Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

The ABB offer has turned into a binding one, and the SYM board has until the end of the month to recommend it.

No material change to the terms.

Now things are getting interesting.

Aussie Broadband has waded into the waters with a 75/25 cash/scrip default offer, valuing SYM at $3.15, with the option for the Symbio board to declare a special dividend that will release an additional 15c in franking credits.

So this could be the start of a bidding battle - I wonder if this is as good as it will get for SYM shareholders?

Disc.: ABB and SYM held.

Superloop has come back with an enhanced offer, which it terms as its "best, improved and final offer".

It's a bit complicated, but the gist is that the implied value of SYM shares is slightly higher than the initial proposal ($2.91 v/s $2.85 under the default 50:50 cash/scrip mix), and that Symbio shareholders have more flexibility in choosing the mix of cash and scrip they want to accept. A 15cps special dividend is also on the table should the SYM Board choose to declare it.

I'm not sure it's that much of an improvement at all overall.

Symbio released its FY23 report

Revenue:

Receipts from Customer

Operating Profit

Singapore Updates

Key Matrics for each division

My View:

- Results aren't as great and as expected from their first half ( where they flagged inventory returns from their mega customers because of the economic conditions).

- That flagged there is pressure in the CPaaS division margin because of cost-cutting from customers and increased competition in the Australian market

- They are more focused on recurring revenue ( and there are certain legacy services that they have discontinued) following graph shows how Recurring Revenue/margin and Variable revenue/margins are tracking

There is a current acquisition discussion going from Superloop to symbio and that exclusivity has been extended for a further 2 weeks - Which is probably what is supporting the share price at the moment. ( I would have thought the market wouldn't like this result)

Symbio received a non-binding indicative proposal from Superloop to acquire all of the shares valuing Symbio at $2.85 per Share + Special Dividend with franking credits of $0.15 per share. i.e. total $3 per Share.

In the same announcement, it announced it's on track to achieve FY23 EBITDA at the upper end of its stated guidance in the range of $27m to $28m.

My View

- At $3, Symbio's market cap is roughly around $260m

- It probably has ~$35m cash so EV = $225m

- Symbio has gone and changed its business significantly in the last 3 years ( it divested all declining businesses and invested heavily in growth businesses and expanded in Singapore and Malaysia) and its almost finished with its investment cycle.

- I think $3 doesn't reflect the potential earning growth Symbio has in front of it

- I don't think this deal will be done at $3 ( There is significant holding from insiders and they will definitely look after the Shareholder's interest in my view). There can be potentially competing proposals from other companies (maybe AussiBroadband locally or Bandwidth (NASDAQ:BAND or similar).

- I would much prefer it not to be acquired and if it has to then it should be acquired by Company focusing on Telco Software rather than pure Telco.

In any case, I am looking forward to 25% paper gain tomorrow. Although $3 barely puts me in the green ( would be very annoyed if this deal gets done - mainly because I invested so much energy/time/effort understanding ins and outs of this business - that all will go to waste.

Symbio joins operator connect for MS teams in Australia, NZ and Singapore.

https://www.symbio.global/resources/symbio-joins-operator-connect-program

It means any customer who has Microsft teams can purchase phone number straight from office 365(teams). However, they aren't the only one who can provide operator(telco) service to MS teams. There are number of other operators as can be seen from below directory.

https://cloudpartners.transform.microsoft.com/practices/microsoft-365-for-operators/directory

Symbio announced the launch of its services in Malaysia today.

https://www.symbio.global/resources/symbio-announces-malaysia-launch

After issuing a trading update confirming guidance and noting the stabilisation of demand from its marquee customers, the shares have staged an impressive one-day rally.

Follow through will be crucial from a technical perspective, as the shares are trading right at the bottom end of the big gap caused by the initial downgrade in December. Filling that gap (up to around the $2.50-55 mark) and consolidating above it over the coming weeks may imply that the turnaround is complete, but right now, it is not out of the woods yet.

Symbio released a Q3 update to the market.

In December, Symbio downgraded guidance for FY23 EBITDA to be in between $26m -$30m ( previously guided between $36m-$39m). The reason was its customers US tech giants were in cost cutting spree and returned excess inventory.

In today's update, It guided the market that the headwind observed in Q2 is now stabilized and its customers ( Zoom, Microsoft, RingCentral, Twillio, etc) are now focusing on sales growth and Symbio is seeing demand improving.

