Getting a stock tip, be it on Strawman or elsewhere, isn’t of much use if you can’t take ownership of it.

When the share price falls — and it always will at some point — how can you possibly muster the fortitude to hold steady if you have nothing other than a tip from a disinterested stranger to go on? Alternatively, how can you know if the fall is justified unless you can understand it in the context of the change (if any) in the underlying business fundamentals?

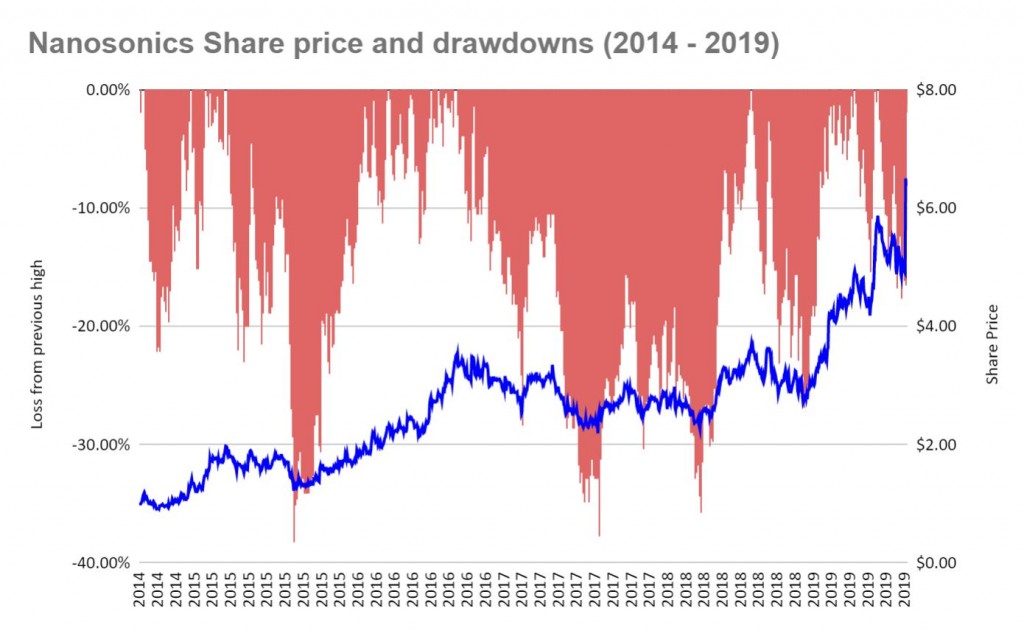

Remember, the very best share market gains — the ones that really change lives — come from multi-year, multi-bagger gains in businesses whose profits and prospects significantly and sustainably improve. Yet these companies, like all others, can suffer brutal short-term drops.

Nanosonics (ASX:NAN) is a case in point. While shares have gained over 500% since 2014, the market price spent much of its time below the previous high — often by a lot:

As Buffett says “some people should not own stocks at all because they get too upset with price fluctuations. If you’re going to do dumb things just because a stock goes down, you shouldn’t hold a stock at all.“

The same things goes for short-term gains. How can you resist the temptation to take a quick profit on a lucky bounce unless you have some conviction on the ‘true’ worth of the business? Locking in a 20% gain in Promedicus (ASX:PME) in 2016 may have felt like a savvy move at the time, but the subsequent opportunity cost has been immense.

If you haven’t taken the time to understand what it is you are buying and thought about what price is reasonable, you’ll have nothing other than the madness of short -term volatility to inform you. And that’s a very, VERY poor guide.

There’s nothing wrong with a tip (you’ll get plenty of good ones by following some of the proven contributors on Strawman) but it’s just the starting point.

It’s your money, and it is you — and you alone — that must take responsibility for how it is invested.

Over to you.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223