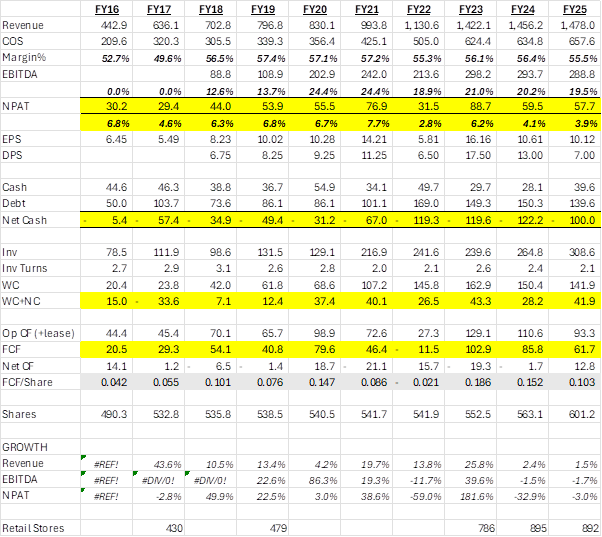

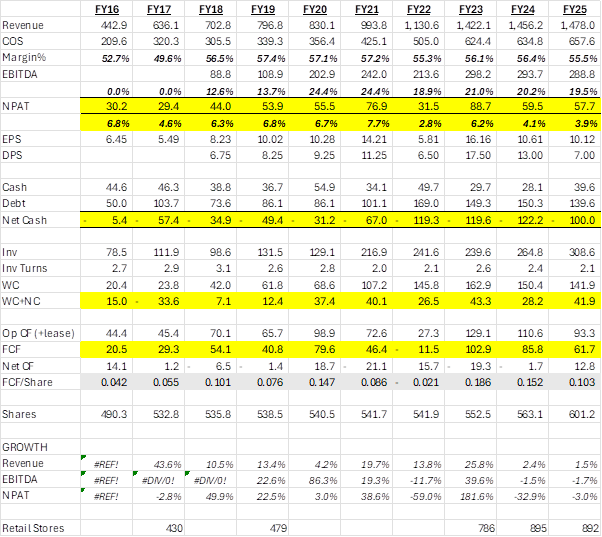

Having followed and held Accent pre-Covid (2016-18) I have held a favourable view of the business with it having had exceptionally strong sales and EPS growth to that point, high and defendable margins from mostly exclusive brand products. However about 7 years ago, from FY19 the sales growth and strong margin position has failed to convert into strong shareholder EPS returns, leaving only dividends or getting your timing right for a capital gain.

7 Year Itch

From FY19 the company seems to have frozen in time as far as shareholder returns are concerned. The top line has shown good growth (Sale up 85% and stores up from 479 to 892 FY19-25) but EPS is flat with NPAT up 7% in line with share count.

A question directly on this disparity between sales growth and EPS growth was asked at the AGM, the chairman offered no explanation, simply a hart felt desire to return to EPS growth but no plan to do so, effectively not answering the question. Investors got the message, selling it down to $0.95, the lowest since 2017 outside of the Covid dip, with no growth priced.

Other changes in the business over the period include an increase in negative net cash balances, this has been in line with sales growth and also working capital growth, so reasonable and appropriate in my view. FCF over the period is in line with NPAT with most (90%) being paid out as dividends, so little investment back into the business. However, Inventory Turns have dropped to 2.1 from high 2’s as inventory has grown faster than sales.

Sales per store is the same in FY25 as it was in FY19 at $1.66m per store, yet the profitability per store has fallen from $113k to $65k in line with NPAT% dropping from 6.8% to 3.9%. I assume prices increase over the period, so either volumes have fallen or sales ranges have started to skew towards lower price/quality products (cost of living?).

It doesn’t look like rental costs changed much or are possibly down from $194k to $172k per store (rent reductions over Covid provide a reason why). Due to how rent is accounted under lease accounting rules which changed in FY20, I have used cash payments for FY25 to compare to expenses for FY19, so it’s not fully accurate, but should be a good proxy.

Employee costs have increased from $339k to $361k per store which is only 6.6%, given the wage inflation between FY19 and FY25 would by much large than this, it indicates headcount reductions per store. Due to a lack of growth in sales per store, this has resulted in employee costs increasing from 20.4% of Sales to 21.8%, a 1.4% increase which explains about half the 2.9% drop in NPAT% from 6.8% to 3.9% from FY19 to FY25.