Symbio also advised the market that it is going through an optimization phase with operating costs and those initiatives are expected to lower cost run-rate in FY24,

Performance update

CPaaS

- expected to reach 7.4m phone numbers by the end of June (12% YoY growth)

UCaaS

- Seats expected to reach 73K (24% YoY growth)

- Add 60K from Intrado acquision

- Integration of intrado will complete by the end of FY23

TaaS

- SIO to reach 185K by the end of June (12% YoY growth)

Singapore

- Phone numbers on the network doubled in the last quarter and if current trends continue cash flow break even in FY24

Malaysia

- Soft launch with 4 global customers on 12th May and full commercial launch by end of June.

Taiwan

- No change - still discussion is underway for M&A

Overall positive, it probably hints to me that issues faced in Q2 were economic headwinds and the growth thesis is still intact.

my concern post the results call is that they seem to be losing work with gov/enterprise customers who are high margin in favour of smaller high volume/low margin customers. this was mentioned a couple times.

The CFO doesn't seem awfully confident either which is a red flag

The main positive is their balance sheet which will give them wiggle room if things deteriorate further

I'm not sure whether I should just look at the numbers or consider the context behind them as well. I've been following Symbio's story for a while now, and I know that they changed their strategy in FY20 and are currently in an investment phase that they expect to bear fruit from FY24 onwards. But I'm worried that I might be too lenient in my approach by believing what management says.

While numbers such as revenue, profit, and cash flow are important, it's equally important to consider the narrative behind those numbers and the context in which they were achieved.

Should I blame symbio for losing customer because it was acquired by symbio's competitor ( Aussie broadband) or Should I be harsh on symbio because its customers ( US Tech i.e Microsoft, Zoom, RingCentral, Google etc) are facing macro headwind and trying to reduce the cost by returning excess inventory.

I have conviction in the strategy Symbio has put forward but I am on high alert for watching the thesis break. It will be interesting to see what future holds for this business. I am looking forward to learning the lesson ( it potentially can be a very expensive lesson for me )

Symbio released its first half FY23 result and things that I would like to document for

- They haven't changed the EBITDA guidance they gave in December for FY23

- Although they acquired Intrado UCaaS business - they don't expect it to make any material difference for FY23 but in FY24 it will contribute $2m of EBITDA

- 400K Phone number order which was delayed ( one of the reasons for the downgrade in December) has now been secured and the number porting process has started However, don't expect it to contribute anything in FY23.

- CPaaS Division

- ~2m margin loss due to inventory return ( i.e 12m margin annually if we assume inventory was returned in November)

- Singapore is not profitable and absorbs $1m annually from the margin currently

- Singapore has good momentum, and Malaysia will launch in May 2023.

- TaaS Division

- Normal growth continues - roughly 10%

- UCaaS Division

- Strong seat growth but still headwind from legacy deprecated data service business in the numbers

- Intrado Australia acquisition doubles the size of the UCaaS division from FY24 onwards

- Singapore Update

- 23 CPaaS customers on boarded and 40 in pricing and contract negotiations

- 19 Cisco partners engaged and Enterprice customers have grown to 2000 seats

- Despite delays in profitability confident of achieving strong ROI

- Singapore customers include Zoom, TATA, Five9, Vonage, NICE inContact, CM.com, Plivo, Fuze etc

- Malaysia Update

- received tire-two carrier license waiting for the tire-one license

- Strong customer interest

- Taiwan update

- Expecting launch in late FY23 via acquisition and customers are engaged with a strong interest

- Paused additional market entry to focus on the success of the existing market

Overall, happy with business progress - ( just too many factors i.e strategy change from FY20 to divest non-core business - numbers aren't clean yet , lost aussie broadband as a customer because of consolidation, US Tech returning extra inventory to cut their cost and Extra investment in Singapore, Malaysia and Taiwan expansion investment hides the growth )

Still FY23 numbers will look ugly but from FY24 onwards growth will shine through. So I am not so optimistic short-term for this one.

Symbio informed the market of its trading update and downgraded its expected EBITDA from (36m - 39m) to 26m - 30m. it is roughly $10m less than what was initially confirmed on 8th November at AGM.

Following disclosures are announced along with downgrades.

