Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I've had a few family and friends reach out recently helpfully highlighting for me that bitcoin has "crashed".

Thanks?

It's weird how, unlike other assets, people love to dunk on you when the market price moves against you. I have held a negative view on bank shares for a long time, but I cant imagine sending a snarky message to shareholders I know because the price fell.

What is it about BTC that engenders so much schadenfreude?

Aaaanyway, it did prompt me to compare it against other more "sensible" assets. Not so much to enter into petty sniping and point scoring (I'll save that for twitter), but because it hopefully offers some useful context.

In doing so, it's pointless to look over any meaningful timeframe. At least for the point I'm trying to make. There's just very few assets of scale that can compete with a ten year CAGR of 75%pa. And even a perma-bull like me will acknowledge that such an insane rate of return cant be sustained over the long term. Even digital trees dont grow to the sky, so that's a dangerous thing to extrapolate.

The point is to try and tease apart risk, quality and volatility over the short term. As we all know, these rarely have any meaningful relationship over shorter periods of time (which is, in part, what we long term investors try to exploit).

For example, if I had put my money into a passive index fund a year ago, I'd have outperformed an investment in a bitcoin ETF, but not by much...

Yeah, dividends need to be included, but that hardly leads to a massive difference. Which is interesting given the extreme difference in the (perceived) risk profiles of these two ETFs.

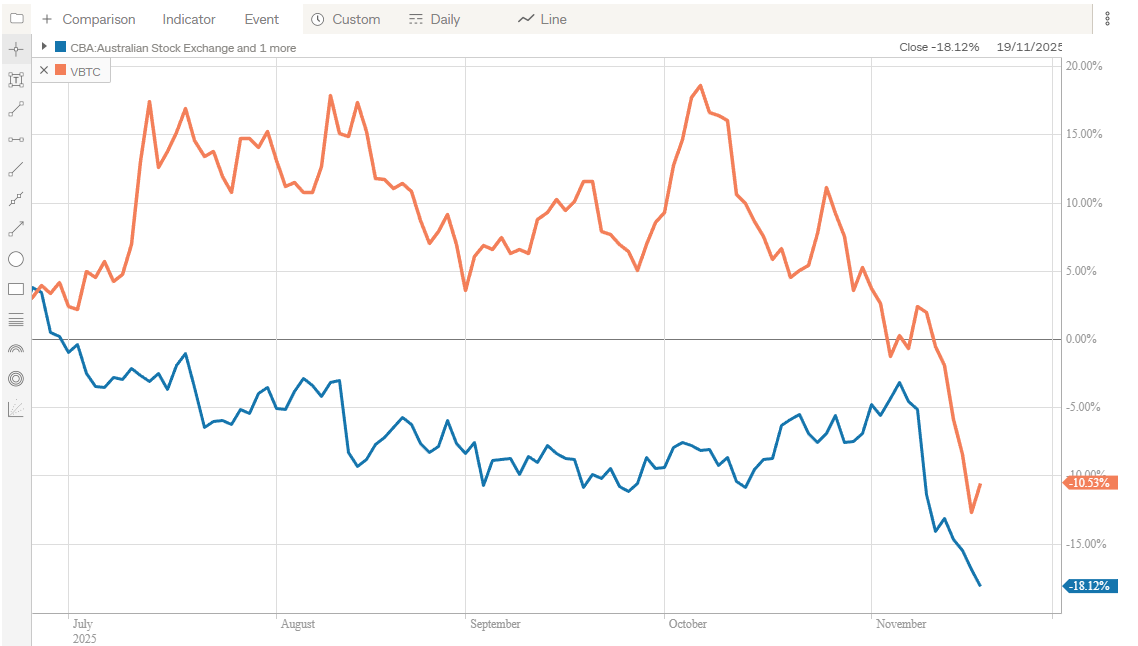

Speaking of the banks, here's how CBA (arguably the best Aussie bank) has performed relative to the Vanguard bitcoin ETF since it hit it's June high

Bitcoin is down ~10% in the last 4 months, but CBA shares are down ~18%.

