Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

I noticed that MAQ hasn’t announced any major new customers for a while (happy to be corrected), so I wanted to check if that was a red flag.

What I found is that Macquarie’s data centres are already running at ~96% utilisation. In other words, they can’t sign new customers until fresh capacity comes online. IC3 Super West will more than double capacity (21 MW → 47 MW) over the next 12–18 months, with another 200+ MW in the pipeline. The real question is how quickly that gets leased once available?

Worth noting too that there’s currently a shortage of DC MW in Australia, with demand from cloud, AI and government workloads outpacing supply. MAQ also has some barriers to entry working in its favour; sovereign credentials, strong government relationships, and the stickiness of bundled services (DC + cloud + cyber) make it harder for competitors to dislodge existing clients. If the new MW fills, you’d expect all three segments to lift together.

Curious what others think about the demand side. Will new capacity get taken up as soon as it’s live, or is that too optimistic?

Disclosure: I hold MAQ in real life and on SM.

Market Cap at $66.11 of $1.7B

Mangement Bios

Peter James, Chairman

Peter has extensive experience as Chair, Non-Executive Director and Chief Executive Officer across a range of publicly listed and private companies particularly in emerging technologies, digital disruption, e-commerce and media. He is an experienced business leader with significant strategic and operational expertise. Peter travels extensively reviewing innovation and consumer trends primarily in the US, Asia and the Middle East. He is a successful investor in several Digital Media and Technology businesses in Australia and the US. Peter holds a BA degree with Majors in Business and Computer Science and is a Fellow of the Australian Institute of Company Directors and a Fellow of the Australian Computer Society. Peter joined the board on 2 April 2012 and was appointed Chairman of Macquarie Technology Group in July 2014. Peter is the chair of the People, Remuneration and Culture Committee and a member of the Audit and Risk Management Committee. Peter is also a non-executive director and Chairman of Nearmap, Droneshield, Halo Food Co and Ansarada.

David Tudehope, Chief Executive

David is Chief Executive and co-founder of Macquarie Technology Group and has been a director since 16 July 1992. He is responsible for overseeing the general management and strategic direction of the Group and is actively involved in the Group’s participation in regulatory issues. He is a member of the Australian School of Business Advisory Council at the University of NSW and was a member of the Australian Government’s B20 Leadership Group. David is a member of the Australian Government’s Cyber Security Industry Advisory Committee. David holds a Bachelor of Commerce degree at the University of NSW. In 2018, David was named Australian Communications Ambassador at the 12th Annual ACOMM Awards. In 2020, David was named CEO of the Year at the World Communications Awards in London. In 2023, David was awarded the Pearcey Medal, the Australian ICT industry’s highest award.

Aidan Tudehope, Managing Director, Hosting

Aidan is co-founder of Macquarie Technology and has been a director since 16 July 1992. He is the Managing Director of the Hosting Group (Cloud Services & Government and Data Centres) with a focus on business growth, operational efficiency, cyber security and customer satisfaction. He leads the Government business unit, encompassing Macquarie’s Secure Government Cloud and Cyber Security offerings. As the former Chief Operating Officer for Macquarie Technology, Aidan played an integral part in the strategy and direction of the Hosting business since its first state-of-the-art data centre, Intellicentre 1 opened in 2001, as well as being instrumental in the development of Macquarie Technologies data networking strategy. He holds a Bachelor of Commerce degree. In 2023, Aidan was awarded the Pearcey Medal, the Australian ICT industry’s highest award.

Lisa Brock, Non-Executive Director

Lisa Brock joined the board on 31 January 2023. She is the chair of the Audit and Risk Management Committee and a member of the People, Remuneration and Culture Committee. Lisa brings more than 20 years’ experience to the Company in business leadership, commercial strategy, corporate finance and infrastructure. She has held a number of senior executive positions at the Qantas Group and is currently a non-executive director at Adelaide Airport. She holds an Honours Degree majoring in Mathematics from the University of Birmingham, UK and a Master of Applied Finance from Macquarie University. She is a Graduate of the Australian Institute of Company Directors and a Member of the Institute of Chartered Accountants in England and Wales.

Adelle Howse, Non-Executive Director

Adelle Howse joined the board on 29 August 2019 and is a member of the Audit and Risk Management Committee and the People, Remuneration and Culture Committee and takes a lead role for Investment reviews. Adelle has extensive executive and non-executive experience in the corporate environment and provides consulting services with a focus on strategy, M&A and governance. She has spent more than 20 years in energy and resources, construction, infrastructure, data centres, telecommunication and property sectors. Adelle is a non-executive director of the Sydney Desalination Plant, an independent non-executive Director of Downer EDI Limited and BAI Communications. She holds an Executive MBA from IMD, a PhD in mathematics from the University of Queensland and a graduate diploma in applied finance and investment. Adelle is a graduate of the AICD.

Macquarie Technology Group (MAQ) reported last week. From their presentation:

