Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

After today's CEO interview, I ran some numbers on CleanSpace and wanted to share a summary. I've looked at three different scenarios and put together DCF models, each with different assumptions about the future. The main inputs I've played with are the discount rate, the long-term growth rate, and margins.

Conservative: $0.45 - $0.65

High WACC 14-15%, revenue growth tops out at 15%, gross margins compress to 70% due to competition. This is the 'small fish in a big pond' view.

Realistic: $0.70 - $0.90

Moderate WACC (12-13%), growth starts at 18% and tapers to 10%, gross margins are maintained around 73-74%. This is the 'decent execution, but there will be bumps' view.

Optimistic: $1.00 - $1.40

Lower WACC (11-12%), strong growth for several years, margins expand to 80% as the 'razor-blade' model entrenches itself. This is the 'we're the next Aussie success story' view.

I reckon the Realistic case is the most sensible. It acknowledges the company's advantages and recent momentum, while also being realistic about the threats from massive incumbents like 3M.

At the current price of 78c, CleanSpace is trading right in the middle of my realistic valuation range. You're not getting a bargain, but you're not paying an outrageous premium either. Personally, I'm waiting for an entry at $0.70 to provide some margin of safety against potential execution risks.

I quite enjoyed this chat. And it's certainly peaked my interest with Cleanspace.

What I like:

- Clear revenue momentum

- Passed breakeven, with positive cash flow

- High and growing gross margins

- "Razor and blade" model, with 47% of sales for consumables.

- Guidance for >20% revenue growth

- Can double volumes without any material CAPEX

- Founder still around

- Forward P/S of 2.6x not excessive *if* sales momentum can be sustained and they can demonstrate good operating leverage

What to watch:

- A tiny player in a competitive market

- Short track record

Anyway, the recording is on the Meetings page and you can access the transcript here: CSX Transcript.pdf

Here's the chatGPT summary:

CleanSpace Technology (ASX: CSX) – CEO Gabrielle O’Carroll Interview Summary

Company Overview

- Sydney-based designer and manufacturer of powered air-purifying respirators (PAPRs).

- Products primarily target industrial sectors: mining, tunneling, welding, manufacturing, and fire services.

- Recently launched the CleanSpace WORK respirator into the U.S. market.

- Reported 26% revenue growth in FY25, with gross margins at ~75%, increased cash holdings, and positive free cash flow in 2H FY25.

Market Dynamics & Growth Drivers

- Market growth: Global PAPR market projected to grow ~7% annually over the next five years.

- Adoption tailwinds:

- Rising awareness of respiratory safety (e.g., silicosis cases in tunneling projects).

- Regulatory push from bodies like WorkSafe (AU), NIOSH (US), and global equivalents.

- Legal and moral dimensions drive enterprises to invest in high-quality protection.

- Geographic expansion: Increasing global reach, with varied adoption rates across countries.

Product Features & Differentiation

- Price range: ~$900–$1,600 per unit, depending on the model.

- AirSensit technology: Breath-responsive airflow adapts to user breathing rates, reducing battery size, weight, and user discomfort.

- Bluetooth integration: Provides fit checks, usage tracking, and compliance reporting.

- Data-driven insights:

- Enables customers to monitor compliance, filter usage, procurement planning.

- Differentiates CleanSpace from competitors; currently, competitors lack similar data capabilities.

Business Model

- Razor-and-blade model:

- Respirator units sold upfront; filters and masks drive recurring revenue (~47% of total revenue today).

- Consumables have higher margins than units.

- Distribution-focused sales:

- Works through partners like Blackwoods in Australia.

- Distributors hold inventory and provide after-sales support.

- Aligns with market norms, where buyers expect to source PPE through established distributors.

Competitive Landscape

- Competes against global giants: 3M, Honeywell, Dräger, Sundström, etc.

- Key advantages over competitors:

- Lightweight, head-mounted design with superior comfort and compatibility.

- Bluetooth-enabled compliance reporting.

- Faster customer service and shorter lead times (~10 days average).

