Update: 5 September 2025

I have withdrawn my SM $4DX valuation. I am keeping the illustration here, below, unchanged for transparency and my own learning.

The reason is that in seeking to independently verify management's $1.1bn market sizing claim for NUC:VQ in the US, I am finding several observations that cause me to lose confidence:

- The market is likely significantly smaller, if I exclude sources that trace back to $4DX or the reference they've cited.

- Primary source analysis of US CMS databases confirms @Chagsy's observation that the procedure count decline in NUC:VQ and which can be confirmed as a US-market wide trend as reported over the period 2004-16 in the JAMA article I cited earlier, can be observed to continue over the period 2020-24. The decline is material and appears to be ongoing.

- An initial market size analysis driven by publicly-reimbursed procedure counts and reimbursement rates, and scaled for likely public-private splits and rates, leads to a conservative estimate of US$230m (AUD354) and a more balanced estimate of US$365m (AUD561m).

Again, the above numbers might also contain errors, but at least I have transparency of them to primary source data of procedures actually report. I am not reliant on some consultant's TAM report.

Thus, there is a potentially material error in my illustration of the potential value of $4DX that is attributable exclusively to CT:VQ displacing NUC:VQ.

As I have not completed my market deep dive, nor assessed the other value drivers for $4DX, I do not at this time have a valuation update to replace those posted yesterday. However, from the above notes, you can see the numbers will be very different.

Again, I want to emphasise that my analysis was solely focused on the NUC:VQ opportunity. There is a lot more to $4DX than that. It's just that I don't have a number for that yet!

Meanwhile, the SP soars upwards relentlessly, +25% today at the time of writing. (HC rules!)

And, as ever, this is not advice and you must do your own research.

Disc: Held, but I will be taking some profits in RL today (I'll let it run on SM for fun!)

---------------------------------------

Original Straw: 4 September 2025

Having realised I didn't allocate nearly enough capital to $4DX 5 weeks ago, even though I had a reasonable idea it was about to hit a transformational milestone, the question obviously arises "when should I be prepared to allocate more"?

It is of course important to not get caught up in the market reaction and hype and I find no better antidote than diving into ... yes, you guessed it ... a spreadsheet.

There's massive uncertainty around this business, but equally, there are some pretty solid facts to ground the valuation on. So, in this Straw, I'll layout how I've made some estimates of valuation.

In this case, I've reverted to a DCF, because the economics of the business are really quite simple, and I will go with that.

1. The Market

Quite simply, CT:VQ will over time replace NUC:VQ. It is as effective, much cheaper and more accessible. (I haven't assessed second order effects such as, the potential to increase the demand for CT facilities, which seems logically to folllow. @Scoonie already having flagged the negative impact on demand for nuclear medicine facilties.)

$4DX have estimated their TAM as 1.1bn in the US and 1.5 bn in RoW.

