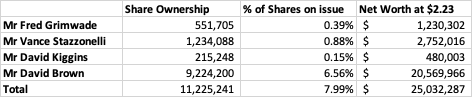

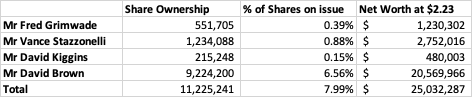

Current Market Cap at $2.23 is $313.3m

Management Bio's

Mr Fred Grimwade (non-executive Chairman)

Mr Grimwade is a Non-Executive Director of Australian United Investment Company Ltd and is a Principal and Executive Director of Fawkner Capital Management Pty Ltd, a specialist corporate advisory and investment firm. He was formerly the Chairman of CPT Global Ltd, and a Director of AWB Limited and Select Harvests Ltd. He has also held general management positions at Colonial Agricultural Company, the Colonial Group, Western Mining Corporation and Goldman, Sachs & Co. He has a broad range of experience in strategic management, mining, finance, corporate governance and law.

Mr Vance Stazzonelli (Managing Director)

Vance joined XRF Scientific Ltd as Chief Financial Officer in October 2009. He was subsequently appointed to Chief Operating Officer in January 2011 and then Chief Executive Officer in August 2012. On 22 February 2018, he was appointed as Managing Director.

Mr David Kiggins (non-executive director)

Mr Kiggins is a Chartered Accountant and Chartered Secretary, and currently Chief Financial Officer of Sadleirs. He has previously held senior finance positions at Arthur Andersen, Automotive Holdings Group Ltd, Global Construction Services Ltd, Heliwest and Stealth Global Holdings Ltd. He is experienced in finance, mergers, acquisitions, corporate governance and consulting. He has worked in mining, resources, automotive retail, construction services, telecommunications and general industrial companies.

Mr David Brown (non-executive director)

David has over 40 years of experience in the research, development and manufacturing of X-ray flux chemicals. He pioneered the commercial development of X-ray fluxes in Australia and was responsible for the commercialisation of current formulae now used by most Australian X-ray flux users. David was previously Chief Chemist for the Swan Brewery Co. Ltd, where he carried out research involving the separation of proteins by gel electrophoresis, a technique that has subsequently progressed to the modern techniques of DNA separation and profiling. David holds B.Sc. and B.Ec degrees from the University of Western Australia and has held the position of Chairman of the Scientific Industries Council of WA.