Travel tech company Serko (ASX:SKO) has seen its shares climb around 37% since it joined the ASX in June last year, but the business seems to have remained under the radar for many investors.

So, what does the business do, and is it worth buying?

Kiwi know-how

Founded in 2007, and listed on the New Zealand Stock Exchange (NZX) since 2014, Serko provides cloud-based corporate travel and expense solutions. With over 6,000 corporate users, Serko processes around $6 billion worth of travel expenses each year through its platform.

It’s kind of like a mini Corporate Travel Management (ASX:CTD), but without the controversy.

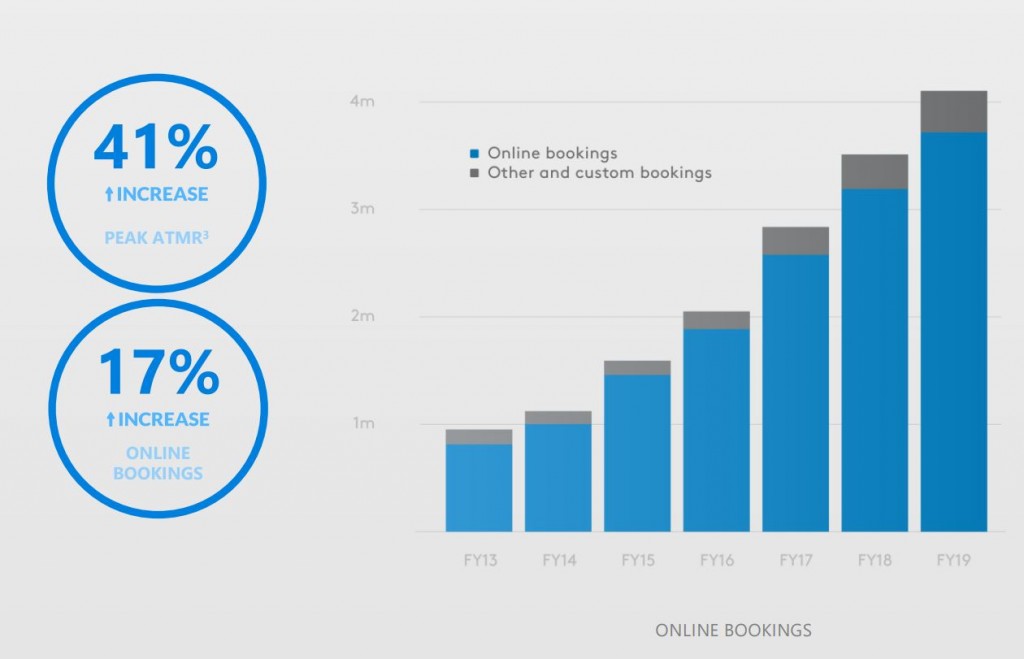

For the year ending March 2019, Serko reported a 28% increase in operating revenue on the back of a 17% rise in transactions and an increased spend per booking. Net profit did however drop by approximately 10% as the company bulked up its team and R&D efforts to support future growth.

Virtualy debt free, and with over $15 million in the bank, Serko is led by its founders who retain a significant shareholding. Already dominant in the ANZ region, the company is now seeing good traction in the North American and UK markets.

Is it a buy?

Serko shares are on a trailing P/E of around 190, or a sales multiple of 13x. However, as with many fast-growing tech companies, traditional valuation metrics can be misleading.

With sales expected to increase by between 20-40% in the current year, and a long runway of opportunity in northern hemisphere markets, bulls no doubt expect Serko to “grow into” its valuation as the largely fixed cost base acts to further multiply growth at the bottom line.

The company has signed partnership agreements with some big name travel management companies — including Flight Center and Carlson Wagonlit Travel — and its Zeno platform has been further enhanced with new features and content. Importantly, management believe they can bankroll its strategic ambitions using existing cash balances and operating cash flows.

Of course, there’s no guarantee that Serko can achieve international success. Should growth stall, the market’s response will likely be unforgiving.

Click below to see that latest research and valuations from the Strawman community.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223