- Agility in innovation cycles compared to slower-moving multinationals.

Manufacturing & Capacity

- In-house assembly in Sydney HQ; components sourced globally (mainly China & U.S.).

- Scalable production capacity up to ~$50M in annual sales without major new investment.

- Flexibility to increase output via additional shifts and workforce scaling.

Strategy & Innovation

- Focused growth:

- Doubling down on industrial markets, deliberately moving away from healthcare.

- U.S. strategy: Rebuilt the sales team with industrial PPE expertise to penetrate the market methodically.

- R&D investment:

- Continuous innovation pipeline, with several projects under development.

- Exploring lower-cost, mass-market models like the successful CleanSpace WORK, which already contributes 15% of global sales.

- Bluetooth-driven data capabilities are expected to become a long-term differentiator.

Financial Position & Capital Allocation

- Recently turned EBITDA and cash flow positive; goal is to sustain this through FY26 and beyond.

- Capital priorities:

- Invest in sales, marketing, and R&D to accelerate growth.

- Expand support for distributors and end-users.

- Explore capital management options (e.g., buybacks or dividends) once sustainable profitability is established.

Risks & Challenges

- Competitive pressure from global incumbents with broader PPE portfolios.

- Regulatory changes could impact product approvals and pricing.

- Macro uncertainty (e.g., U.S. tariffs, geopolitical risks) could slow industrial investment and decision-making.

- Managing shareholder expectations: balancing long-term innovation with short-term profitability.

Long-Term Vision (5-Year Outlook)

- Doubling company size through:

- New products from R&D pipeline.

- Geographic expansion, including emerging markets (e.g., India).

- Leveraging data and software integration.

- Retain high-performance culture, strong customer service, and agility while scaling globally.

Key Takeaways

- CleanSpace is transitioning from niche player to global contender in the PAPR market.

- Differentiated by innovation, data capabilities, and customer focus.

- Strong financial footing supports deliberate, focused expansion.

- Long-term upside lies in scaling industrial markets, expanding consumable revenue, and embedding data-driven compliance into customer workflows.

CSX has continued it's strong revenue growth, maintaining the 26% revenue growth from the 1H into the 2H and FY. Growth was strong across all regions:

Off a low base, but 45% in the US is very strong, particularly against the weaker USD this year.

No comment on margins unfortunately, but if they have remained steady I think CSX will achieve it's goal of being EBITDA positive this year.

Includes H1 2025....

Nice to see - on market trade of ~20k

Very pleased with results. Choose a metric and it’s improving both PCP and also H2 on H1 (aside from cash in bank but doesn’t look likely to need cap raise) Thanks to @Wini for introducing. Keen to hold and watch this one long term.

NB: thank you to @Wini for his work which informed and inspired my interest and analysis.

CSX requires sales growth of 20-30% to pivot into profitability in the next year or two and should see profit grow at around twice (in dollar terms) that of sales if it can maintain this growth rate. This is in contrast with the last 3 years where profitability has improved faster than sales due to significant cost reductions from restructuring the business, which is now mostly complete, hence no longer going to occur.

Take the below projection, assuming 30% sales growth, but expenses also start increasing at 6% in FY25 then by half sales growth and compare to an extrapolation of the FY22-FY25 projection of profit:

With around $7m in net cash and FCF break even due to low capital cost requirements, the business shouldn’t need to raise further capital and may be in a position to pay a dividend in a few years provide growth targets are achieved. Trading at 2x Sales with possible 20%+ net profit margins at scale, the current price is reasonable/cheap, but conditional on aggressive growth assumptions and upside will take several years to translate into PE rations the market will see as appealing and be willing to pay.

Instability of performance over it’s listed history and lack of tangible metrics to value the company as it pivots into profitability provides opportunities for investing at low valuations, but also likely to provide high volatility in price movements over the coming year as sentiment changes.

As such I am open to buying at below $0.40 but I am looking for additional support for the assumption that sales will grow at 30% or there abouts for the next 3-4 years. Good US market execution could do this as well as indication that growth in Europe is likely to continue despite conditions there.

So this is a thesis pending investment if the conditions look right at some time in the future.

Disc: I don’t own, but it’s high up on the watch list.

Cleanspace Holdings have announced the appointment of their new CEO.

The new CEO, Gabrielle O'Carroll has quite the CV, and appears to be quite the coup, as she is the main competitors Asian Industrial Sales Director, with many years of established contacts in the Industrial sales channel.

Half of Gabrielle's long term incentive package is based on share price appreciation, with incentives based on achieving a share price of $1 - $2 by end of 2028.

DISC - HELD

Had the opportunity to tour Cleanspace Holdings facility after the AGM (Nov. 11) with @mushroompanda . Some of my notes from the AGM & tour:

All sales are via the distribution channel, and as a result, sales can be lumpy, depending on the re-sellers inventories (the MD stated they tell their distributors to keep inventories low, as they can supply stock as needed). When you look at the previous half year, the first 4 months generated $1.325 M per month. This then fell to $1 Million per month over Nov. to December. France sales represent 25% of all sales. The MD reported they received some big French orders over the past few days and recently won an Irish Govt tender, and they are confident sales will outperform the quiet Nov - March period they experienced last FY. It is fair enough to be skeptical, we have seen this movie before when it comes to H2 guidance (or hopes).

Some additional things I learned: The new Work product is simply a re-badged Halo PAPR. They have 3 production lines - Ex. (explosion proof PAPR), CST Ultra & Pro (main products), and Work / Halo. Their production lines take up about 70-80 m2 of warehouse space (the filter production plant and lab take up about another 130 m2). They have a massive inventory, and they will be downsizing their warehouse by what I reckon is 1000 m2 (reducing operating costs by about $200-300k pa). The existing production line can deliver $70 M in sales per annum. So there will be no need for growth capital expenditure for many years, and there will likely be inventory, currently written off, being re-used on the Work PAPR.

Interestingly, they manufacture the HEPA filters in house. The MD complained they are too good, as consumable sales are not lining up with PAPR sales - Users tend to just run the PAPR fan / battery harder to get more filter life......They are looking into ways to reduce the pain / barriers to ordering replacement filters. Possibly a centralised app / platform to monitor device run times and alert customers when filters need replacing.

US sales team - Is being completely re-built, and the prior team was geared towards health sector, and was unable to pivot to industrial. They have a new US sales director, and they decided to sack the entire US sales staff and start again under the new leadership / strategy (Notably - they hired a new West cost sales manager over the past week or so). They are aiming to have a team of 4 in the US sales team.

Their production leadership originates from Resmed, and most to the production team has been there for years. Work and team culture look OK. They have applied innovations form Resmed devices, such as using onboard pressure sensors to modulate airflow according to the users breathing pattern, thereby minimising airflow and battery usage, which in tunr enables a miniturised product.

They have found the new CEO, and an announcement will be coming out in the coming weeks.

I have in my notes they are aiming / expecting for 15% revenue growth on H1 2023 (which seems doable if they maintain current monthly runrate) - which is also the same as H2 2024. Lets check in on this number after H1 results.......I would be happy enough with this - As long as they can get US sales traction by end of FY 2025.

DISC - HELD

Slightly edited copy and paste from latest Mere monthly report: https://www.merewethercapital.com.au/wp-content/uploads/2024/12/MC-Nov-24-Report.pdf

CSX is a classic busted IPO, floating in late 2020 on the back of an explosion in revenue to healthcare customers who received Government funding as a response to the Covid pandemic. After doing $11.2m in revenue to industrial customers in 2019, large sales to healthcare customers saw revenue grow to $28.4m in 2020 and $49.9m in 2021.

Unfortunately, healthcare customers panic buying respirators with Government funding sent a false signal to CSX management, who pivoted their business model to try and grow further into hospitals. While the industrial business is entirely sold through distributors who provide sales, training and support to end customers, CSX in-housed these functions for healthcare customers which saw the cost base of the business grow from $8.2m in 2019 to a peak of $24.9m in 2022.

A ballooning cost base combined with collapsing revenues from healthcare customers saw CSX swing from a $16m operating profit in 2021 to a $15.1m operating loss in 2022. The market reaction was savage, with the share price falling from highs above $7 to a low of 20c.

However, of course digging deeper shows a different story. Splitting out segment revenue shows an industrial segment growing at ~37% per year over the last two years while healthcare has fallen to essentially zero:

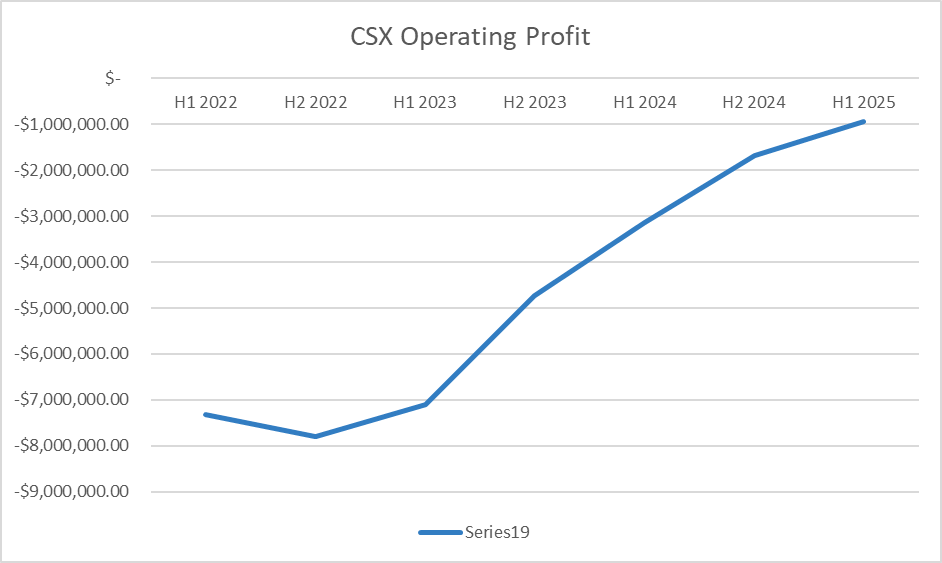

With the business shifting back to its previous operating model of selling industrial units through distributors, the excess cost base has also been removed with the business rapidly moving back towards profitability:

The market is often very poor at recognising business models that will exhibit exceptionally strong operating leverage as they scale. However, once the leverage shows up in the reported numbers, the market tends to get quite excited!

CSX has a business model that inherently has very strong operating leverage. It begins with 70-75% gross margins, world class levels for a manufacturer driven by CSX selling their PAPR’s with high-margin recurring consumables (masks and filters).

As already detailed, the use of distributors around the globe to reach industrial end customers greatly reduces the sales and support footprint required. As an example, speaking recently with the CEO he outlined how the US sales team was being restructured with the previous healthcare focused team let go with the current plan to have four industrial focused sales representatives for the entire country.

The manufacturing itself is also very capital light, with less than $1m in plant and equipment on the balance sheet as manufacturing is simple manual assembly.

Interestingly, the volatile history of CSX means we don’t have to guess what we think operating leverage may look like in the future, because the spike of Covid healthcare sales gave us a very brief glimpse of the business’s economics at scale. In the calendar year 2020, CSX did $60.8m revenue which resulted in $26m operating profit. Again, the potential for 40% operating profit margins is world class for a manufacturer.

So, all of that is to say I am confident that if CSX continues to grow it will soon become profitable and beyond that become exceptionally profitable. The key question is how confident can we be of future growth?

Answering that question begins with the product itself and how it compares to peers in the industrial PAPR segment.

CSX was founded by Dan Kao in 2009 after spending the previous 8 years at Resmed as a Senior Design Engineer. Dan saw the potential to take Resmed’s sleep apnoea respirator technology and apply it to the industrial market.

