01-May-2024: Some relatively minor buying by the Chairman and another director of Duratec on April 24th at $1.05, announced today:

Change-of-Director's-Interest-Notice-M-Brydon.PDF (25,000 @ $1.05, Martin Brydon is the non-exec Chairman of DUR)

Change-of-Director's-Interest-Notice-K-Bates.PDF (transferred 14,150 from one account to another and also purchased another 19,000 on-market at $1.05, non-exec director)

At this point in time, DUR is the only company in my largest portfolio that is in the green TODAY (for the day), up half a cent to $1.03 today. In my SMSF, the only one in the green today is NEU, up 5 cents/share at this point in the day.

[Edit: Both DUR and NEU ended up in the red by the end of the day]

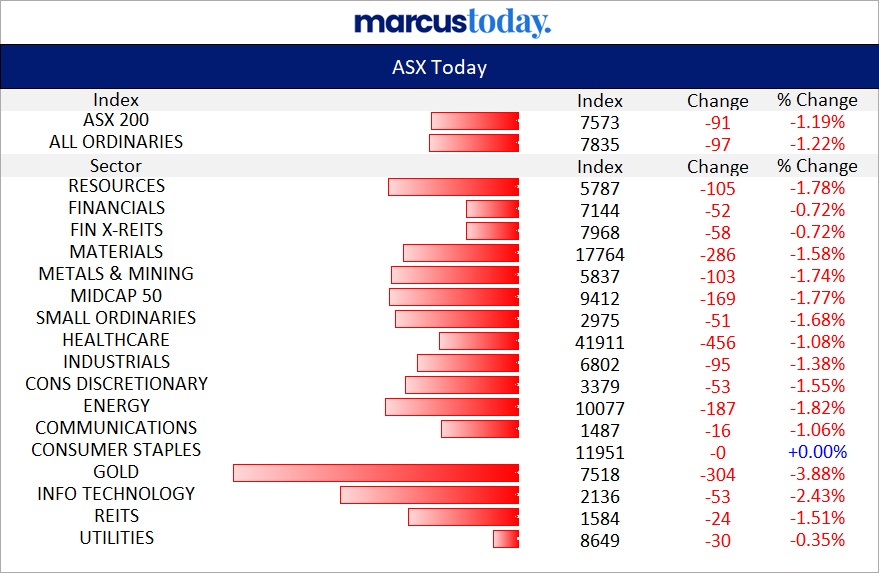

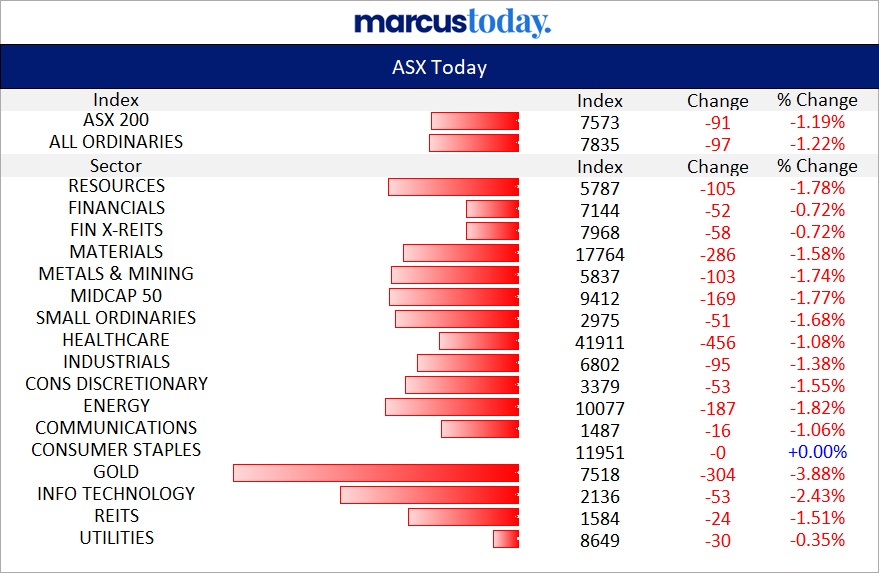

Lots of red across all of the sectors today, with gold underperforming (worst sector):

Not too fussed about that however, we've had a good run, and we do get these days every now and then.

