Pinned straw:

For $22m Stealth are purchasing Australia's largest privately owned national buying group for the hardware and industrial sector. And are confident that it's a step up not only in 2028 revenue but also with better NPAT margin.

So when they say 'Australia'a largest alternative' they really have been talking about Bunnings and Metcash. I wasn't ever sure what they meant until now.

BendigoInvesto

I too remain sceptical of this new goal, not sure how they would have made their 300m let alone the 500m.

So I am now on the sidelines, sold out today IRL and SM

topowl

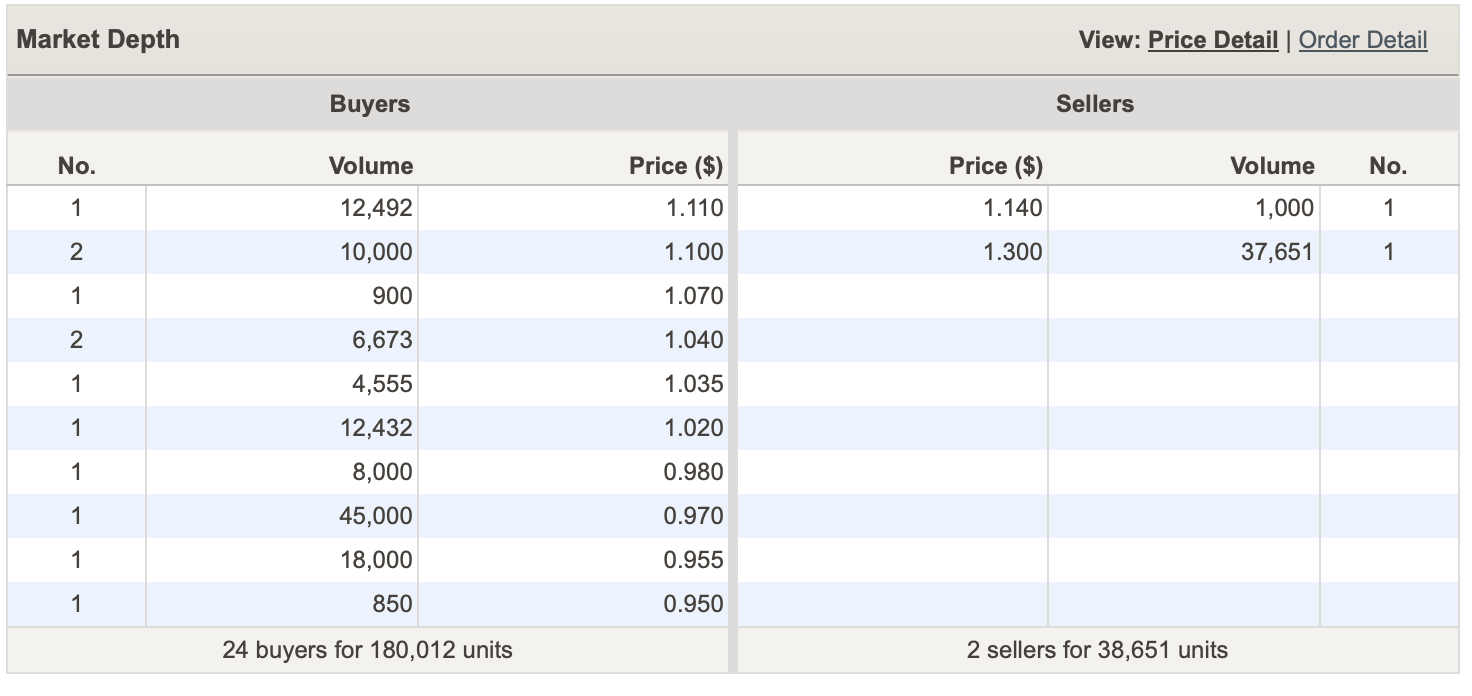

No chance I'm selling at the moment....the volume has been really building.

Learnt the lesson selling too early with Droneshield.

I'd rather have the price drop and lose a little of the top than sell and have this hit $1.80.

Ugh, worst feeling ever. Never again.

Who knows, this may transform into a bbq-hype share....stranger things have happened...and boy, it's got the name....lol

All the best everyone.

BendigoInvesto

I wanted to sell into higher volume, I do not want to be left holding the can with lower volume trying to sell a significant number of shares

Rocketrod

For those of us who jumped on board early for the Stealth train ride (so far), a massive, massive shout out to @DrPete for putting this stock in front of us. Next catch up in Sydney, @DrPete , leave your wallet at home!

UncleWally

It shows the value of the Strawman community.

Well done Stealth holders and well done @DrPete

nessy

@lastever this does look a good acquisition on first look assuming they can integrate it well (and they seem to have a solid history of good integrations). If the figures are correct it is good for the bottom line, and no CR. Will be interesting to see what the market thinks. Would still like to see some organic growth.

