times he suffered a 50% loss:

There are a few things that stand out.

First, “conduct your life so you can handle the 50% decline with aplomb and grace“. This isn’t just a call for calm, but a reminder that you need to structure things in such a way that when a big decline comes your way, you’re not forced to sell, and have the luxury of time for the wound to heal. No amount of emotional restraint will help you if a margin call comes your way.

But it’s the last part that really resonates with me:

“Don’t try and avoid it. It will come. In fact, I would say if it doesn’t come you’re not being aggressive enough.”

Avoiding big falls means parking your capital in “low-risk” assets. Great for when you’re expecting to need the money in the near term, but an outright disaster over the long term. The silent killer of inflation largely nullifies any nominal returns when it comes to cash and fixed interest.

Hedging strategies too are not without risk. Insurance simply isn’t free, and because markets tend to go up much more often, and to much greater degrees, the ongoing cost of hedging usually just dampens your long-term returns.

Just accept it. It’s going to happen. At least if you’re investing in a manner that has any hope of building long-term wealth. As Charlie says, if not, you’re being way too cautious.

The thing is, as every great investor knows, volatility does NOT equal risk. Intellectually, it’s obvious. Emotionally, it’s anything but.

To me, the only real test of conviction is how you feel when your portfolio craters. If you are gripped by fear and doubt, it only highlights the fact that you never really had any conviction in the first place. It’s easy enough to convince yourself of quality when prices are on the rise, but only the pain of loss can really tell you just how confident you are in your investments.

I mean, if you genuinely have a lot of confidence and conviction in your investments, and the only thing to have changed is the market price, you should welcome big falls and embrace them for the incredible opportunity they represent. If you like a company at $10 a share, and nothing has changed in regard to its long-term earning power, you should be doing cartwheels at the prospect of being able to buy it at $5.

This isn’t a call for you to average down on your losers or back up the truck on some heavily beaten-down stocks. But to honestly reflect on how the (paper) losses in your portfolio are making you feel. None of us are entirely immune from distress, of course. You’re allowed to be annoyed by the fall. But if you’re having trouble sleeping and panicking over all the red on your screen, it just says you never had much conviction to begin with.

It’s a good call to action. Not to reflexively buy or sell because the price has changed, but to take the time to revisit your reasons for holding and strengthen your investment thesis. If, in the absence of the warm embrace of rising prices, you can’t build any degree of confidence in the business’s future, it’s probably sensible to take the loss and move on. But if your outlook remains more or less unchanged, your best bet is not to do a damn thing. Or, if you can, buy more.

The main thing to remember is that big, stomach-churning drawdowns aren’t just a feature of markets in general. They are unavoidable even when you back the best-performing stocks on Earth. In fact, you can make the case that the very best-performing stocks tend to have the biggest drawdowns on their way to the moon.

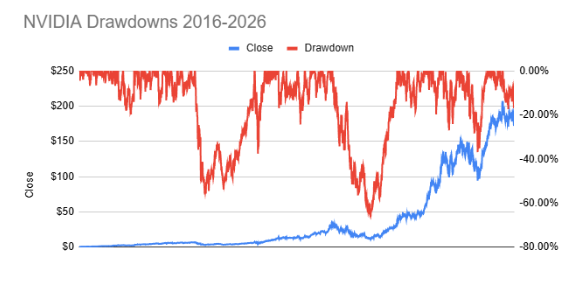

There are thousands of examples, but AI darling NVIDIA (NASDAQ:NVDA) demonstrates this better than most:

Here is a stock that, in the last decade, has gone from 66c per share to $171.81 — an average annual compound growth rate of more than 74% pa.

And yet, despite that insane track record, shareholders experienced a dozen drawdowns of greater than 20%. In fact, roughly one in every four trading days, investors were more than 20% below a previous all-time high. Sometimes for years at a stretch.

As you can see in the chart, there were two periods where investors sat on a 50% loss or greater.

I’m sure it wasn’t a great experience. But it was nothing compared to the hell suffered by those that capitulated during these periods. That’s the kind of thing that will haunt you for a long, long time.

The point isn’t to suggest that you should hold through every drawdown. There are plenty of times when the market was proven right to be pessimistic, and shares never recovered. My point is that a falling share price — even when big and protracted — doesn’t automatically prove a busted thesis. Moreover, you can forget about ever scoring a 100-bagger if you can’t endure such things. Because, as Charlie said, you can’t avoid them.

Remember, it’s at times like these that great investors prove their mettle. At some point in the future, when your portfolio is punching higher and friends and family call you “lucky”, you can smile quietly to yourself and remember the gut-wrenching red days and the mockery of the crowd, knowing you didn’t just stumble into wealth, you earned it. Every cent of those gains was the reward for doing the hard thing when others doubted.

Stay the course. The view from the top is only for those who survive the climb.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2025 Strawman Pty Ltd. All rights reserved.