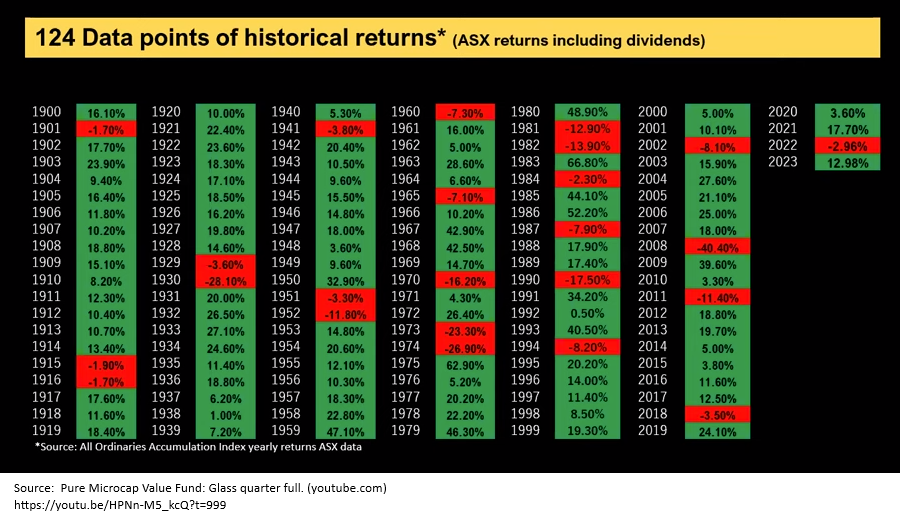

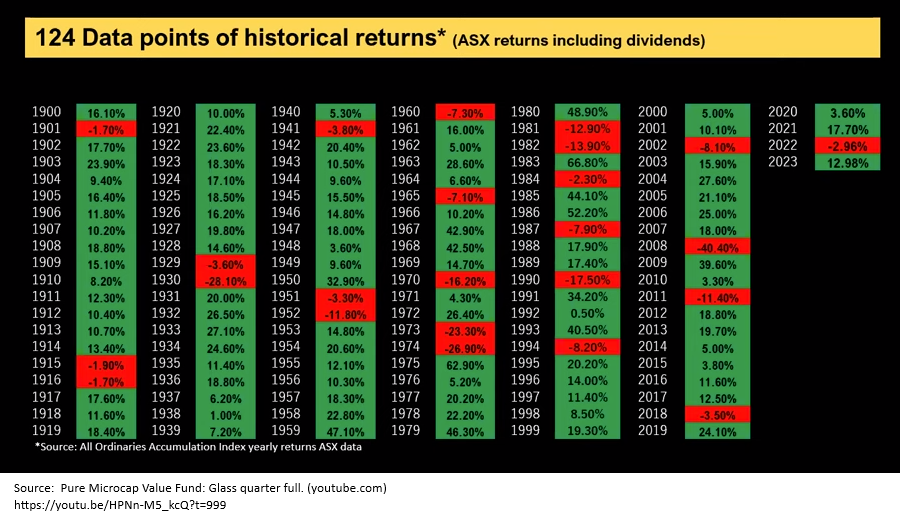

Came across this chart in the past couple of days from that Microequities Asset Management Presso that somebody here linked to, and it shows that we should expect 1 negative year out of every 5 years on average, based on historic returns of the All Ords Index:

As long as we have a reasonably decent process of good stock selection, we should do well over time, but a minimum target investing period (or time horizon) of 5 years is helpful in achieving that.

Here's a link to that point in their presso if you want to hear the context around the chart inclusion: https://youtu.be/HPNn-M5_kcQ?t=999

Duratec is one of those companies where I wouldn't be too surprised if they fall further or trade sideways for a while until the market is once again convinced that they are growing their WIH/Order Book at a good clip as well as increasing their profits, so it might take 5 years, hopefully not, but it might. We shouldn't always expect companies to shoot northeast as soon as we buy some of them, it's a game of waiting - having a good process and then letting time do its thing. Company management teams can make all the right moves, but it often takes a while for the results to show up in the share price, and the best company management teams are thinking longer term anyway, as co-owners of the business (because the best management teams have skin in the game like these directors do) so they are looking to build stronger, more resilient companies that are best placed within their industry in future years.

One example is with these contracting companies - either engineering and construction or mining services or infrastructure services - all relatively low margin businesses, so good management teams choose to chase relatively higher margin work and turn down work where there is a higher chance that they could lose money if things don't go to plan, and that can show up as lumpy revenue that can fluctuate significantly from year to year. That lumpiness can be simply due to the nature of the industry or the workflow within the industry, but it can also be impacted by management decisions relating to the type of work that they want to chase. We don't have total visability of this of course, so that's where we want to back competent management with skin in the game and a decent track record of making sensible and strategic decisions that should move the company in the right direction over future years.

Sometimes that involves some pain first before gain in subsequent years. Sometimes...