- 1H'23 phone numbers are likely to be 5% above 1H'22 ( i.e 6.8m based on 6.5m numbers in 1H'22)

- It is expected to have $36m to $39m of cash, excluding any acquisitions, as at 30 June 2023

- FY23 CAPEX is expected to be $22m compared to the $24m forecasted during AGM

- Expansion to Malaysia and Taiwan will still go ahead as planned but further development will be on hold until all 3 new countries reach cash flow positive.

The reason for downgrades:

- Several US-based global software on cost-cutting and returning excess inventory ( i.e phone numbers)

- New deals are taking longer i.e existing 0.4m numbers that have been in the final stage of the contract since 30th June 22 haven't materialized.

At the time of writing, the Shares are trading ~35% less than it was trading before this news.

Shares were getting so cheap before this news that it didn't make sense to me the way the share price was moving. It seems to me that some shareholders knew it coming. I wasn't expecting it and it caught me off guard. I was actually averaging down :(.

Does that mean, you would have to take a clue from price action? and that's where technical analysis comes handy.

So keeping emotion aside, If I have to judge the company at today's price - Would I sell/hold/buy?

- It has roughly 85m shares on issue. At $1.70, the market cap is ~145m.

- They expect $36m in cash at the end of FY23 and don't have any debt ( EV = 109m)

- Based on all the numbers provided i.e cash at the end, investment etc It will generate ~20m cash from operating activity and ~26m EBITDA

- So EV/EBITDA ratio is ~4.2. ( not demanding at all)

Now the question is, Is this downgrade structural in nature? competition is eating into it or is there no demand for its product?. At this stage, in my mind, it's not a structural issue but a market condition.

I have decided to hold it but stop averaging down on this one - wait to confirm that growth drivers are intact and this is a once-off setback to the growth - will reflect on this one during the holidays and analyze again in February after the 1H'23 result.

Sure enough, here comes the trading update with a big downward revision at the midpoint. The price action in the lead up was telling.

Symbio Holdings expects FY2023 EBITDA to be between $26m-$30m (previously guided FY2023 EBITDA to be between $36m-$39m). The revised EBITDA, which is a 25% decrease on the midpoint of previously guided EBITDA.

I currently hold a small position (have been in and out of the name a couple of times for modest profits over the years), and I am not a TA guru, but looking at the long term chart, SYM has been in a steep downtrend in recent months that finds the shares hanging above lows going back about 8 years, excluding the brief Covid shock/plunge. It has to hold above those levels, or the odds are good for further drawdowns (barring any material fundamental developments in the meantime).

New updates :

- Guidance confirmed

- Singapore signed in total 23 CPaaS customers and 31 in pricing and contract negotiations

- E.G Zoom, TATA, Vonage, Five9, Fuze

- Delay in onboarding large clients in Singapore

- Malaysia will go soft launch in Feb 2023 ( achieved Malaysia Digital status - waiting for carriage license)

- Expecting product launch in Taiwan in late FY23 ( Very close in negotiation for small acquisition to kick start in establishing presence )

- Total investment in Singapore - 15m ( Mostly done in FY22), Malaysia - 8.7m ( FY23), and Taiwan - 10m ( FY23 and FY24)

Hi all,

I am a huge podcast fan and listen to a varied selection during my drive to work and back.

Recently I have heard several panellist, analysts and fundies when asked about a stock they would buy, Symbio seems to come up a lot.

Can someone tell me whats so special about it and it's USP.

Just starting to research it

Nice conversation between Gary Rollo and Rene Sugo. It explains the growth thesis

https://www.youtube.com/watch?v=W9LLXKt0Yvk

I quite like this business but l am a bit annoyed by the last result ( not actually about the development but the way they presented it - Check my Chart Crime straw for more detail ) But I do respect this management and still haven't lost trust.

Symbio announced a very disappointing result for FY22. - Well, if you have read my straw earlier then I have documented that Aussi Broadband (ABB) acquired Over the wire (OTW) and decided to move its business from Symbio to Over the Wire for voice traffic to get synergy from the acquision.

It was well understood that this FY22 result would be affected by ABB and OTW consolidation. However, being upfront about that management just excluded Service In Operation (SIO) for ABB from the chart and gave the impression that growth is normal (shareholders should ignore churn).

- FY21 Presentation TaaS Service in Operation (SIOs) graph ( Check FY20 numbers and FY21 Numbers)

FY22 Presentation TaaS Service in Operation (SIOs) graph ( Check FY20 and FY21 Numbers) - Wha they did is removed the number from lost customer.

Update 23/6/22

Revisiting this valuation after learning more about the company. Symbio have since divested their direct mobile and internet services business to simplify their business into more software products.

