Sports analytics company Catapult (ASX:CAT) has returned to the market’s good graces this morning after delivering a solid full year result — with no nasty surprises.

Let’s go through the numbers.

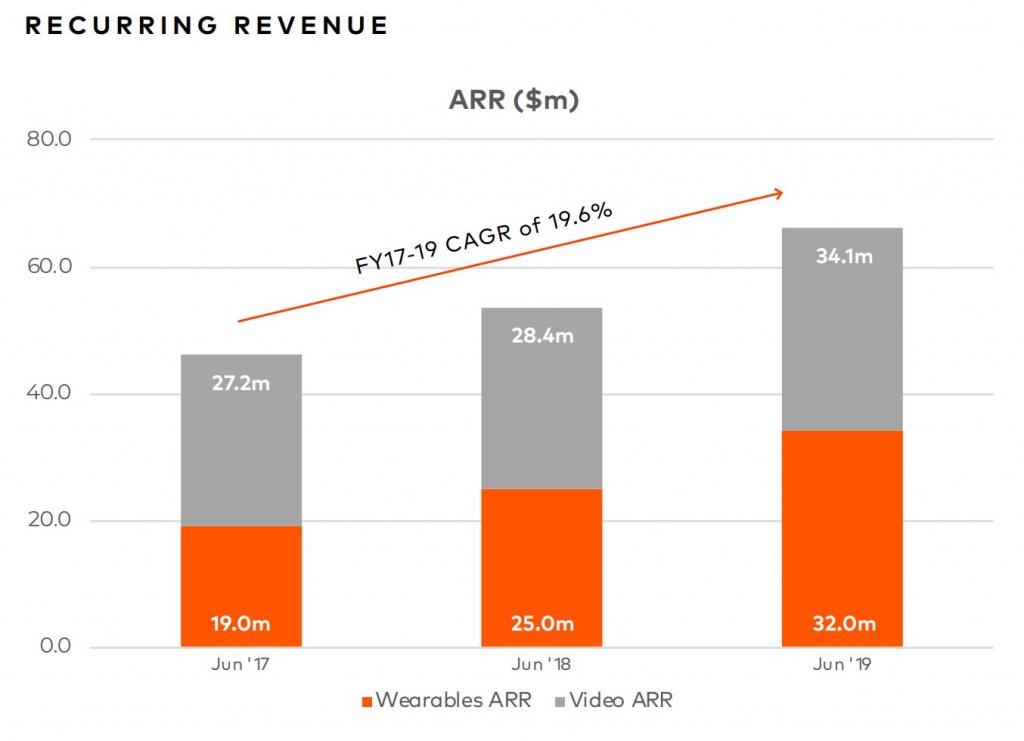

Revenue rose by 24% to $95.4 million, maintaining the solid pace of growth from last year. Further, annualised recurring revenue (ARR) saw the same percentage increase, growing to $66.1 million. Two thirds of all revenue growth came from an increase in recurring revenue.

Importantly, Catapult delivered on its promise to post a positive operating profit (EBITDA), which saw a $6 million improvement to come in at $4.1 million. Total operating costs continued to increase — an area that has frustrated many investors — although the increase here seems more modest than in the past. All told, OPEX was 9% higher driven mostly by an investment in growth and product.

Catapult is, however, still a loss making entity on a statutory basis with post-tax profit of -$12.6 million, although that is down from the $17.4 million loss in FY18. Further, operating cash flows were negative for the year with the business losing $2.2 million in cash.

All told, accounting for investment cash flows, Catapult has reduced its cash balance by approximately $20 million over FY19 but has $21.5 million of cash in hand as of last week. The company reiterated its goal of achieving positive free cash flow by FY2021 with management saying it “is focused on bringing forward positive free cash flow with executives aligned with this goal”.

After a roller coaster of a year for shareholders, who have seen shares halve then double, today’s news is a welcome relief. At the time of writing shares in Catapult were up over 13%, taking gains for 2019 to over 87%.

Shares are presently trading on a price to sales multiple of 2.7, or 3.9 times ARR. The EV/EBITDA ratio is 58 times.

Is that cheap? Well, assuming the top line can continue its momentum and costs and gross margins are well contained, there’s a very good case for value — especially when you put the business in context with other ASX growth stocks. One would also hope that the days of regular capital raisings are a thing of the past too.

But, this is a business that has erred before. And despite the tech theme, scalability and margin potential isn’t ever going to be the same as it is for a pure SaaS business. Nevertheless, the latest full year results give cause for optimism and the longer term potential remains exciting.

Ranked #33 on Strawman, shares sit slightly above the consensus valuation.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223