Nessy

held

Tom73

The big take away @lastever & @nessy is the below upgrade for that $22m price tag (non-dilutive, debt funded):

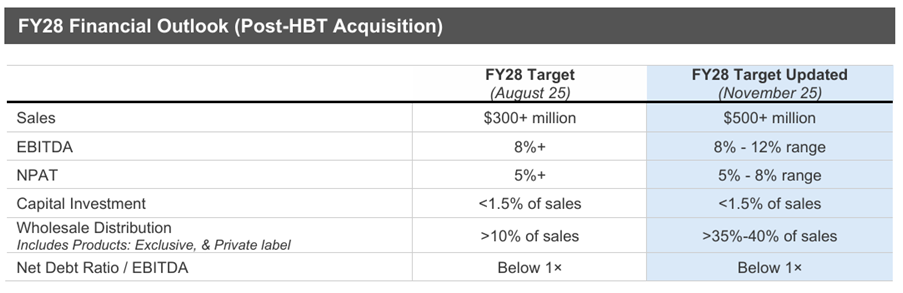

Upgrades FY28 Guidance: Sales > $500 million (up from $300 million), EBITDA margin 8 12% (up from 8%), and NPAT margin 5–8% (up from 5%).

Little wonder the price has popped. I had several orders at various price points to trim my position. The 82.5c completed but I have pulled the higher ones to look more closely because it looks very good!

UlladullaDave

It feels a bit strange that they upgrade revenue guidance by $200m for FY28 (why again no near term guidance?) by acquiring a business that last year did $6.9m in revenue. They did ~$145m in revenue last year, they had a low chance of reaching $300m but now they've just upgraded that to $500m. It doesn't feel credible to me at all and they haven't really explained how that is achievable. The $8m NPAT improvement in FY27 based on synergies is frankly quite unbelievable to me. I would bet good money that the upcoming HY result will show a continuation of the lack of any organic growth in this business.

The market reaction has surprised me. I guess some of it is just a reflexive bounce because there's no cap raise.

Strawman

I'll dig into this after the Shape CEO interview, but it certainly seems as though the market likes it.

For now, it's worth highlighting that pre-announcement, pre-trading halt moves really can be a false signal. Remember, the day before the trading halt Stealth was down 15% at one stage. The narrative (not unreasonably) was that there had been some leakage and the announcement was going to be terrible. Well, here we are with a 30% pop after the fact.

And this also is not something we should read too much into.

Anyway...yay! ;)

Tom73

@nessy me too, but it's getting close to a double spiffypop - "SpiffyBoom" may be a new term...

@UlladullaDave agree there are some circles to square in all this, but my initial thought was that the additional revenue was from switching from a commission sales model to a wholesale model for the business currently going through HBT which would explain most of it. More work to be done before concluding on this.

Tom73

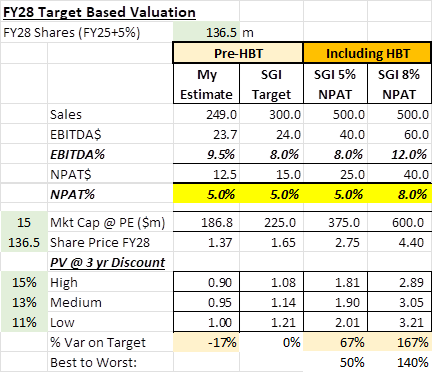

Up 45% as I write (SpiffyBooooom), my first sense check is: Assuming you believe the company as much on this target as the last, how much does this increase your view on value (ie more or less than 45%).

So I did the below, comparing Pre-HBT and targets now with HBT (at higher and lower ranges). I also looked at a rough PE 15 value discounted back at different discount rates.

Take the PE and discount rates as subjective, the objective outcome is that at consistent valuation metrics the HBT addition adds between 67% to 167% to the value of SGI’s original target. Against my conservative target (249m sales by FY28) it adds up to 200%

So my current view is that the price action so far today has been rational and probably conservative.

Noting that the company has additional debt and execution risk, so discount rates should probably tick up between valuation, but even if you moved from an 11% discount rate to a 15% discount rate the value would change from $1.21 to $1.81 or +50% comparing the original SGI target to the new HBT inclusive target at 5% NPAT.

Can they do what they say they will? My money is on a relatively successful integration (this is almost a normal part of business for them), but I am skeptical that it will be fully integrated in 2 months (wow) and let’s face it, between now and FY28 there will be another acquisition… so provided they buy at good prices (which this seems reasonable at 5.9 EBITDA multiple), value should increase.

Disc: I own RL+SM

UlladullaDave

Hi @Tom73

I don't believe that is where they are pulling the extra $200m in revenue from. It reads more like a belief that they can extract an additional $200m of non-agent revenue through having HBT as a distributor. If they get anywhere near that then yes, the shares will have been cheap. Given the way they repeatedly miss their own targets and have struggled to show any organic growth, I have my doubts.

