Workplace productivity company LiveTiles (ASX:LVT) today unveiled a raft of encouraging figures for the latest quarter, helping to push shares back towards their 52-week high.

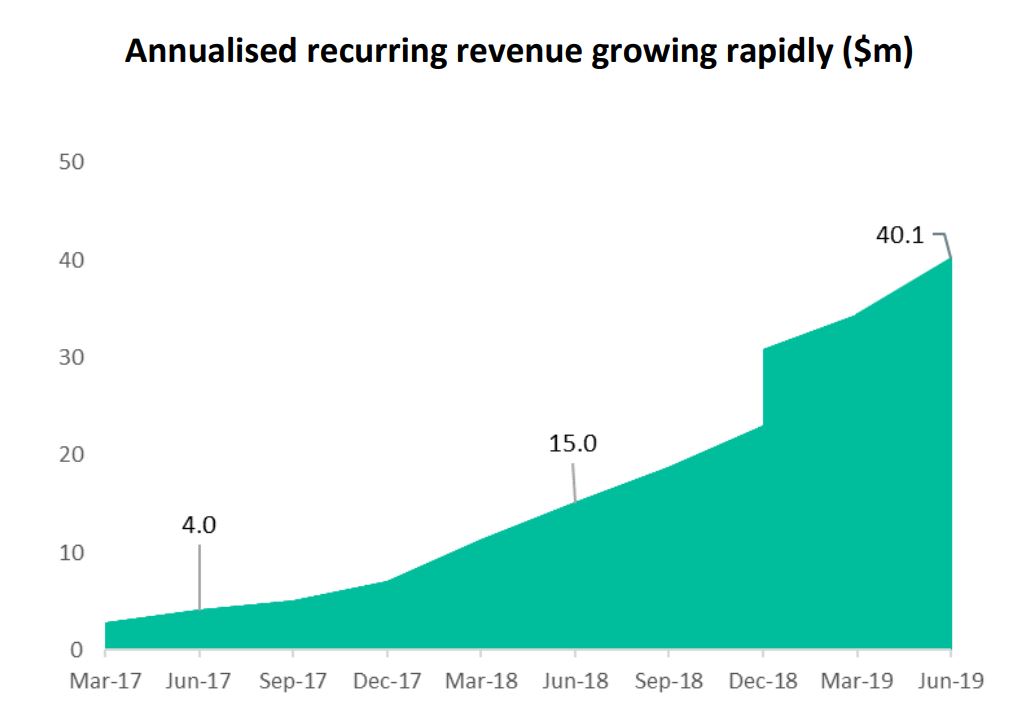

The company, which develops software that integrates a raft of 3rd party solutions, saw annualised recurring revenue (ARR) hit $40.1 million, a gain of 167% over the past year. As can be seen from the chart below, the acquisition of Wizdom during the year helped deliver a step-change to ARR, although excluding this LiveTiles said growth would have been 114%.

ARR is now over 10-times what it was only two short years ago.