Not saying that there's pain in store for DUR shareholders (I am one) however it's something to be aware of as a possible eventuality and not something that would necessarily indicate the investment thesis was busted. Sometimes things get worse before they get better. As long as they DO get better.

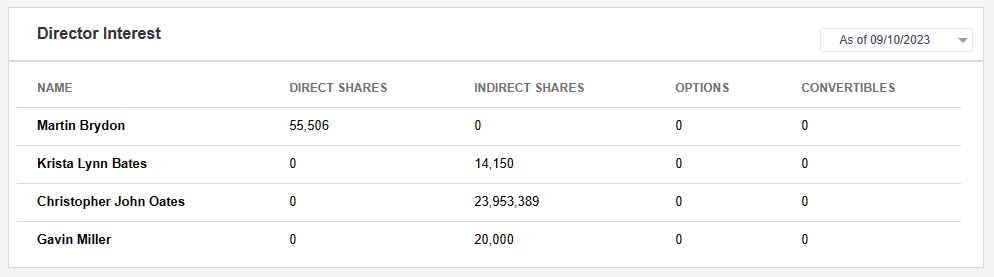

DUR has retraced from just over $1.70/share in January to below $1/share - they closed at 99 cps on Monday (29-Apr-2024), and it seems that some of the Board members (half of them as there are only 4 on the DUR Board) either see value down here or else are trying to signal to the market that there is value down here.

The old saying is there are many reasons for management (including Board members) to sell their shares but only one reason to buy.

Well there's clearly at least 2 reasons to buy - (1) Because you see value, and (2) Because you want to signal to the market that there is value in the share price (the shares have been oversold). They are similar but not exactly the same, and it's usually impossible to know which one applies. One thing that would sway my thinking there would be the SIZE of the purchases, and these purchases are NOT huge, they are modest, but then this is only a $254m microcap company, so perhaps these purchases are significant in that context.

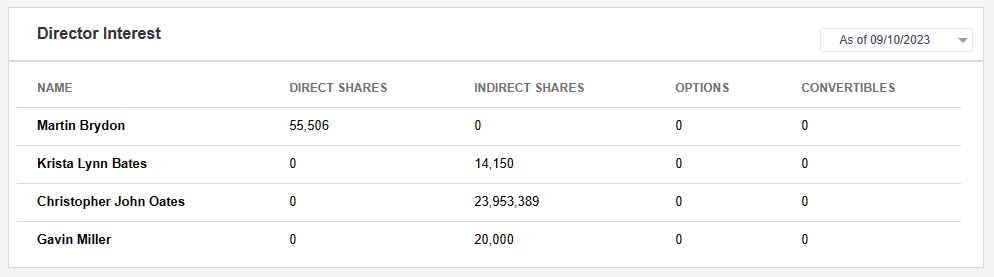

Here's what the Duratec directors' owned prior to last week's buys:

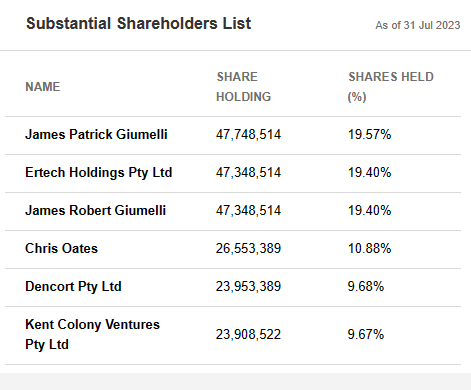

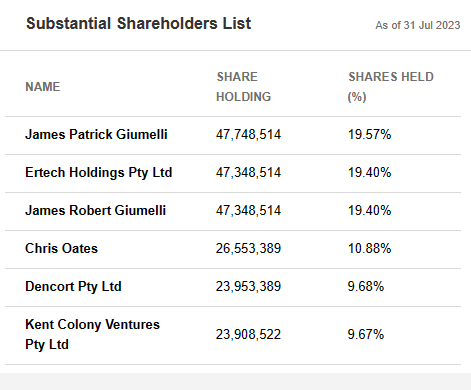

Chris Oates is their MD by the way, so the boss man, and he has over $24m worth of DUR shares, which is 9.68% of the company. Here are their Substantial Shareholders:

Phil Harcourt, Chris Oates and Deane Diprose are three founding directors of Duratec, and together they sold down 8.5 million DUR shares in September (2023) which represented 3.4% of the company’s issued capital at that time and they said the sale "enables increased liquidity and free float as well as greater personal diversification for the vendors."