Yes, I've been extremely selective in my timeframe here. But my point is that so have the people who are dunking on bitcoin lately. The 4 month performance of CBA is as irrelevant to any sensible bull case, and the same is true of the last 4 week performance of bitcoin.

Besides, this is entirely normal for bitcoin. Since 2017, there have been at least 10 drawdowns of 25% or more, 6 bigger than 50% and 3 bigger than 75%. Every dip was, with hindsight, an incredible buying opportunity.

My point is that short term volatility says NOTHING about risk or quality. Not for CBA, not for a passive ETF, and not even for magic internet beans. Not that all of these things dont have genuine, legitimate risks. Only that volatility is not one of them.

Final thought -- it's at times like these that I always remind myself of Lynch's maxim: "Know what you own, and why you own it".

The bull case for bitcoin hasn't changed in the last month. If anything, it's gotten stronger. That doesnt mean it cant go lower. I have no idea what it does over the next 6-12 months, but history suggests it could easily go much lower.

If it does, the only thing that will bother me is all the hot takes from uncle bob :)

According to 42Macro leading liquidity indicator, Global liquidity inflected to a significant uptrend in September. Refer to green highlight parts of chart below.

Translating this onto the $BTC/USD chart below:

42Macro have been running this methodology for about 18 months or so, so a small sample size. However prior liquidity uptrend signal flagged the beginning of a rally in $BTC price.

DISC - HELD.

No one tell @Strawman I've done this, but I sold 40% of my Bitcoin stack at around USD $111k on Sunday night.

In general the decision has been led by my belief that the US tariffs are going to drive a massive hole through their economy and asset values will fall for a period thereafter. Will Clemente on X shared the below chart over the weekend that further reinforced that thinking. The latest US economic data has been moving in a stagflationary direction and I'd be surprised if a 25 or 50 bp rate cut next week will be enough to turn the tide.

I'm nowhere near certain that this is the top of this cycle. But having ridden these buys up from June 2022 at USD $22k to $111k, it feels like a good time to harvest a portion of those gains and move to a slightly more defensive posture (Like buying some of that ASX blue-chip AIM lol)

On a longer-term view, I'm still highly convicted on Bitcoin and will be holding my existing stack with a view to buying back in at lower levels eventually.

I am hoping it has atleast another leg up before the tides turn, but profit-taking from long-term holders over this cycle suggests we are in the late stages of the latest Bitcoin bull.

I thought this latest piece from Bitaroo (which is the local exchange that has an ABN and AFSL) that I and @Strawman use, was an easy look at who is holding and/or adding more BTC. Particularly intersting was about 3 million of the 21 million seem to be "out of action"...

https://www.bitaroo.com.au/bitcoin-ownership-in-2025-who-controls-the-worlds-btc-supply/

Hi, couldn't see any mention of this (unless I missed it). We will see what happens toward October

A judge says bitcoin is just another form of money, which means it could be exempt from capital gains tax – a decision that upends the Australian Taxation Office’s approach to taxing cryptocurrency and could open the door to millions in refunds.

The judgment – made public for the first time here – was made as part of a criminal case brought against a former Australian Federal Police officer who allegedly stole 81.6 bitcoin in 2019, then valued at approximately $492,000. Today it would be worth just over $13 million.

Wheatley’s defence team argued that bitcoin is information, not property, and therefore cannot be stolen. Michaela Pollock

Victorian magistrate Michael O’Connell said bitcoin was property, but akin to Australian dollars rather than foreign currency, shares or gold.

The implication is that just like exchanging a $20 note for two $10 notes, no tax is payable.

If upheld on appeal, the interlocutory decision could mean taxpayers who’ve paid capital gains tax on bitcoin transactions are eligible for refunds collectively worth as much as $1 billion, said tax lawyer Adrian Cartland, who acted as co-barrister for the defence.

Looks like it is all systems go for Bitcoin.

A few weeks ago, I anticipated it would test its all-time high. It looks like it is close to nailing its ATH close (though still below the $109k odd reached intra-day on the day president Drumpf was inaugarated.

Price action, momentum, relative strength are all bullish, as is seasonality. Buckle up I guess?

Hi all,

I am invested in the Bitcoin ETF (ticker code) EBTC. However on Strawman I have noticed the majority of people (if invested in a Bitcoin ETF) are invested in VBTC.