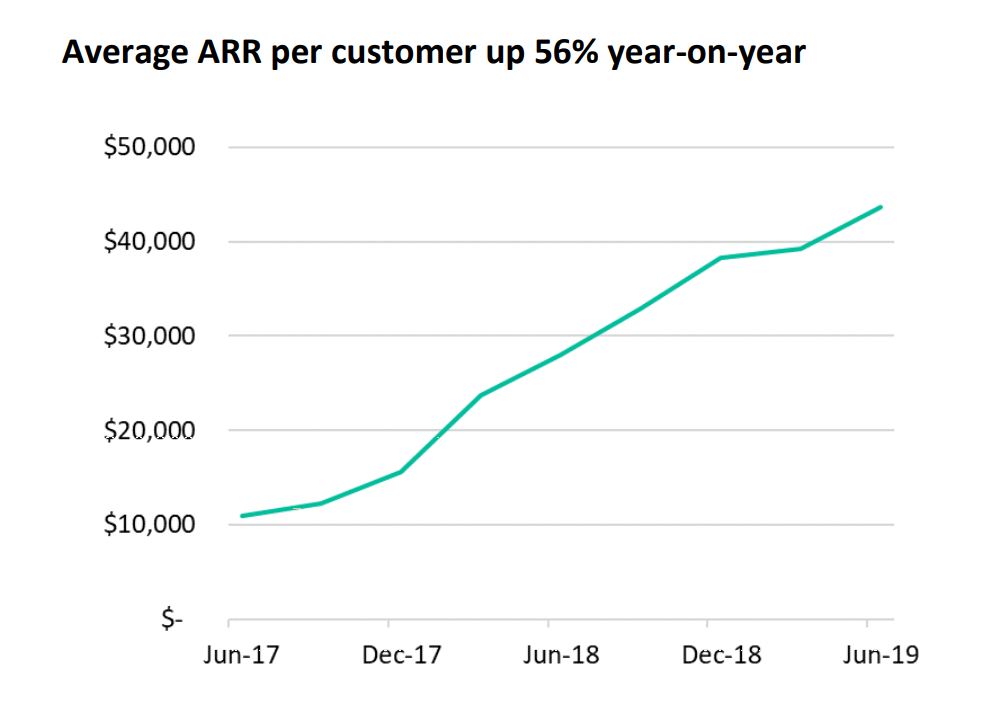

Driving this increase was a 71% increase in customer numbers, which now sit at 919. Additionally, thanks to cross-selling, bundling and other initiatives, the average revenue per customer increased by a solid 56%, continuing the trend we’ve seen over the past few years.

LiveTiles also said that the number of transaction partners (resellers that have closed at least one transaction) grew by 89% to 178.

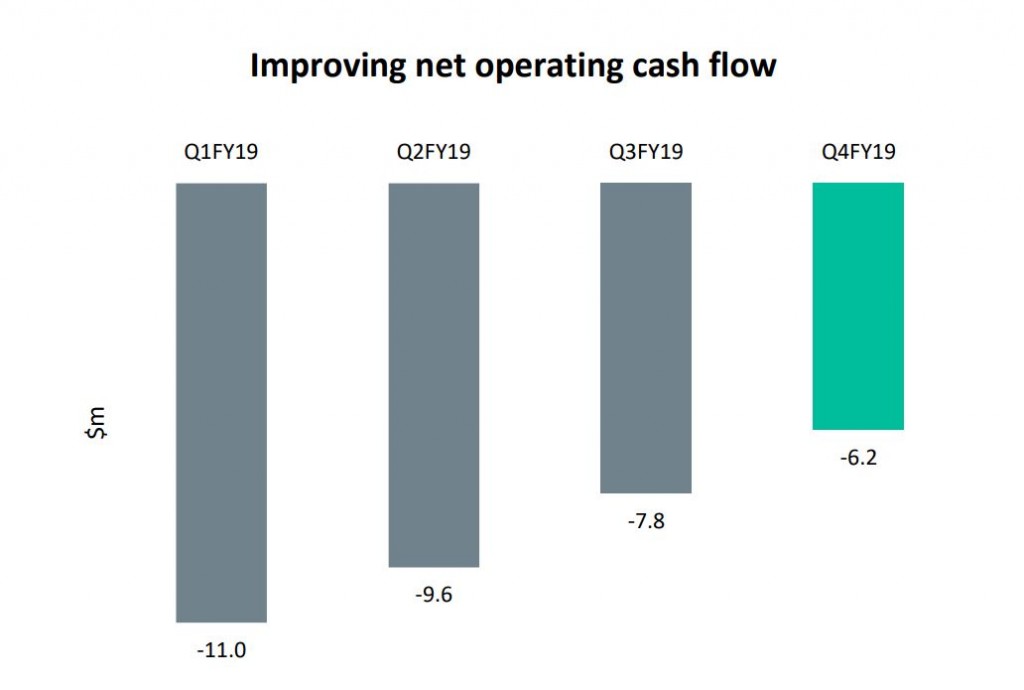

All of this has, of course, translated into a boost to cash receipts from customers. For the final quarter of FY2019, cash collected from customers grew 130% to $7.9 million. Still, LiveTiles remains a cash flow negative proposition once expenses are accounted for. Indeed, underlying expenses came in higher than originally forecast; $15.3 million for the quarter compared to the $14.5 million it guided for back in March. For the current quarter, LiveTiles said to expect expenses to come in around $15.9 million.

LIveTiles said this was due to efforts aimed at supporting growth and was supported by the boost in cash receipts. On a net basis, operating cash flows continue to trend towards the all-important breakeven point. With $14.8 million of cash on hand, the business will hopefully avoid another capital raise, or the need to rely on any debt.

Co-founder and CEO Karl Redenbach said the business was still on track to deliver “at least” $100 million in ARR within the next two years (which requires annual growth of approximately 58% from here).

Ranked #11 on Strawman, LiveTiles is a community favourite and continues to trade below the fair value estimate. Click below to learn more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223