The sale was undertaken at a price of $1.35 per share by way of an underwritten block trade. Following the sale, founders Phil Harcourt, Chris Oates and Deane Diprose each retained a 9.7% shareholding in Duratec. "Mr. Harcourt, Mr. Oates, and Mr. Diprose remain committed long-term shareholders of the Company and have no intention to sell any further shares in the medium term."

Source: Partial-Share-Sale.PDF [08-Sep-2023]

That's the bottom three taken care of in the above table:

- Chris Oates, 9.68% (that 10.88% listed in the table appears to be incorrect based on all of the forms lodged by DUR); Chris is the current MD of Duratec.

- Phil Harcourt (Dencort), 9.68%; Phil was the MD of Duratec until 03-Dec-2023.

- Deane Diprose (Kent Colony Ventures), 9.67%; Deane is an executive manager at Duratec and was a founding director - see here: (24) Deane Diprose | LinkedIn

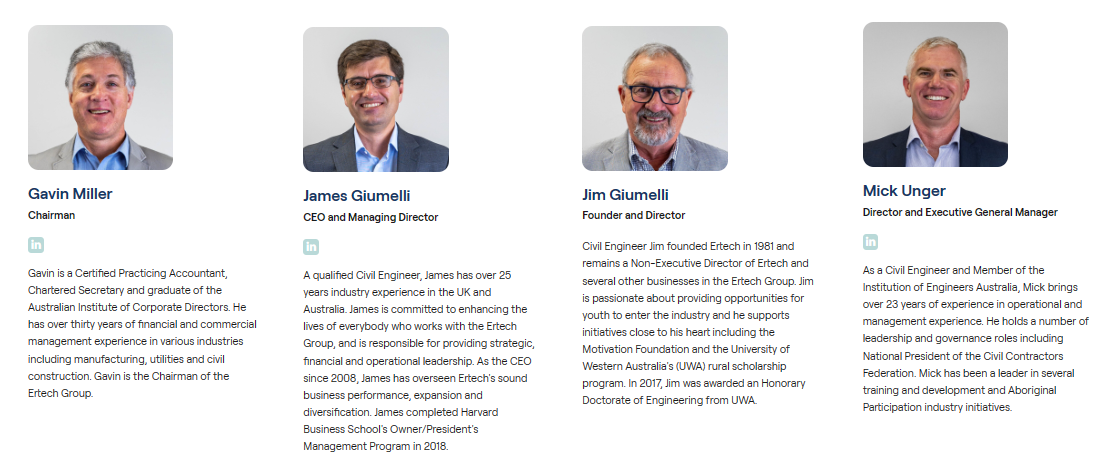

And then we have the top 3, which appear to total 47.75m shares worth 19.57% of DUR which are held by Ertech Holdings, a private company controlled by founder Jim Giumelli and his nephew James Giumelli, and one of them holds 400,000 DUR shares in addition to the 47,348,514 held by Ertech, hence speaking for 19.57% instead of 19.40%.

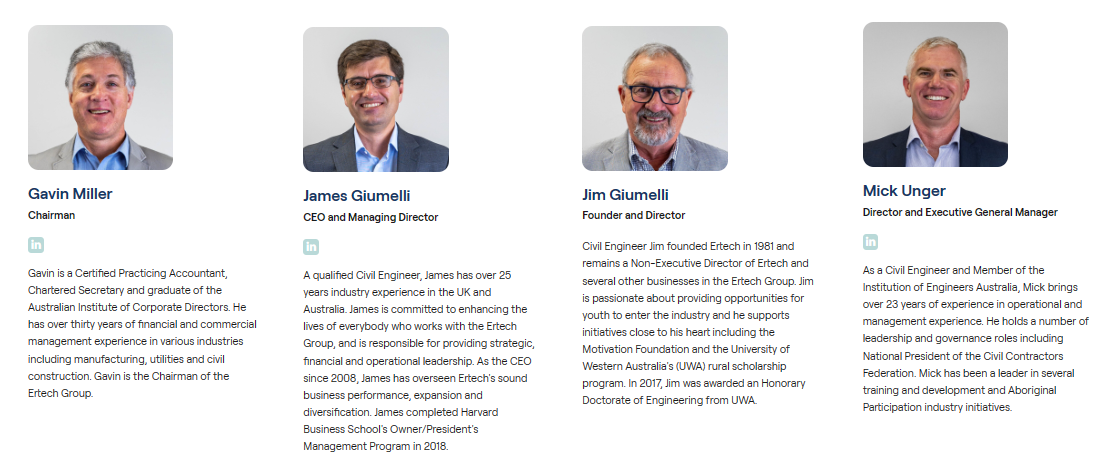

Ertech is an Australian and employee-owned civil and electrical construction business, delivering services to the private sector, and local, state and federal governments across Australia. Their head office is at 118 Motivation Drive, Wangara WA 6065, and they also have a Queensland division.

