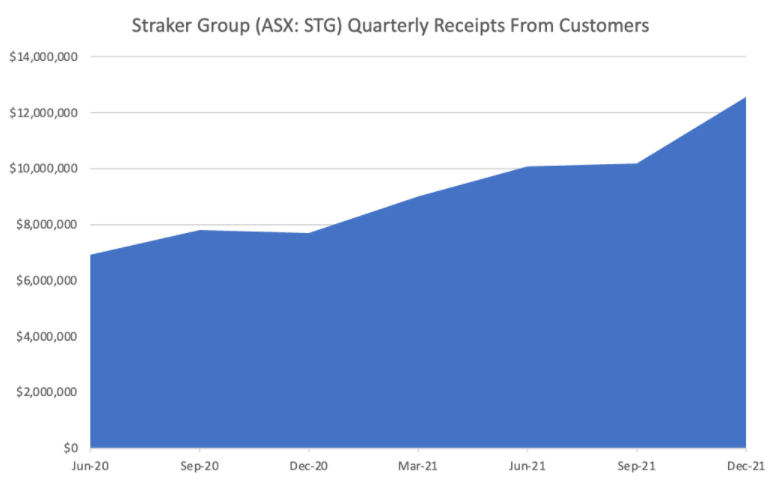

Straker Translations (ASX:STG) is a translation services business based in New Zealand, so this article will refer to NZD unless otherwise specified. In the half to September 2021, Straker made a loss of $5.5m on revenue of $23.3 million. Since then, the company reported its cashflow statement for the quarter to December 202, achieving positive operating cashflow of $34,000 and record quarterly cash receipts, as you can see in the graph below.

Last week, Strawman Premium members caught up with Straker Group founder and CEO, Grant Straker, to hear more about the company’s plans.

Mr Straker outlined how his company uses software and machine learning to better support their human translators to translate more accurately, and more efficiently. Straker Group is paid for the finished product, so it makes money when the amount it is paid is more than the amount it pays contractors to do the translation work. The company’s Ray platform is its competitive advantage, because that system makes human translators more efficient.

Personally, I thought his explanation of how he sees machine learning assisting the business was interesting. He said:

“Anything that’s going to be AI driven is going to be about the interface between the human and the machine… The people that are going to win are going to be the ones that come up with the best designed interface… With our system, we’ve figured out how to get humans really fast, and we’ve done it not just in one go but over ten years of iterating… The core concept is that if you’re going to do this everyone has to work on one platform, or else you can’t collect the data.”

With this approach, Straker may well end up with a translation platform that allows for significant sustainable profits in the future.

Speaking of profits, it was also interesting to hear Mr Straker talk about how the business could scale in the next few years. He said that of all the acquisitions they’ve made in the last few years, only one was for the technology, being Lingotek. The rest were essentially about buying the customer base.

One limitation of this approach is that it means the company constantly needs to allocate capital to making acquisitions. In some ways you could think of these “investments” as actually just a customer acquisition cost, more comparable to marketing. That said, it does make sense that a larger translation company would be more efficient. For example, the simple ability to offer multiple different language translations creates cross-selling opportunities, when it is only doing some (but not all) languages, for any given client.

Finally, there is also some potential that an increasing proportion of the company’s revenue will be on a subscription basis. Straker said:

“We already have about $5m in SaaS revenue through the Lingotek acquisition… [and] going into FY 2023 we’ll start to roll-out some new SaaS models which will drive up margin and grow sticky revenues.”

This is a theme that Strawman member Chagsy has touched on, theorizing that while Straker “is certainly not a true SaaS company… I suspect [it] will end up one day predominantly charging in a similar fashion to SaaS companies (i.e. a mix of volume based and subscription based).”

This is an interesting theory, because it points to one of the major ways listed companies can create value for shareholders; improving the quality of their business over time. In my view, the next few years will be very interesting to watch.

Turning to profits, Straker says “If we wanted to be a 20% EBITDA company right now, we could do it.” Personally, I think the market currently doubts how profitable the company can really be, and that shareholders would likely be rewarded if the company could produce a profit.

If Straker can achieve $50m revenue for the full year, on net profit margins of just 5%, it would make $2.5m. While the CEO is looking to move the company into profitability, it’s not clear exactly, when; or what margins will be. At the time of the interview, the share price was $1.20, equating to a market capitalisation of under $82 million.

In my view, the most likely reason the share price could move significantly higher from here, is if Straker can achieve a solid profit in the next year or two. While I don’t own any shares myself I’m certainly cheering the company on.

This post was contributed by Claude Walker. Check out the A Rich Life Ethical Equities column for more of his articles.

Please remember that these are personal reflections about a stock by the author. The author does not own shares in Straker Translations at the time of publication. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.