The market is hot for all things tech right now, especially if artificial intelligence, or AI, is involved. Combine that with fast growing sales in a large and rapidly expanding market, and you have all the ingredients for super-sized returns.

Just ask Appen (ASX:APX) shareholders.

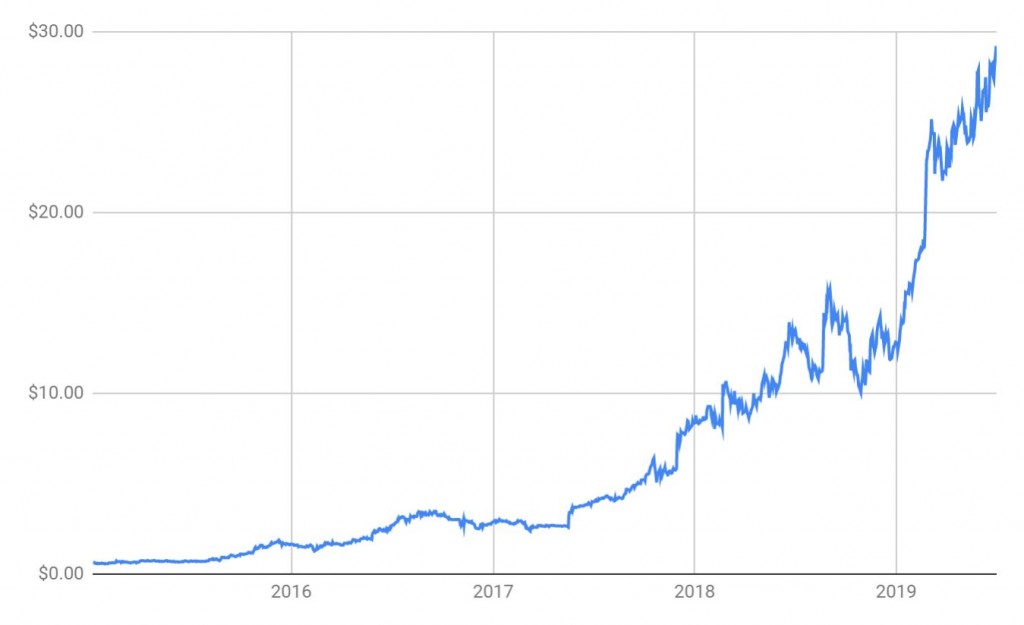

Shares have more than doubled in the last 12-months. Over the past 4-years, investors have seen their stake grow by a phenomenal 48 times! It’s the stuff of dreams.

Importantly, these gains were not driven by hype alone — Appen has achieved spectacular financial success. Since the end of 2014, sales have grown over 600% while some favourable operating leverage has seen per share earnings increase almost 20-fold. Unusually for a growth company, Appen even pays a dividend; one that has doubled in the past few years.

So what’s it all about and is it too late to buy?

What does Appen do?

Appen helps AI get smart by providing training data — mountains and mountains of data, which tech companies use to help teach their systems to recognise images, text, speech and more. That data needs to be collected, annotated and packaged in a way that is secure and useful to clients — companies like Microsoft and Facebook. Indeed, 9 out of the ten largest US tech companies are customers of Appen.

Properly trained, AI can be employed to drive cars, power voice assistants, enhance search results, and a thousand other things. Indeed, Appen is broadening its focus to expand into insurance, finance and medical applications. It’s also making headway in China, the worlds second largest AI market.

Are shares good value?

Bouyed by a recent capital raising, and the acquisition of US-based Figure Eight, the company has told the market it expects a full year operating profit (EBITDA) of between $85 – $90 million (although that was based on one AUD being worth 74 US cents — the recent slide in the Aussie dollar will likely boost this). That’s a ~23% improvement on the previous year.

At the current price, that puts shares on an EV/EBITDA ratio of ~42 (EV is enterprise value, and factors in the business’ capital structure. EV/EBITDA is a similar measure to the more familiar PE ratio). Like so many tech companies, such a multiple makes a mockery of any historical market norms but it’s not necessarily silly.

Companies like Appen are growing extremely fast into very large and fast growing markets. Often, there are “winner takes all” dynamics at play too, and these kind of companies tend to enjoy very high gross margins and relatively fixed operating costs. That means the profitability can improve radically as the business scales.

In fact, we’ve already seen that play out somewhat in recent years with earnings growth far outstripping the top-line improvement. For this reason, shares in such companies almost always seem expensive when measure by traditional valuation ratios.

Of course, as Charlie Munger reminds us, no business, no matter how wonderful, is worth an infinite amount. At a point, investors can still get burnt if they pay too high a price, even if the underlying business continues to grow strongly. And despite the underpinning of fast growing earnings, Appen’s shares have also been boosted by so-called ‘multiple expansion’ — something that does tend to revert to the mean over time.

It’s not an easy one.

Appen is ranked #5 on Strawman, with shares having more than doubled since it was added to the Strawman Index. At present, shares sit above the community’s consensus valuation.

Click below to learn more…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223