I've had a few family and friends reach out recently helpfully highlighting for me that bitcoin has "crashed".

Thanks?

It's weird how, unlike other assets, people love to dunk on you when the market price moves against you. I have held a negative view on bank shares for a long time, but I cant imagine sending a snarky message to shareholders I know because the price fell.

What is it about BTC that engenders so much schadenfreude?

Aaaanyway, it did prompt me to compare it against other more "sensible" assets. Not so much to enter into petty sniping and point scoring (I'll save that for twitter), but because it hopefully offers some useful context.

In doing so, it's pointless to look over any meaningful timeframe. At least for the point I'm trying to make. There's just very few assets of scale that can compete with a ten year CAGR of 75%pa. And even a perma-bull like me will acknowledge that such an insane rate of return cant be sustained over the long term. Even digital trees dont grow to the sky, so that's a dangerous thing to extrapolate.

The point is to try and tease apart risk, quality and volatility over the short term. As we all know, these rarely have any meaningful relationship over shorter periods of time (which is, in part, what we long term investors try to exploit).

For example, if I had put my money into a passive index fund a year ago, I'd have outperformed an investment in a bitcoin ETF, but not by much...

Yeah, dividends need to be included, but that hardly leads to a massive difference. Which is interesting given the extreme difference in the (perceived) risk profiles of these two ETFs.

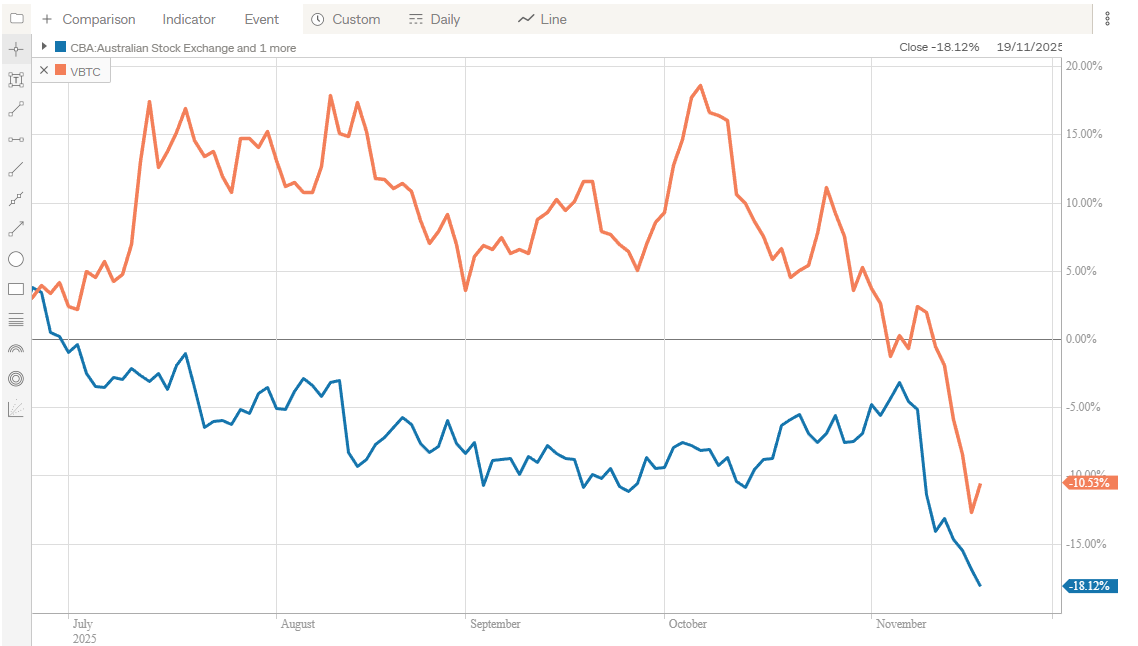

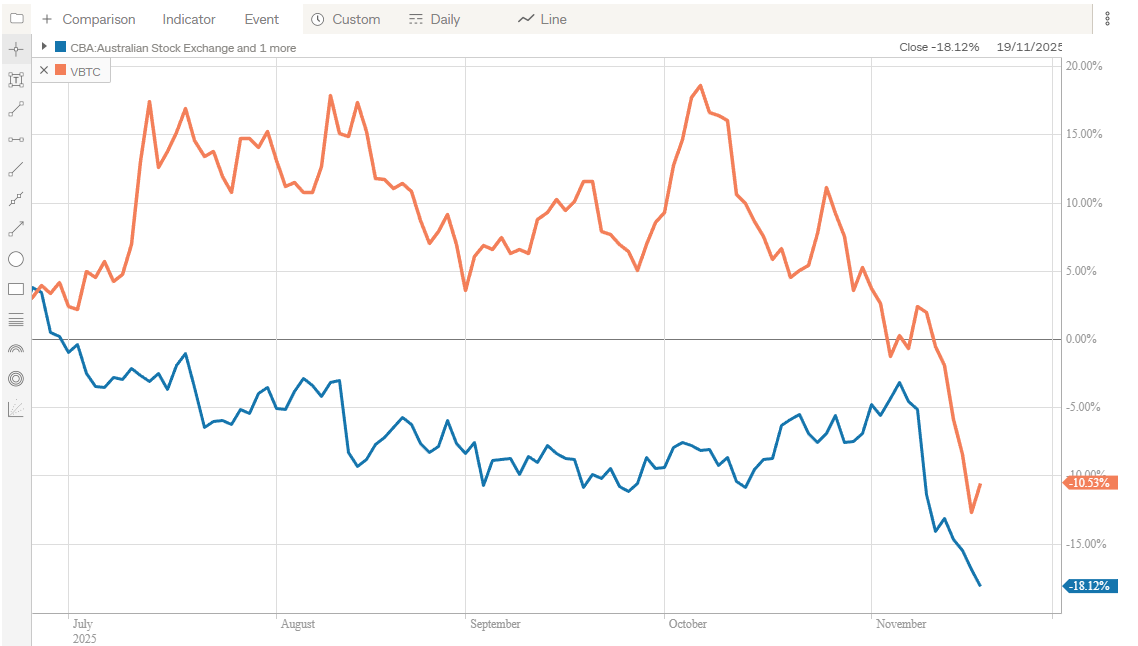

Speaking of the banks, here's how CBA (arguably the best Aussie bank) has performed relative to the Vanguard bitcoin ETF since it hit it's June high

Bitcoin is down ~10% in the last 4 months, but CBA shares are down ~18%.

Yes, I've been extremely selective in my timeframe here. But my point is that so have the people who are dunking on bitcoin lately. The 4 month performance of CBA is as irrelevant to any sensible bull case, and the same is true of the last 4 week performance of bitcoin.

Besides, this is entirely normal for bitcoin. Since 2017, there have been at least 10 drawdowns of 25% or more, 6 bigger than 50% and 3 bigger than 75%. Every dip was, with hindsight, an incredible buying opportunity.

My point is that short term volatility says NOTHING about risk or quality. Not for CBA, not for a passive ETF, and not even for magic internet beans. Not that all of these things dont have genuine, legitimate risks. Only that volatility is not one of them.

Final thought -- it's at times like these that I always remind myself of Lynch's maxim: "Know what you own, and why you own it".

The bull case for bitcoin hasn't changed in the last month. If anything, it's gotten stronger. That doesnt mean it cant go lower. I have no idea what it does over the next 6-12 months, but history suggests it could easily go much lower.

If it does, the only thing that will bother me is all the hot takes from uncle bob :)