Generally speaking, competitors in the industrial PAPR segment are quite low tech, using fans to blow a constant stream of air through a tube connected to a face mask. With a constant stream, those PAPR machines will filter roughly 180L of air per minute, however by using a patented technology CSX products sense the changes in air pressure as a user breathes and only blows in filtered air as they inhale.

With that technology, CSX respirators process less than 50L of air per minute (assuming the user is breathing normally) meaning they can drastically reduce the footprint of the respirator unit. All other competitors use a backpack or belt mounted system to carry a unit that weighs 3-4kgs, but with a smaller battery and fans CSX respirators weigh less than 500gms and can rest on the back of the neck making mobility for users much easier:

Cleanspace Ultra compared to 3M Versaflo

Together with Bluetooth reporting technology to both end users and an enterprise level for work health and safety auditing, CSX has a best-in-class product that is priced roughly 10-20% cheaper than peers. While a product edge is no guarantee of success against large incumbent competitors, it provides the opportunity for CSX to continue to grow their business into the future.

However, it won’t be smooth sailing. The drawback to the low operating cost model of selling through distributors is CSX will be a victim to the re-stocking/de-stocking of inventory through its customers supply chains. Both end customers and distributors tend to order CSX’s products in bulk meaning period to period they can be victim to lumpy sales depending on ordering patterns.

Which brings us to the recent purchase of our position following a nearly 30% fall in the share price following a weaker than expected trading update at the AGM.

At their AGM during the month, CSX management updated the market disclosing that sales through the first four months of the financial year were flat on last year, below the 30% growth target they had previously set.

A few reasons were provided such as a disruption from the Olympics in their largest market of France and the transition to the new industrial focused sales team in the US slowing sales to new customers. However, I suspect the largest impact was the simple lumpiness that exists in the business that is exacerbated on the current low revenue base.

The start to this financial year was cycling a period of over 50% growth last year, benefiting from the roll-out of new products and partnerships with new distributors. While below budget/trend, management guided to 15% revenue growth for the first half of this financial year and maintained their 30% target for the full year. Speaking to the CEO after the AGM, they have seen normal ordering patterns returning from distributors and seeing very good signs from early US sales discussions.

At the current share price of 35c, CSX is capitalised at roughly $28m with a clean balance sheet with no corporate debt and $8.5m in cash. Management have guided to being at least EBITDA and cashflow breakeven for this financial year despite the weaker than expected first quarter.

However, given the operating leverage inherent to the business model, it is the 2026 financial year I expect to be the breakout. On the 2024 financial results call management stated that the cost base is now largely right sized, and moving forward they expect that to achieve their targeted 30% growth it may require costs increasing 5-10%.

Even taking a conservative view of 20% revenue growth and 10% cost growth, I expect the business can do $2m EBITDA which would look very reasonable against the current market capitalisation. However, like any business around the profitability inflection point, it is the incremental dollars hitting the bottom line that matter and in CSX’s case it should be quite exceptional.

Nonetheless, it is a new position in the Fund and not without risks so for now it is a medium weight in the portfolio. As I’ve said before, it usually takes the market a while to wake up to businesses inflecting strongly into profitability, so I suspect we will get a chance to add to our position if the thesis is playing out.

CleanSpace ha announced that their new Chair will be Mr Rathie who has board experience with 4DX Medical, Cettire CTT, and Polynovo PNV

Cleanspace announce the following regulatory approval that Cleanspace says increases their TAM:

- HALO devise meets NZ's Medsafe requirements and added to WAND database. Cleanspace report trails have commenced in NZ hospitals with HALOs.

- AX filter approvals in Europe and ANZ. THis increases the industrial applications the cleanspace PAPR can be used for.

Notably, there was no reporting of Q1 sales. They should have good data on this, given it is October 1. I see this as a negative...

DISC - I HOLD.

@Rapstar a follow up to your earlier straw on CSX. I agree a lot with this straw. Thanks for sharing Dr Berger tweet. I have been meaning to do a straw following the presentation however reporting season has been busy. So here are some of my thoughts on this company following results release.