Strawman

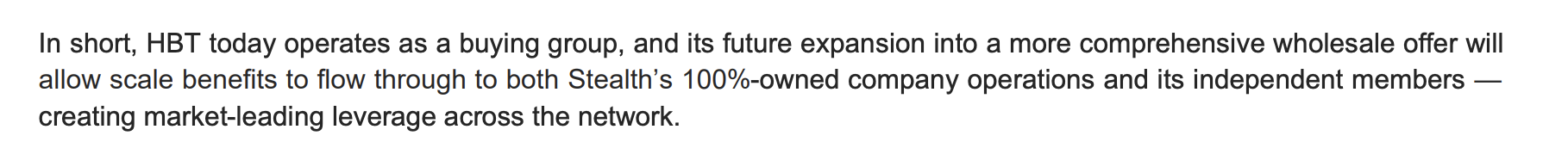

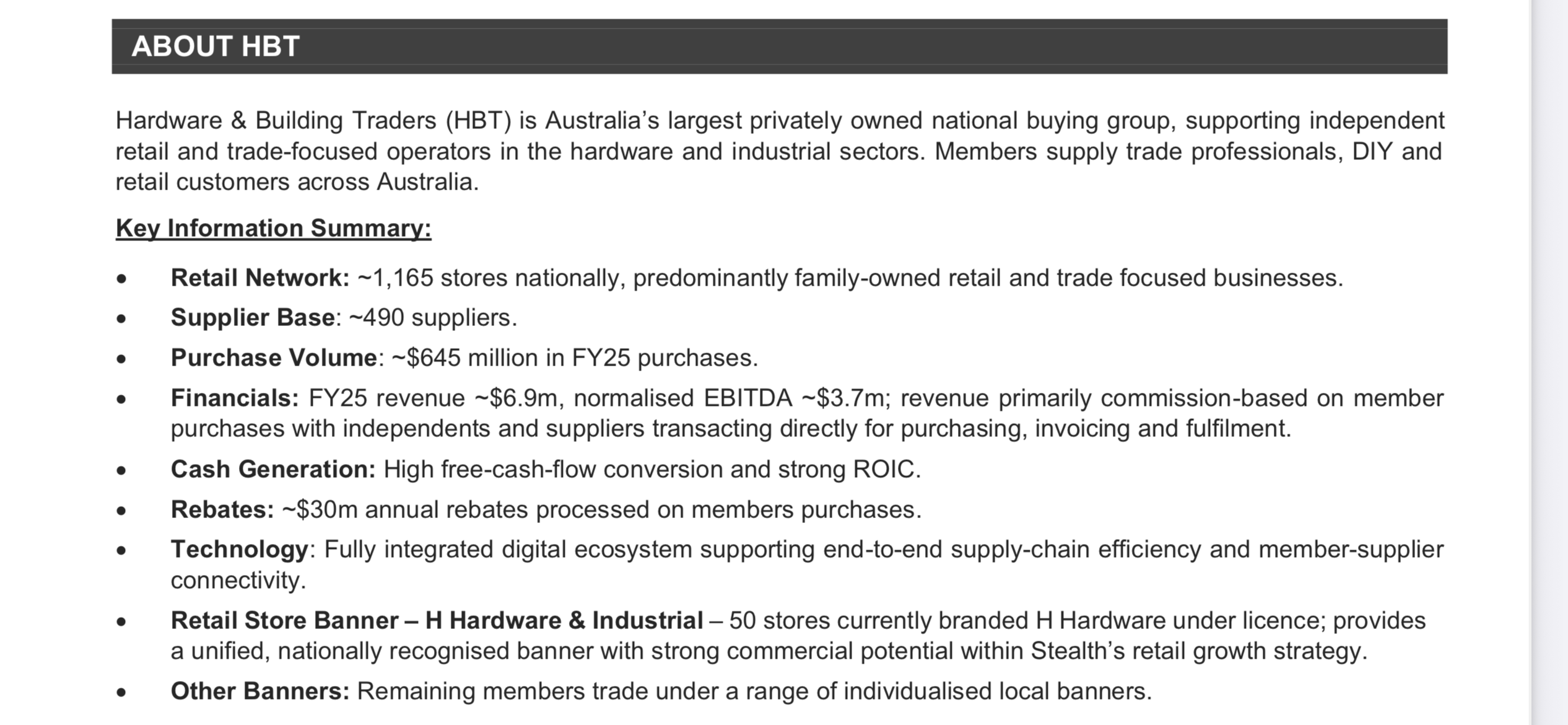

My initial view is that this is a cracker of an acquisition. I was a little nervous given the last one felt very much out of left field, and not obviously in line with their existing operations. But Hardware & Building Traders (HBT) seems like a very rational fit, being Australia’s largest privately owned buying group in the hardware and industrial space. It represents 1,165 independent stores and roughly $700m in annual purchasing volume and should add some serious muscle to Stealth’s footprint, taking them from about $100m in wholesale purchases across 32 locations to over $800m across more than 1,200 sites nationally. It’s a major scale-up that very much positions them as the leading alternative to the likes of Wesfarmers and Metcash.

