Pinned straw:

I knew AMP had taken a small BTC position in their super offering but intersting that such a staid and underperforming legacy financial firm is now writing Livewire articles on it! Link here, with a few interesting updates on the ownership mix at the end of 2025.

Wow, what a horrendous article....lol

Fret not @Strawman. All the boomers and boomers-to-be are just jealous they weren't along the ride for the absurd returns Bitcoin has posted since inception, despite several stomach-churning drops (will this time be any different? This isn't even "real" pain yet going by its history). I guess they are feasting on their fully franked bank dividends - all power to them!

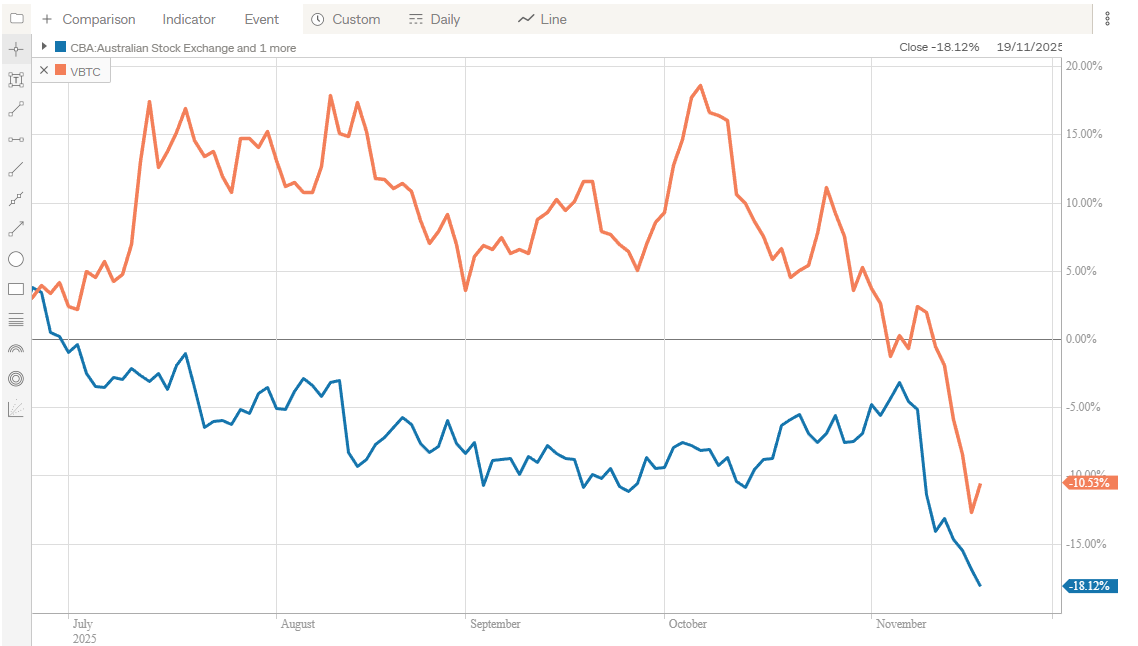

Little doubt that it is looking ugly, especially at a time when its fellow risk assets have largely held steady. Is it a leading indicator of worse things to come for equities? Or do we have some divergence and correlations are breaking down (this would be a good thing if Bitcoin is a true hedge). There will be a time to start buying again, but I am inclined to wait and see until some sustainable green shoots emerge in the price action.

My 2c here…,

Many, in fact the vast majority, still don’t really understand what Bitcoin is and why it is not Crypto per se.

So those who think it is a scam or otherwise have not done the work are happy to say ‘I told you so’ when we get dips like this whereas a bit of research will show this Is perfectly normal and is in fact a small’ish decline compared to history but we could well go lower yet. However, when the price rises they also say oh this won’t end well…. Yes I am generalising but hopefully you get my point.

Anyhow, as Bitcoin is over half of my holdings in my SMSF it is not great to see how much I am down but equally I sleep well at night as I know why I hold it.

In fact, I just purchased some more this morning. It is business as usual folks.