Investor presentation yesterday guided for the lower end of guidance for EBIDTA around $35-38m. If I assume $35m EBITDA its almost an exact double of 1HFY22 results. NPAT (for continuing operations) would therefore come in around $13.5m.

Management are actively pushing into Asia but this has been a difficult process so I'm going to scale back their growth from my predictions to 10% pa. This gives us:

- FY27 NPAT = $21.74m

- FY27 price target (assuming PE of 25x) = $5.44

- Discounting back 10% pa gives valuation of $3.71

Disc: Held IRL and on Strawman

Original Valuation

Symbio Holdings (previously MNF Group) are involved in software for cloud-based communication services

FY21 NPAT = $15.6m

EPS (84.7m shares on issue) = $0.184

SYM have recently divested their direct mobile and internet services but to keep it simple, assuming 15% annual NPAT growth for the next 5 years.

FY26 NPAT = 31.38

EPS (assuming 100m shares on issue) = 0.314

FY26 price target (35x PE) = $10.98

Discounting this back 10% per annum = $7.50

Now given management have flagged that there would be EBIDTA contraction as a result of the divestment in the direct mobile and internet part of the business, and are expecting increased overheads to support their expansion, I would apply a margin of safety of at least10% before deciding whether or not to purchase.

Currently don't own but would be interested if the price got down to around $6.50.

Positives

- CEOs are now in place for all three divisions ( CPaaS, UCaaS, and TaaS)