Beyond the size, what makes this interesting is how well it plugs into Stealth’s existing model. HBT’s structure is asset-light and cash generative, with most stores independently owned, and Stealth is planning to consolidate its other buying group operations under the HBT umbrella. That means a much larger platform to roll out their private label products, tool hire services and digital offerings, which were previously only targeting a 32 store rollout. Now they can potentially scale these across more than a thousand outlets.

Financially, the deal looks reasonable at 5.9 times EBITDA, and it's good to see no share dilution as a result of it being debt financed. That lifts the leverage somewhat, with net debt/EBITDA just under 2x at completion, and management targeting a reduction to below 1x by FY28. There's a good earn-out provision too.. HBT must achieve a NPBT of $10m in both year 2 and 3 post acquisition for the vendors to get an extra $2.5m. None of us would be upset if they end up getting that extra kick.

Finally, the most eye-catching bit is the upgraded FY28 guidance, where sales are now forecast to exceed $500m (up from $300m), EBITDA margins are targeted at 8-12% (up from 8%), and NPAT margins at 5-8% (up from 5%). They’re expecting around $8m in annual profit synergies by FY27 and an extra $200m in sales through cross-selling, supply chain efficiencies, expanded exclusive branding and enhanced buying power. Obviously the numbers are big and the targets are bold, and they’ll need to prove they can execute on the integration and extract those synergies... far easier said than done! That said, this isn’t a random pivot and is very much in line with the direction they’ve been signalling for some time. If they pull it off, this deal shifts them from a niche distributor to a serious national player with scale, optionality and a path to meaningful earnings growth.

I'll update my valuation in a bit. But all told, I'm a happy camper.

mikebrisy

@UlladullaDave while I celebrate the success of many StrawPeople here, I went on the sidelines with $SGI because I could not see any organic growth. So I exited completely in April this year, selling final tranches from $0.76 to $0.86 in RL.

Like you, I also cannot make sense of the metrics and upgraded numbers for FY28. Part of my incredulity is that the bigger they become, the harder the top line percentage growth number becomes in what is, after all, a mature market and competitive market.

I was originally a bull on this business, with a very positive valuation. But the thesis required good top line organic growth, and we've now gone 2 years where we haven't seen any.

Obviously the market is telling me I am wrong and I accept that I in all likelihood am wrong. And of course I wish I hadn't sold (because today I could sell at $1.11, which I would), but I'd still prefer to see some organic revenue growth before I consider owning again. Like you, I can't make sense of:

FY23 Revenue $111m SGI only

FY24 Revenue Proforma: $159 m ($115m SGI +$44m Force)

FY25 Revenue (SGI incl. Force): $145 m + HBT $6.9m

FY25 Revenue Proforma (SGI incl. Force & HBT): $152m

FY28 Revenue Targets increased from $300m to $500m, as a result of adding HBT

Or, put in other terms, they've acquired a business with only $7m Revenue, and upped their required revenue CAGR from 27% to 48%

I haven't given this detailed attention today but, can someone who has, tell me what I am missing? (As far as I can see there is no peer in the distribution space that has generated this kind of organic growth at this scale,...ever.)

My starting point is that, even after today's announcement, $300m in FY28 looks a stretch.

I know there is a lot more to shareholder value creation than revenue growth. And with a larger flow of material through their distribution process, there is the opportunity to extract improved margins (economies of scale). But the revenue target before today didn't look credible to me, and now looks even less credible.

Put another way, as I read it, the target would have them catching up to $SNL's revenue in FY28 (consensus $503m), but from a standing start of no organic growth today, whereas $SNL has delivered consistent albeit declining revenue growth rates of 27%, 20%, 15% over the last 3 years. (I know $SNL has very little overlap, but it is still a distributor in a mature industry, so I put it up as a valid "peer" comparison.)

So, to avoid this forum becoming an echo chamber, I wanted to support a contrarian view.

On the investor call, did Mike explain how the combined business is going to achieve these targets? What am I missing? Help me, please.

Disc: Not held.

Chagsy

@mikebrisy you are not alone.

I've been increasingly unsure about how they are going to hit their targets. I think this is the point I will sell, but the timing is unclear; there seems to be significant momentum in the near term:

pdevries

Hi. just a bit confused on the above you mentioned $7 m in revenue, but doing a bit of research on co pilot it showed $700 m in revenue.

