As the grandmother of 4 kids heading towards digital-age, my interest was piqued by Qoria. IR, I’ve held it for over 18 months, and so far, I’m pleased by the steady-as-she-goes execution.

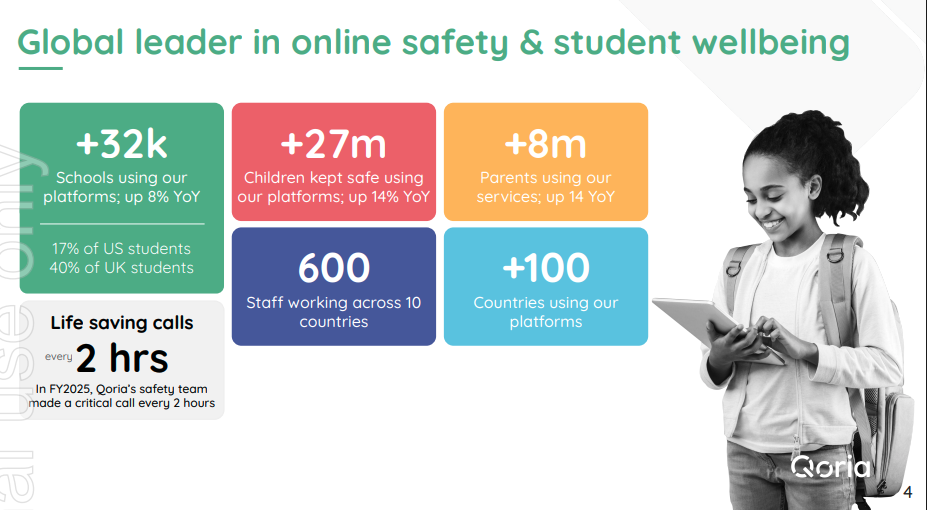

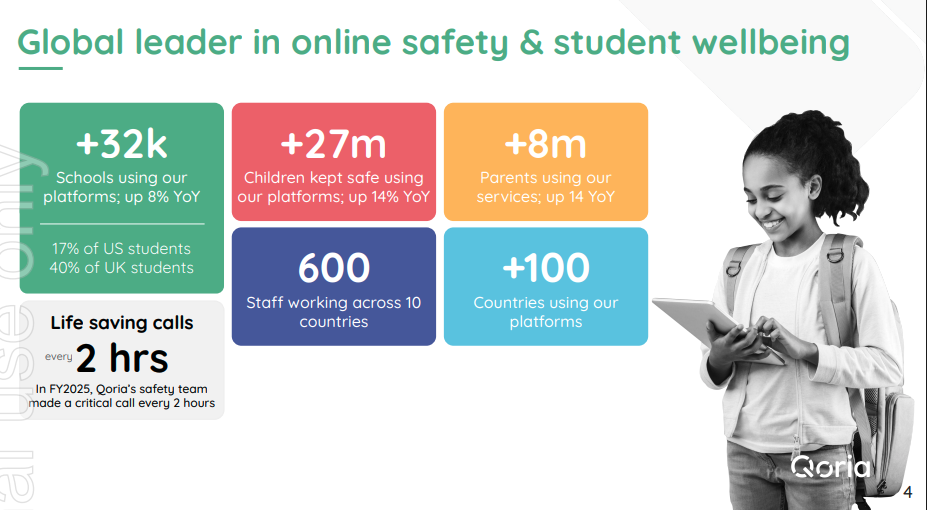

Below are the highlights from the latest quarterly.

All good. What’s not to like? They also put up a detailed breakdown of their cashflow, line by line, which they went through in yesterday’s investor call. That really helped understanding where the costs in the business were and how the various items were changing with time.

I’ve checked out Qustodio (odd name but it resonates with what it does). Custodial control of your kids’ access to the internet (on any device) via an app (on your phone). I’m not surprised it’s ramping up in sales (annualized ARR growth of 33%).

During the call, they indicated they were expecting to inflect into profit this financial year (although they still expect Q3 to be negative). The numbers seem to support that outlook. Note: they have been a VERY seasonal business as so much of the K12 sales (max currently in the US) are to/via schools and school districts, and those tend to be finalized in the June quarter. In contrast, Qustodia sales/expansion peaks in the Dec quarter due to Black Friday and Christmas buying of kids’ new personal devices. So the growth in Qustodia is starting to smooth out their quarters.

Disl: Held IRL and on SM.