As we already know, Megaport broke the lights out today and probably sent shorts scrambling with a 25% rally to close at $12.48.

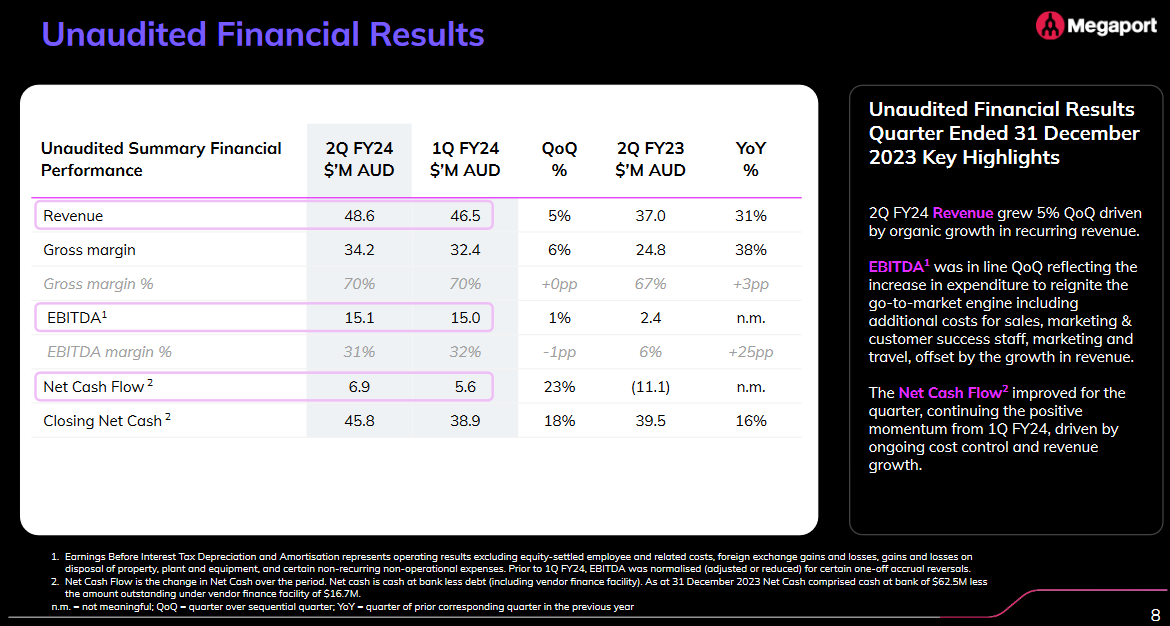

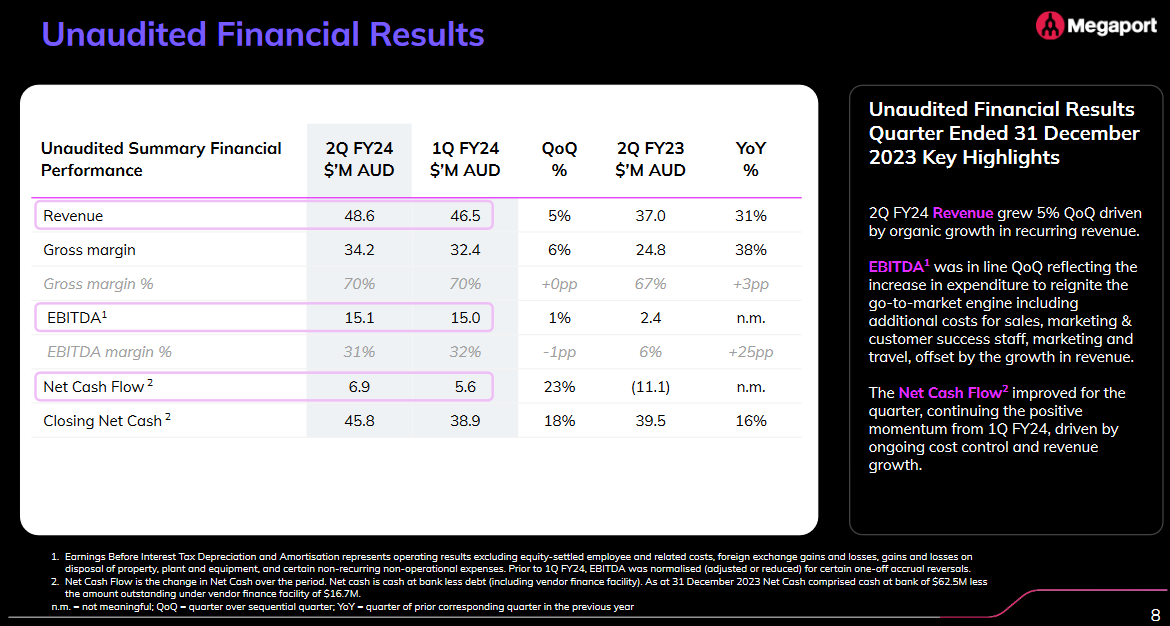

Seems like a beat on most metrics versus consensus

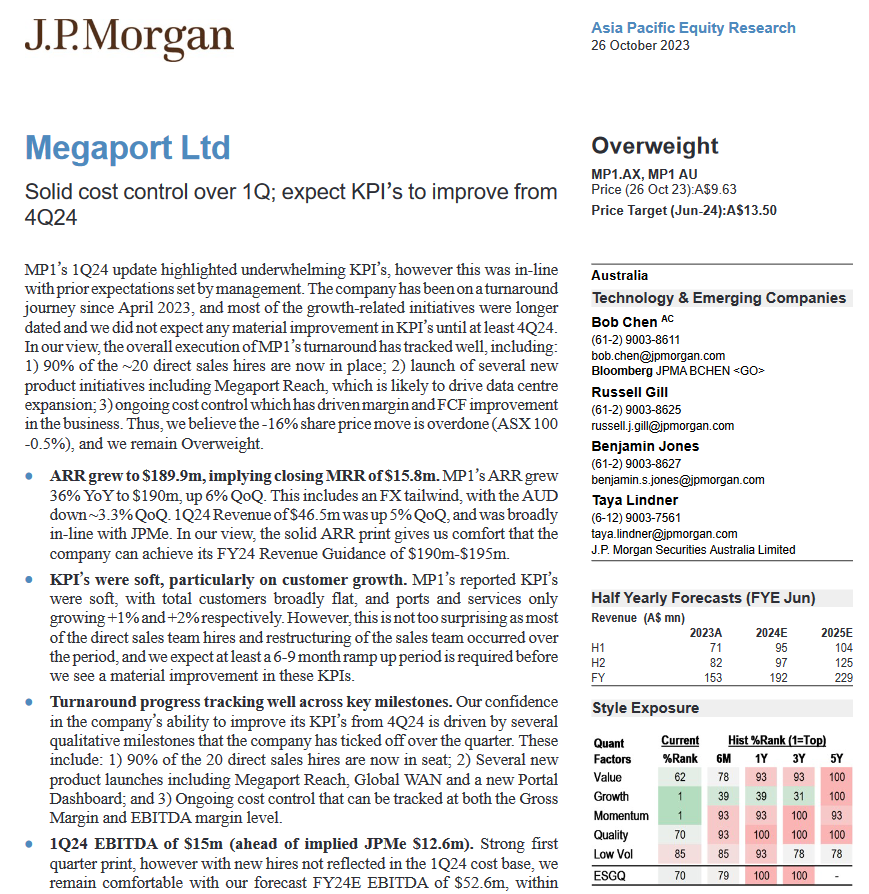

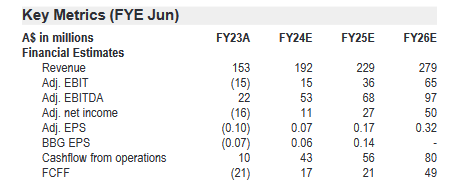

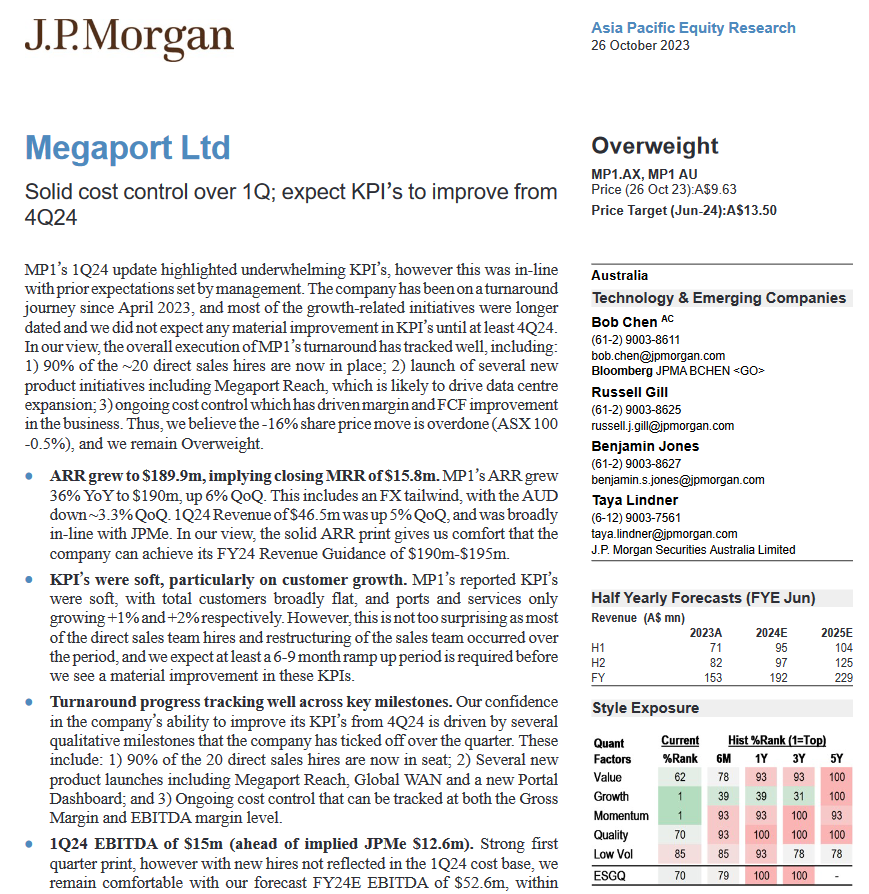

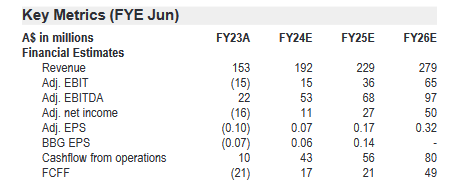

JP Morgan from 26-Oct-23 had forecasted 95m. See below

Finally a little summary from Citi - "Australia's Megaport soars over 30%, tops ASX 200 on earnings beat" - Reuters 30 Jan 24

The Brisbane-based firm reported second-quarter operating earnings of A$15.1 million ($9.98 million), compared with a Visible Alpha consensus estimate of A$11.3 million, according to Citi.

Its quarterly revenue of A$48.6 million was 2% ahead of Citi estimates.

"While KPIs (key performance indicators) continue to be soft, this was expected and we continue to see upside to VA consensus EBITDA (earnings before interest, taxes, depreciation, and amortization) FY24e forecasts given the 1H beat," Citi analysts wrote.

"We expect the share price to outperform today due to the FCF (free cash flow) and EBITDA (earnings before interest, taxes, depreciation, and amortization) beat."

Capital IQ Pro only had the FY24e but sentiment score is the highest for the last 12 months.

Given we are at the halfway mark, it looks like Megaport will most likely beat the full year forecasts on at least revenue and free cashflow.

[held]