I'm sure im missing something as $22 million for $700 m in revenue seems too cheap. if it seems too good to be true then it usually is.

I do think the synergies in both expenses and ability to distribute their unique lines through more stores will be a help though

NewbieHK

Hi @pdevries Revenue is 6.9m.

The way I understand it, the 700m (645m) is in reference to the buying power of the buying group which, SGI bought. SGI has bought the buying group HBT not, the 1165 independent stores hence, why it only cost 22m. HBT acts as the buyer agent for the independents. By acting on their behalf (and taking an %) and buying in volume, their purchasing power is greater, allowing them the ability to negotiate better wholesale prices, compared to if each independent sourced all products themselves.

I guess SGI will be looking to push their own brands out through this network to improve margins.

I like others am struggling to understand the price jump. I am wondering if some investors have not fully understood what SGI has purchased. Maybe they have and I haven’t.

I have always struggled with SGI. I have wanted to hold it but, I have struggled to rationalise the margins. I guess I am missing something. Anyway nice job to the holders. The old saying of you have to be in it to win it, rings true today.

PS: after seeing SM updated valuation I am suffering some FOMO.

Ref below today’s release. Note: don’t hold

mikebrisy

@pdevries with distributors it is important to understand the revenue model. Not all distributors take ownership of the inventory.

So while today HBT deals with $700m of product, it is doing so on behalf of its purchasing network. I think they (the network) bear the inventory risk. So HBTs revenue is small, ie, $6.9m.

So now $SGI has a mixed business model in terms of inventory ownership. So revenue becomes a very poor metric to track its progress (it could tweak this any way it chooses.)

Holders should be laser focused on cash flows!! Beware.

This business has just become a lot more opaque.

Disc: Not held

Tom73

Thank you @UlladullaDave , @pdevries , @mikebrisy and @NewbieHK we need skepticism and push back, avoiding group think is the greatest value of a respectful and open forum such as SM.

This post seeks to identify the key elements that underpin the value change in SGI if any and understand what the company suggests will drive these changes. Members can make their own calls on the likelihood of success of these plans by the company.

General Status:

· FY25 Net Sales of $141.7m, target of $300m by FY28. Organic growth has been lacking, for the Industrial business store closures to improve profitability has been a temporary drag, but the newly purchased Consumer business there is no indication to suggest growth will occur. New exclusive product ranges, Loyalty program and the hire business offer strong future sales growth for the Industrial business but hitting the 300m FY28 target will require additional initiatives or ranging or acquisitions.

· FY25 NPAT $3.1m 2.2% of Sales has increased with operating leverage and a focus on bottom line growth over sales growth. NPAT of 5% is the FY28 target and management has shown a commitment operational efficiency, productivity and profitability.

· Working capital, capital investment, cash and debt management have been tightly controlled but move significantly with the business as it progressed through each growth acquisition. Recent initiatives have spiked Capital Investment to >3% of sales but are expected to revert to <1.5% and Net Debt Ratio/EBITDA will go over 2 but is targeted to be blow 1 by FY28.

HBT Addition:

· Expected to increase FY28 Sales target by $200m to $500m with an NPAT margin of 5-8%.

· HBT current revenue is $6.9m and EBITDA $3.7m driven by commissions on buyer group management of $645m in purchases each year by independent Retail Network of 1,165 stores (50 under the H Hardware & Industrial banner) and 490 suppliers.

· HBT generates $30m in annual rebates for it’s members from suppliers due to purchasing power.

SGI Strategy:

· Buying power: Adding HBT to it’s existing $100m in buying and 32 company stores creates a buying group of around $800m and 1,200 stores with $1.3b in retail sales. HBT currently generates $7m in commission and $30m in rebates for its group, any increase will improve margins and drop directly to bottom line.

· Channel Scale: Current wholesale (B2B), direct to business (B2B) and direct to customer (B2C) channels will have additional scale and provide additional economies, further emphasised in the wholesale distribution and margin points below.

· Wholesale Distribution: Currently less than 10% of sales are via wholesale distribution, this is planned to expand to the HBT network with 35-40% of sales using this model. Which suggests that this will increase from less than $10m to $175-200m, which explains almost all of the additional $200m in sales suggested by the company for FY28 through HBT.

· Synergies: $8m in synergies have been identified, removal of HBT duplicated costs will be a small part of this, but I suspect that spreading fixed costs currently in SGI over more sales is a part of this and built into the 5-8% NPAT margin expected.

· Margins: In addition to margin improvement from scale, there is increased channel opportunities for the own range, exclusive range, loyalty program and tool hire business which are all higher margin than 3PL wholesaling.

In short, the plan is to convert the HBT commission business to a wholesale distribution business, leveraging on the companies already strong systems, experience and efficiencies in inventory management. The expanded role in the supply chain will expose the company to more of the margin on products going through the network, hence the anticipated increase in sales revenue and if done well, synergies and operating efficiencies will add to margins and profits.

Risks & Issues:

· The company has shown limited ability to grow sales organically taking into account the headwind created from initiatives to improve profitability at the expense of sales.

· The original FY28 sales target of $300m requires sales to double (HBT excluded), the initiatives to bridge this (exclusive range, loyalty, hire, etc) are yet to show any change and even if they perform as the company expects there is still at least a $50m shortfall, suggesting another acquisition.

· HBT integration: Noting that HBT is a capital light and simple business, the addition of $700m in products sales and 1,200 retail customers is a major project. The company has a history of adding in business to support some confidence but they have a 2-month aggressive timeline for the integration.

· Wholesale Transformation: If as suggested an additional $200m in sales is added, this increases the current wholesale operations from $100m to $300m. Working capital, logistical capacity and storage requirements will increase dramatically. The company has historically referred to debt that supports working capital separately from other debt, so the debt ration of <1 x EBITDA may exclude a very large working capital debt addition.

· Cash Flow: The current year increase in capex spend (mostly supported by the recent capital raise), increased working capital requirements plus commitments to pay dividends are going to be an issue for near term cash flows at the very least. The company has a good track record in cash management through multiple acquisitions, none the less the significant scale up in working capital and capex will be a challenge.

· Sales Vs Margins Vs Profit Vs Cash (+WC): The business mix is complex and changing in terms of margins and cash generation. Each of these if looked at in isolation will mislead, ultimately cash generation is king, but business changes will disrupt cash flows, so keeping an eye on all to ensure long term growing profitable cash flows are generated.

Please add more facts or questions and your opinions as you see fit.

Big shout out to the OG @DrPete who brought SGI to the attention of the SM community – definitely my shout if we are at a meet up.

Strawman

Agreed, there’s been a lot of sharp analysis here, and it’s super important to balance the excitement with some healthy skepticism.

The $200m jump in FY28 revenue guidance does look pretty extreme at first glance given what HBT currently generates. But my interpretation is that this is less about what HBT earns directly and more about the scale of the network it controls. With ~$700m in member purchases across over 1100 retailers HBT gives Stealth potential access to a far larger volume of product flow than its own base business currently manages.

It seems Stealth is planning to shift some of that volume from a commission-based model to a wholesale model, using its existing infrastructure to supply more of the network directly. Management mentioned that wholesale distribution is currently less than 10% of SGI’s sales but could grow to 35-40% with HBT. If they’re successful in doing that, it could explain how they’re projecting an additional $200 million in sales. There’s also the strategy of expanding private-label ranges, loyalty programs, and tool hire -- all of which could lift both revenue and margin (at least in theory).

That said, @mikebrisy is spot on in the observation that they have struggled to show organic growth for a while now, and there’s a legitimate question around whether this is just financial engineering or a genuine step-change in capability. Also, a shift of this scale can definitely produce some hiccups, especially given the capital, logistics and working capital demands it requires. The 2 month integration timeline looks pretty optimistic.

I still think the upgraded guidance is plausible, but agree that a lot has to go right. Not just in execution, but also in customer behaviour and channel adoption. If it works, it could transform Stealth into a much more significant player. But it's far from certain.

As always, i may be way off in my interpretation. So any pushback is warmly welcomed.

mikebrisy

@Strawman and @Tom73 thanks for the clarifications. However, I'm still not sure how the mixed model will work, and I am not convinced about the shift from commission-based model to wholesale model. Let me explain, by putting myself in the shoes of the customer, i.e., one of HBT's 1100 store members.

As one of the 1100 network members, I am currently bundling my purchases with the network, and HBT negotiates essentially a volume-driven price discount from the manufacturer/brand owner. It is the classic, small business buyers' network that has operated in many industries for many decades all over the world.

So, HBT gets a commission, in the order of Revenue/Value or $6.9m/$645m or 1.1%. This is a reasonable commission for a demand aggregator, who might expect to capture anything from 5% up to 20% of the benefits they capture for their customers depending on the scope of services they provide (ordering, platforming, supply chain management etc).

For the network members, its pretty transparent, because they know the price they can get on their own, and therefore they can measure the benefits of being part of the buyers' network. Savings can be very significant - from 10% up to as much as 50% of the undiscounted price.

So, I am curious how the network members will feel about shifting to another model? This is a model where $SGI will seek to capture more of the margin. But to achieve this, they have to offer additional value. What will the components of that value be?

- Catalogue management?

- Relationship with the manufacturers/ brands?

- Supply chain and logistics?

- Quality management / warranty services?

- Inventory management?

