Cloud software licensing specialist Rhipe (ASX:RHP) has seen its shares more than double in the past year, hitting a new record since the current business incarnation listed in late 2013. For a tech-oriented stock in 2019, that’s not that unusual — the market has seen some extraordinary gains in the sector so far this year.

The real question, as always, is whether the business outlook justifies such a rise. Moreover, do shares represent good value at current prices?

What does Rhipe do?

Rhipe is a reseller for a number of cloud solution companies, most notably Microsoft. In addition to selling these solutions, Rhipe also generates revenue through marketing, support and consulting services.

In essence, Rhipe facilitates the transition to the cloud for businesses in the Asia Pacific region, with the promise of improving efficiencies and strengthening business models. The ongoing structural change underway in corporate IT requirements has been a potent tailwind for the business, and has helped grow sales by an average of 22% per annum over the past few years.

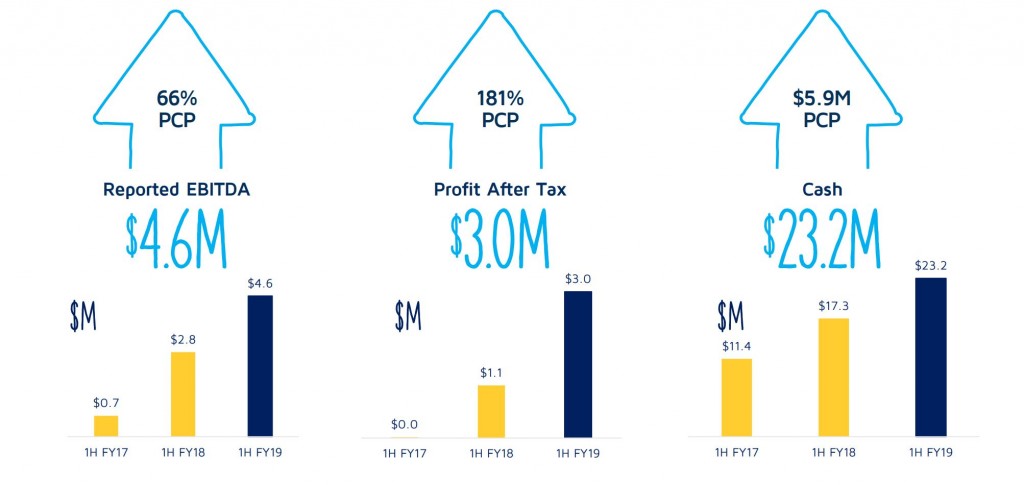

At the most recent half, Rhipe reported a 30% lift in revenue and a 79% lift to operating profit. After tax profit came in at $3 million; an increase of 181%. For the full year, Rhipe is expecting to post $12.5 million in operating profit, which would represent growth of more than 50% for FY2019. In the current financial year, management have guided for a further ~28% growth in operating profit.

Rhipe has zero debt and over $23 million in cash in the bank. It even pays a modest dividend; 2cps over the past year.

Are shares good value?

Rhipe’s preferred metric “operating profit” excludes a lot of costs, such as depreciation, interest, tax, share based payments, FX impacts and restructuring charges. But if we take that as a reasonable proxy for normalised EBITDA, then we can say that Rhipe is trading on an EV/EBITDA ratio of approximately 30 times, using the expected result for FY2019. On a forward basis, using management’s FY2020 target, the ratio reduces to around 23 times.

Although that’s rather high next to longer-term market averages, it’s not especially demanding for a capital-light business that is experiencing such rapid profit growth. And that should be the key consideration for investors; can Rhipe sustain this pace of expansion?

Given the size of the addressable market, the associated growth and Rhipe’s leading position, the potential is certainly there. The current thematic around cloud services is still in the early stages.

Nevertheless, Rhipe is largely a services based company and customers can easily cancel or defer expenditure if economic conditions were to deteriorate. With a strong balance sheet and base of recurring revenues, the business is well placed to survive any downturn, but the impact to profits would be material.

As such, earnings are likely to be rather cyclical.

Ranked #113 on Strawman, shares are presently a tad above the current community consensus valuation. Click below to learn more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223