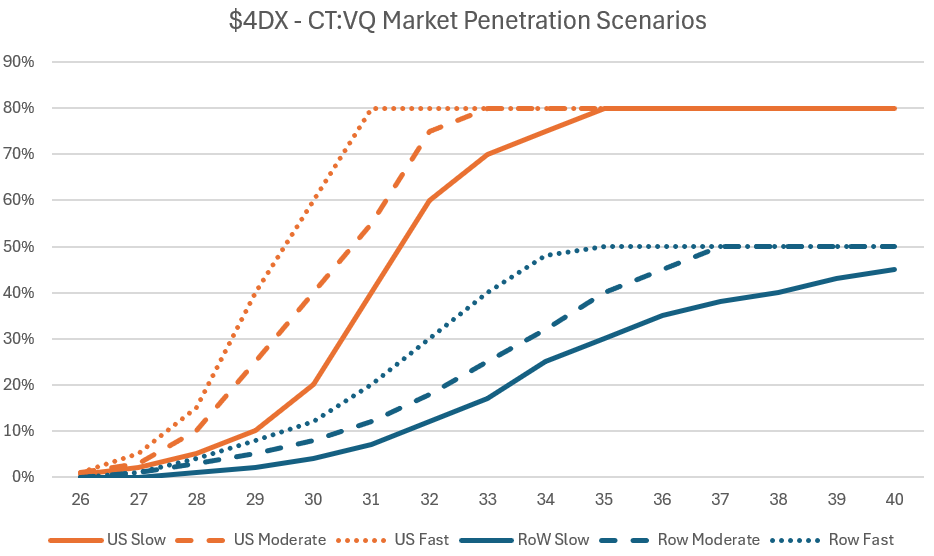

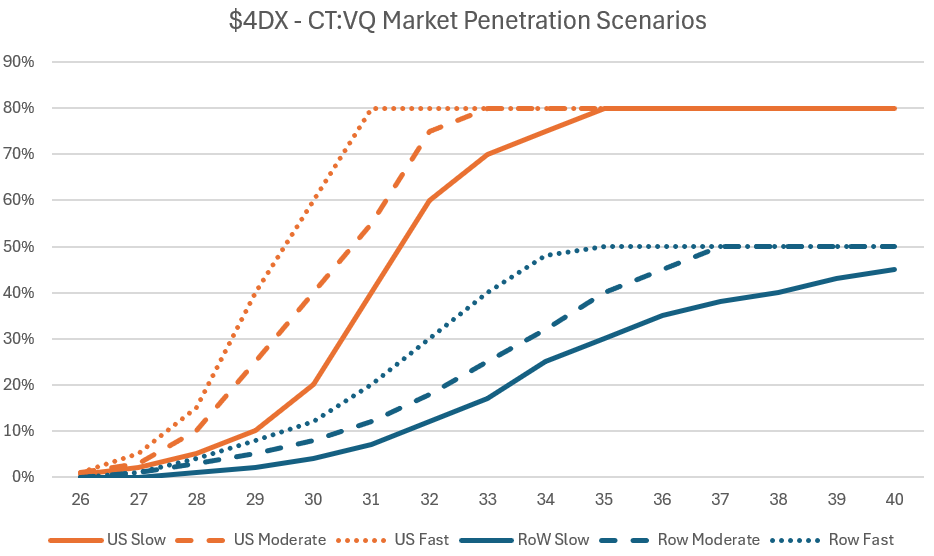

So, I will run three adoption scenarios, Slow, Moderate, Fast, where in the US 80% of the NUQ:VQ market is displaced, and in Row only 50% is replaced, as a lagging rate.

Rather than describe each scenario, here's what they look like in terms of market penetration.

Obviously, there are scenarios where the maximum penetration achieved is significantly lower. However, based on the data presented, this is really looking like a true technology replacement modality. Nonetheless the residual 20% in the US and 50% in RoW present some conservatism in the long run numers that drive the NPV.