I am wondering if anyone can see a potential issue with my holding in EBTC, something I haven't thought about??

Here is an article talking about both options:

https://www.selfwealth.com.au/blog/etfs-head-to-head-vaneck-vbtc-vs-global-x-21shares-ebtc

Thanks in advance.

Yellen reports TGA spend down to commence mid January, following debt ceiling expiry on January 1. This will be a short term boost to global liquidity, with over $700 Billion currently in the TGA. The TGA will be exhausted by July / August if the debt ceiling fails to be re-negotiated in the first few months of the Trump Administration.

During the TGA spend downs of 2021 and 2023, Bitcoin produced positive returns.

DISC - HELD

I wonder if the appearance of Krypto in the new Superman trailer today will give BTC a bump?

#lol

#superdog

Institutions vs. Bitcoin. "Pension funds make up only 1% of the reported holdings in the nine new ETFs. We expect that number to increase in 2025, following expected regulatory changes from the Trump administration that will make it easier for traditional finance (TradFi) to participate in digital assets."

Standard Chartered via Zero Hedge

VBTC - toot, toot - Good growth here

Info Below:

VBTC - VanEck Bitcoin ETF | The first & most cost-effective on ASX

ETFs Head-to-Head: VanEck ‘VBTC’ vs Global X 21Shares ‘EBTC’ - Selfwealth Media & Articles

Key takeaways:

- The VanEck Bitcoin ETF is the first Bitcoin ETF to list on the ASX, albeit the Global X 21Shares Bitcoin ETF has already been trading on the Cboe Australia market since 2022, amassing over $100 million in net assets since that time.

- VBTC is a ‘feeder fund’, investing directly in the US-listed VanEck Bitcoin Trust to gain exposure to Bitcoin, whereas EBTC is 100% backed by physical Bitcoin held in ‘cold storage’.

- In response to the launch of VBTC, Global X is reducing its management fee for EBTC, which means both funds will charge 0.59% per annum as of July 1, 2024.

- Please note that at the time of this article publication, VanEck Bitcoin ETF (VBTC) is not available to trade via the Selfwealth platform.

BTCUSD Bitcoin US Dollar - Currency Exchange Rate Live Price Chart

BTC$100 in in sight (USA - New Governance / Values proving a factor here)

Microsoft is under some pressure to consider adding Bitcoin to its balance sheet, though its Board is presently against it.

https://fortune.com/crypto/2024/10/25/microsoft-tells-shareholders-to-reject-call-to-invest-corporate-cash-in-bitcoin/

Will be big if (when?) it happens...

- US economy remains resilient, with a strong private sector balance sheet (the wealth 30% anyway).

- Fed is asymmetrically dovish, kowtowing to fiscal dominance by artificially stimulating demand for US Treasurys amid explosive growth in US federal deficit.

- Weakening USD should accelerate dollar recycling and provide China scope to support their flagging economy with stimulus.

- US fiscal impulse and treasury's financing policy are getting increasingly positive in Q4 ahead of $700 Bn spenddown of the US TGA in Q1 2025.

- Trump election may drive euphoria in the short term, but his policies risk stagflation in the medium term (bad for $BTC)

- NEAR TERM RISK: Tight Democrat election win could lead to civil unrest, as Trump and MAGA unlikely to accept result. Long term, civil unrest may boost use case / adoption.

My April 2025 $BTC target: $125 K USD

Wow - do some of us need to worry about who we are chatting with on Strawman!!!

The link here for those with an AFR subscription -

https://www.afr.com/markets/currencies/crypto-owners-are-more-likely-to-have-psychopathic-traits-study-says-20240902-p5k73c?utm_content=around_the_world&list_name=EBE726C6-38DF-4725-9BE4-5091999D8384&promote_channel=edmail&utm_campaign=the-brief&utm_medium=email&utm_source=newsletter&utm_term=2024-09-02&mbnr=MjExOTY0NTg&instance=2024-09-02-12-03-AEST&jobid=30762471

Apparently I'm not the only beanie baby collector :)

You can now get Bitcoin exposure on Strawman.

Me:

Everyone else: