21-Apr-2022: I have been avoiding Megaport and Superloop for a couple of years now, and I have explained some of the reasons why in some straws I have written for both companies. Here's my current Bear Case for Megaport:

- I don't understand the tech completely - I can tell you what they do - Flexible bandwidth (elastic) network connections - or in their own words, "Megaport is a software layer that provides an easy way to create and manage network connections. Through the Megaport network, you can deploy private point-to-point connectivity between any of the locations on Megaport's global network infrastructure." But if you ask me for further details I'll soon run out of words. Because I've read enough to know that what they are doing - the service they provide - while once quite novel - is now being offered by other larger players, so they don't have this market all to themselves and there are some pretty big gorillas in the game. So I don't generally read on after realising that they do not have a clear competitive advantage in their chosen field.

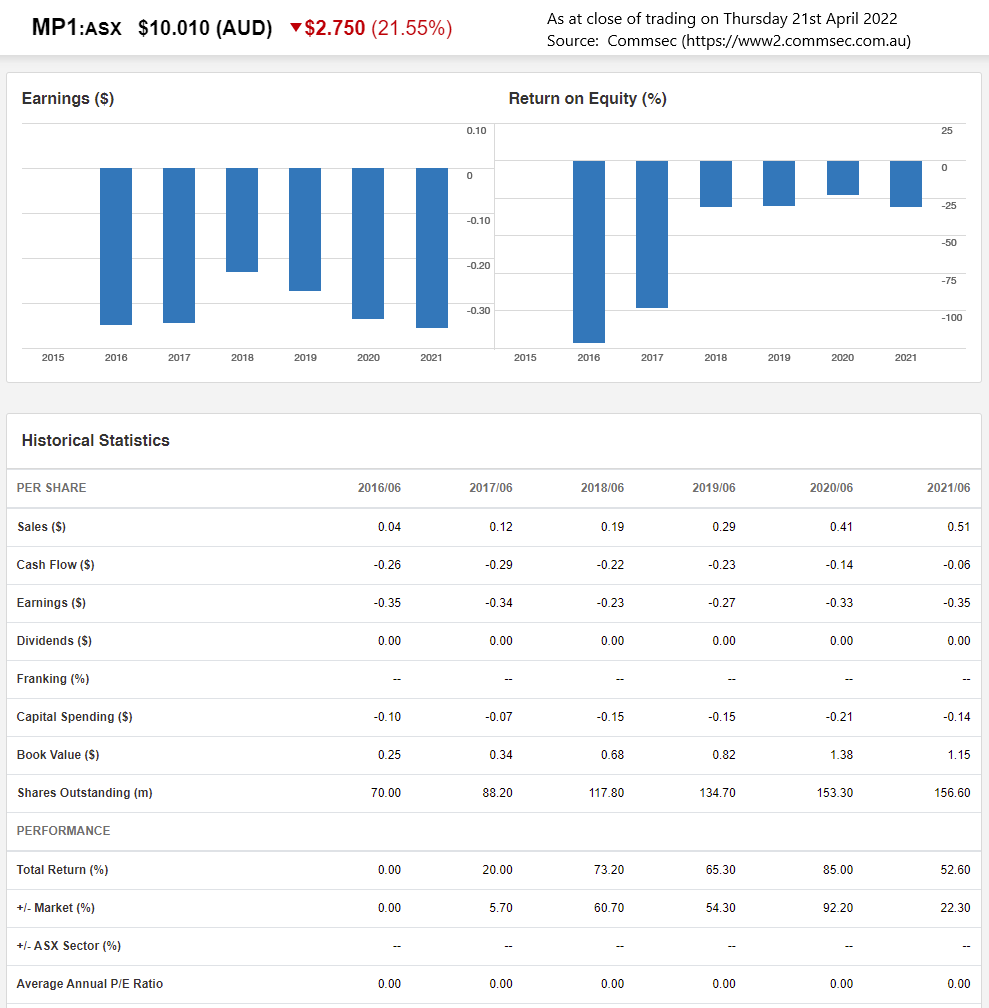

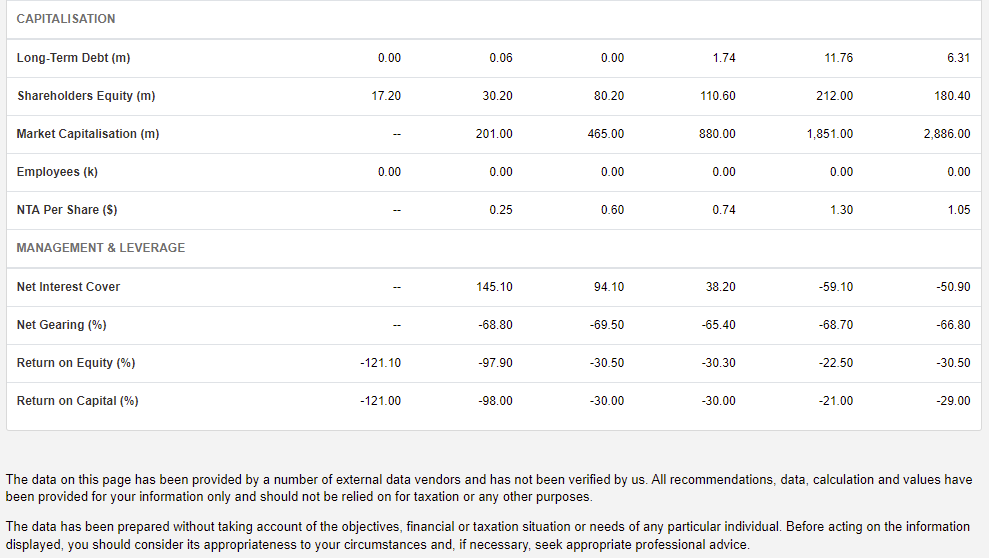

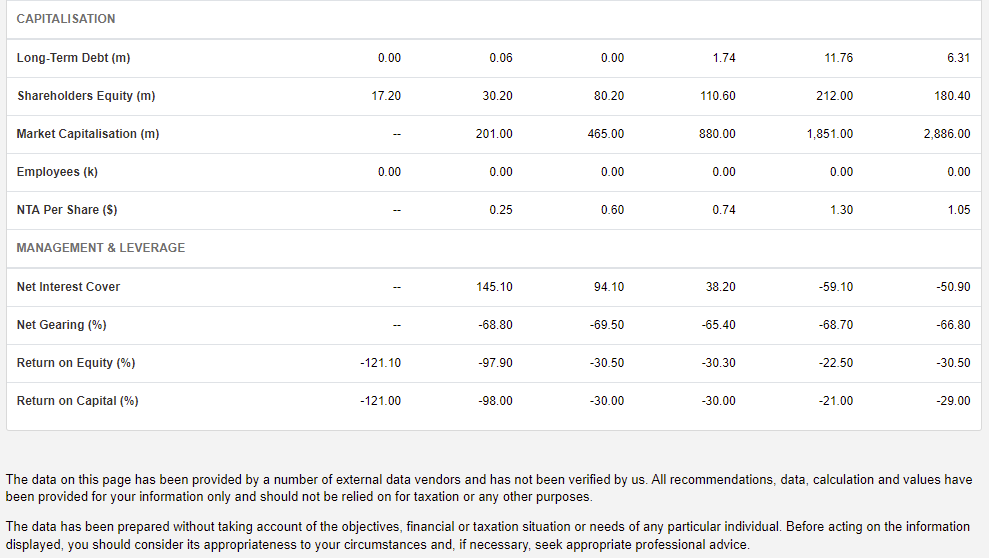

- This is borne out by their results, which can be lumpy but often trend in the wrong direction. Look at the data below, starting with their Earnings, which have always been negative, but are getting worse each year - since 2018. Next, they have negative ROE and while that was at least heading up towards zero, it turned back down in FY21. Sales are growing, but that is not translating into profits, or even translating into lower losses - the losses have been increasing every year since 2018. No dividends, because no profits. FY21 Book Value = $1.15/share. FY21 NTA (net tangible assets) = $1.05/share. Both are Lower than in FY20. Both heading the wrong way in FY21. Their shares are trading at over $10/share. Was over $21/share in November (5 months ago). Share count has increased every single year and is now more than double what it was in FY16. Total Return numbers look great, because the share price has risen, but I do NOT think that is sustainable, so there is plenty of scope for a much lower share price from here based on these metrics (fundamentals analysis).