Another possibility/explanation for the drop in lease costs and subdued employee cost growth is that new stores are being opened in less popular locations. Lower rent, less staffing required but lower sales compared to prime locations, hence growth requires expanding via less profitable locations.

The other part of the drop in NPAT% is due to gross margins dropping -1.9% from 57.4% to 55.5%, which is normally not a big issue when sales go up 85% over the period. The problem is that the cost base has shown no economies of scale, in fact it has show diseconomies of scale with employee costs increasing faster than sales, offset slightly by lower lease costs as a proportion of sales. They have to run faster to stand still – saturation of the market?

Value With or Without Growth

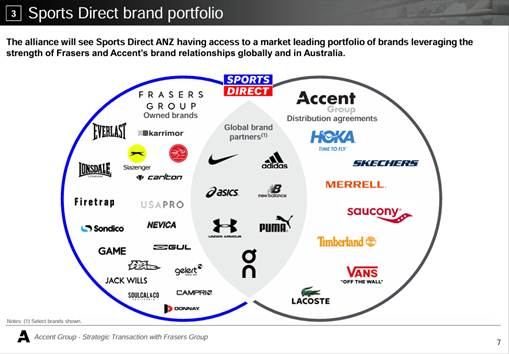

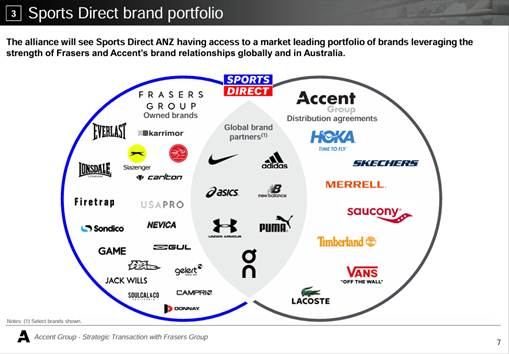

The November trading up date of “challenging” retail conditions for the first 20 weeks of FY26, Like for Like sales down 0.4% and gross margins down -1.6% have reinforced/highlighted the issue. The companies purchase/partnership with Frasers Group to add the Sports Direct business provided $49m in capital at a 5% dilution comes with plans for 50 new stores over the next 6 years, so about a 5% store count growth to offset the share count 5% dilution (ie no EPS growth). Also the MySale business (an online side hustle of Frasers included in the deal) is being wound down having clocked $3.5m in EBIT losses in just 4 months to October 2025.

The addition of Sports Direct expands the Sports retail portfolio which is more resilient than the Lifestyle retail portfolio that many of Accent’s brands fit into. It is a large store format, so the economics of the store may be better, but margins will be lower because ranging will include more non-exclusive product via a broad range. It does provide Accent an additional channel for exclusive brands and also adds some new quality exclusive brands (see below).

The first store was opened at Fountain Gate in November and 3 more are planned in FY26, so even if it’s a raging success it will not move the dial for quite a while due to representing such a small part of the company. It is however a growth opportunity, and the company is continually closing underperforming stores and opening new ones and experimenting which should at least ensure they remain relevant and competitive.

If there is no growth but earnings are maintained a PE of 10 would provide a 10% return. A PE of 12 would assume system growth rates around 2%. Neither assumption is particularly demanding and as such the current price looks reasonable. However, I would expect the dividend to drop as capital is needed to expand Sport Direct beyond that already provided. The dividend for the last half was 1.5c, which is a warning of this with the previous being 5.5c. The full year dividend dropped from 13c to 7c FY24 to FY25, still a 10% yield if franking credits are included at the current price of $0.95, but be prepared for the dividend to go lower.

If they can get earnings growth of 5-7% on a sustained basis, then a PE of 17-20 would be justified (assuming interest rates around current levels). So the price per share could easily double, where it was back in May and many times over the last 7 years.

Conclusion

So failing bad news, the current price looks good and is a bargain if they can find some growth soon. Sports Direct may help over the next couple of years, but they really need to find a way to improve the business economics. Early FY26 figures say that isn’t going to happen, but their full year EBIT expectation of $85-95m suggests low single digit growth, which is all they need to provide good returns to shareholders from here.

It is probably a favourable asymmetric bet at this point, I am still undecided especially with how the year has started. A lower price or more information that suggests a turn around on the current trajectory would get me across the line. As usual, we will know if it’s a bargain or not with perfect hindsight in the future.