James Giumelli is Ertech's CEO and he was a director of Duratec from Nov 2014 to Aug 2020 (for 5 yrs & 10 months) when Duratec was still part of Ertech - see here: (24) Experience | James Giumelli | LinkedIn

His uncle is Jim Giumelli, the founder of Ertech. Duratec was the name of Ertech's Maintenance Business which was spun out of Ertech (floated on the ASX) in 2020, and Ertech retained a 19.4% stake, which is why Ertech's founder Jim Giumelli and his nephew James are listed as "Subs" for DUR because it is considered that they control Ertech.

See here: Ertech workers enriched by dividend windfall | The West Australian

Ertech workers enriched by dividend windfall

by Sean Smith, The West Australian, Thu, 26 August 2021, 7:24PM

Ertech founder Jim Giumelli in 2017.

A dividend windfall has catapulted a handful of long-serving workers at the privately-owned civil construction and engineering group Ertech into the ranks of the State’s millionaires.

The workers are amongst 35 employees who are also shareholders of Wangara-based Ertech, which banked $24 million from the sharemarket float of its Duratec maintenance business late last year.

Ertech has now returned about $19m of the surplus cash to its shareholders, including senior management, taking total payouts to about half a dozen veteran employees over their time with the group past $1m each.

“There’s some long-serving employees who have become millionaires from holding the stock,” Ertech executive chairman Gavin Miller said.

Mr Miller said the employee ownership had worked well, with the participants “truly invested” in the success of Ertech’s clients. The group has about 350 employees in WA and NSW.

“People who have been with us for a while understand (the scheme), and they’re easier to encourage in,” Mr Miller said.

“New employees often just want to wait and see. But I think after this, we should be able to encourage a few more to buy in.”

Ertech will also spend $7m on a selective buyback and cancellation of up to 415,000 shares from founder and former chief Jim Giumelli and other shareholders.

The buyback will further reduce Mr Giumelli’s holding in Ertech from about 52 per cent to near 32 per cent.

The former EY Entrepreneur of the Year award winner owned about 66 per cent before selling into a 2017 buyback that coincided with him stepping down from executive duties with Ertech in the final leg of a staged retirement from the group he founded in 1981.

“In our 40th year of operation, I am proud that the business is in a strong and stable financial and leadership position to enable a successful transition of majority ownership of the company from myself to our valued employee shareholders,” Mr Giumelli said.

Mr Giumelli said he had no intention of reducing his shareholding further “for the foreseeable future”.

--- ends ---

See also: Ertech to look east for its earnings | The West Australian

Ertech to look east for its earnings

by Peter Williams, The West Australian, Wed, 9 November 2016, 12:06PM

[i.e. well before they spun Duratec out of Ertech]

Private contractor Ertech Holdings is putting more of its eggs in the east-coast basket after buying Queensland’s Moggill Constructions.

The move comes in the wake of founder and majority shareholder Jim Giumelli stepping down from his executive role after 35 years.

Describing business conditions in WA as “absolutely woeful”, Mr Giumelli said the board took the view a couple of years ago that it had to expand interstate.

“We weren’t flogging a dead horse here but the opportunities existed over east,” he said.

Moggill is a 43-year-old business involved in civil engineering construction, mainly in public infrastructure.

The deal follows Ertech setting up in Sydney over the past year. It has had a presence in Melbourne for about a decade, while subsidiary Duratec also operates in the east.

Managing director James Giumelli, the founder’s nephew, said about 80 per cent of Ertech’s $292 million revenue came from WA in fiscal 2016. Net profit was $9.6 million.

“It’s still very competitive in WA,” he said. “There are some good opportunities but you have to be quite selective about the ones you target.”

Director Gavin Miller has taken over the executive chairman role.

“I’m still a director on the board and give my tuppence worth on probably more things than I should,” Jim Giumelli said.

A beef cattle producer, the 69-year-old plans to gradually sell down his stake in Ertech, whose shares are held by about 50 employees.

--- ends ---

In summary, this appears to me to be about people who can succesfully build good businesses and think like business owners rather than just managers, because they ARE part-owners of the business.

Ertech remains a privately owned business.

Duratec is ASX-listed, and I hold Duratec shares both here and in my largest real money portfolio. Duratec's largest shareholder is Ertech (with 19.4%), and Duratec was part of Ertech before they were spun Duratec (their Maintenance business) out into a separate company. Both Ertech and Duratec have management with significant skin in the game.