- This is another company that was founded by Bevan Slattery, like NextDC (NXT), Superloop (SLC) and PIPE Networks (which was acquired by TPG in 2010 for $373 million). I find it instructive to follow what he has his money in, and where he retains a management interest. Bevan remains the Non-Executive Chairman of the Megaport Board and currently holds just over 8 million MP1 shares which is 5.11% of the company. He hasn't been buying though. He sold 1m shares in September and another 3m shares in March (last month) - you can view that announcement here: MP1-Change-in-Substantial-Holding-18Mar2022.PDF In terms of Superloop (SLC), Bevan was their Executive Chairman up until 30-Oct-2021, but currently has no board or CEO role at SLC. He holds shares worth 13.31% of SLC and has not been selling or buying recently. That 13.31% of SLC is currently worth $60m, and his 5.11% of MP1 is worth $103m based on today's closing share price (of $10.01) but was worth $131m based on yesterday's closing price ($12.76). The market wasn't too keen on today's Global Update. MP1 finished today down -21.55% (or -$2.75). Bevan seems to have limited to no interest in NextDC (NXT) these days. He was their CEO back in 2013, but appears to have had no role there over the past 8 years and 5 months. He is not listed as a substantial shareholder for NXT. I believe most of Bevan's time is now spent on his newer projects and on his investment portfolio where some microcap company share prices tend to double, triple, or more after they announce that Bevan Slattery has just become a substantial shareholder. While he still holds over $100m worth of Megaport shares, he has been selling down, and he no longer performs an executive role at Megaport.

Source: Commsec - https://www2.commsec.com.au/quotes/financials?stockCode=MP1&exchangeCode=ASX#/financials/company

In summary, I just don't see the appeal. There just isn't much to like, IMHO.

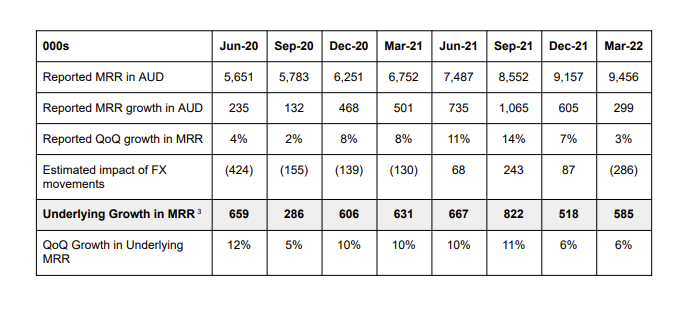

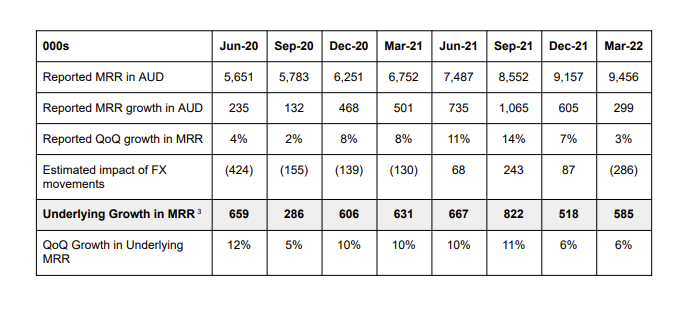

Expensive. Loss making. Many metrics heading in the wrong direction. Founder selling down and no longer running the company (although still the non-executive Chairman of their board), they don't look like turning a profit any time soon, no clear pathway to profitability that I can see, and growth is slowing:

(3) Underlying Growth in MRR is the QoQ (quarter on quarter) growth in MRR excluding the estimated impact of FX movements.

Source: Today's "Global Update" from the company.

See the trend in Reported MRR (Monthly Recurring Revenue) from the September 2021 quarter ($1.065m) to the December 2021 quarter ($605K) to the March 2022 quarter ($299K), it's definitely slowing, even when you allow for that FX movement.

The problem is that the losses are increasing while the growth is slowing. It's not a good combination. I believe that's a core reason why MP1 was sold down -21.55% today on the back of this update

I will continue to avoid both Megaport and Superloop.