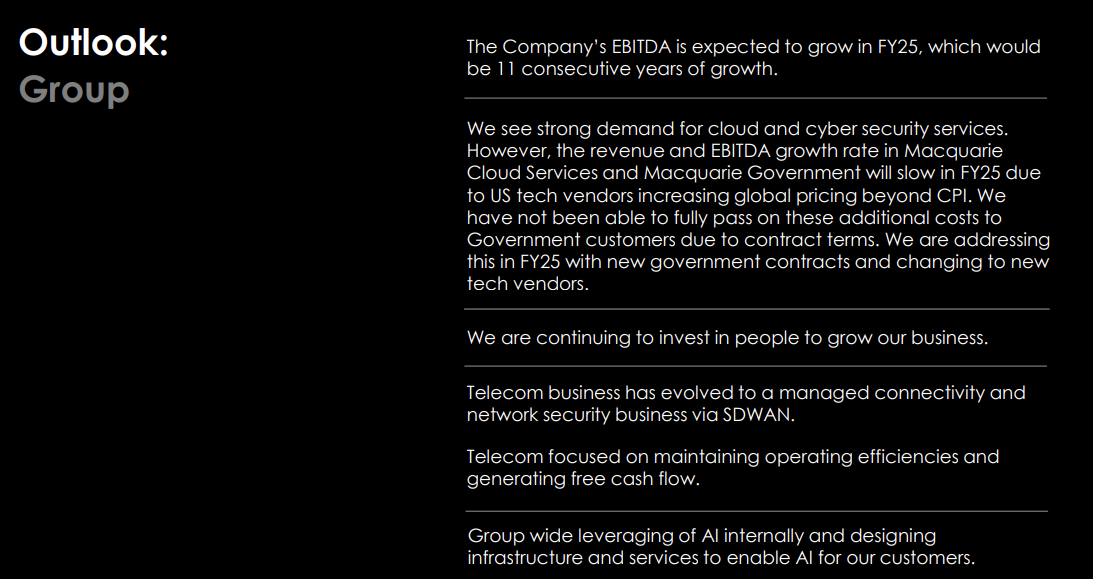

Overall a decent result. Somewhat muted increase in revenue and EBITDA as was flagged at the AGM and at the previous full year results.

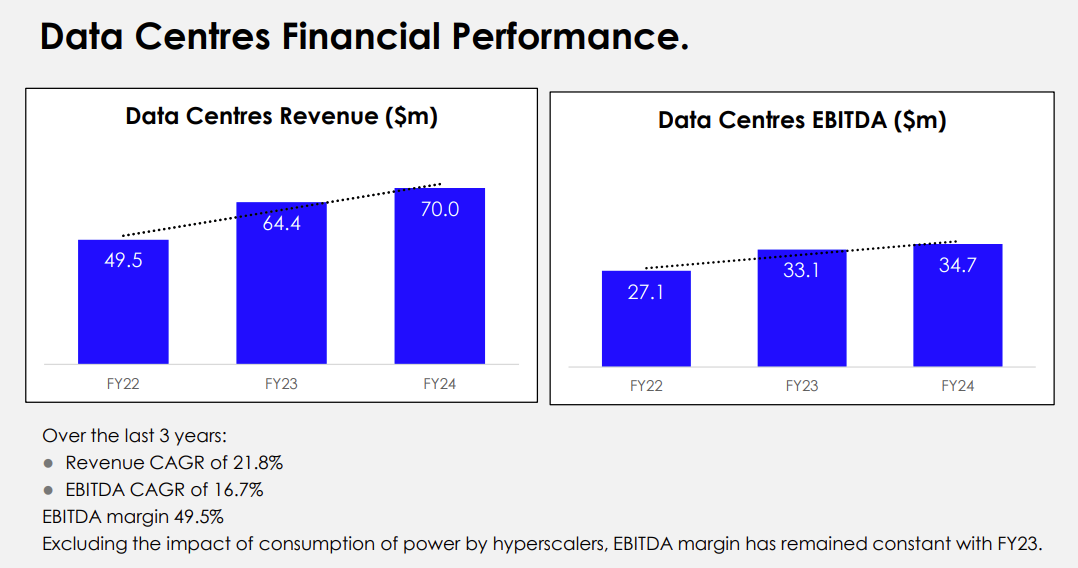

Data Centre revenue increased which is the highest margin segment of the business. Although this margin was impacted by development activities related to the potential acquisition of a new data centre site in Sydney. Otherwise EBITDA margins would be 50%+.

No change to the outlook provided in terms of the development of IC3 Super West. The 1st part of construction is expected to be completed in Q3 2026 at a cost of $350m with an expected 6MW of IT load available. The total load for IC3 SW has also been increased to 47MW.

MAQ remains fully funded so far with an undrawn debt facility of $450m available and around $91m in cash on the balance sheet.

Disc: Held IRL and on Strawman.

Macquarie Technology Group (MAQ) reported last week. I know @raymon68 has already posted the results so this is more for me to journal down my thoughts on the result.

From their presentation:

Overall I thought it was a solid result albeit EBITDA was more on the lower end of guidance.

Not much changed from last report. Data Centre EBITDA percentage slightly down on last half.

Main thesis for MAQ is the continued growth in its data centre segment which is the segment with the highest margins. MAQ currently has around 23MW of data centre load across 3 sites:

- IC1 (Sydney CBD) = 3MW

- IC2, IC3 east and IC3 super west (Macquarie Park) = 10MW (IC2)+ 8MW (IC3 E)

- IC4 and IC5 (Canberra) around 2MW

Future development of IC3 SW is due to start soon and when complete will bring the total capacity to around 68MW.

Outlook was somewhat muted considering IC3 SW has been part of plans for a while now. MAQ expect that the first phase will be online around 3Q 2026 bringing an extra 6MW of capacity. I guess the market probably also didn't like the fact that MAQ expect growth rates in the Cloud and Government segments to slow in the coming FY.

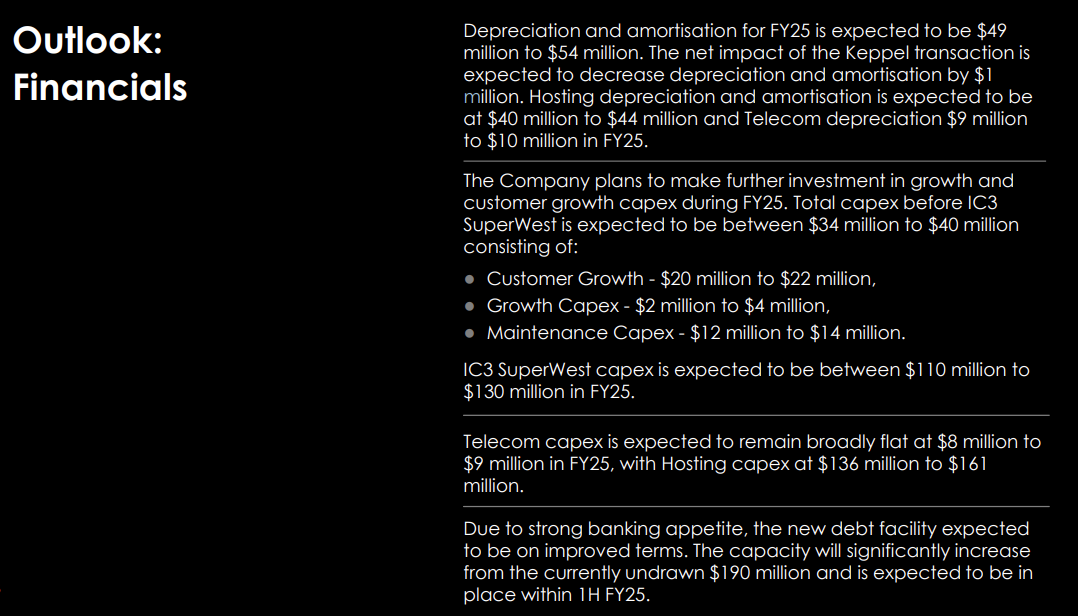

Overall capex is expected to be higher than previous years considering the need to spend to build IC3 SW. Currently MAQ have no debt but there is a loan facility of 190m which I do expect them to tap into otherwise they'll need to do another raise in the next year.

With D&A expected to be slightly lower than FY24, and EBITDA is continue to increase, I expect that NPAT may gain slightly or may be flat based on how much interest costs will be.

Considering we are only just entering the growth phase for MAQ, I will give them some leeway in terms of their financial metrics as I see this being a much bigger business in 5-10 years time once their new data centres are all up and running however it does make this business quite hard to value at the current stage.

A thesis breaker would involve further delays in the development of IC3 SW or a complete blow out in costs involved to build out the centre. So far, apart from delays, it seems that management have fairly good capital management and I trust that this should continue into the future.

Disc: Held IRL and on Strawman.

- Release Date: 28/08/24 19:07

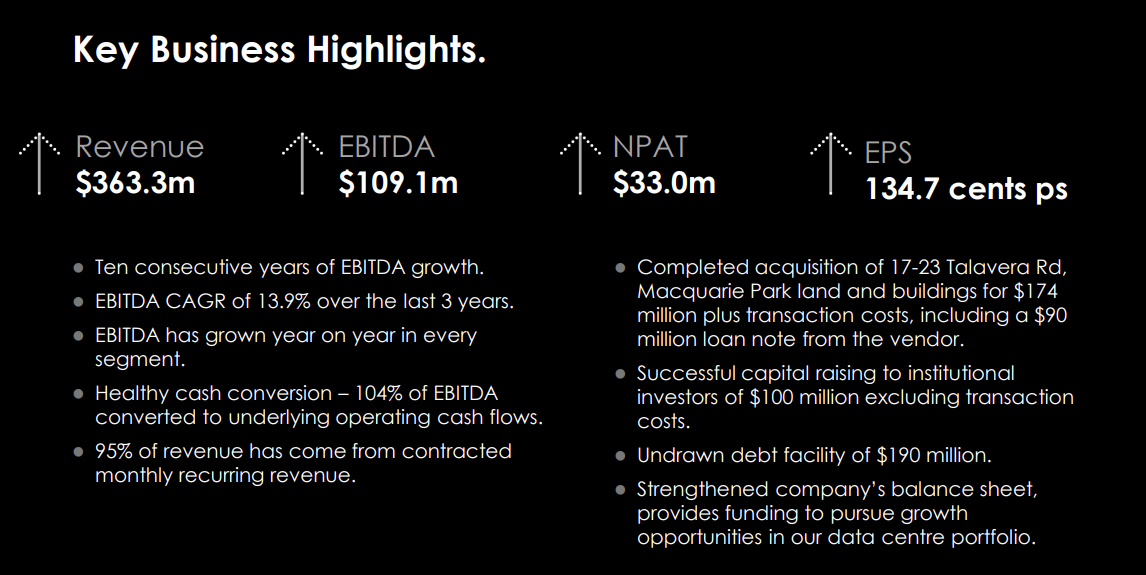

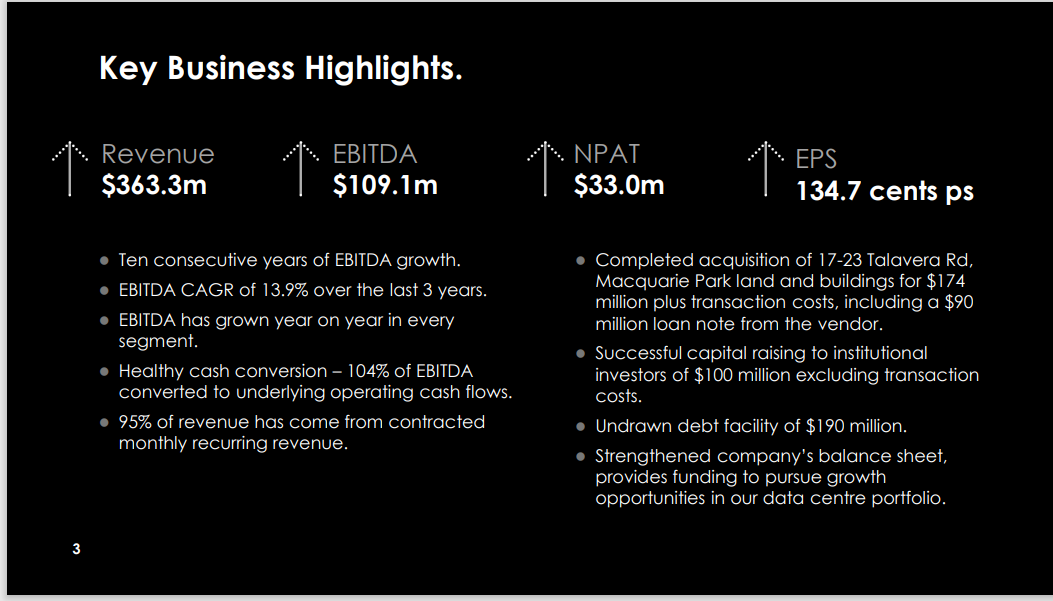

Key Points

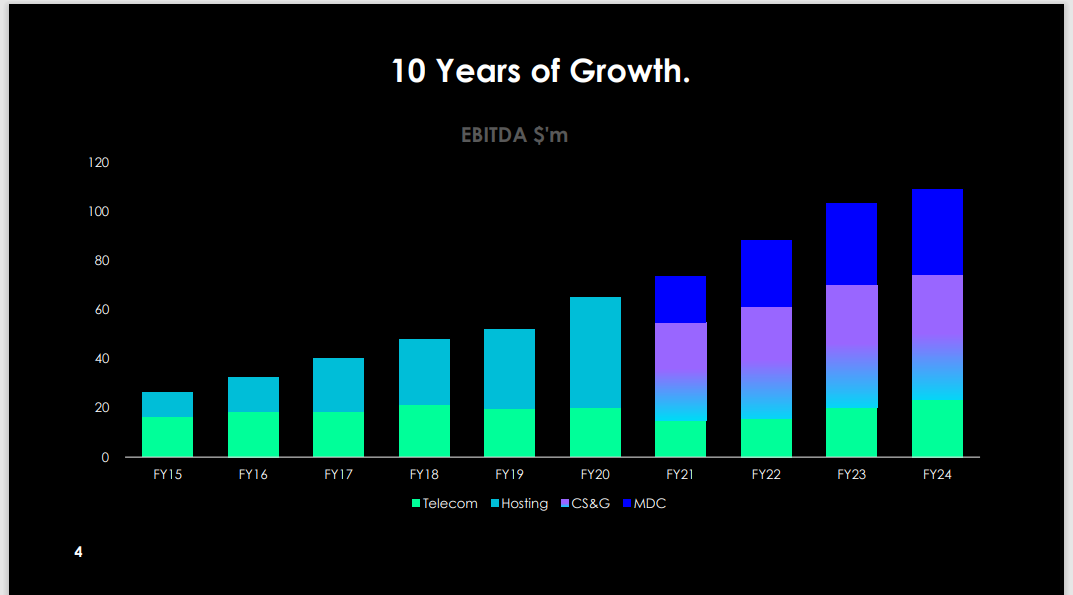

• Ten consecutive years of EBITDA growth. • Group Earnings before interest, tax, depreciation, and amortisation (EBITDA) of $109.1 million, an increase of 13.9% over the last 3 years.

• Conversion of EBITDA to operating cash flows generated total operating cash flows of $117.8 million during the year. Strong 103.8% cash conversion of EBITDA into operating cash flows, after excluding tax received and interest.

• Completed acquisition of 17-23 Talavera Rd, Macquarie Park for $174 million plus transaction costs, including a $90 million loan note from the vendor.

• Successful institutional investor capital raising of $100 million to support acquisition of 17-23 Talavera Rd, Macquarie Park.

• Capital expenditure was $51.1 million before acquisition of Macquarie Park driven by Growth Capex of $24.0 million,

Customer Related Capex of $18.5 million and Maintenance Capex of $8.6 million. Chief Executive David Tudehope said, “The acquisition of the Macquarie Park Data Centre Campus land, along with the $100 million equity raise, has positioned us for the growth of our digital infrastructure platform for the years ahead.”

Macquarie Technology Group (MAQ) released results after hours last night. From their presentation:

On the surface seems a pretty good result. Increasing costs have put pressure on margins but they have remained fairly strong.

The Data Centre business once again doing well and this is the growth driver in this business.

Interesting though that most of the EBITDA growth was driven from the telecom business which isn't considered one of the growth segments of the business. The decrease in Cloud Services and Government EBITDA was flagged at the last report due to increased investments and timing of sales.

Outlook was given with particular focus towards the new IC3 Super West Data Centre which has been a long time coming. Works have commenced and expected to be completed in Q3 CY26. This will increase the data centre load from 22MW currently to 60MW with further capacity to increase this to 67MW.

MAQ management have historically been pretty good capital allocators so hopefully this new build can be funded from the profitability of the existing segments of the business without the need for further dilution.

Disc: Held IRL and on Strawman.

Macquarie Technology Group released their results after hours yesterday, from their presentation:

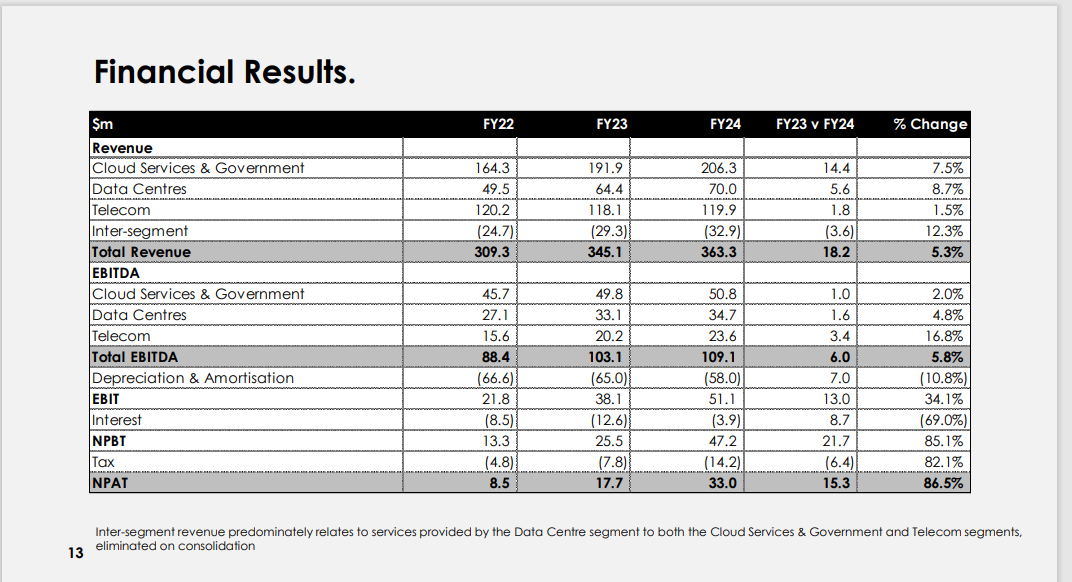

Once again operationally a very solid result with continued growth in all segments of the business.

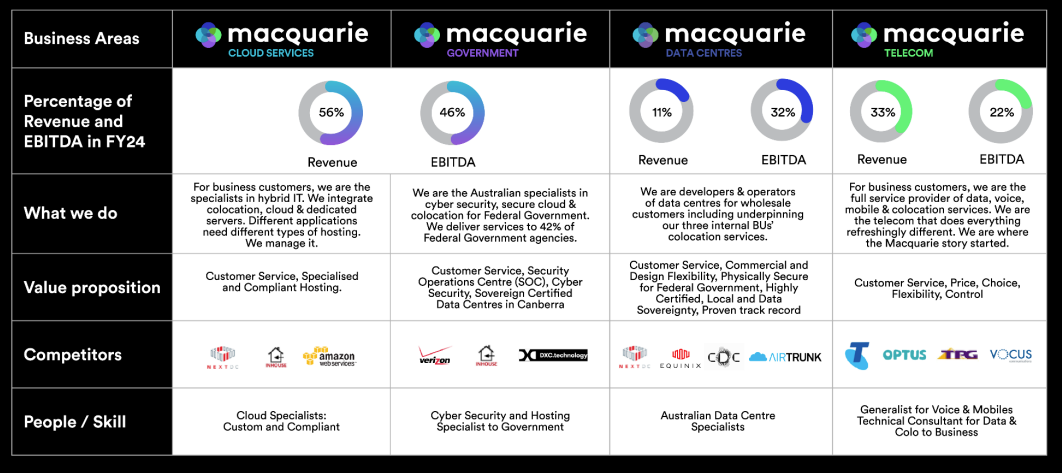

Data centres now comprise 11% of total revenue but amazingly contribute 32% towards total EBITDA. The slide below shows the incredible margins of the data centre business:

Telecom revenue actually declined compared to FY22 however EBITDA increased due to operational efficiencies. Long term I don't see telecom being a major segment of the business but it is profitable at present and does contribute 20% towards overall EBITDA.

Capital expenditure which was forecasted to be $76m-$80m ended up being $65.8m. I suspect this may be due to ongoing delays with their IC3 Super West build which has once again been delayed. IC3 Super West was due to be approved mid 2023 but is now expected late calendar 2023. The build will also now take 30 months, up from 18-24 months from the last report. Total load of IC3 Super West has been upgraded to 38MW with potential to increase to 45MW if needed.

Outlook for FY24 was given:

As expected, Capex will increase in FY24 due to (hopefully) the build of IC3 Super West. On a cash flow level, they shouldn't have any issues given that they raised capital last year and repaid all of their debt. The company also generated free cash flow of around $43m (if you back out the cash they placed into Investment Accounts). There is still the potential to use the debt facility which has a capacity of $190m.

Doing some rough numbers based on their outlook. Say EBITDA grows to around $110m, then assuming around $58m depreciation, there is a potential for MAQ to generate NPAT of between $30-35m.

Disc: Held IRL and on Strawman

MAQ announced that they have completed their raise.

In the end they have raised $160m (more than the $130m they were aiming for) and thus will issue 2.74m shares.

Probably one thing of interest that I did note was that the raise introduces multiple new institutional shareholders to the Company’s share register and increases free float.

Currently MAQ is not in the ASX300 even though it is large enough for it to be included (and borderline ASX200 by market cap). Perhaps the increase in free float may allow it to be included in the indices in the near future?

Full Announcement here

DIsc: Held IRL and on Strawman.

Macquarie Technology Group (ASX:MAQ) announced that they will be raising capital to fund further growth in their data centres business.

From their presentation:

Seems to be only an Institutional Placement with nothing for us private investors.

Maybe a little surprising that they are raising capital at this stage given that they still have $80m in undrawn debt facilities and $13m in cash. Although they did say that they will be paying down their debt at the last set of results. Perhaps taking the opportunity to reduce their debt with the cash raised?

FY23 outlook was also given in the presentation:

Total Depreciation and Capex are actually lower than previously forecasted. May be a short term boost to their overall profitability at the next set of results.

Full presentation here

Disc: Held IRL and on Strawman

Note: This is the same post as my $NXT Straw. I just also wanted it to appear on my #MAQ history. So please move along, if you've already seen the $NXT straw, as there is nothing new to see here.

$NXT reported results yesterday that were broadly well-received by the market. Expansions, site acquisitions for new data centres, and expectations of material new contracts supported this long term growth story. Analysts reactions are broadly positive, with no major moves to SP targets based on the updates so far. (Although GS tweaked down their 12m TP from $13.60 to $13.30)

I've had exposure to the data-centre theme IRL for several years ($NXT, $MP1) and continue to see it as a long term growth theme.

However, I have recently switched my RL position from $NXT to $MAQ, and I'll briefly explain here.

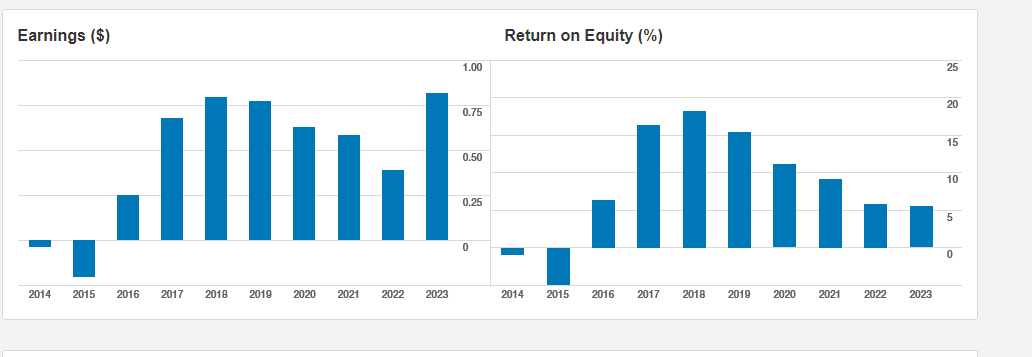

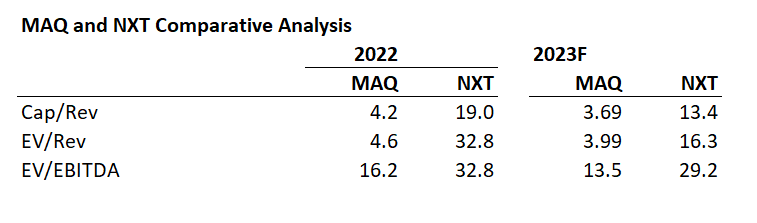

$NXT is a more agressive growth play, with 3-year revenue CAGR to end FY22 of 18% vs. 8% for $MAQ, and a 3-yr EBITDA CAGR of 26% vs, 19% at $MAQ. However, this is at the cost of significant debt, with long-term borrowings now reaching $1.26bn and interest for the last 6 months now up to $62m (annualised).

On a comparative basis $NXT is spending 32% of EBITDA on interest, compared with a more conservative 12% at $MAQ.

Furthermore, $NXT have recently signalled an intention to expand internationally, although we are yet to see what this means in practice. This further increases the risk profile.

Looking at valuation multiples, $MAQ is looking favourable, and I have initiated my RL position recently at $55.50 (2.75%). (I will follow today in SM, because strictly speaking these companies are "yet to prove themselves", which is my criterion for holding in SM.)

Table 1: Comparative Valuation Multiples

Source: www.marketscreener.com; Company Accounts

Overall, with interest rates still rising (and the real chance that peak forecasts will go up further) and with tech companies reducing investment in new storage, this sector may move from a focus on expansion to a greater focus on utilisation and profitability, with consequence implications for pricing.

Overall, while I like both $NXT and $MAQ, I consider that $MAQ is more defensively positioned given these risks. I have been watching it for several years, and with the SP below $60 I feel now is the time to switch horses.

$MAQ brings some other differences to $NXT as follows:

- It is founder-led, managed and majority owned

- The limited free-float means that it is not as easily accessible to institutions; however, liquidity is fine for a retail investor

- Its capital structure is different with a higher proportion of capital leases vs. owning real estate.

I don't often switch horses within a sector and, while I think BOTH companies will generate long-term shareholder value, I now prefer the risk-reward profile of $MAQ. So, out with $NXT and in with $MAQ.

Disc: $NXT - not held; $MAQ - held IRL (and later today on SM)

P.S. For those who follow Gaurav Sodhi, you'll recognise I have adopted his rationale. I have been aware of his perspective for well over a year, and on this occasion my analysis aligns with that story. You can look it up by watching back issues on "The Call" - just search for $NXT and $MAQ and pick the days when he the "talking head".

21-Feb-2023: MAQ released their results after the market closed (as they have done for a couple of years now). It's funny. If they were disappointing results, I'd probably be annoyed that they released them after the market had closed, but they're not, and I'm not, and they have form for doing this; their last full year results (for FY2022) and their last two half year results were all released after the market had closed.

Here's the first page of today's half year results announcement:

You can read the full announcement here: Half-Yearly-Report-and-Accounts.PDF (there is a second page, but I've also included that below if you keep reading.)

No dividend declared yet again, but as Buffet says, (and I'm definitely paraphrasing here) better for companies that need cash for growth capex to reinvest their profits at decent rates of return than to give it to their shareholders as dividends and then borrow money and pay interest on it. MAQ do both, reinvest their profits and borrow money for growth, but they've said today that in FY23 their debt will reduce. They give a fair bit of capex guidance on the second page and it looks like their spending is slowing down at last. Not that I've minded - they've spent well! Seventeen consecutive halves of profitable growth isn't something that most companies that not many people have heard of can claim. And, let's face it, Macquarie Telecom is not exactly a household name. Known mostly for data centres, cloud computing, cybersecurity and as a reliable business telco, they have a lot of government clients, including the ATO, and they tend to sail under the radar of most investors, even investors who are generally interested in those very areas.

MAQ has been trading at or just above $50/share of late, which is around their 12-month lows, so it will be interesting to see how the market reacts to this report in the morning.

MAQ-Half-Yearly-Report-and-Accounts-Presentation.PDF

Those returns shown on the right are capital gains (or a capital loss in TNT's case) over 5 years, and those numbers don't include dividends. If you add in Telstra's dividends it ain't going to get you up to MAQ's +255% return from TLS's +21% return. That's not annualised. That's your return at the end of 5 years if you placed the same amount of capital into those 4 companies. You'd get Telco exposure with TLS, you'd get cybersecurity with TNT, you'd get cloud storage (data centres) exposure with NXT, but you'd get all of that exposure with MAQ and heaps more capital growth as well.

MAQ has been damn impressive over the past 5 years that I've held them, and even since I added them here to my Strawman portfolio more recently (in 2019 and 2020, as shown below). I obviously hold more in real life than I do here on SM (the limitations of a $100K portfolio here mean my dollar weightings tend to look pretty small; a lot smaller than my real life positions). IRL my average buy price for MAQ was $17.38/share. Here it's $21.33/share. They've been as high as $80/share (in August 2021) and they're back down to $54 now. I think they go higher tomorrow on the back of this evening's report, all other things being equal.

Like I said, I can forgive them for not paying dividends for this sort of capital growth.

That 37.15% for my MAQ here actually IS annualised, so that's the money weighted annual return - +37.15% p.a. for the past three years.

I've done straws on the company before, so I won't go on, but they're a nice little growth story. Although their current market cap is $1.14 billion, so perhaps not so little any more.

Here's the second page of today's MAQ FY23 first half results announcement this evening:

Noice!

MAQ reported last month however I'm just coming around to reading through the results. And realised no one had posted a straw yet about their results. From their announcement:

- Eight consecutive years of EBITDA growth.

- Full year revenue of $309.3 million, an increase of 8.5% compared to $285.1 million for FY21.

- Earnings before interest, tax, depreciation, and amortisation (EBITDA) of $88.4 million, an increase of 19.8% from prior year, at the top end of June’s guidance.

- Conversion of EBITDA to operating cash flows generated total operating cash flows of $98.0 million during the year. There is a closing cash balance of $3.0 million and undrawn debt facilities of $64.0 million having drawn down $126.0 million.

- The Company has completed work on the fit-out of Intellicentre 3 East data centre development (“IC3”) and has commenced billing of its hyperscale customer.

- Net profit after tax (NPAT) of $8.5 million, reflecting the increase in depreciation & amortisation flowing from the significantly higher levels of capital expenditure since FY20.

- Capital expenditure for FY22 was $98.5 million (FY21: $139.1 million) driven by Growth Capex of $64.5 million primarily relating to fit out of IC3 East in Macquarie Park. Customer related Capex was $24.5 million. Maintenance Capex was $9.5 million.

On first glance the results are pretty impressive on an EBITDA level. Revenue increased by 8.5% but EBITDA increased almost 20% showing some operating leverage and scale. The breakdown of each segment and its contribution was also interesting. Data centres only comprised 8% of total revenue but contributed 31% of total EBITDA. Although capex (and future depreciation and amortisation) will also be high as they increase capacity.

Outlook:

- The Company’s EBITDA will continue to grow in FY23. Due to investments being made in Data Centres and Cloud Services & Government in the 1H FY23, EBITDA will grow in 2H FY23.

- Expected EBITDA for the Data Centres business in FY23 is between $31 to $33 million.

- Inflation impacts on cost base are being materially passed through to our customers.

- We continue to see a strong demand for cyber security and hybrid IT in our Government and Cloud Services businesses.

- Telecom is focusing on new initiatives to improve operational efficiencies and continued growth of our successful SDWAN business.

- Pleasingly we are able to increase the total IT Load capacity of IC3E by approximately 1MW independent of the IC3 Super West build. We will invest in this opportunity by 2H FY23. This leverages our existing investment in IC3E.

- State Significant Development Application submitted for IC3 Super West. We expect to receive DA approval in late calendar year 2022 to mid-calendar year 2023 and construction to be completed 18 to 24 months later.

- Depreciation and amortisation for FY23 is expected to be $70 to $74 million, driven by full year impact of IC3 in FY22. Cloud Services & Government and Telecom depreciation to remain broadly flat at $27 to $28 million and $19 to $20 million respectively in FY22.

- We are focused on maintaining industry leading Net Promoter Score greater than +70 across all business segments.

- The Company plans to make further investment in growth and customer growth capex during FY23. Total capex is expected to be between $76 to $80 million consisting of:

- Growth Capex - $37 to $39 million

- Customer Growth - $23 to $24 million

- Maintenance Capex - $16 to $18 million

- Telecom capex will remain broadly flat at $11 to $12 million in FY23 with Hosting capex at $65m to $68m.

Nothing too surprising in the outlook for FY23. Capex is expected to be lower than in FY22 but I expect this to accelerate again into FY24 and FY25 due to continued build out of their data centres.

Overall I think this was a decent result for MAQ. They are slowly building out a very strong cloud and data business and doing it whilst maintaining profitability. On a cash flow level they were also FCF positive for this year and although the cash balance appears low at $3m, there is plenty of loan facility available to utilise.

Disc: Held IRL and on Strawman

Another very solid result. Excellent company with great management.

Macquarie Telecom Group Ltd (ASX: MAQ) (the Company) today announced its results for the half-year ended 31 December 2021, which were ahead of guidance.

Chairman Peter James said, “This result represents our fifteenth consecutive half of EBITDA growth, an outstanding achievement made possible by our committed teams, our strategy and ongoing investments across all of our business units”.

Key Points

• Fifteen consecutive halves of growth.

• Revenue of $149.3 million, an increase of 4% on 1H FY21 ($143.4 million).

• Earnings before interest, tax, depreciation, and amortisation (EBITDA) of $40.5 million, an increase of 11% on 1H FY21 ($36.4 million).

• Strong conversion of EBITDA to operating cashflows of $37.6 million in 1H FY22 vs $27.0 million in 1H FY21 (on an underlying basis).

• The Company is operating effectively from remote locations during recent Covid restrictions and is well positioned to return to the office. We have continued to deliver a high level of service to our customers despite challenging circumstances.

• Net profit after tax of $3.7 million, a decrease of 48% on 1H FY21 ($7.0 million) reflecting the increase in depreciation & amortisation flowing from increased levels of capital expenditure.

• Capital expenditure for 1H FY22 was $68.9 million (1H FY21: $77.3 million) driven by Growth Capex of $46.2 million primarily relating to the investment in the fit out for Intellicentre 3 East. Customer related Capex was $17.1 million. Maintenance Capex was $5.6 million.

Chief Executive David Tudehope said, “Strong demand for cyber security, private and public cloud has driven our investment in our Government and Cloud Services businesses. Continued demand from our Federal Government Agencies for cybersecurity and secure cloud, including Tier 1 Agencies such as ATO, gives high confidence for future growth in the Government Business.“

Our Intellicentre 3 East data centre fit out project for a leading corporation was delivered on time and on budget, with associated revenue commencing as planned from this quarter. We will continue to reinvest profits back into our Macquarie Park Data Centre Campus, an outstanding facility that provides world class infrastructure to support the digital economy.”

OUTLOOK

• Underpinned by strong sales growth, full year FY22 EBITDA is expected to be approximately $85 to $88 million.

• FY22 Total Capex is expected to be between $120 - $129 million, consisting of:

Customer Growth - $25 to $28 million. Growth Capex - $80 to $86 million. Maintenance Capex - $15 to $18 million.

• FY22 Depreciation is expected to be between $65 and $68 million.

Disc: Held in Strawman and IRL

Really interesting interview with CEO David Tudehope. The part I found most interesting was David explaining the difference between their data centre model as opposed to competitors (didn’t mention NextDC by name but clear it’s who he was referring to). Gives a great explanation about that side of the business and how it opperates.

Disc: Hold MAQ and NXT in Strawman and IRL

https://www.livewiremarkets.com/wires/latest-developments-from-macquarie-telecom

Got a buy from both Gourav and Wini on The Call today. Gourav with a price target around $100.

I’ve underestimated this one in the past, outstanding business with brilliant management and such strong tailwinds in the cloud and data centre thematics. Bought this one in RL about a month ago and added it as one of my larger Strawman holdings about a week ago. I plan to hold it in both portfolios for a long time.

https://www.ausbiz.com.au/media/the-call-thursday-16-december?videoId=18135§ionId=1885

14-July-2021: IC3 Super West and Confirmation of Guidance

Plus: IC3 Super West Investor Presentation

Macquarie Data Centres: IC3 Super West - 50MW Campus

Macquarie Telecom Group Limited (ASX: MAQ) provides the following update to the market:

IC3 Super West

Macquarie Data Centres has today lodged a State Significant Development Application to build a new data centre at the Macquarie Park Data Centre Campus, within the Sydney North Zone. The new data centre will be called “IC3 Super West” and will be the largest data centre on the campus, adding 32MW of IT Load to bring the total campus IT Load to 50MW over time. IC3 Super West is designed to seamlessly interconnect with IC3 East.

Macquarie Data Centres is aiming to complete construction of Phase 1 of IC3 Super West in the second half of calendar year 2023. IC3 Super West has been designed to meet the needs of the corporate, government and wholesale markets and will enhance the state’s cybersecurity infrastructure and capabilities.

David Tudehope, the Chief Executive of Macquarie Telecom Group said: “IC3 Super West will expand our Macquarie Park Data Centre Campus to 50 MW of IT Load. This global scale data centre campus will attract new investment into Australia from multinationals looking to expand in the Asia Pacific region. The Macquarie Park Data Centre Campus will also be the home to our new Sovereign Cyber Security Centre of Excellence which is being launched today with the support of Investment NSW.”

Macquarie Data Centres is currently obtaining the necessary planning consents, which are expected to be received in early 2022. Construction and funding of IC3 Super West will then follow and remains subject to final Board approvals.

Sovereign Cyber Security Centre of Excellence

The Sovereign Cyber Security Centre of Excellence is an integrated mix of leading edge physical and virtual infrastructure designed to monitor and manage cybersecurity events. It will be monitored 24/7 by trained engineers equipped with the latest tools. The infrastructure and personnel will be housed in IC3 Super West offering a truly Australian sovereign solution to the growing cyber security threats.

David Tudehope, the Chief Executive of Macquarie Telecom Group said:

“NSW’s digital economy is rapidly growing, and this project will create world class infrastructure and valuable long-term jobs in the digital and cyber security sector.”

Confirmation of Guidance

The Company today confirmed that its FY21 EBITDA will be within the previously announced guidance of $72 to $75 million.

--- ends ---

[Disclosure: I hold MAQ shares.]

24-Feb-2021: 1H FY21 Results Announcement plus 1H FY21 Results Presentation and Half Yearly Report and Accounts

Macquarie Telecom delivers thirteen consecutive halves of revenue and EBITDA growth

Macquarie Telecom Group Ltd (ASX: MAQ) today announced its strong performance for the half-year ended 31 December 2020, in line with guidance.

Chairman Peter James said, “Our strategy of investing in Data Centres, Cloud and Cyber Security continues to drive further shareholder value and ongoing returns and has resulted in thirteen halves of profitable growth”.

“Macquarie’s focus on customer experience was recognised by the “Best customer experience in the World” award by 60 international judges. Macquarie is the first Australian company to win this award in 22 years of the World Communications Awards in London”.

KEY POINTS

- Revenue of $143.6 million, an increase of 9% on 1H FY20 ($131.9 million).

- Earnings before interest, tax, depreciation, and amortisation (EBITDA) of $36.4 million, an increase of 15% on 1H FY20 ($31.6 million).

- Conversion of EBITDA to operating cash flows generated total operating cash flows of $13.6 million during the half-year.

- Net profit after tax of $7.0 million, an increase of 5% on 1H FY20 ($6.7 million).

- Capital expenditure for 1H FY21 was $32.9 million (1H FY20: $23.1 million) excluding Intellicentre 3 East.

- Customer Growth Capex was $13.9 million, 20% more than 1H FY20 $11.6 million, reflective of our continued data centre sales success and product mix.

- The company has drawn down $93.5 million to support data centre developments in Intellicentre 3 East and Intellicentre 5 South Bunker.

Chief Executive David Tudehope commented, “Macquarie’s 20-year strategy of investing in world-class data centres is based on strong demand for data centre capacity as customers migrate to cloud and colocation services. The win, of the 10MW of IT Load sold to a Leading Corporation, recognises the world class investment we have made in the Macquarie Park Data Centres Campus in Sydney’s North Zone.”

OUTLOOK

- FY21 EBITDA is expected to be approximately $72 to $75 million.

- Telecom continues to win customers from legacy data and IP carriers with our nbn and SD WAN solution.

- FY21 Total Capex is expected to be between $57 - 66m, excluding IC3, consisting of:

- Customer Growth - $25 to $28 million.

- Growth Capex - $17 to $20 million.

- Maintenance Capex - $15 to $18 million.

- IC3 Expenditure - $123 to $126 million.

- FY21 Depreciation is expected to be between $50 and $53 million.

--ends--

--- click on the links at the top for more ---

[I hold MAQ shares. They don't shoot the lights out, although their share price has over the past couple of years. Their results however are just steady growth, and they are still building the company, particularly the data centres and the hosting (cloud services). Great company with strong tailwinds.]

17-June-2020: Investor Briefing Presentation by MAQ

Aidan Tudehope from MAQ was interviewed on Ausbiz on Wednesday in their Barangaroo Studios. See here.

Post a valuation or endorse another member's valuation.