Shares in engineering & construction group SRG Global (ASX:SRG) have roughly doubled since April, recouping some rather sizable losses from the preceding 6-months. Shares had been under pressure after the newly merged group was forced to lower full year guidance due to delays in contract awards, but sentiment has since shifted on the back of a number of new contract wins.

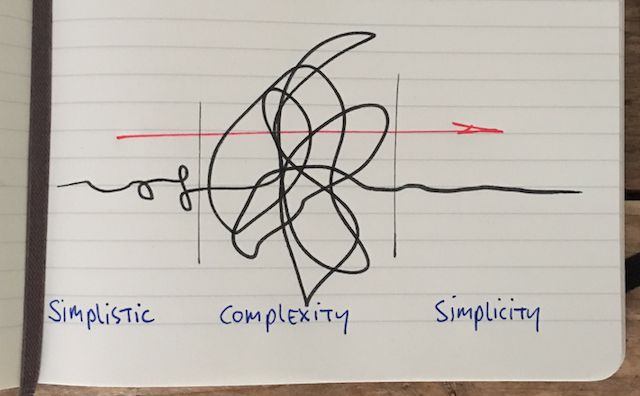

Project delays, cost overruns, utilisation rates and uncertain tender outcomes come part and parcel with engineering service companies, particularly those involved in large, complex projects. For investors that crave any degree of earnings visibility it can be frustrating, and makes the already tricky task of valuation that much more difficult.

Still, for the disciplined investor, there can be great reward. When volatile earnings combine with material swings in sentiment, there exists the potential for significant price movements — as is evidenced by the recent surge in SRG’s share price. The question, of course, is whether further gains are likely.

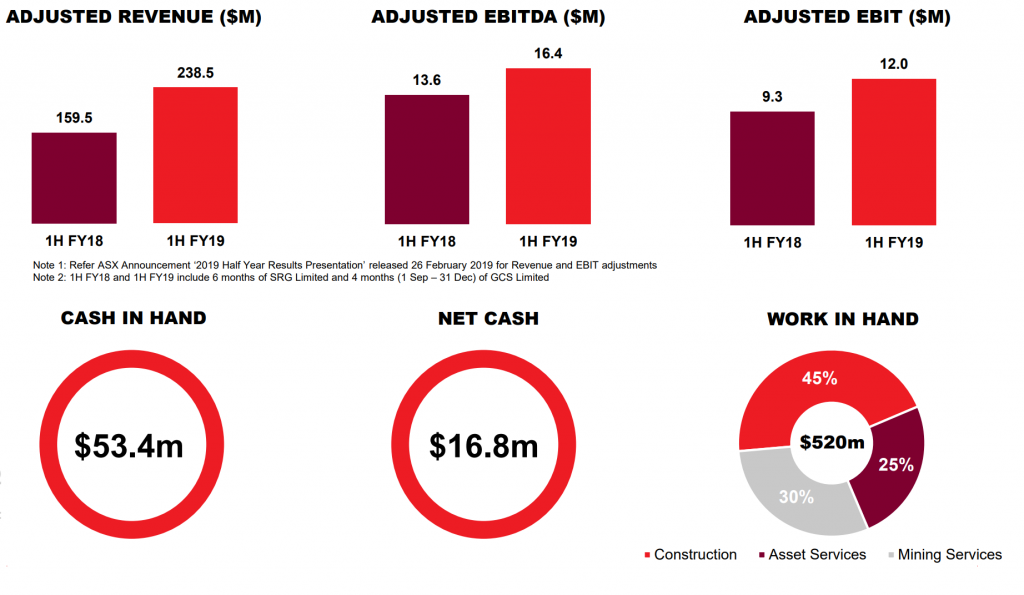

SRG’s operations span a variety of segments and geographies, which offers some degree of protection against individual project risk. Further, around 45% of revenues come from asset and mining services contracts which deliver more reliable recurring cash flows.

On a pro-forma basis, accounting for the newly merged structure, revenue was ~50% higher in the first half of FY2019, with earnings before interest and tax climbing roughly 30%. SRG disclosed $520 million worth of work in hand, and a net cash position of almost $17 million.

For the full year, SRG told investors to expect EBIT to come in between $22-27 million, while EBITDA around $10 million higher. Based on the current market price, that puts SRG on an EV/EBITDA ratio of 6.9.

That’s far from demanding, especially if management are right to expect a “step change” in earnings growth in the current year, and with $4.5 billion pipeline of work from a variety of growth sectors.

Ranked #77 on Strawman, the community consensus values SRG shares at 93.5c — a good 58% above the last traded price. Click the button below to learn more…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223