- A strong balance sheet with cash and undrawn debt facilities renewed

- Twillio as a UCaaS partner added

- Malaysia's formal license application submitted

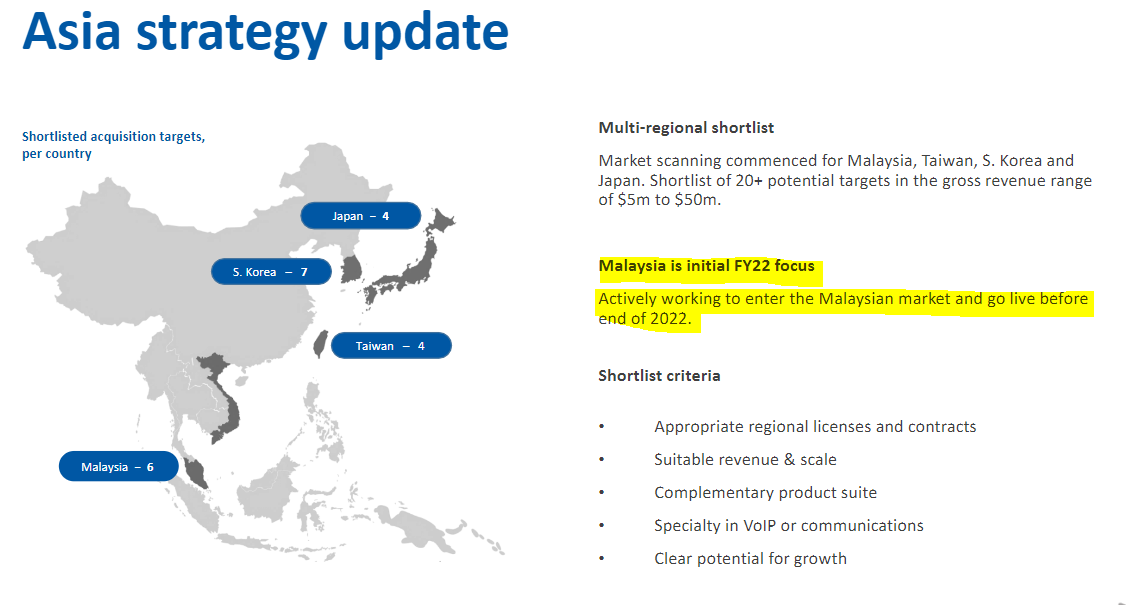

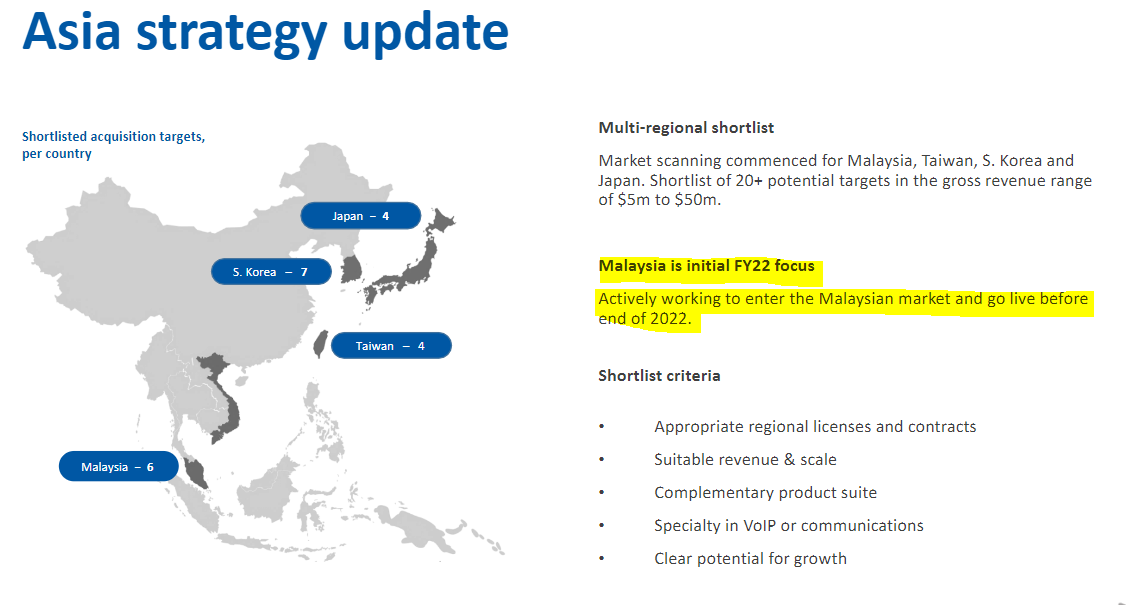

- Scanning acquisition targets and planning market entries in Taiwan, South Korea and Japan

- Industry experts' views are that there will be significant tailwinds for UCaaS and CPaaS services for next 5 to 10 years and Symbio is favorably placed to take advantage.

- A product demo of Application" Symbio Enterprise Calling" - Value add for partners to enable Microsoft Teams calling in minutes as compared to days with competitors.

Negatives

- On track to deliver guidance at the lower end of the range ( $35m to $38m)

- Singapore won't be at breakeven by end of FY22 as promised earlier ( Onboarding slower than expected)

- Malaysia acquisition didn't go through because of the valuation criteria ( entry to Malaysia will be organic and hence a little slow)

Overall, negatives were kind of expected as Symbio lost a big customer in Aussi Broadband because of industry consolidation. The future looks bright and no changes in my view. The share price has sunk close to 60% from a recent high.

What's not to like? : Profitable company with a strong balance sheet and positioned for high growth for the next 3 years. Yeah, agree, the return won't be immediate but risk-reward in the investor's favor at the company level ( not sure about the Macro-level).

Aussie Broadband announced to market following. ABB has moved its voice traffic from Symbio to the Over The Wire voice network.

Its a tailwind for Symbio - However, Symbio confirmed their EBITDA guidance not that long ago so I would suspect it must have got growth to cover for this loss somewhere.

As preparation for reporting season, I just reviewed my thesis and noted down things at a high level I am monitoring for this business going forward. I expect Revenue and EBITDA to decline ( because of divestment of Direct business as well as 11.1m investment Management has flagged for FY22). Should the following things be tracking well in the right direction and because of known expected Revenue and EBITDA decline stock sell-down, I shall be prepared to buy more IR.

- Recurring Revenue and Margin growth

- Three divisions Key performance indicators

- Singapore momentum

- Malaysia Update

MNF has two types of revenue:

- Variable Revenue

- FY20 - 129.4m with 28% margin (i.e 36.7m)

- FY21 - 105.5m with 32% margin (i.e 34.1m)

- Recurring Revenue

- FY20 - 101.5m with 59% margin (i.e 59.7m)

- FY21 - 113.2m with 60% margin (i.e 68.1m)

If you value business only on Recurring Revenue business -- What multiple would you apply for sticky 60% margin revenue of 113.2m ?

Currently, if you ignore the total variable component (which generates 105m revenue with 34m margin). total business is on multiple of 5.4 X ARR

A major part of revenue drag came from

- Variable revenue from Global Wholesale ( because of lack of international roaming and audio conferencing traffic)

- PArt of this is once-off

- Variable revenue from Direct Segment ( because of declining consumer segment )

- This has been sold now.

