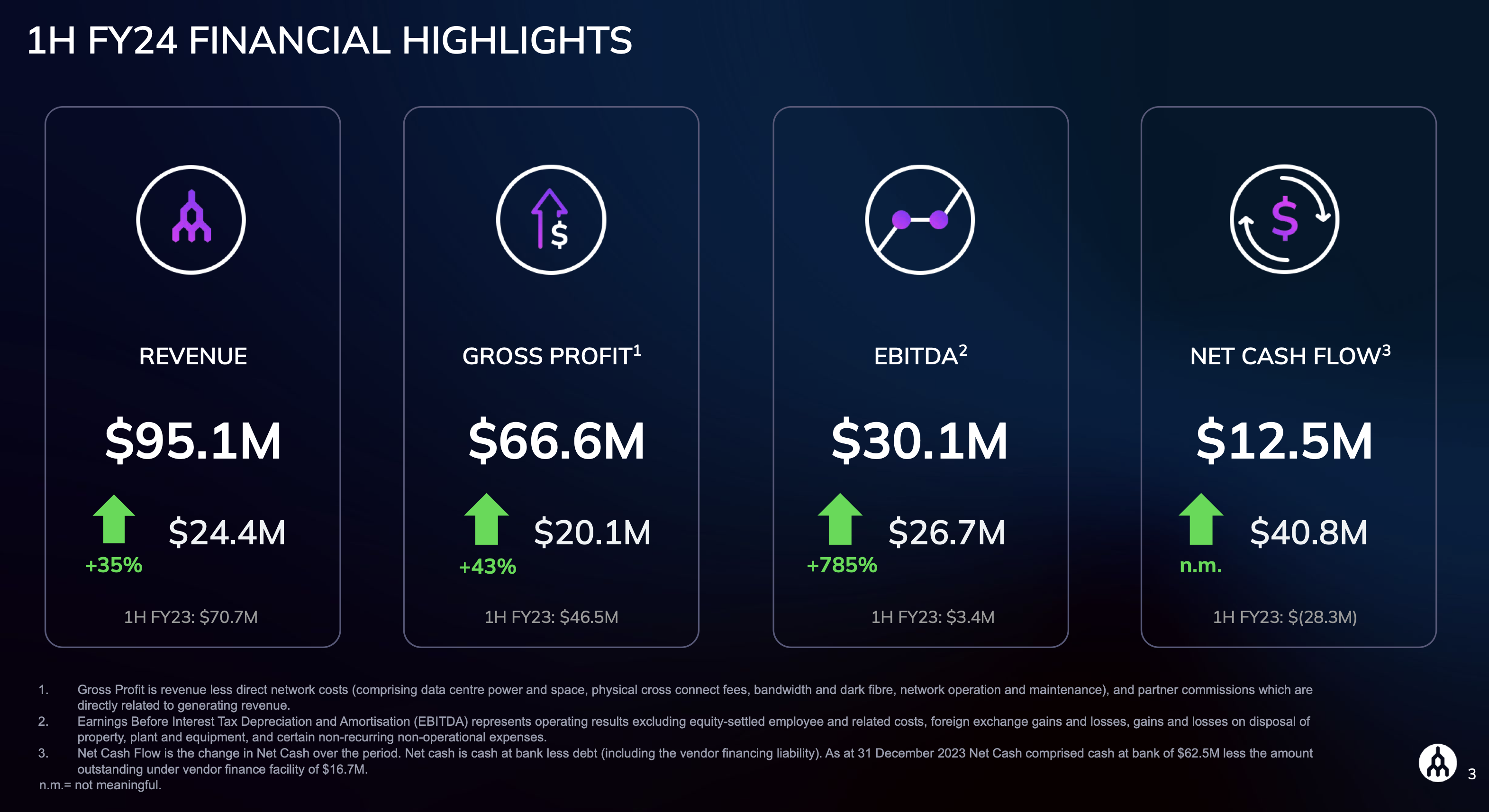

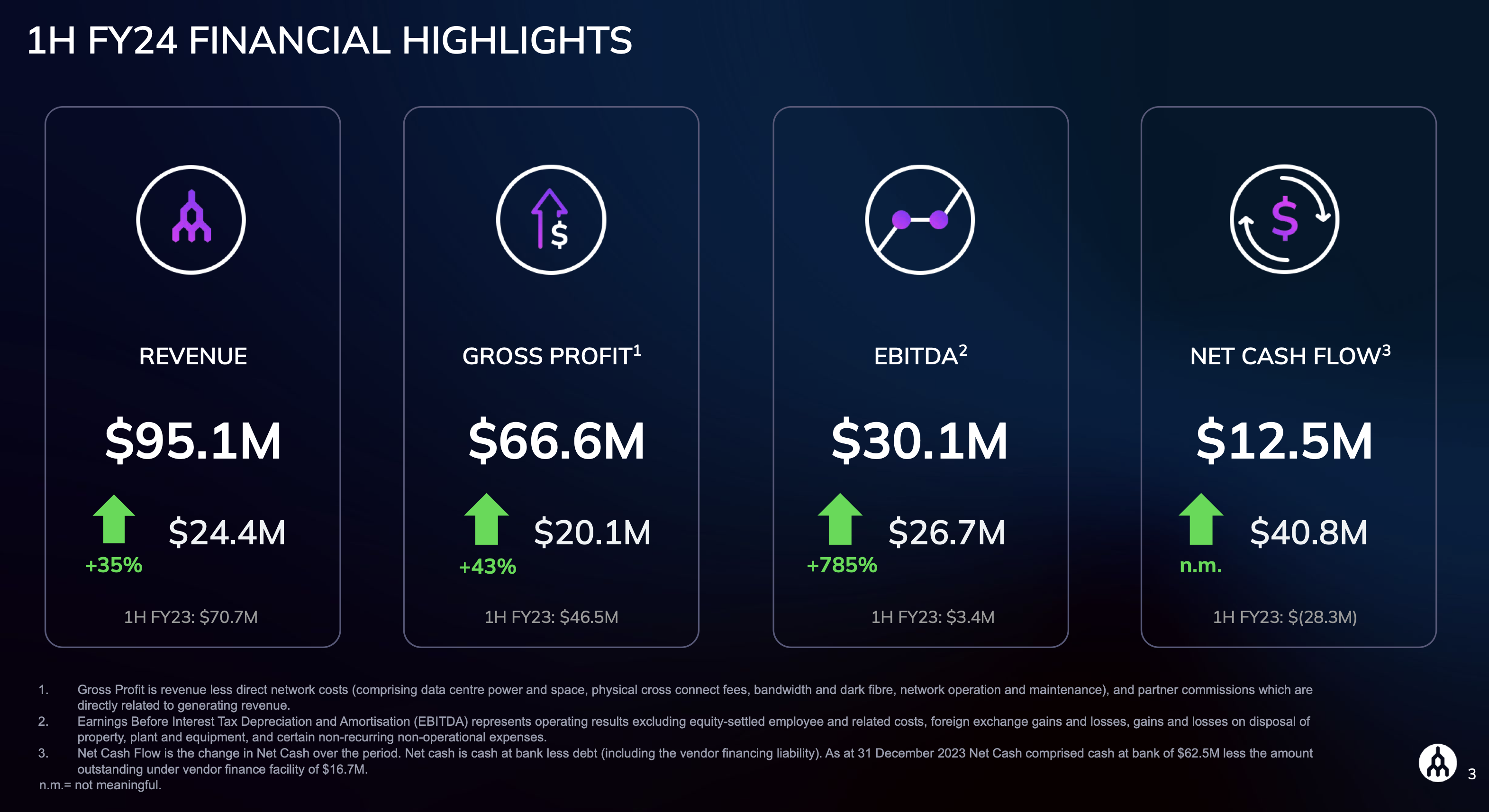

Megaport have emphasised some good looking numbers: positive net cash flow and big jump in EBITDA.

A few notes:

- Costs are down due to cost control efforts. These are expected to increase again due to investment in “the go-to-market engine.” So, expect costs to go up in the near term followed by, hopefully, increase in customer logo count.

- Revenue is up 15% compared to 2H FY23, while annual recurring revenue is up 7%

- Continue to increase customers (3% on previous period). Number of services and spend pre customer also continue to increase.

- Have to acknowledge the handy spreadsheet they provide investors at https://www.megaport.com/investor/business-overview/#kpis. Wish more companies did this!

- New CEO (well, in place since March 2023) seems to prefer simplified reporting metrics which I admire. For example, they break out ‘customer logos’ and ‘customer accounts’: the former will be lower, but represents the true number of customers because it counts multiple accounts for the same customer as one.

The presentation emphasises comparison with the prior corresponding half, which might be reasonable. Even compared to previous period the business is heading in the right direction.

Interesting comment from CEO Michael Reid in the call transcript:

And that we are then preparing for customers who go, I need to train my model, I need to move data from Oracle Cloud now, and I need to move it over to this GPU-as-a-service that sits in X, wherever it may be.

So as more companies want to leverage AI they will likely want to get there data from their own facilities to whoever is training models for them. This will be large amounts of data, infrequent, and to ad hoc locations. Perfect use case for Megaport but don’t think it’s fundamental.

[Held]