Aerial imaging company Nearmap (ASX:NEA) has revealed its preliminary results for the 2019 financial year, and the numbers have yet again impressed.

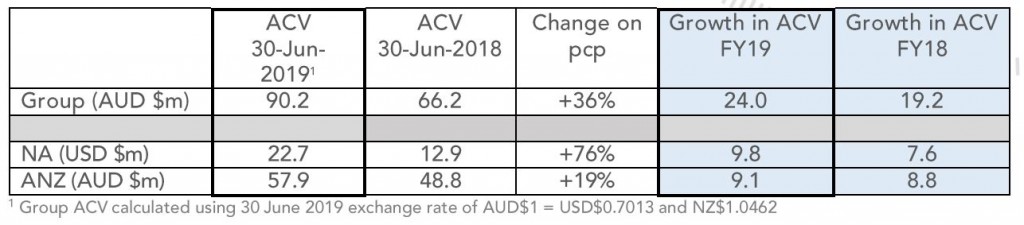

Annualised contract value (ACV) for the group grew 36% over the prior year, coming in at $90.2 million. Importantly, the incremental ACV added was 25% stronger than the amount added in FY18.

The more established Australia & New Zealand segment saw a 19% lift to ACV, while the all important North American segment managed a whopping 76% improvement. America now represents 36% of group ACV, after only three years since Nearmap commercialised there.

Importantly, Nearmap managed to deliver on guidance to pass cash-flow breakeven in FY19 (excluding the contribution from the recent capital raise). The total cash balance for the group now sits at a comfortable $75.9 million.

Nearmap shares were over 1% higher in morning trade, but remain below their all time high of $4.23 set in June. Accounting for a number of options, the market is valuaing Nearmap at around 19 times ACV, or 23 times sales (assuming sales grow at a similar rate to ACV).

With expectations for EBITDA to come in between $14.5 and $16 million (compared to $4.9 million in the prior year), Nearmap is on a EV/EBITDA ratio of ~107.

Whatever your chosen metric, Nearmap appears rather expensive. Or, at least, the market is pricing in some impressive and sustained growth. That’s not necessarily irrational when you consider the pace of growth, the potential for significant operating leverage and available market opportunity. Especially for a business that is now (ostensibly) self funding.

Ranked #12 on Strawman, Nearmap is a community favourite and has delivered exceptional returns for its backers. Best of all, shares remain below the consensus valuation…

Click below to take a closer look.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223