MNF has embarked on a business simplification strategy, as part of it has streamlined brands through the divestment of non-core Direct Segment brands like Pennytel, Connexus, Call Stream, and MyNetFone [Not the brand just customers]).

MNF now can focus on high performing/high margin/recurring revenue part of its business ( Global Wholesale, Domestic Wholesale, and Enterprise/Gov ). With the focus on Software as a service (SaaS) models, it has created the following three divisions

- Communications Platform as a Service (CPaaS)

- Old Global Wholesale division ( Symbio and TNZI brand)

- Telco as a Service (TaaS)

- Old Domestic Wholesale division (Telcoinabox and iBoss brand)

- Unified Communication as a Service (UCaaS)

- MNF Enterprise and Government as well as Express Virtual Meetings brands from old Direct division

- CPaaS --- Focus on Phone numbers as KPI

- TaaS -- Focus on Services In Operations (SIO) as KPI

- UCaaS -- Focus on Number of Enterprise Seats as KPI

Asian Expansion:

- Australia ( Since 2004)

- New Zealand (Since 2015)

- Singapore (Since 2021)

- Malaysia (TBA)

- Vietnam (TBA)

- Taiwan (TBA)

- Japan (TBA)

- Korea (TBA)

Phone Numbers

MNF Currently has 5.8m Phone numbers on their platform.

Target

MNF is targeting to expand into above mentioned 6 Asian countries and service in total 100m Phone numbers on their platform by 2030.

Cash

MNF currently has $40m cash and no debt ( $60m debt facility for M &A)

MNF is going through from transactional revenue to Recurring revenue model. Attached is my forecast for next 3 years.

Update 7/6/21

MNF did the strategic review in 2020 and decided to divest most of the business within Direct Segment.

Today it announced that it has gone into a term sheet agreement to sell a major part of Direct Segment.

This now leaves MNF with only MNF Enterprise in Direct Segment.

This is good news for MNF Shareholders as Direct Segment was growing revenue at 5% rate and bringing overall growth down.

Now MNF can focus on Wholesale divisions which are High growth and higher-margin divisions.

============================

MNF Operate in three segments

1) Direct 2) Domestic Wholesale and 3) Global Wholesale.

It derives its revenue from recurring (high-margin, sticky revenue) and variable ( transaction-based) revenue from the sale of its software and services in Australia and New Zealand.

Direct Segment provides mobile, conferencing and collaboration services directly to residential, small business and enterprise and Government customers ( BRands: MNF Enterprise, Connexus, Express Virtual Meetings, MyNetFone, Pennytel (sold recently) and Supernet (Singapore))

Domestic Wholesale provides software and network to Retail and Managed Service providers and IT companies in Australia and NZ ( Brands: Symbio Networks, iBoss and Telecoinabox)

Global Wholesale customers are international UCaaS,CPaas and CCaaS vendors (Google, Microsoft, Zoom, RingCentral, Twillio, etc) (Brands: Symbio Networks and TNZI)

The global Wholesale segment is growing at the back of demand from global players. In General, MNF is transforming it's revenue from transaction-based to high-margin recurring revenue ( Check attached document).

The global Wholesale segment has built its network in Singapore ( invested in 2019 and 2020) currently going through a technical trial and will go live at end of FY2021.

MNF is planning to increase its footprint in other APAC regions. They have shortlisted 6 potential countries and currently analyzing regulatory and compliance requirements.

My prediction is that it will easily grow its margin by 25% for the next 5 years.

Highlights:

- Recurring revenue rose 15% to $55.7 million (H1 FY20: $48.3 million) as a result of growing wholesale revenue

- EBITDA increased 16% to $19.6 million (H1 FY20: $16.9 million)1

- Phone numbers up 24% to 5.1 million (H1 FY20 4.1 million) due to strong organic growth

- Net Revenue Retention (NRR)2 rate across top 10 customers was 115%

- Underlying NPAT-A increased 30% to $8.4 million (H1 FY20: $6.5 million) 3

- Trials have commenced with customers in Singapore marking a major milestone in MNF’s offshore expansion strategy

- Strong financial position with net cash of $22 million and cash conversion of 107%

- Earnings per share up 62% to 7.83 cents per share (H1 FY20: 4.83 cents) supporting a 32% increase in dividends to 3.30 cents per share fully franked (H1 FY20: 2.50 cents)

Disc: I hold