I recently commenced a very small position in CSX in both strawman and IRL.

I do have some concerns with CSX and will not add to this until I see some further uptake in the product. Following last weeks results and investor call I continue to have concerns around their distribution methods. Currently CSX have a world class product that they are having difficulty getting traction. Essentially they have reps who sell a range of PPE products. With the over supply of N95 masks, cheaper prices of these and just the simplicity of them they will continue to dominate this field. The reps would benefit from selling larger products but they will also just sell what they have available and an over-supply of. I got the vibe they did not have much insentive to push the HALO product by Cleanspace over other products that these distributors sell.

Management mentioned they have had a lot of focus on distribution capabilities over the past 12 months. This includes adding to sales team including 17 new distributors in the industrial sector and expanding global training of the product. Lockdowns and just covid itself has restricted distributors particualry in the industrial side of things in the EU. They believe they now have systems in place to expand and are positive on growth.

Currently CSX sell to Healthcare (72% of sales) and Industrial (28% of sales). Over time this should be closer to a 50-50 split. Currently the Geographical split is 30% EU, 30% AUST, 30% in US 10% emerging markets. The significant area is the US with emerging dominance occuring in this market. In the US the healthcare sector dominates wheras in the EU sales are more Industrial dominant. This means that there is a lot of upside in the healthcare sector for the EU. Further as the Industrial sector starts to return to full functioning we should see further uptick in sales.

My take on CSX is that as the world opens up CSX will see strong growth. I do firmly believe a transition from being 100% reliant on Vaccines which appear to have efficacy issues on transmission will lead to a greater need of protection of healthcare workers. At the end of the day if they can mandate vaccines for the safety of workers and patients than they should ensure all avenues are considered and this is where CSX growth may occur. Staff such as the one @Rapstar linked will demand stronger protection and IMO N95 masks which have limited evidence will not be good enough and COVID wards, ICU, ED, Paramaedics etc will need to find better alterantives. I would further expect PPE supplies to come back to a more normalised amount compared to what we experienced over the past year and therefore the distributors may be more inclined to sell the HALO product.

An additional point was that each unit has a $120 per annum per unit cost for accessories and parts. Currently there are 100,000 units worldwide (if I heard correctly). This is similar to the ResMed approach where they make a lot of revenue from selling parts and accessories yearly to maintain the longevity of the product.

Disc- Held

Cleanspace Holdings sales & marketing capabilities / capacity is currently sub-scale, with around 20 employees in sales - globally. Just 3 are in the USA, and USA is a market they sell directly to. They rely on distributors in most markets, with direct sales, I believe, in Australia and the USA.

However, there is a growing movement of Health Care professionals advocating for safer workplaces and better protection, and an example of this is Dr Berger, who intends to buy a Halo device for his personal use, in the absence of the Hospitals providing them.

Anecdotally, there appears to be a bottom up movement from Health Care Workers (HCWs) to insist on access to a safer working environment that Cleanspace's can help provide.

Cleanspace have an enormous oppotunity ahead of them. It remains to be seen whether Cleanspace Holdings sales & marketing capabilities are up to the task.

Personally, I would like to see their sales team scaled up in the USA, and would liek to see Cleanspace target the top 100 hospitals, and to do they, they will need way mor ethan 3 sales people......

DISC - I HOLD - but want to see better sales execution befreo adding...

Cleanspace released their H2 results. It was a mixed bag of news, with short term results poor, but medium term outlook looking good, with strong tailwinds via regulatory requirements presenting a good opportunity. Highlights are:

1) Revenue of $10.2M, which means Q4 revenue was just $3.2M. 2H EBITDA of -$2 M. This equates fo sales of about 2000 respirators, based on aconsumables / rpoduct mix of 49/51%. This result is of little surprise, and was flagged by management, as PPE de-stocking and vaccine rollout impacted sales.

2) US market was a significant drag, with H2 revenue of $2.7M, vs $20.2 M for H1. Clearly, US hospitals virually ceased purchasing, as they de-stocked disposable masks, and focused on vaccine rollout.