So, yes, I can see that SGI has 2 new organic growth levers here:

1. Selling its existing catalogue into the HBT network

2. Converting the HBT network members from commission-only to full service wholesale across some portion of the $645m volume.

in addition to the pre-existing levers:

3. Adding new outlets to the network (by demonstrating a superior value prop. including price, product range, service etc.)

4. Expanding the range, including via white label and exclusive deals.

1. and 2. are truly organic growth and will potentially access $SGI's marginal EBITDA margin. They are potentially material.

So, my questions are:

- Do the HBT network members value the price-product offering of the $SGI catalogue over their current product portfolio?

- Do they want to swtich from a transparent commission buyer-network to a wholesale model?

I don't know the answers to these questions, and I don't know how convincing Mike was on the call to give confidence that $SGI can do it. But equally, I have no doubt that Mike must have done due diligence by talking to some HBT network members to understand what they value. Did he talk about this on the investor call?

I accept that if they can be successful, then the kind of valuation that @Strawman posted yesterday is entirely reasonable.

So my plan is to watch this one over the next year and look for evidence of i) successful integration and ii) renewed organic growth from the FY25 proforma starting point.

I think there is enough potential upside to get onboard later. I just can't get over the facts of the absence of recent organic growth, which - given the high-grading of the legacy store network to drive profits - points to the underlying, low, single digit organic revenue growth that you might expect to see in this sector.

I remain skeptical, and $SGI remains on my watch list.

Disc: Not held

Strawman

Yeah fair points @mikebrisy

"If" really is the biggest little word in the English language :)

You know what, we really need to get Mike back for a Q&A (something i've been meaning to do for a while anyway). Hopefully a meeting will help us all get a better handle on these questions.

UlladullaDave

Your posts, and everyone else, have been great @mikebrisy

I would add to this

- Do they want to swtich from a transparent commission buyer-network to a wholesale model?

If they want to, why have they not done so. There are plenty of wholesalers out there so why did they use a buying group. I think potentially the answer is in the announcement which mentions $30m of annual rebates. Those small independents won't get access to those rebates if they switch to being a wholesale customer. That's really the strength of being in a buying group: you access wholesale pricing and you have upside to rebates which are pretty substantial at 4.5% in the case of HBT.

This article about HBT was quite interesting and calls out the rebates.

“Our members get 100 per cent of the rebates that HBT has negotiated, and that allows stores to sell very competitively.”

Also interesting given SGI believes they can sell more of their own in house brands when the purpose of any buying group is really to allow independents to have wholesale buying power while keeping their own inventory autonomy...As I understand all of HBT revenue is from charging suppliers, members of the buying group pay nothing.

“Our members continue to buy products independently — they can choose who they use — the supplier reports to us the volume going through the group and pays us a small admin fee.

https://www.tradiemagazine.com.au/what-is-hbt-a-tradies-guide-to-the-national-buying-group/

It doesn't immediately seem clear to me that they will be able to push through $200m in revenue to a collection of independent retailers who seem to value having the power to make their own store level purcashing decisions.

DrPete

Awesome discussion above everyone. Love the full range of bears, bulls, and those just excited to be part of the ride. Special kudos to @Tom73 for his recent excellent summary, which aligns heavily with my thinking.

What needs to be said has already been said. I'll just jot a few of my thoughts here:

- I agree there's a big question mark over Stealth's ability to pull in-house a lot of the revenue currently going directly between HBT's customers and suppliers. In response to @mikebrisy's valid questions, I think the added value that may enable Stealth o capture that revenue is: warehousing, consolidating invoicing and fulfilment (at present customers are dealing with many suppliers, and suppliers are dealing with many customers), wider range (now HBT will expand to include Stealth's existing suppliers), and the additional offerings that Stealth has been planning (eg private/exclusive labels, tool hire).

- But at present this vision is just in Mike's head. I completely understand @UlladullaDave and @mikebrisy's concerns about lack of organic growth. @UlladullaDave, I always value your contrarian views, although on this occasion I think it's harsh to say Mike has repeatedly missed targets - I only remember one significant one, which was Mike's goal for FY25 rev of $200m, compared to the actual ~$140m. But 70% of an ambitious target ain't bad, and it was roughly 20% CAGR. And many other stats have been consistently marching forward. But I absolutely agree there's a big "if" with future organic revenue growth. This FY we'll see how well the rubber hits the road.

- I cringed a bit with Mike's massively expanded FY28 goals, on top of what was already extremely ambitious numbers. I fear he has put himself out on a limb too far. I'm more of an underpromise, overdeliver kind of guy. I don't think he'll get there. But maybe 70% there?? And if share price moves and stays forward, we'll forgive him.

- Overall the acquisition is strong. Clear alignment and opportunities. Decent price. And got to give Mike kudos for putting the company in a position to do this without a cap raise.