2. Revenue

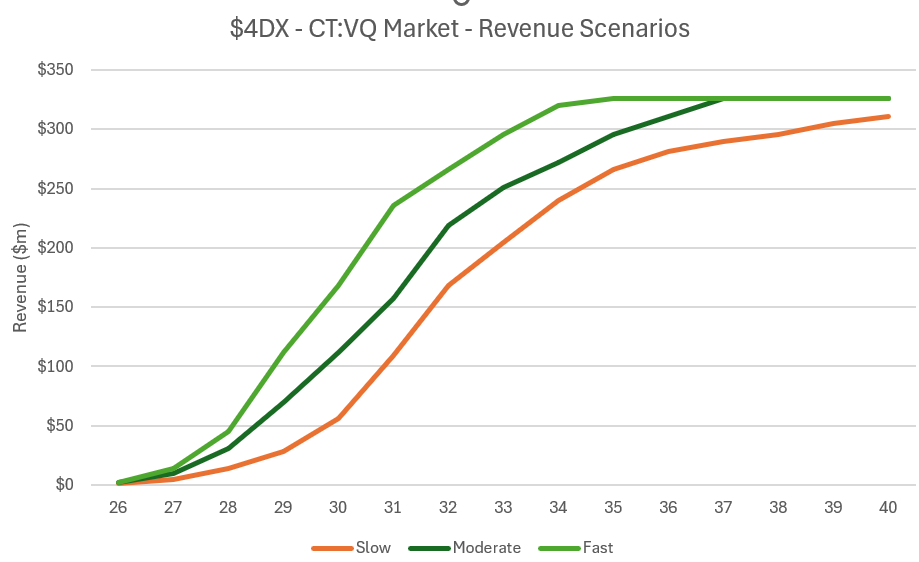

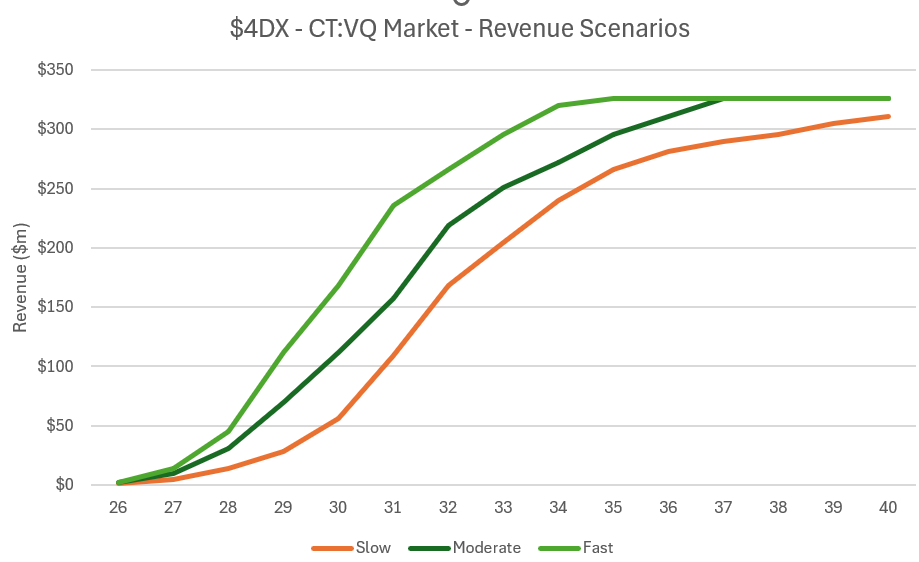

Calculating revenue is then simply the TAM x % market market penetration x Gross to Net.

I've assumed a GTN of 20%.

How reasonable is this?

Well in medical devices there are several possible supply chains:

$4DX - Hospital - Patient

$4DX - HMO - Hospital - Patient

$4DX - PACS Vendor HMO - Hospital - Patient

$4DX - Equipment Vendor - HMO - Hospital - Patient

Depending on the model the manufacturer ($4DX) can end up with anything from 10% to 40% of the revenue, skewed to the lower end.

However, $4DX is a breathrough technology, there is no alternative using CT methodology, and the modality offers significant advantages over the standard of care.

Therefore, in the direct sales model, $4DX should be able to keep 30+% of the $650 per scan, and even in the distributed chains, it should be able to negotiate better than the market norms.

So, I think 20% GTN is a reasonable assumption.

The resulting revenues are shown below:

3. Costs

I'm essentially assuming COGS are $0 (actually $4 per $650 scan). No a biggie for this guesstimate.

3.1 Opex

Opex is currently running at about $48m p.a. - that's a lot - although they have recently implemented some cost savings, to significantly reduce the burn rate.

However, I think they need to step up US sales and marketing, so I am going to step them back up to $50m in FY26 and inflate at 5% p.a.

3.2 Capex

Most of the develop costs appear to be expensed, however, I am going to put in $5m capex p.a., escalating at 5% p.a..

Other Assumptions

I have ascribed not value to $4DX's other products, other than the base $5m revenue from 2025, which is assumed to contine.

SOI - I assume capital will be raised soon to bring FY26 SOI to 500m, and thereafter to grow at 1% p.a.

WACC - 10% (sensitivity run at 15% discount rate)

Tax - 30%

DCF model run to 2040, with continuing value growth of 3% p.a.

4. Valuation Outputs

(in parenthesis I've added a sensitivity with a 15% discount rate)

Scenario1: Slow = $1.26 ($0.44)

Scenario 2: Moderate = $1.64 ($0.69)

Scenario 3: Fast = $1.92 ($0.91)

Conclusions

These are just one set of illustrations for what this business might do in the success case.

However, the potential is exciting enough that when the current froth blows off, I'll consider adding more around $0.70.

In terms of my SM valuation, I will put in the "Slow" senario of $1.26, and for the range around this I will put $0.50 - $2.00, as guesstimates.

Disc: Held in SM and RL