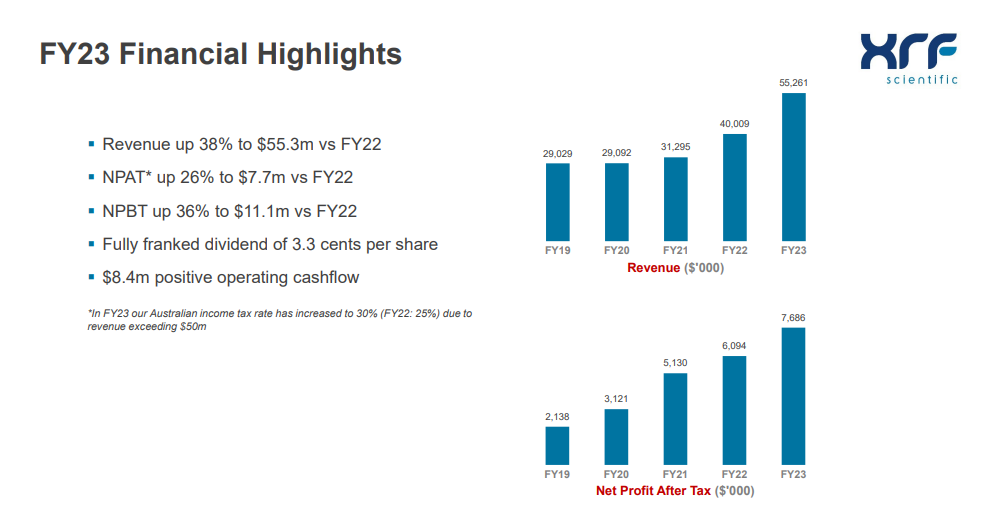

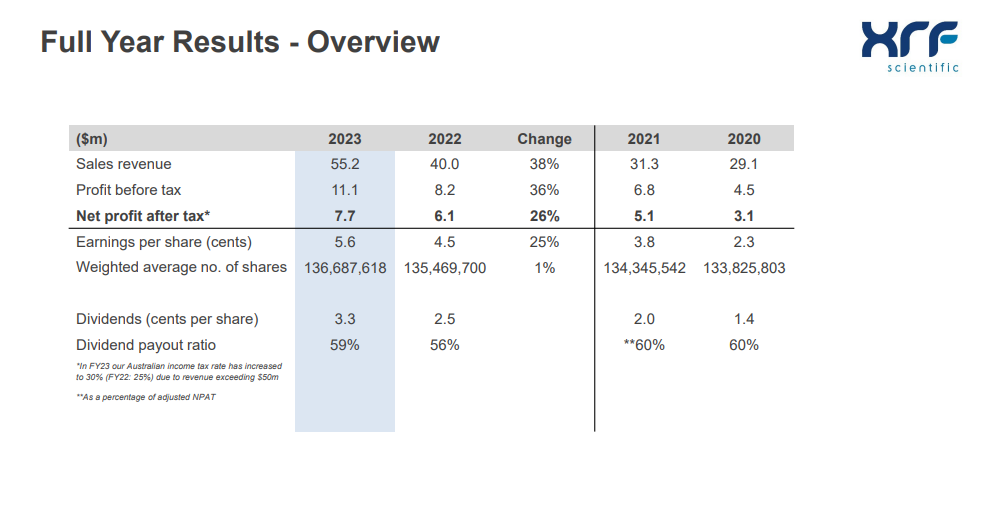

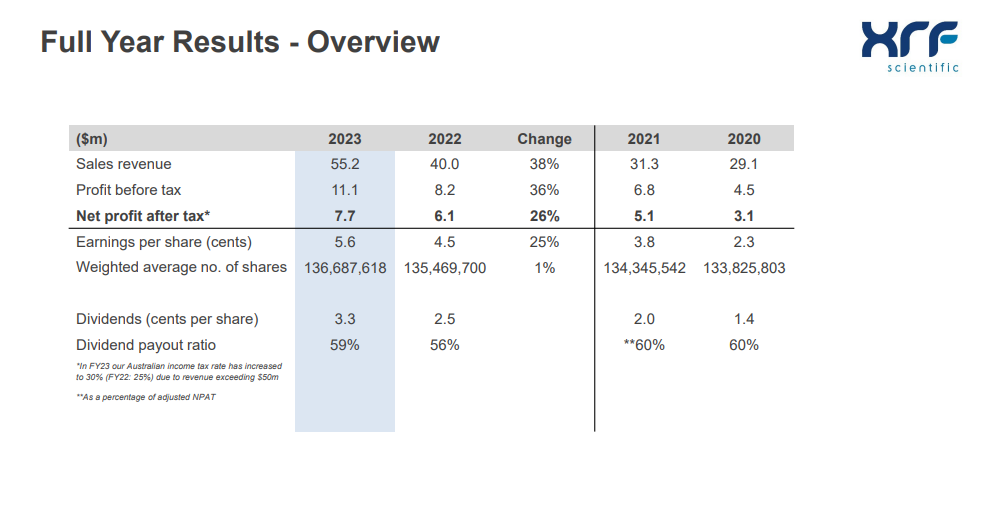

Record revenue and profit

Very strong demand from mining and industrial customers

Strong demand for capital equipment products, currently at record order levels

Launch of new product line: xrTGA thermogravimetric analyser

Continued R&D investment in new products across all divisions

XRF SCIENTIFIC LIMITED (ASX:XRF) - Ann: 2023 AGM Presentation, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

Outlook: We expect the December 2023 quarter to be a positive period, with a focus on machine lead times, xrTGA sales, new product developments and international sales growth

Return (inc div) 1yr: 22.99% 3yr: 52.81% pa 5yr: 48.26% pa

Market Cap; $132M

*limited analyst coverage along with low trading liquidity holds XRF back. Reduction in mining industry generally