3) Europe and other markets reported H2 revenue of $7.5M vs $20.2M for H1. Again, significant slowdown in these regions.

4) Good News: US Emergency Temporary Standard was released on June 21, 2021, which applies to all workplaces where COVID-19 cases will be present, mandating:

"When employees have exposure to a person with suspected or confirmed COVID–19, the employer must provide a respirator to each employee and ensure that it is provided and used in accordance with 1910.134" - A respirator is defined as: Respirator means a type of personal protective equipment (PPE) that is certified by NIOSH under 42 CFR part 84 or is authorized under an EUA by the FDA. i.e. N95 marks are not deemed adequate protection.

This ruling has not had a material impact on Cleanspace results, however, Cleanspace report this standard is expected to be made permanent in the coming months, and they will provide a marke tupdate when this Stadnard is finalised.

DISC - I HOLD

Winnie the poo strikes again....https://www.ausbiz.com.au/media/smart-caps-for-smart-tax-an-end-of-fiscal-year-strategic-recap-with-luke?videoId=11760

Caught up with this briefing, which can be seen here.

A rather awkward briefing via zoom, with a rather emotional investor peppering management about company valuations and share price at the end of the call - don't be that investor.

There was some interesting insights though:

1) Despite revenue for the quarter falling to $7 M, Cleanspace was still generating positive operating cashflow.

2) Margins fell from 78% to 73% - still great for a device business.

3) 5-6K devices were sold during the quarter (final numbers not confirmed at time of briefing). This compares to 4.6k devices sold in previous corresponding period.

4) health care / industrial revenue split in H1 2021 was 80/20. It was 60/40 split in Q3 (or was that 40/60 - rather unclear in call ? - CFO a little rattled)

5) 46% of revenue was consumables. This equates to about $125 per installed device, which is close to pre-pandemic level of $110 per device. This indicates use is normalising very quickly.

6) US revenue fell from 50% of sales in HY1 to 20% of sales in Q3. I.e. it fell from about $6M per quarter to $1.4 M per quarter. This means other regions sales fell slightly from around $6M per quarter to $5.6 M per quarter. CEO & Chair advise this is due to resources being devoted to vaccination rollout, which will continue for another 4 months or so.

7) CEO, Alex Birrell, estimated they currently had less than 1% of market share for Operating theatre / ICU PPE market, with opportunities to expand into other hosptial / medical departments.

8) Chair, Ron Weinberger (ex. Nanosonics CEO), explained their go-to market strategy, of establishing case studies (or examples of excellence) at places like University of Maryland Hospital, following the Nanosonic strategy as defining the Cleanspace device as the exemplar personal protection equipment in healthcare through having Cleanspace being referred to in operating guidelines and procedures for PPE.

9) Ron went on to say he sees Cleanspace as re-defining / disrupting the PPE space, and sees it as a $5 Billion market cap business, and claimed he was itching to buy shares at this price.

Subsequent to call: On April 15, a change of directors interest notice for Ron was released - he brought $49 869.46 worth of shares @ $2.06 average price.

CleanSpace Holdings provided an update this morning, reporting a significant slowdown in sales in Q3 2021, with revenue expected to come in at $7 M for the quarter.

Sales have slowed significantly in the US, with the unwinding of a large stockpile of disposable masks, and the roll out of vaccines impacting sales in the short term.

CleanSpace report there is a strong US hospital pipeline for the medium to long term. CleanSpace is deploying capital to double regional sales capability.

CleanSpace will not be providing guidance for H2 2021. It looks like the sales pipeline will be disrupted by the inevitable de-stocking process, and vaccine roll-out.

I expect the normalised, post-COVID-19 revenue run rate for CleanSpace to be around $35 M per annum (current $28M) by 2022. It may take time, say 12-18 months for this to occur, and it may worsen before it improves. Patient buyers may pick up a bargain over the next 6-12 months.

DISC - I HOLD.