- I agree with @Tom73 in thinking the spiffy-kaboom-pop can be justified and sustainable. The share price had been drifting lower, well below the $0.80 I had as a fair price. So I see part of the pop as just a catch-up. And the rest is a reflection of profit contribution from the acquisition. Most of the discussion here has focused on revenue, but it's profit that ultimate matters. As a very quick-and-dirty pricing, the acquisition makes perhaps a current NPAT of $5m for the combined business. If that's growing 30% pa (way, way below Mike's guidance) then a current PE of 30 is easily justified, giving a market cap of $150m, right about where it is now.

- I'll update my SM valuation for Stealth in a separate post (hopefully tomorrow), but based on a quick think, I'm not sure I'm going to increase my bull case much, given I'm highly sceptical of Mike's uber ambitious guidance. But I think this acquisition will lift my bear and base cases.

Big picture, I think Stealth is a better company today than it was before the acquisition.

Finally, a quick thanks to the shoutouts from @Rocketrod, @Tom73 and @UncleWally. But I have to say "back at ya" to the whole Strawman community. Thanks to the robust discussions here in the early days, I had the courage to bet big on Stealth. It has been life-changing for my family. I said to @Strawman yesterday that it is bizarre that a single stock pick has generated more wealth than the sale of my business that I grew for 20 years. Mind blowing. Many thanks to all of you who have shared your thoughts about Stealth over the last couple of years. Been an amazing ride!

Rick

Please excuse my ignorance about Stealth. Can anyone explain how Mike proposes to lift NPAT margins from 2.2% in FY2025 to 5% - 8% in FY2028?

”Upgrades FY28 Guidance: Sales > $500 million (up from $300 million), EBITDA margin 8–12% (up from 8%), and NPAT margin 5–8% (up from 5%).”

The wholesale model sounds similar to what Metcash does in its hardware division for Mitre 10 and Total Tools (for the TT stores they don’t own outright).

In FY2025 Metcash achieved an EBIT margin of 5% in the hardware division, and an estimated 3% NPAT margin. I’m not saying Stealth can’t achieve 5%-8% NPAT margin because the business models might be completely different. However, it does seem a bit high to me.

Strawman

Hopefully something we can get Mike to better articulate for us @Rick (he's said he's happy to come back and talk to us, but his schedule may mean we have to wait a month or two)

But yeah, the margin uplift does look ambitious on the surface.

A few things that should help them:

Stealth has been carrying a sizeable cost base that should scale more efficiently with the HBT acquisition. It plans to consolidate its existing buying groups under the one umbrella, which could simplify the structure and reduce duplication. They reckon $8m in synergies over the next couple years.

They're also moving toward more wholesale supply, which may improve margin mix through private label and fulfilment.

Still, there’s definitely execution risk in getting there.

UlladullaDave

It has been life-changing for my family.

That's awesome @DrPete . Congrats!

Thanks for the engaging respectful discussion to you and the other guys. I think I actually ended up 6x on SGI. I remember at the time discussing with you on here that when you brought it to my attention on here it was just dirt cheap, and really the only reason I sold was that the risk reward, imo, had shifted. Obviously I have some reservations about the targets too. LOL.

It's definitely going to be an interesting story to watch unfold over the next few years.

Cheers!

lowway

Like @Strawman and I'm sure, many other SM members, I too would love to see another of your presentations @mikebrisy Would also love to do another catchup with you and the other Qld SM members again, hopefully on the Sunny Coast in Jan/Feb 2026. The last catchup was thoroughly enjoyable and well worth the drive to Brissie!!

mikebrisy

@lowway Thanks. Very happy too ... if I can think of something useful to say!

And, yes, I'll be Sunshine Coast-based from end-Dec until end-Jan, so we should definitely see if we can round up some StrawPeople for a gathering (locals and visitors).

Probably ought to change my handle from @mikebrisy to @mikesunny for January each year, or @mikegympietce ... to follow your lead.

My goodness, the year end is fast approaching, so we probably ought to get a date an location up soon, so people have time to opt in if they want.

lowway

Sounds great @mikewhatever (aka@mikebrisy).

Ill throw some dates to you when I get back from cold, wet, windy Tassie in 2 weeks

Strawman

For sure @lowway . There's always an open invitation@mikebrisy!

Same goes for any member that's keen to share their insights/experience.

Hit me up whenever you're ready.

Tom73

Now a 10 bagger for me, first since Altium and I credit the MP Pro team for that, this one I can claim some credit, along with all those who have contributed in every way on SM especially @DrPete , life changing indeed!

Still holding all except a small trim order I had which had already partly executed prior to the announcement, I withdrew all my other trim orders on seeing the news. Prior to the announcement the asymmetry of SGI had gone from crazy favorable at 10c to balanced at 70c. Post announcement at $1.35 I see favorable asymmetry, but will have to continue to assess at higher prices if only due to position size.