Valued at just $26-odd million by the market, fintech 8Common (ASX:8CO) has largely gone unnoticed by the big end of town. But as the business continues to gain traction it is increasingly finding support from small-cap investors, with shares up over 160% since April.

So, is there any substance to this move, and does it warrant a closer look?

The business

8Common develops financial software solutions, with its core expense8 product providing an expense and travel management system. With clients such as Woolworths (ASX:WOW), Amcor (ASX:AMC) and the NSW Department of Education, the business has seen a steady and solid improvement in sales in the past year and has now past cash flow break-even.

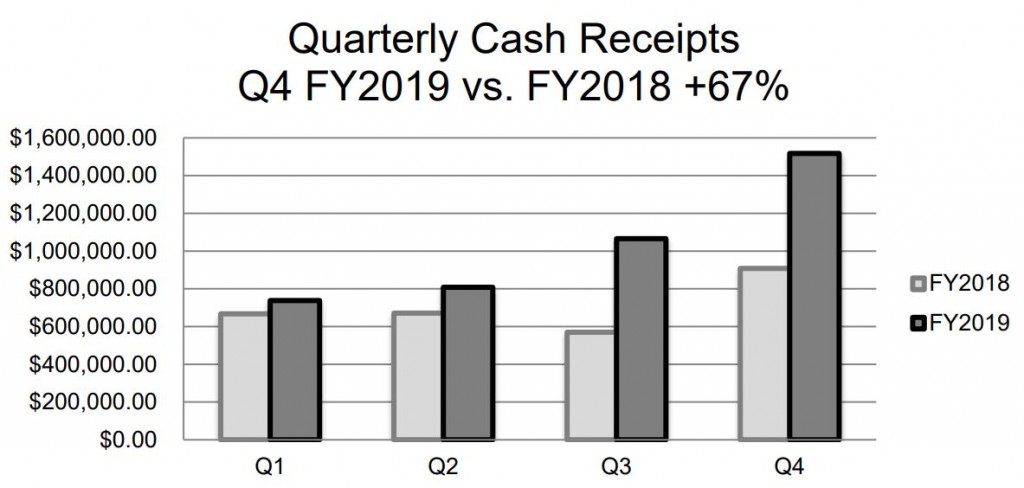

Indeed, quarterly cash receipts saw a 67% boost for the final quarter of FY2019, and the business managed to dramatically improve its cash position: moving from just $374,000 in the bank in April, to now having over $1 million.

With some notable and sizable contract wins in recent times, the business is experiencing some encouraging momentum and management say they are “very well placed” for the current financial year. Actions, of course, speak louder than words, so it’s worth noting that management have some skin in the game: approximately 1/3 of listed shares are held by company insiders.

What are the risks?

Although SaaS products tend to be rather ‘sticky’, clients will nevertheless transition to a new solution if the benefits outweigh the costs. While customisation and integration offer some competitive advantages for 8common, there are no shortages of rival solutions — some from very large and well-heeled players.

Further, it’s not uncommon for the benefit of rising sales to be eroded by rising costs, especially as companies tend to ‘double-down’ on development and marketing to win the ‘land grab’. While not a terrible idea, it makes the costs of failure even higher.

Finally, with shares at roughly 9.2 times FY2019 sales (accounting for some options conversions), a lot of expectation is already priced in by the market. To justify such a multiple, 8common will need to sustain high rates of growth for a good while yet, all while keeping costs on a tight leash.

Worth a buy?

8common has been steadily climbing the rankings on Strawman, and currently sits at #69. Moreover, shares presently sit below the community’s estimate of intrinsic value.

Investors should note that shares tend to be fairly illiquid, and buying or selling larger positions will have its challenges. But for those that have a good risk tolerance, and are looking for early stage tech businesses, 8common is one to keep an eye on.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223