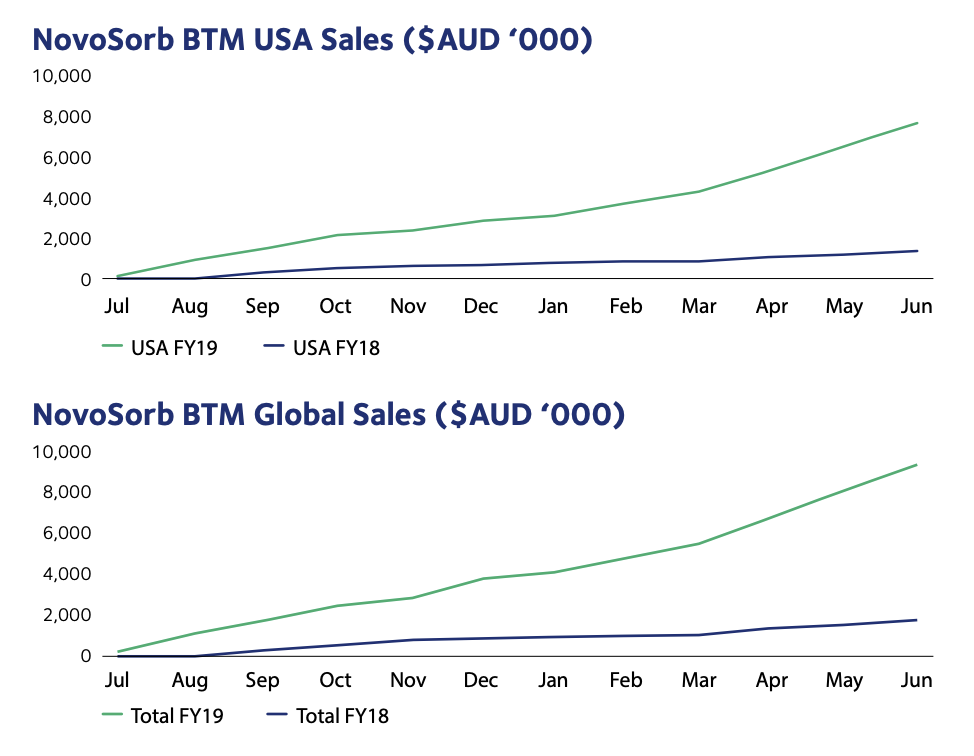

Polynovo has enjoyed a spectacular run in 2019, with the share price rising from $0.56 at the start of the year to a high of $2.66 on the back of rising sales in the US and entry into the ASX200. But in recent weeks the share price has languished, dropping nearly 40% in just over a month. So the question is, does now represent a good buying opportunity?

Born out of the CSIRO in 2004, Polynovo sells a series of synthetic polymers under the Novosorb platform which act as a dermal ‘scaffold’ to help the body regenerate lost tissue. It’s particularly useful in severe burns, where clinical studies have produced extremely encouraging results. Many of the surgeons who pioneered its use are now large shareholders, with many more acting as defacto sales staff through word of mouth praise to their peers.

Another reason to like Polynovo is that unlike many other health tech businesses, there is already a well established market for its product. The publicly listed Integra Life sciences has been operating in the US for over 30 years and sells an animal-based version of the same product. However unlike the synthetic Novosorb, Integra’s product is slower and more expensive to produce, has a much higher infection rate, and is more than twice the price of Novosorb.

Between signs of stagnating revenue in Integra’s wound care segment, poached sales staff and nervous analysts on earnings calls asking about competitor activity, it would seem that Polynovo could be starting to invade their territory at a rapid pace. And given Integra’s revenue for their competing product is over USD $320m per annum, it might be safe to assume Polynovo is set to capture a lot of that market in the not-to-distant future.

With a market cap. of over $1bn on FY19 revenue of only $13m, even now Polynovo’s valuation looks stretched. However there is a lot to like about the trajectory of the business, given broker consensus is that revenue will more than double this year and management are constantly adjusting their projected sales run rate.

Ranked #23 on Strawman, Polynovo sits well below the community consensus valuation. Click below to learn more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211